Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Markets at a glance 25 September

Around the grounds

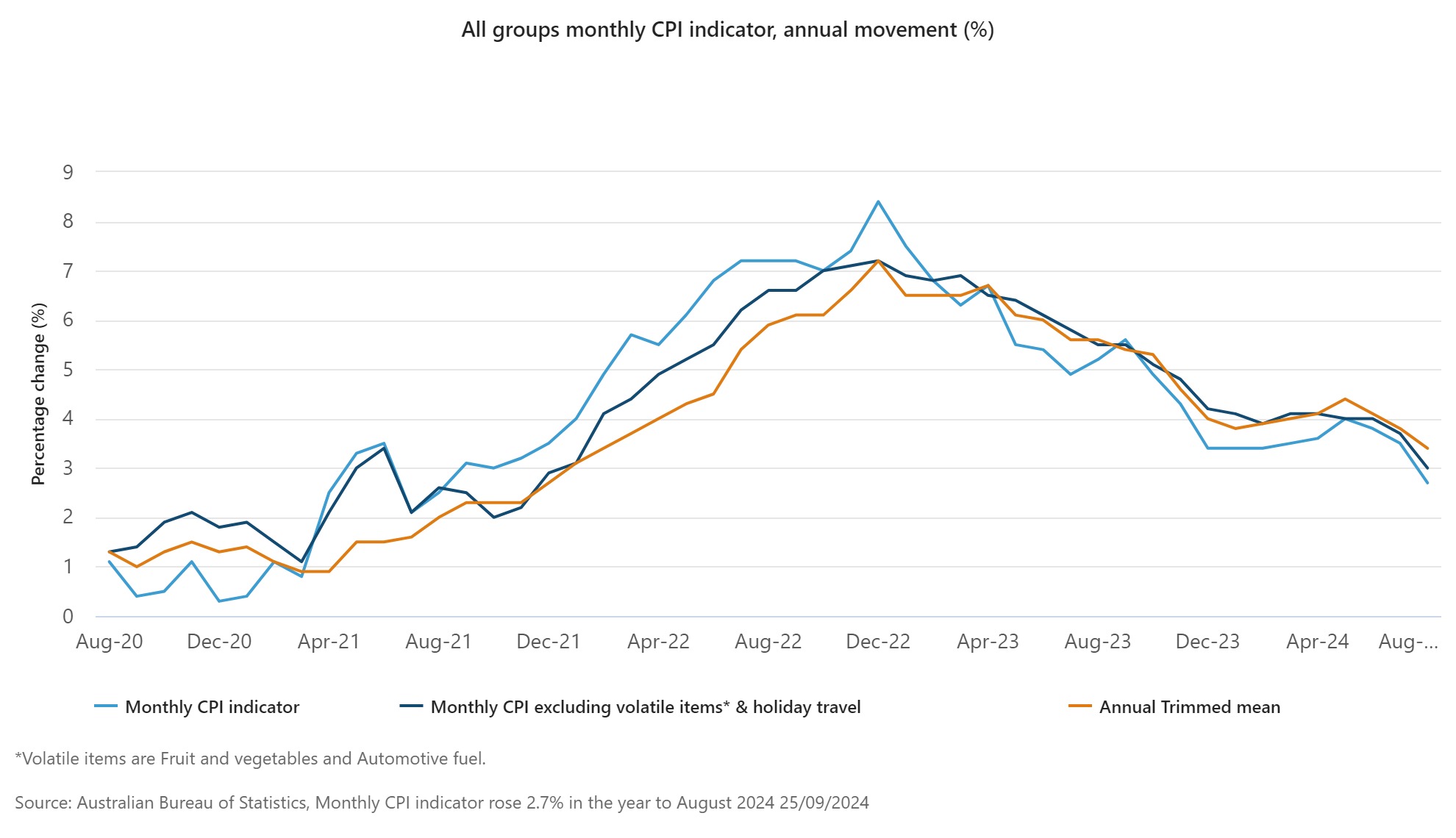

The Australian share market is edging higher after a two-session slide thanks to gains in commodity stocks helping to offset losses in financials. On the data docket, August’s CPI print came in bang on consensus at 2.7%, compared to a 3.5% increase seen in July.

