Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Market volatility playbook – defensive tools for your portfolio

Marc Jocum | Global X

A global market sell-off at the start of August and concerns around the Fed’s approach to rate cuts have prompted investors to consider reassessing their portfolio allocations as market volatility has returned after its brief hiatus. Almost every wave of market volatility quickly becomes a whirlwind of misleading noise, as Wall Street strategists, economists and online pundits rush to offer explanations and craft predictions about what’s next. Our advice would be rather than to predict, it’s better to prepare, by having an arsenal of defensively orientated tools in your portfolio to navigate potential volatile periods.

Key takeaways

- August experienced one of the most volatile periods in recent years, with the volatility index (VIX) recording one of its highest intraday spikes, reaching levels not seen since the COVID-19 pandemic and the 2008/09 Global Financial Crisis.(1)

- Volatility is a natural part of investing. Staying diversified is one of the most effective ways to safeguard portfolios against market sentiment swings and psychological reactions.

- To manage volatility prudently, investors might consider incorporating defensive assets such as gold and US treasuries, as well as exploring strategies such as covered calls and low volatility equities.

Did volatility go missing?

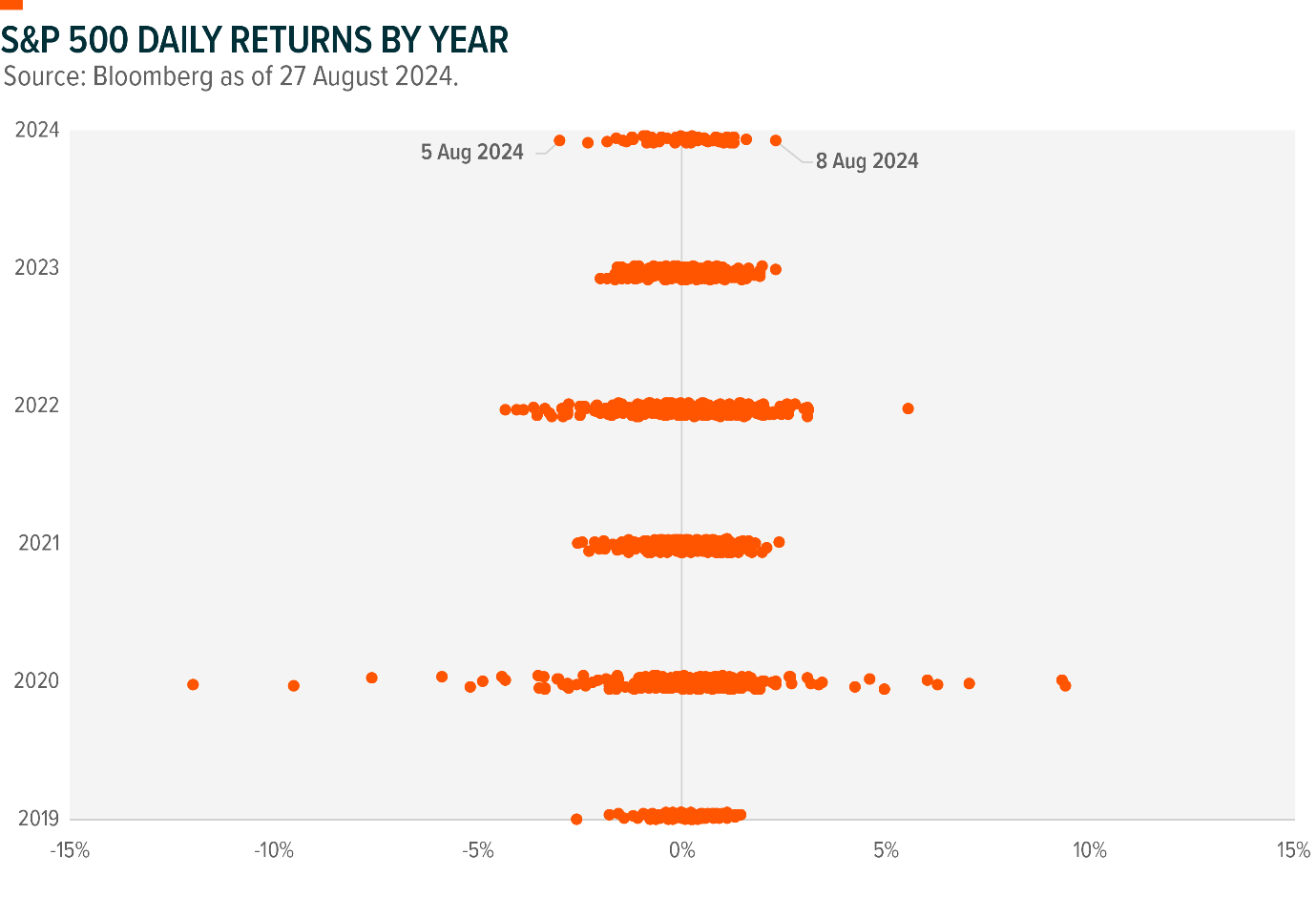

Over the last couple of years, share markets have seen relatively muted volatility. The chart below illustrates the daily movements in the US share market across the last five years, showing that both 2023 and 2024 have been relatively calm compared to the turbulence of 2020 during the COVID-19 pandemic. The early August 2024 points stand out as the most significant outliers so far this year.

