Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

AUS: May CPI Indicator is clearly bad news, but not quite as bad as the headline suggests

Taylor Nugent | Markets Research

Key points:

- Monthly CPI indicator rose to 4.0% from 3.6% (NAB 3.6%, consensus 3.8%)

- Volatile travel prices fell much less than expected and account for all of the miss relative to our forecast

- Elsewhere, themes were closer to expectations, particularly on market services

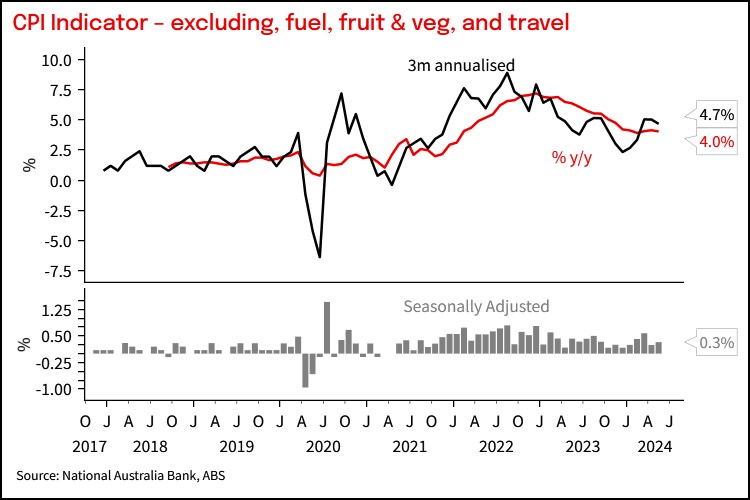

- Ex volatiles and travel did slow from 4.1% to 4.0% and while key services categories remain too strong, they do show some cooling

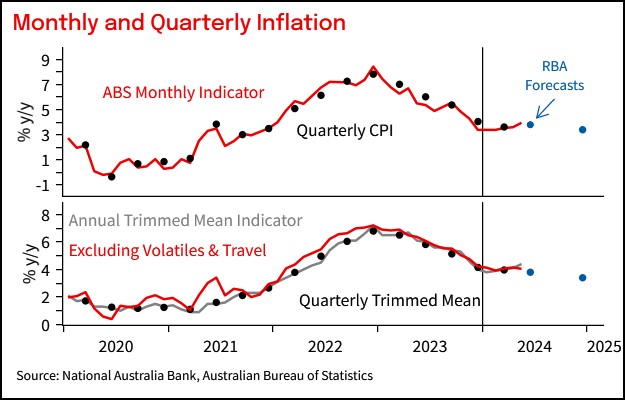

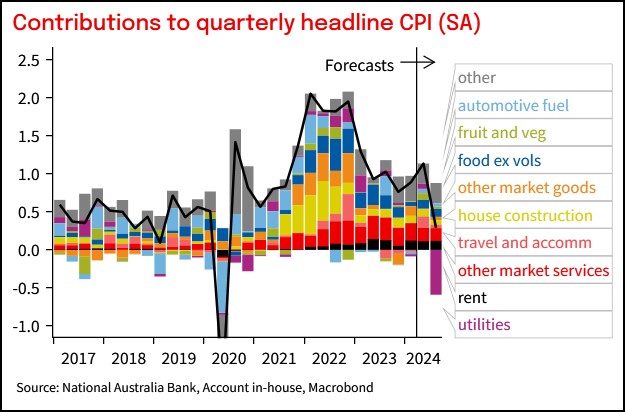

- But overall, updates through housing, goods, and food mean our early mapping puts the risk to a 1.0% q/q from our preliminary Q2 trimmed mean estimate of 0.9% q/q; the RBA SoMP had pencilled in 0.8% q/q.

- NAB’s RBA call is under review

Bottom line:

The Monthly CPI Indicator surged four tenths to 4.0% y/y in May from 3.6%. That four tenths lift is bad news for the RBA, but not as bad as it looks at face value. The surprise to our forecast was volatile travel prices, for the full Q2 CPI, that’s a headline, not a trimmed mean, story. The RBA has the luxury of waiting for the full quarterly CPI on 31 July before the August meeting and forecast update. The ex volatiles and travel reading did slow a little, from 4.1% to 4.0% and key services categories remain too strong but do show some cooling. Worth noting, but not our preferred underlying measure from the monthly, the annual trimmed mean accelerated to 4.4% from 4.1%.

