Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Markets at a glance 28 August

Around the grounds

The Australian share market has edged lower in today’s trade dragged by losses in miners as investors digest key inflation data and a deluge of corporate earnings.

Sector specific, the miners are off by around 0.6%, despite an uptick in Fortescue shares, while the gold plays are tracking higher thanks to underlying strength in bullion prices with the broader index touching an over 3 and a half year high with the sub-index on track for a third day of consecutive gains.

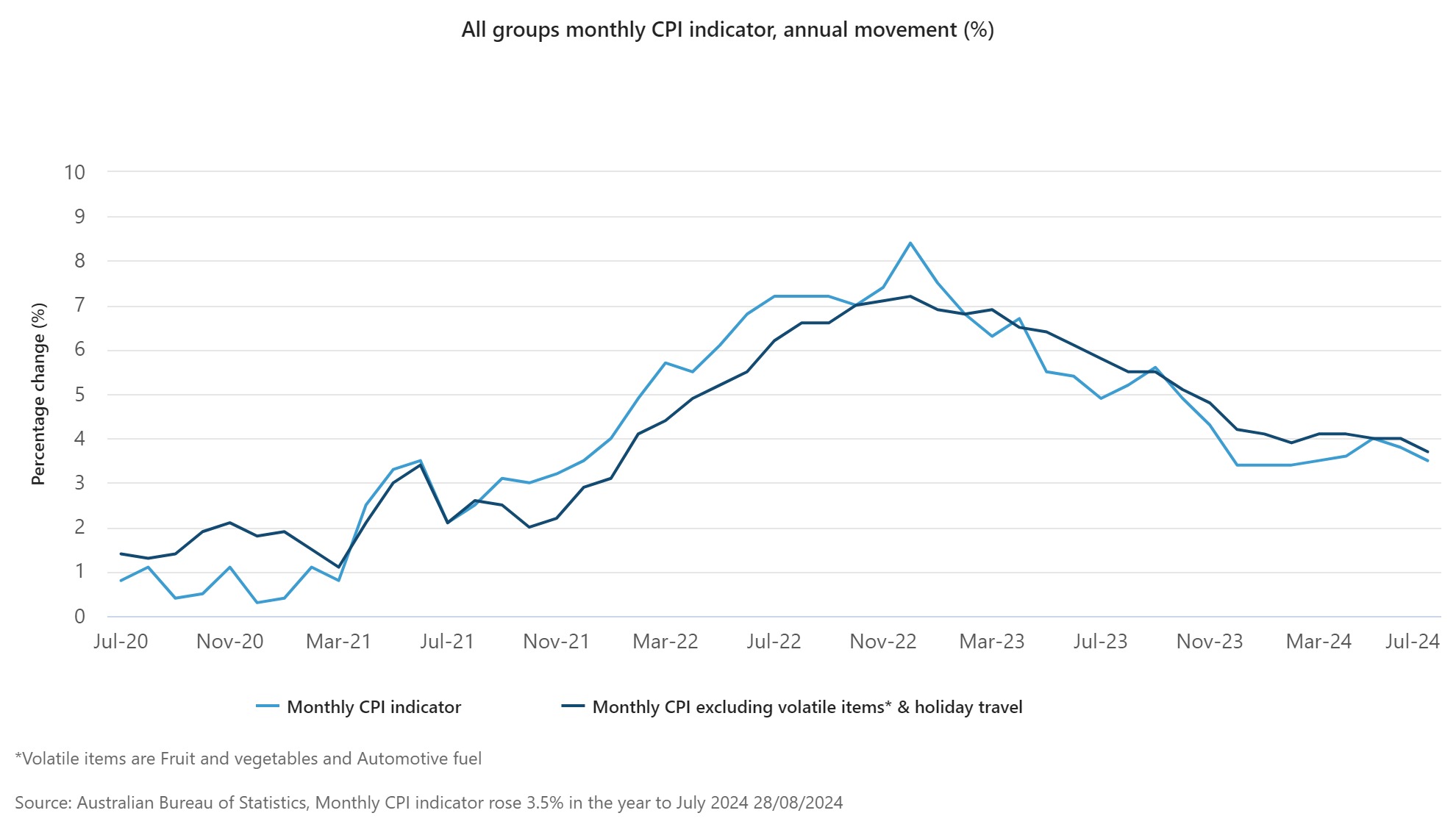

On those inflation figures, the Australian dollar has climbed to touch an eight-month peak after CPI data came in slightly above forecasts in July, though slowed to 3.5% from 3.8% the previous month. The market had been hoping for a 3.4% or less print. Diving into the detail. While a couple measures of core inflation slowed, with one touching its lowest level since 2022, progress is proving again to be gradual.

The Reserve Bank of Australia has repeatedly warned core inflation remains too high and is unlikely to allow a cut in the 4.35% cash rate this year. Futures have priced in a 28% chance the RBA will start easing in November and are almost fully priced for a cut to 4.1% in December.

In the news

Reporting season continues to roll in thick and fast, today’s it’s all eyes Fortescue (ASX: FMG) after the mining giant reported a 3% rise in annual profit, boosted by higher iron ore shipments. Despite logging its third-highest earnings in company history, profit fell short of expectations.

On the payout, shareholders will get a final dividend of 89 cents per share, lower than last year but higher than Visible Alpha consensus.