The calm in the markets over the past 18 months enticed hedge funds and major traders to take on increasingly higher levels of risk. However, like a rubber band being stretched to its limit, there’s a point where it can snap, and when that does happen, there can be pain.

So what caused the volatility last month? It’s always hard to know the exact reason why, but many believe it’s attributable to a few reasons:

- Japan announced its biggest increase in interest rates in over 17 years which wreaked havoc with investors who engaged in the “dollar-yen carry trade” given the unwinding of highly leveraged positions.

- The US announced some mixed economic news around PMIs declining and rising jobless claims.

- Warren Buffett’s Berkshire Hathaway selling down a large portion of its holding in Apple.

While this might feel like a triple whammy, it’s crucial to understand that market sentiment can swing rapidly, like a pendulum, and investors’ moods can drive price fluctuations. This shift doesn’t always indicate a sudden deterioration in fundamentals as it’s often about how investors perceive the situation.

The VIX, often referred to as the “fear gauge,” measures market expectations of near-term volatility. It reflects investor sentiment, with higher VIX levels indicating increased uncertainty and potential market turbulence. The table below illustrates how various asset classes perform across different VIX environments over a 90 day period (given it’s associated with nearer term volatility). Typically, during periods when the VIX is low, equities tend to perform well, while in high VIX scenarios, more defensive assets like bonds and gold often outperform as investors seek safety amid heightened volatility.

One of the most effective ways that investors can safeguard their portfolios against these psychological and market-sentiment swings is by staying diversified and having defensive tools in their portfolios to manage ongoing market volatility. Let’s dive into these potential tools for investors to consider.