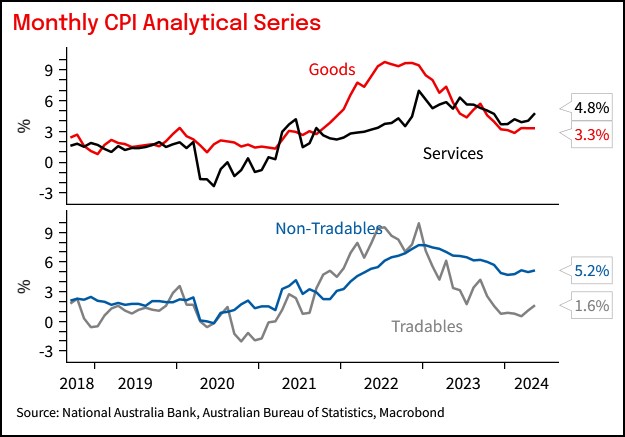

RBA Deputy Governor Hauser speaks tomorrow evening and will be a useful test for just how uncomfortable the RBA is about the lack of progress on inflation. RBA Governor Bullock highlighted at last week’s June meeting that “there’s been limited information about services inflation since the May Board meeting.” That picture is a little more complete with today’s data in hand and there is evidence of cooling in some market services components. Inflation in hairdressing, sports and cultural activities slowed, while restaurants and other personal services remained relatively benign. Against the grain, insurance remains elevated.

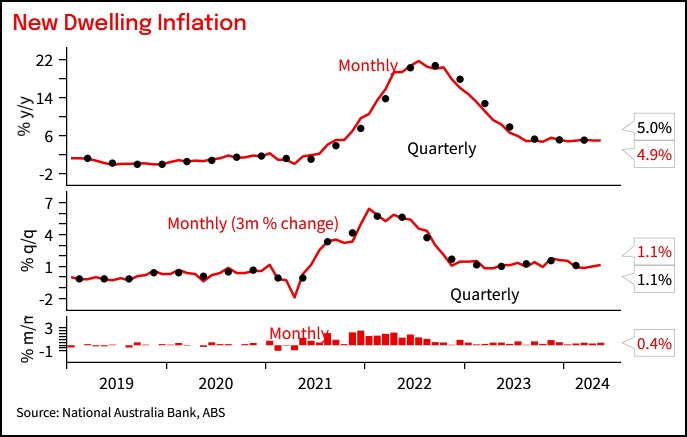

However, housing related inflation remains strong, with rents up 0.8% m/m, slightly higher than its recent 0.7% run rate, and new dwelling cost inflation remains stubborn at 0.4% m/m. Housing is a real barrier to further progress on underlying measures. Grocery inflation has improved from its earlier run rate but was a little stronger than our preliminary forecast pencilled in, and seasonal declines in garments were only modest in May. The net is the risk skews Q2 trimmed mean inflation firmly to a 1.0% from our preliminary forecast of 0.9%, while headline at this stage looks like a 1.0% q/q in Q2. The RBA had only a 0.8% q/q pencilled in for Q2. We will finalise out Q2 forecast in the coming days, and note that there is still some large categories, including new cars and financial services, we have no partial indicators for yet out of the April and May Monthly indicators.

Detail:

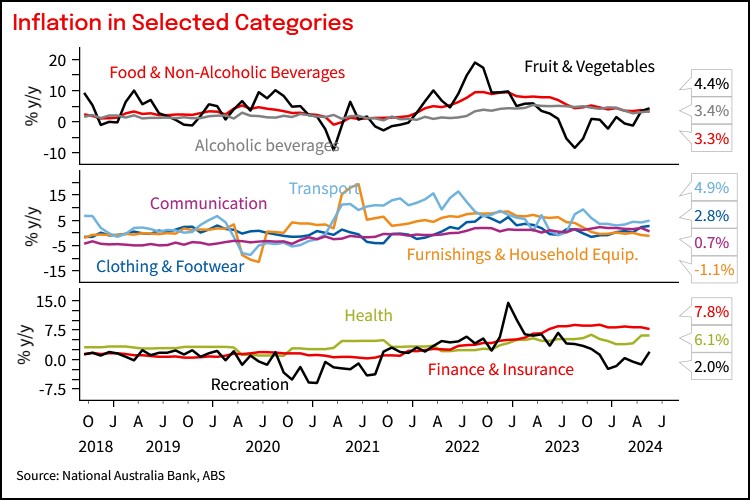

Market Services: In what is generally not a good print, the detail on the subset of services components that the RBA has been focussed on as a barometer of domestic inflation pressures look consistent with some further progress in Q2. Hairdressers, personal and other household services, restaurant meals, and a range of recreation and cultural services are all annualising below 4%. Insurance remains elevated.