Sticking in the mining space, Australian listed shares of Lynas Rare Earths (ASX: LYC) are moving higher after the company posted a smaller-than-expected fall in annual profit, helped by lower operating costs. Full year net profit however tanked have tanked nearly 73%, hurt by weak prices and subdued demand from China.

No dividend was declared for fiscal 2024.

Australian listed shares of engineering firm Worley (ASX: WOR) have extended gains, as the company reported a 27% pop in full year underlying profit and says its targeting low double-digit EBTIDA growth in FY25. The stock is down 17% this year, as of last close.

Turning to grocers, Woolworths (ASX: WOW) full year profit came in flat on a year ago, as weak performance in New Zealand and Big W divisions offset sales growth in Australia as the company grapples with inflation-induced margin pressures and rising operational costs.

Final dividend of 57 cents per share declared, compared with a 58 cent a share payout a year earlier, and has declared a special dividend of 40 cents per share.

Flight Centre (ASX: FLT) shares are in focus after the travel agent company doubled full year profits and boosted its dividend 122% to 40 cents a share. Total transaction value for the 12 months ended 30 June also surged, up 8% to a record of AU$23.7 billion, driven by both its leisure and corporate businesses. Looking ahead, the company remains confident it can ‘capitalise on opportunities in a normal growth market during FY25 with a strong balance sheet and improving margin profile’.

And shares of bookmaker Tabcorp (ASX: TAH) have sunk to touch four-year lows as the company swings to a full year loss of AU$1.36 billion dollars, compared to a AU$66.5 million profit last year, largely due to a AU$1.38 billion non-cash impairment charge relating to wagering assets as recovery in the market lags thanks to higher inflation and interest rates which has impacted consumer spending.

Stripping out one-time items, underlying profit also missed consensus. The stock is the top loser on the ASX 200 benchmark and down over 32% YTD, as of last close.

Ending on a positive note, shares of Australian clothing retailer City Chic (ASX: CCX) have skyrocketed, at one stage up over 41% as the company’s revenue forecasts for fiscal 2025 top estimates. CCX shares are down over 77% this year, as of last close.

Going global

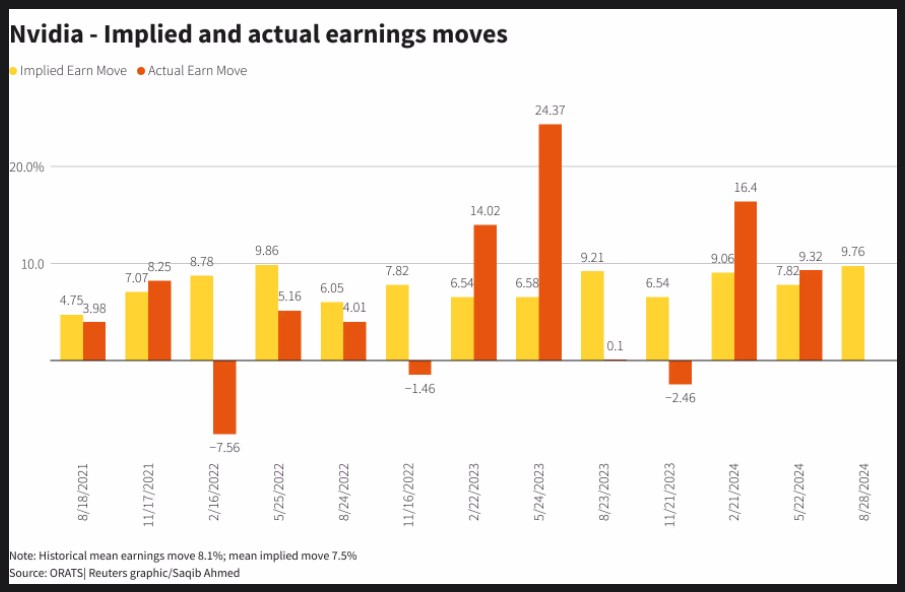

Rounding things out on the global stage, investors are watching and waiting for Nvidia (NASDAQ: NVDA) earnings hitting the wires tonight. While the revenue number is expected to be a blockbuster event focus has shifted to the aftermath. Traders in the U.S. equity options market are tipping the upcoming report to spark a more than US$300 billion swing in Nvidia shares.

Options are pointing to a near 10% move in the share price on Thursday, the day after it reports earnings, which would be larger than any expected move over the last three years and well above the stock’s average post-earnings move of around 8%, according to analytics firm ORATS.

With a market cap of over US$3 trillion, a 9.8% swing would translate to around US$305 billion, which would be the largest expected earnings move for any company in history.

US futures are back online with a mixed open expected when the Wall Street session gets underway, Nasdaq futures are pointing to a gain while S&P 500 E-minis are down around 0.17%, at the time of writing.

Around the rest of the region, MSCI’s broadest index of Asia-Pacific shares outside Japan are marginally lower, with Tokyo’s Nikkei 225 edging into the red. Finally, currency markets are trading in a tight range as the market awaits for further clues to the size of the widely expected FOMC interest rate cut next month.

The US dollar has held near its lowest level in more than a year against a basket of its peers, with sterling trading just off multi-year highs while the euro has bucked the broader trend to trade lower but remains within flirting distance of a 13-month peak reached earlier in the week.

All prices and analysis at 28 August 2024. The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.