Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

12 July Markets at a glance

Around the grounds

It’s been a roller coaster ride for the Australian share market, but it looks set to end the week with a bang. The S&P/ASX 200 has climbed to a record high on this Friday session, getting a leg up from the miners and financials after a surprise to the upside in US inflation reading which all but guarantees a cut from the FOMC in September.

Diving into the details, interest-rate sensitive financials have also hit a record peak and are on track for their fourth consecutive session of gains. The AXFJ sub-index is up around 16% YTD as of last close.

Miners have also jumped, after iron ore prices rose on hopes that top consumer China will unveil more stimulus measures. On the week though, iron ore futures are set for a fall on profit-taking. Similar story for energy shares, trading in the green, while the healthcare sub-index has added over 1% in the day’s trade touching its highest level since June 2023.

Across the ditch New Zealand manufacturing activity remains in stuck in contraction for 15 months as the latest PMI survey fell to 41.1 in June from 46.6 previously. It’s equity index though is still tracking higher, up around half a per cent.

In the news

Big moves in the miners, with Australian listed shares of BHP Group (BHP) under pressure as it suspends operations at its Western Australia nickel mine effective October, as it grapples with declining metal prices and oversupply in the global market. BHP says it will review the decision by February 2027.

In response, Lynas Rare Earths (LYC) has flagged the mining giant’s ability to supply sulphuric acid to its own WA facility will be disrupted by the suspension.

As of last close BHP shares are down 13.6% year to date as of last close.

Shares of Australian listed Whitehaven Coal (WHC) have taken a hit, as Bell Potter warns of lower Q4 sales, impacted by shipping delays at the company’s Newcastle port due to adverse weather conditions in late June, leading to high coal stockpiles. WHC is scheduled to report its fourth quarter production results on July 19th.

‘Hold’ rating retained, while the price target has gotten a boost to AU$8.90 from AU$.7.70 a share. The stock is up 16.5% this year as of last close.

On the flip side, shares of Australia’s Incitec Pivot (IPL) are tracking higher as analysts at Citi resume coverage on the chemicals manufacturer with a ‘neutral’ rating a price target of AU$3 per share. IT comes after the company pulled the pin on talks to sell its fertiliser business and reinstated its earlier announced AU$900 million buyback. Stock up nearly 17% this year as of last close.

Finally at the smaller end of town, Australian listed shares of Coventry Group (CYG) have surged, posting their biggest intraday percentage gain since mid-April as the mining services provider posts a strong FY24 group sales number, up nearly 4% on a year earlier, with EBTIDA soaring over 22%.

The stock is down nearly 8% so far this year as of last close.