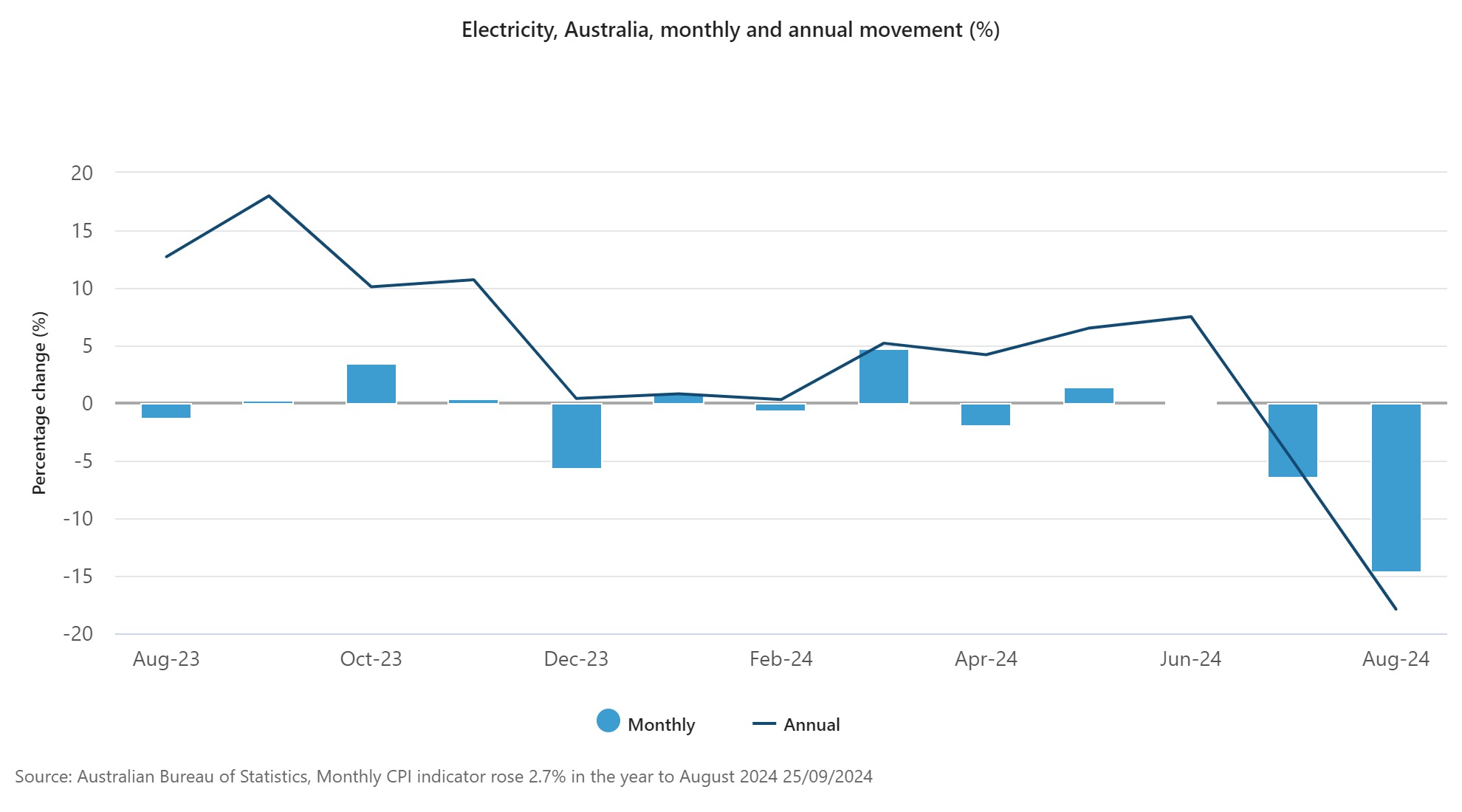

While the print has slowed to a three-year low, the moves are largely due to government rebates on electricity and a drop in petrol prices. Core inflation has hit its lowest level since early 2022 in a sign costs may be cooling, albeit gradually.

Diving deeper into the data, the trimmed mean, a measure closely watched by the RBA, slowed to an annual 3.4%, from the 3.8%, leaving it well above the Australian central bank’s 2-3% target band and continues to be a hurdle to cuts in interest rates.

The Australian dollar (AUD) was little changed after the data drop at 11:30am AEST.

Elsewhere, gold stocks are supporting the bourse, scaling a four-year high amid Middle East tensions and bets for more U.S. rate cuts. As of last close, the index is up over 18% this year, overshadowing a 7.3% gain in the benchmark S&P/ASX200.

The miners are singing a similar tune, with the sub-index up over 2.5% to kiss a two-month high as iron ore prices continue to surge on the tails of a wave of fresh monetary stimulus from top producer China. Copper prices are also at their strongest levels in 10 weeks. As of last close, the AXMM sub-index is down nearly 16% this year.

In the news

Quick check in on some of the stocks to watch in today’s trade. On the reporting calendar, Australian listed shares of Premier Investments (ASX: PMV) have taken a tumble, down over 9% to mark the steepest intraday drop since late-March 2020. It comes after the company reported a near 5% slide in full year net profit, with global retail sales down nearly 3%. Final dividend of 70 cents per share has been declared.

This as the company walks away from its demerger plans of stationary brand Smiggle next year and has prioritised exploring a proposed combination of Myer Holdings’ (ASX: MYR) with PMV’s apparel brands business.

Shares of Sigma Healthcare (ASX: SIG) are also lower as the pharmaceutical distributor posts a near 70% slide in half year net profit from a year earlier.

The stock is up over 33% YTD.

Meantime, ASIC has slapped Macquarie Bank (ASX: MQG) with an AU$5 million fine for allegedly failing to prevent suspicious orders being placed on the electricity futures market. The regulator added, Macquarie has complied with the infringement notice and has paid the fine

In an emailed response, Macquarie said it take full responsibility for all aspects, and has implemented remediation actions to ensure such orders are escalated and actioned appropriately.

Earlier this year, the Federal Court of Australia fined Macquarie Bank A$10 million for its lack of controls to detect and prevent unauthorised fee transactions carried out by third parties on customer accounts.

Australian listed shares of Fortescue (ASX: FMG) are in focus, after the company confirmed it has signed an AU$2.8 billion partnership with German-Swiss equipment manufacturer Liebherr to create one of the world’s largest zero-emission mining fleets. It comes as the iron ore miner continues to explore various strategies to produce green iron, while also expanding into production of hydrogen from renewable resources as it continues on its track to its 2030 ‘Real Zero’ targets.

Shares have touched a three-week high in today’s trade but are down 36% YTD.

Finally, across the ditch, New Zealand listed shares of Fonterra (NZX: FCG) have soared to an over three-year high as the diary firm declares a special 15 NZ cent per share dividend despite a 25% drop in annual profit.

The stock is up over 48% YTD, as of last close.

All prices and analysis at 25 September 2024. The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.