Gold: The safe haven precious metal

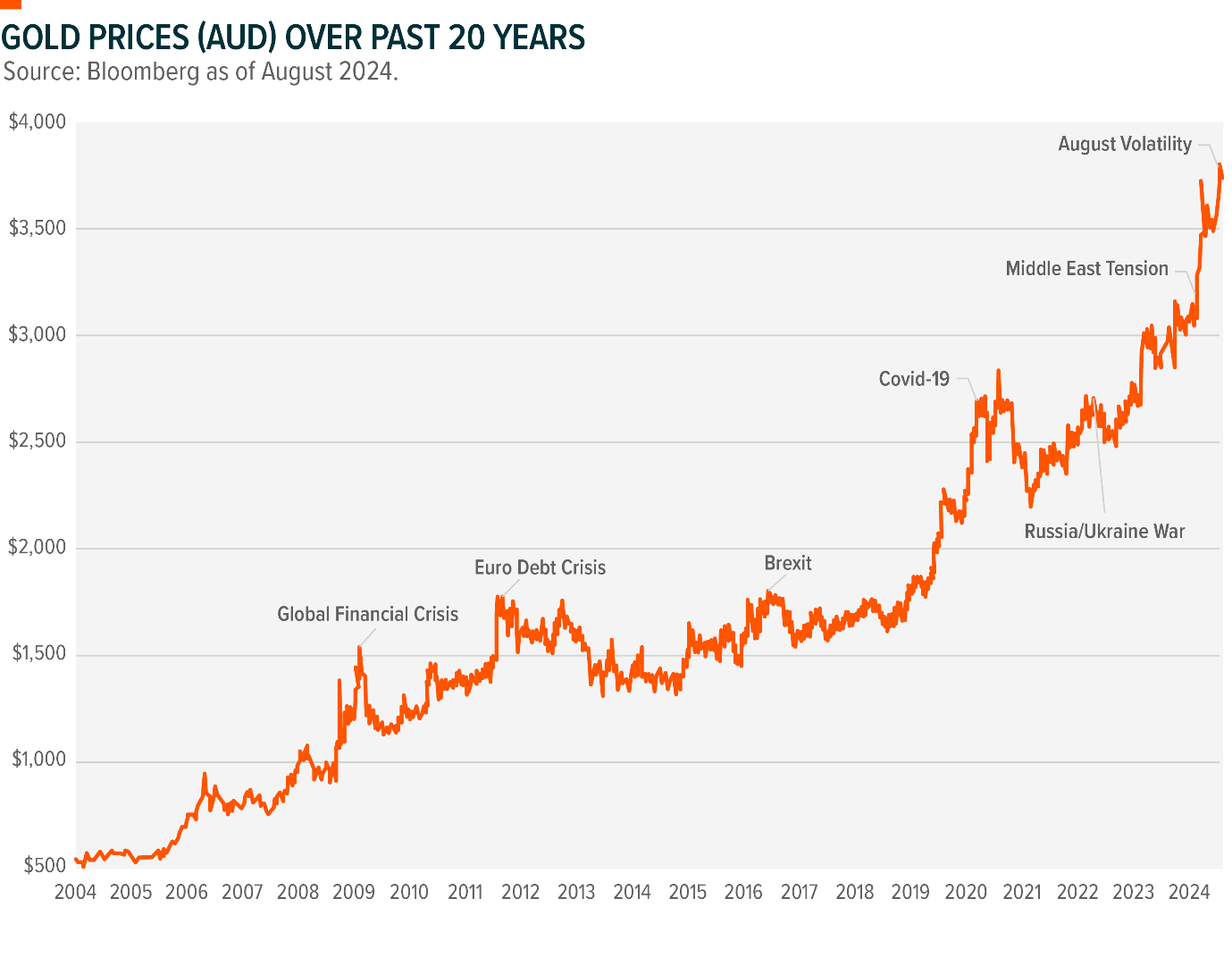

As seen in the table above, gold had the best relative performance compared to other asset classes when volatility increased. Gold is generally uncorrelated to equities providing enhanced diversification benefits to portfolio implementation.(2) It’s the ultimate insurance policy when it comes to investing. As strange as it may seem, gold is the one asset that investors might not mind if it performs poorly in their portfolio because it means that it’s likely everything else is doing well. Thankfully for gold investors, the precious yellow metal has had a great last decade of performance, withstanding the various economic and geopolitical scenarios inducing volatility.

For investors who may have concerns about rising share market volatility, whether it’s caused by inflation shocks, geopolitical tensions, or just general concerns around the share market, gold can be an interesting alternative defensive asset to consider.

Treasuries: A potential source of treasure

US Treasuries are another example of a safe-haven asset that is highly sought during market volatility due to their status as one of the most reliable assets, backed by the full faith and credit of the US government. In times of uncertainty, investors tend to flock to Treasuries for capital preservation and stability, which helps to offset losses in riskier assets like equities. Adding US Treasuries to a portfolio can provide a valuable hedge against market downturns, reduce overall portfolio risk, and enhance diversification, especially when market conditions are turbulent. US Treasury bonds have a quarter of the risk as US shares(3) and can act as a defensive ballast during share market drawdowns.

If broader share market activity is negatively impacted, it could lead central banks to consider cutting interest rates to stabilise the economy. Such rate cuts generally increase the attractiveness of Treasury bonds, as lower interest rates make existing bonds with higher yields more valuable, leading to potential capital appreciation. This dynamic creates a favourable environment for Treasury bonds, making them a key component in portfolios, particularly during periods of economic uncertainty.

Equities: Covered calls and low volatility factor

For those seeking to retain equity exposure while lessening downside risk, investors may wish to consider covered call strategies and stocks that have low volatility profiles.

Covered calls provide an opportunity for investors to potentially monetise market volatility. Generally, when volatility rises, the premiums on offer for writing call options increase, which can provide an income avenue for investors. During recent periods of market volatility such as COVID-19 and the inflation shock in 2022, higher implied volatility translated into a pick-up in options premium income for investors.

The income generated from covered calls can provide an inherent protective buffer for client portfolios, as these strategies typically perform well when markets are flat or declining. During severe market downturns like the GFC and COVID-19, covered call strategies had less impactful drawdowns than the broader share market.(4) For investors seeking modest downside protection while also aiming to capitalise on expected volatility, covered calls can be an attractive option.

Investors might also consider focusing on income-oriented companies with low volatility characteristics. A multi-factor approach to equities that focuses on both yield and volatility factors can provide exposure to more defensive sectors like utilities, consumer staples, energy, and healthcare. Historically, this strategy has delivered strong performance during volatile periods, including the 2000/01 Dot Com boom, the 2008/09 Global Financial Crisis, 2016 Brexit and US elections, and the 2022 pandemic-induced inflation shock.

Helping investors stay disciplined and invested

Volatility is a normal part of the investing process. It’s the price of admission that investors pay to potentially seek enhanced returns above cash. While long-term investing has proven to be a powerful wealth-building strategy, emotions and psychology can sometimes disrupt even the best-laid plans. To stay the course, investors should consider incorporating a variety of volatility protection tools into their portfolios. Exchange traded funds (ETFs) have made these strategies more accessible and affordable, offering a practical way to manage risk.

As Benjamin Graham noted, “The essence of investment management is the management of risks, not the management of returns.” Rather than avoiding risk, investors can focus on managing it wisely by potentially adding layers of protection, such as gold, US treasuries, covered calls, and low volatility equities. By doing so, they can navigate market turbulence and trust their portfolios are resilient enough to weather both storms and sunny days.

Learn how the industry leaders are navigating today's market every morning at 6am. Access Livewire Markets Today.

Footnotes

1. Bloomberg. (August 2024)

2. Bloomberg. (August 2024) based on ten-year correlations.

3. Bloomberg. (August 2024) based on ten-year volatility.

4. Bloomberg.

All prices and analysis at 5 September 2024. This document was originally published in Livewire on 5 September 2024. This information has been prepared by GLOBAL X MANAGEMENT (AUS) LIMITED (AFSL 466778, ACN 150 433 828).

The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, click here.