Going global

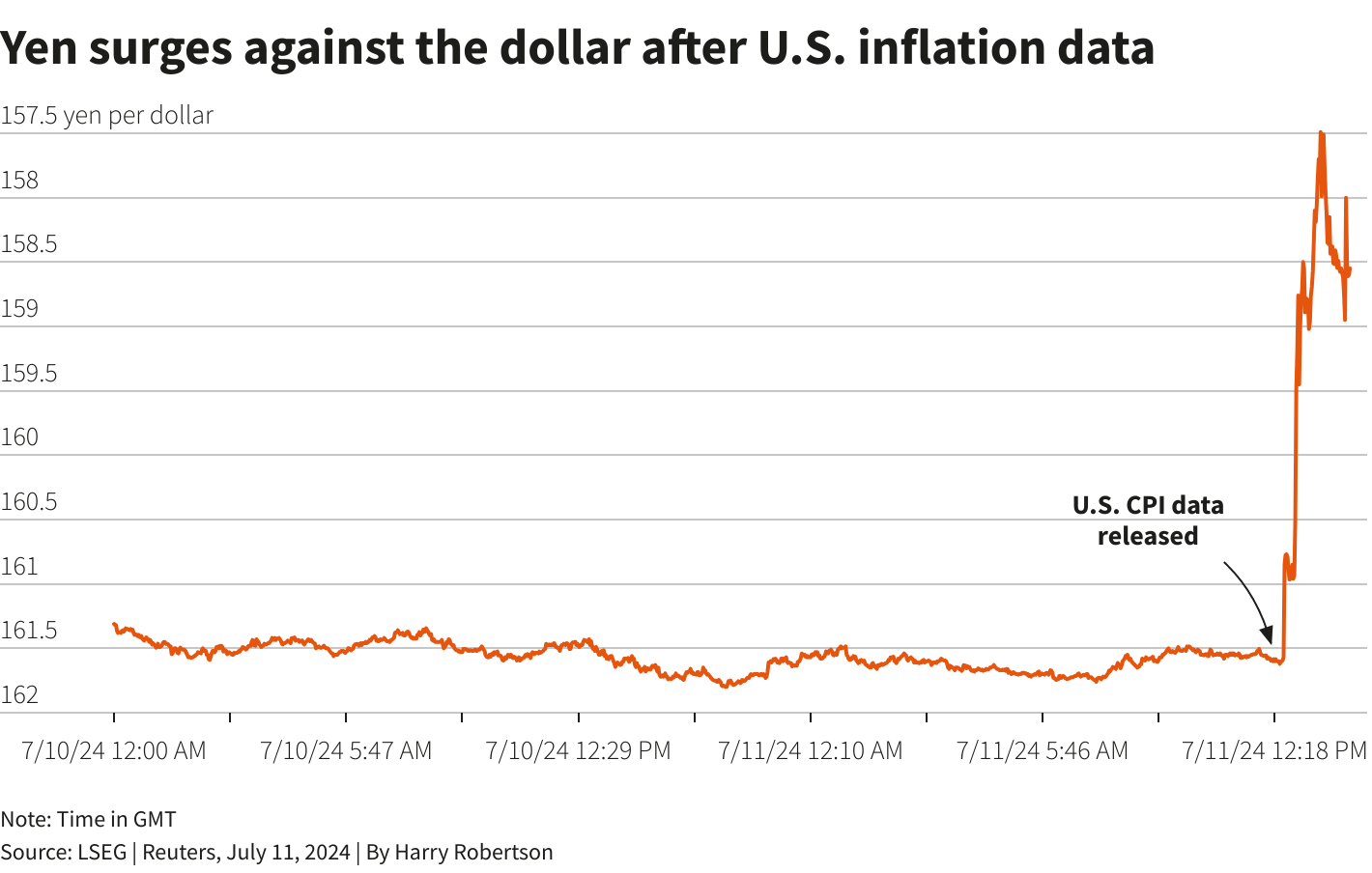

Another day another focus on currency markets. The yen continues to whip-saw after a sharp surge overnight after the June CPI print stateside surprised markets and came in softer than expected. The Japanese currency has swung from red to black in the Asian trading session after having spike as high as 3% immediately after the release of that inflation print.

Market participants though are questioning whether those moves were a CPI short squeeze, or indeed an intervention. Tokyo’s top currency diplomat however has thrown cold water on intervention speculation saying authorities will take action as needed in the market but declined to comment on whether they had already.

Elsewhere, the US dollar is on the defensive, as the road is all but certain for a September rate cut from the Fed, with futures pricing in an over 90% chance, compared with the 73% before the CPI reading, according to the CME FedWatch Tool.

The euro is holding just below a one month high, while sterling is sitting tall near a one-year peak.

Rounding it all out, global shares are eyeing a modest weekly gain. MSCI’s broadest index of Asia-Pacific shares outside of Japan is little changed in the afternoon session taking cues from a negative US session as investors rotated into smaller companies. The index though is on track to gain 1.6% for the week, helped again by growing bets of an imminent U.S. rate cut.

Tokyo’s Nikkei 225 is the weak spot, down over 2% dogged by falling technology stocks. And US futures are flat to negative coming back online ahead of the North American trading session.

All prices and analysis at 12 July 2024. The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.