Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

AUS: RBA Minutes re-iterate the push back against near-term cuts

Tapas Strickland | Markets Research

Key points:

- RBA Minutes contained little new information on top of recent communications

- As already stated by Bullock: “unlikely that the cash rate target would be reduced in the short-term”

- However, RBA is not dogmatic, Board open to pivoting if the data flow turns quickly:

“placing somewhat greater-than-usual weight on the flow of data, relative to the forecasts”

“members were alert to the possibility that labour demand could soften, perhaps quite rapidly” - Being on hold and guiding to hold for longer than market pricing is seen as the best option to balance risks

- NAB retains its view that the RBA will wait until H1 2025 before cutting rates

- We have pencilled in May, though risks do skew earlier in 2025 depending on data flow

Summary:

The RBA Minutes for the August Meeting were not expected to contain new information given the plethora of communications from Martin Place. In this they exceeded, with Governor Bullock’s push back on market pricing repeated in these Minutes: “based on the information available at the time of the meeting, it was unlikely that the cash rate target would be reduced in the short term”.

The Board also re-iterated its strategy of “bring[ing] inflation back to target within a reasonable timeframe”, but “their tolerance for this timeframe being pushed out further was limited”. While the Board did discuss the merits of hiking rates, the Minutes clearly reveal the RBA’s preference is to be on hold. Being on hold and pushing back against rate cut expectations in the near-term was seen by the Board as balancing the risks surrounding the outlook for inflation and the labour market.

Interestingly, the case to hold rates was partly justified on financial conditions being seen to be less restrictive than had previously been the case given credit growth and market pricing for cuts: “Members observed that it was possible to achieve a comparable degree of tightening in financial conditions as an increase in the cash rate by holding the cash rate at its current level for longer than the technical conditioning assumption”. However, given the push back on pricing in the short-term, we do not read too much into this comment.

Implications:

As forecasters we need to have a good view for where the economy is going. But there is greater than usual uncertainty given levels of demand/supply vs subdued growth. Reflective of this the RBA is explicitly “placing somewhat greater-than-usual weight on the flow of data, relative to the forecasts”. This should leave markets very sensitive to data prints particularly around the labour market and inflation.

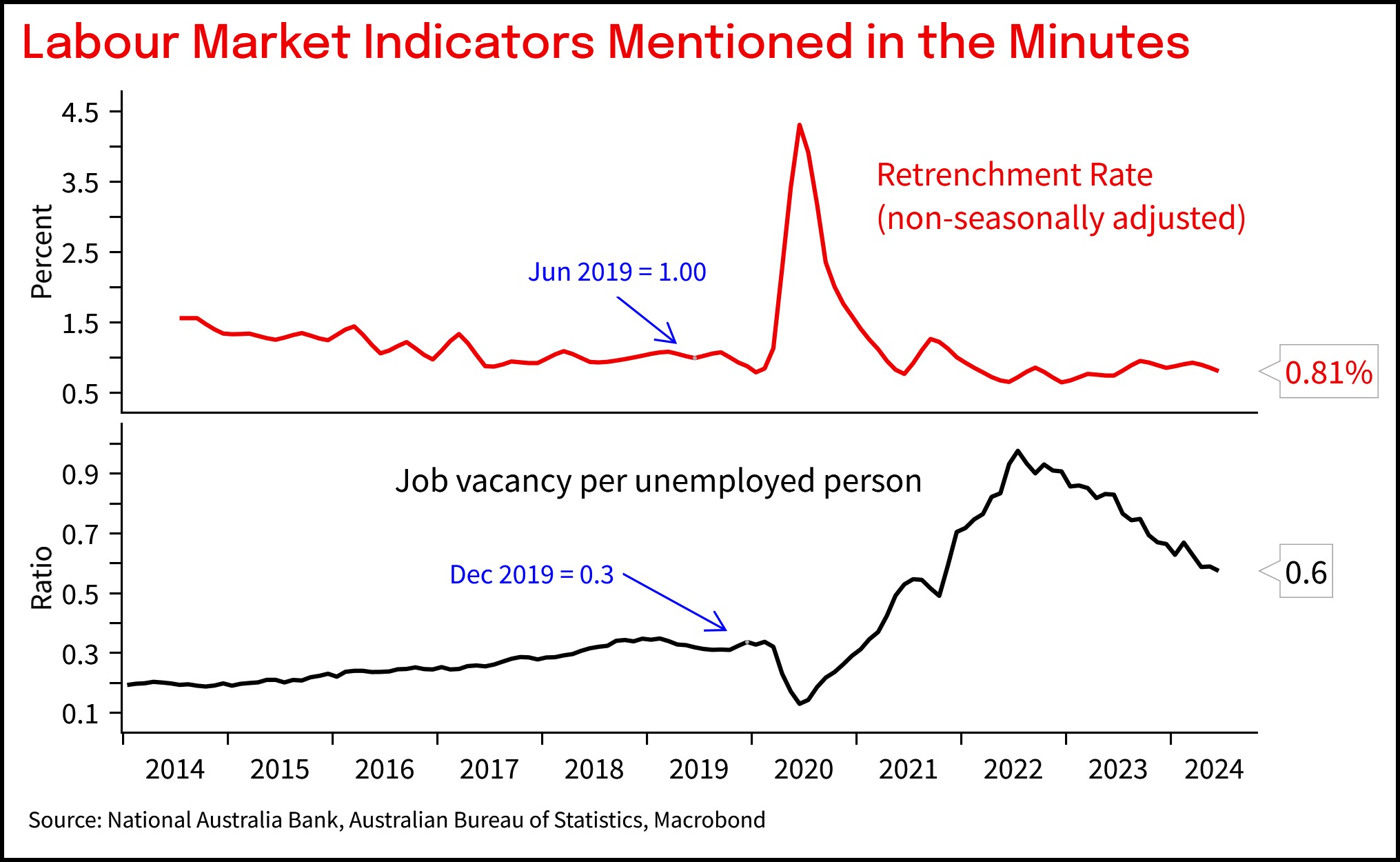

Importantly, the RBA Board is not being overly dogmatic in their guidance. The Minutes note: “members were alert to the possibility that labour demand could soften, perhaps quite rapidly”. Of course, there is little evidence of labour demand softening. The Minutes noted “the rise in the unemployment rate owed more to reduced flows of workers into employment than an increase in layoffs, which remained very low”. And that “the level of job vacancies remained well above both its pre-pandemic average and outcomes in other advanced economies, despite falling significantly from its peak” (see NAB chart on this below).

NAB retains its view that the RBA will wait until H1 2025 before cutting rates. We have pencilled in May, though risks do skew earlier in 2025 depending on data flow. The most important of that data flow being labour market indicators given “members were alert to the possibility that labour demand could soften, perhaps quite rapidly”.

Chart 1: The Minutes noted layoffs remained very low and the level of job vacancies remained well above both its pre-pandemic average and outcomes in other advanced economies despite falling significantly from its peak

This document has been prepared by National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 ("NAB"). Any advice contained in this document has been prepared without taking into account your objectives, financial situation or needs. Before acting on any advice in this document, NAB recommends that you consider whether the advice is appropriate for your circumstances. NAB recommends that you obtain and consider the relevant Product Disclosure Statement or other disclosure document, before making any decision about a product including whether to acquire or to continue to hold it. Please Click Here to view our disclaimer and terms of use. Please Click Here to view our NAB Financial Services Guide.

All prices and analysis at 20 August 2024. This information has been prepared by National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 ("NAB").

The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.