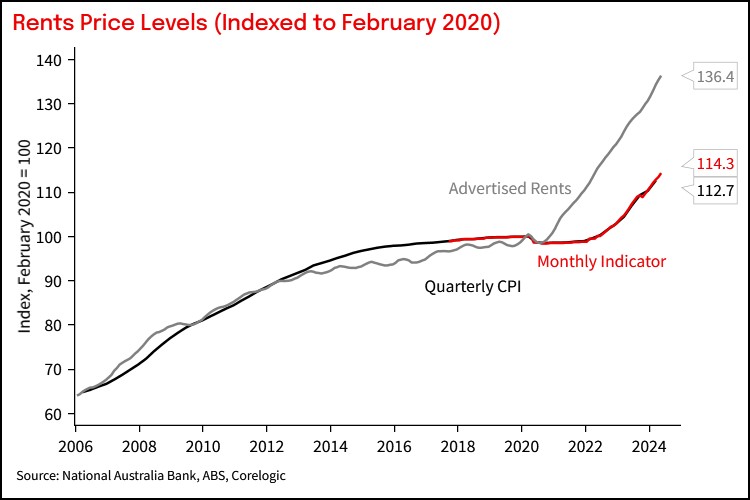

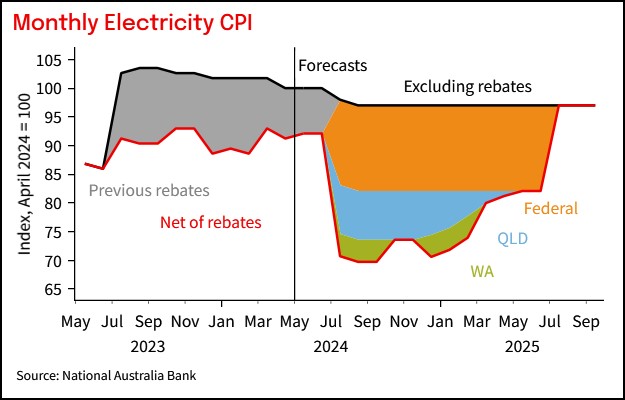

Housing: Rents growth was 0.8% m/m in May, sustaining elevated growth rates with little scope for meaningful cooling until well into 2025 at the earliest given more timely advertised rents data. New Dwelling Construction inflation has moderated materially from its early 2022 peak, but remains very high at 0.4% m/m and after 0.3% m/m in April. That is the largest component of the CPI and makes it more challenging to get underlying measures lower. the Statistician did note: “builders continuing to pass on higher costs for labour and materials” and “strong demand for rental properties amid tight rental markets continuing to drive rental price rises”. Across utilities, subsidy impacts continue. Victorian subsides unwound in May, adding 1.4% to electricity prices. We expect the remaining subsidy impact to unwind in July, but be more than offset by new, larger subsidies, resulting in a net 0.5ppt drag in Q3 CPI, see chart below.

Chart 1: CPI excluding volatiles and travel

Chart 2: Monthly and Quarterly CPI

Chart 3: Services inflation acceleration driven by travel

Chart 4: New Dwelling inflation

Chart 5: Rents inflation

Chart 6: Monthly inflation categories

Chart 7: Preliminary forecast contributions to seasonally adjusted CPI for Q3 and Q4

Chart 8: inidcative forecast profile of electricity subsidy impacts

This document has been prepared by National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 ("NAB"). Any advice contained in this document has been prepared without taking into account your objectives, financial situation or needs. Before acting on any advice in this document, NAB recommends that you consider whether the advice is appropriate for your circumstances. NAB recommends that you obtain and consider the relevant Product Disclosure Statement or other disclosure document, before making any decision about a product including whether to acquire or to continue to hold it.

Please Click Here to view our disclaimer and terms of use. Please Click Here to view our NAB Financial Services Guide.

All prices and analysis at 26 June 2024. This information has been prepared by National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 ("NAB").

The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.