Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Markets at a glance 15 August

In the news

Kicking it off with reporting season – let’s get to the numbers. Telstra (TLS) has posted a near 16% drop in full year profit as growth in its mobile segment was outweighed by weak performance of its enterprise and wholesale businesses amid heightened competition and constrained customer spending.

Stripping out onetime items though, profit rose 7.5%, with a final dividend of 9 cents per share, up on the 8.5 cents declared a year ago. Shares are higher in today’s trade thanks to that near 6% boost to the payout.

Cochlear (COH) shares are under pressure in today’s trade, on a weaker-than-expected profit and outlook. FY underlying earnings jumped 27% to AU$386.6 million but missed the mark on consensus. The stock is up 13% YTD, as of last close.

It’s a similar story for Origin Energy (ORG) shares, tumbling as much as 10% on a bleak outlook for its Energy Markets division business. It comes despite a 58% surge in annual underlying profit, and a warning electricity profits could decline in fiscal 2025. Final dividend of 27.5 cents per share declared, compared to last year’s 20 cents a share payout. The stock is up over 25% this year, as of last close.

Treasury Wine Estates (TWE) has set its sights on stronger growth this year as it bets on robust demand for its premium and luxury brands as exports to China resume following years of heavy tariffs. On FY numbers, TWE reported an 8% rise in underlying profit at AU$407.5 million a shade below estimates.

Final dividend of 19 cents per share was declared, compared to last years 17 cents a share payout. Shares are higher in today’s session.

Shares of crop protection and seed technology company Nufarm (NUF) have slumped to a near four-year low after it trimmed FY24 underlying guidance citing competitive pressures which are causing adverse movements in price and product mixes which in turn, are impacting its North American crop protection business.

Stock is down nearly 16% as of last close YTD.

Around the grounds

Quick check on the boards, the S&P/ASX 200 has edged higher in today’s trade, bolstered by financials and fresh inflation data from the US which has moved to reassure investors the Federal Reserve will start cutting rates next month.

Around the sectors, Australian listed mining stocks have tumbled to a 21-month low as the price of iron ore slides after disappointing credit data from top consumer China dented sentiment, which is already being hampered by diminishing demand and high supply. The AXMM index is down nearly 20% YTD, as of last close.

Elsewhere, the energy plays are higher, tracking a rise in oil prices.

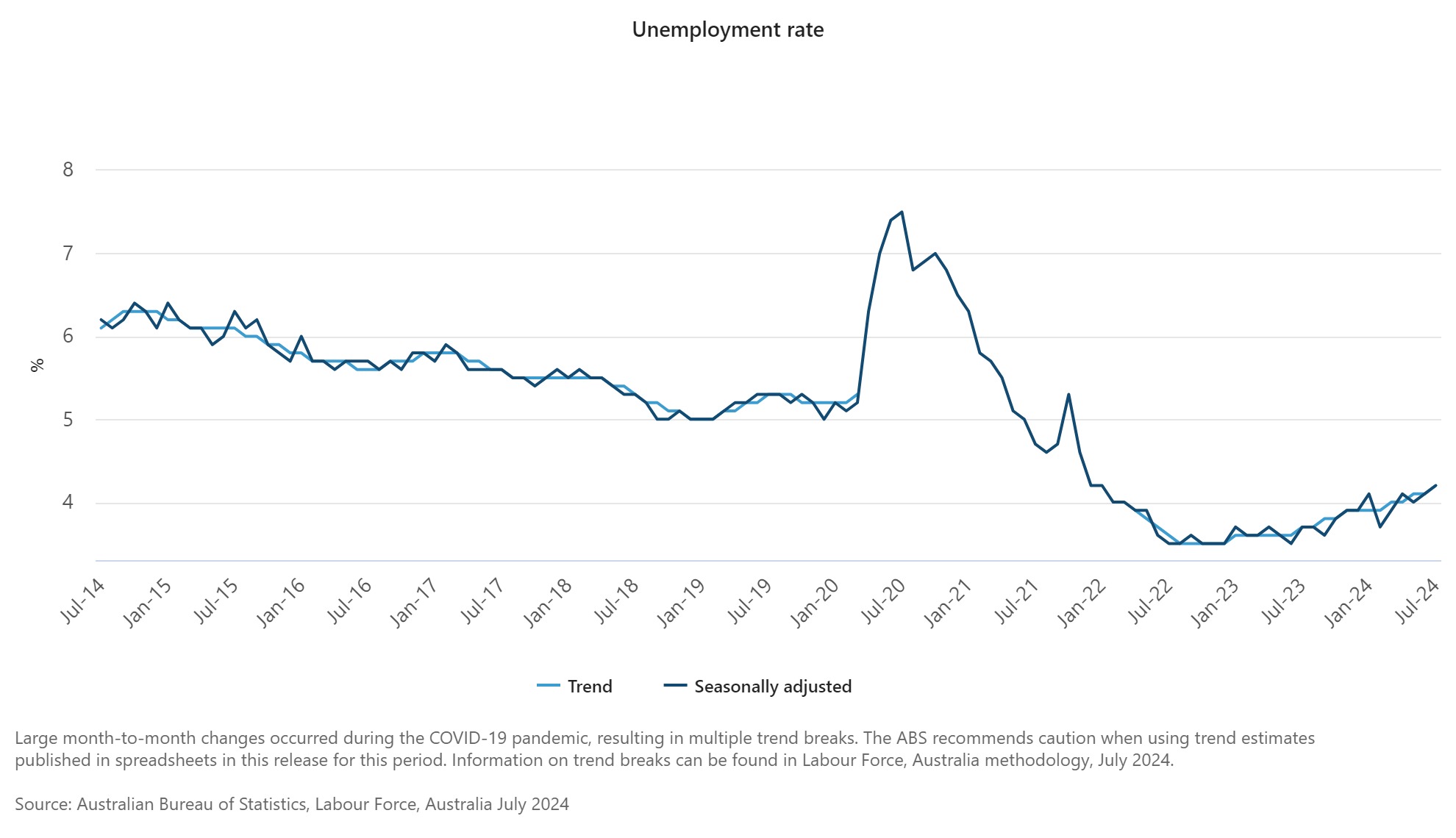

Finally, to the economic outlook, July employment figures blew past forecasts for a second straight month, up 58,200 compared to the mere 20,000 rise economists were expecting. The jobless rate though, ticked higher as worker participation hit record peaks in a sign labour demand remains solid despite high borrowing costs.

Unemployment now sits at 4.2%, its highest level since early 2022 and above estimates of 4.1%, while the part-rate rose to an all-time high of 67.1%. The Australian dollar has jumped on the news, last up around the 66.1 US cent mark.

Going global

Rounding things out on the global stage, Asian markets are firmer in today’s trade taking leads from gains on Wall Street with Tokyo’s Nikkei 225 rising 0.5%. Mainland Chinses blue chips are also higher, though Hong Kong’s Hang Seng remains marginally in the red. Margin trading in Japan has fallen sharply as investors were forced to dump stocks after the Nikkei’s biggest fall in nearly 40 years last week.

US futures are back online pointing to a small rise at the start of the Wall Street session after stocks rose yesterday buoyed by the slowest rise in CPI in more than three years.

Finally, to currencies, the US dollar remains on the back foot after slumping overnight to its lowest level against the euro since the end of last year. Sterling is also depressed after soft UK inflation figures hinted at faster and deeper rate cuts form the Bank of England (BoE).

All prices and analysis at 15 August 2024. The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.