Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

5 June Markets at a glance

Around the grounds:

- ASX treads water; economy slows to a crawl in Q1

- Gold & mining stocks slump to one-month low

- Iron ore futures near seven-week low

- Medibank (MPL) faces civil lawsuit over data breach

- Stocks in India tumble; investors spooked by election results

The S&P/ASX200 has managed to hold onto marginal gains, as a rise in banks and healthcare outweighed losses in commodities.

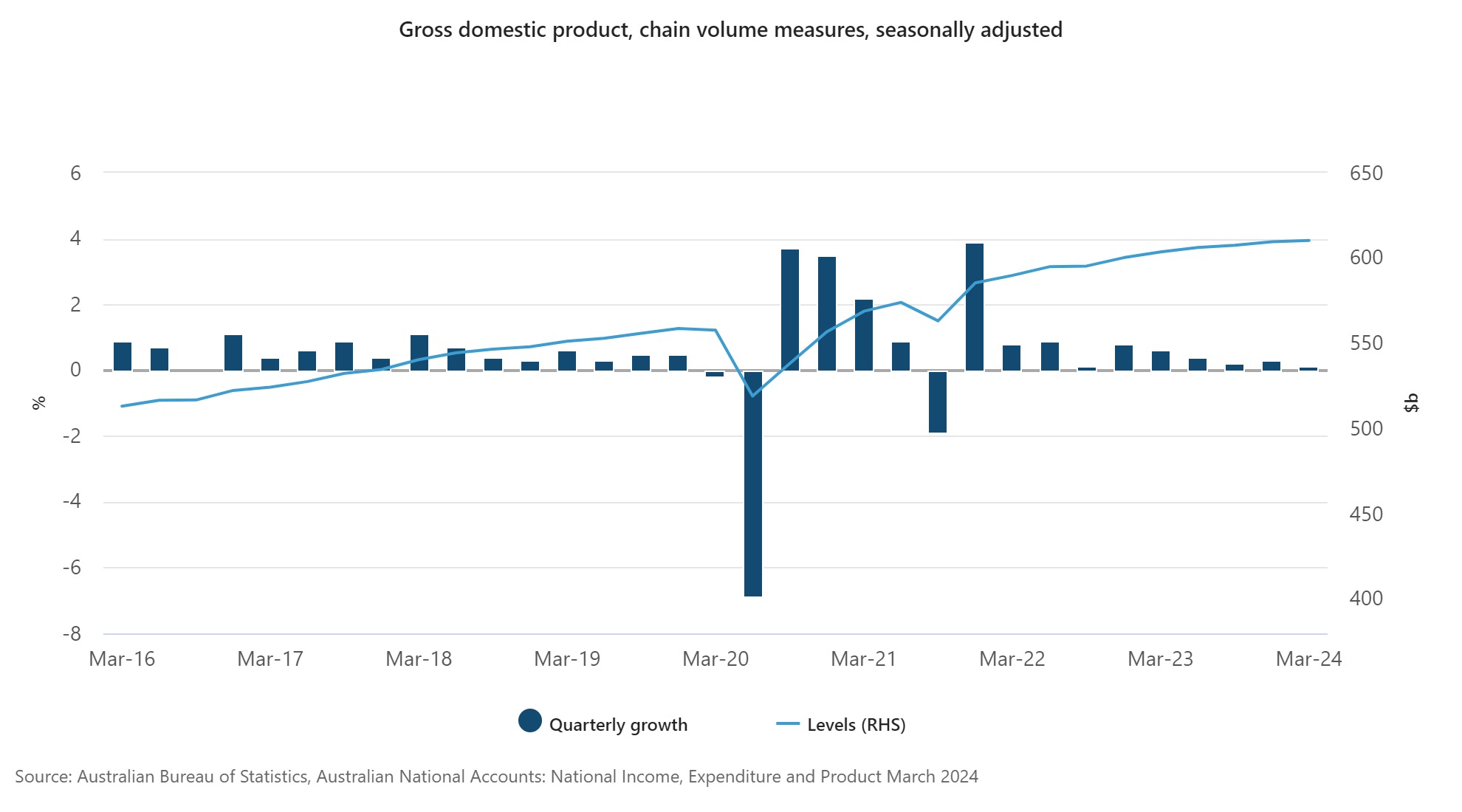

This as fresh data showed the Australian economy stalled in the March quarter as high borrowing costs and sticky inflation continue to dampen consumer spending. ABS data showed real gross domestic product (GDP) rose just 0.1% in the period, in line with NAB’s revised forecast.

On an annualised basis, GPD fell to 1.1% from the 1.5% seen the previous quarter, and marks the slowest annual pace in three decades, outside the pandemic.

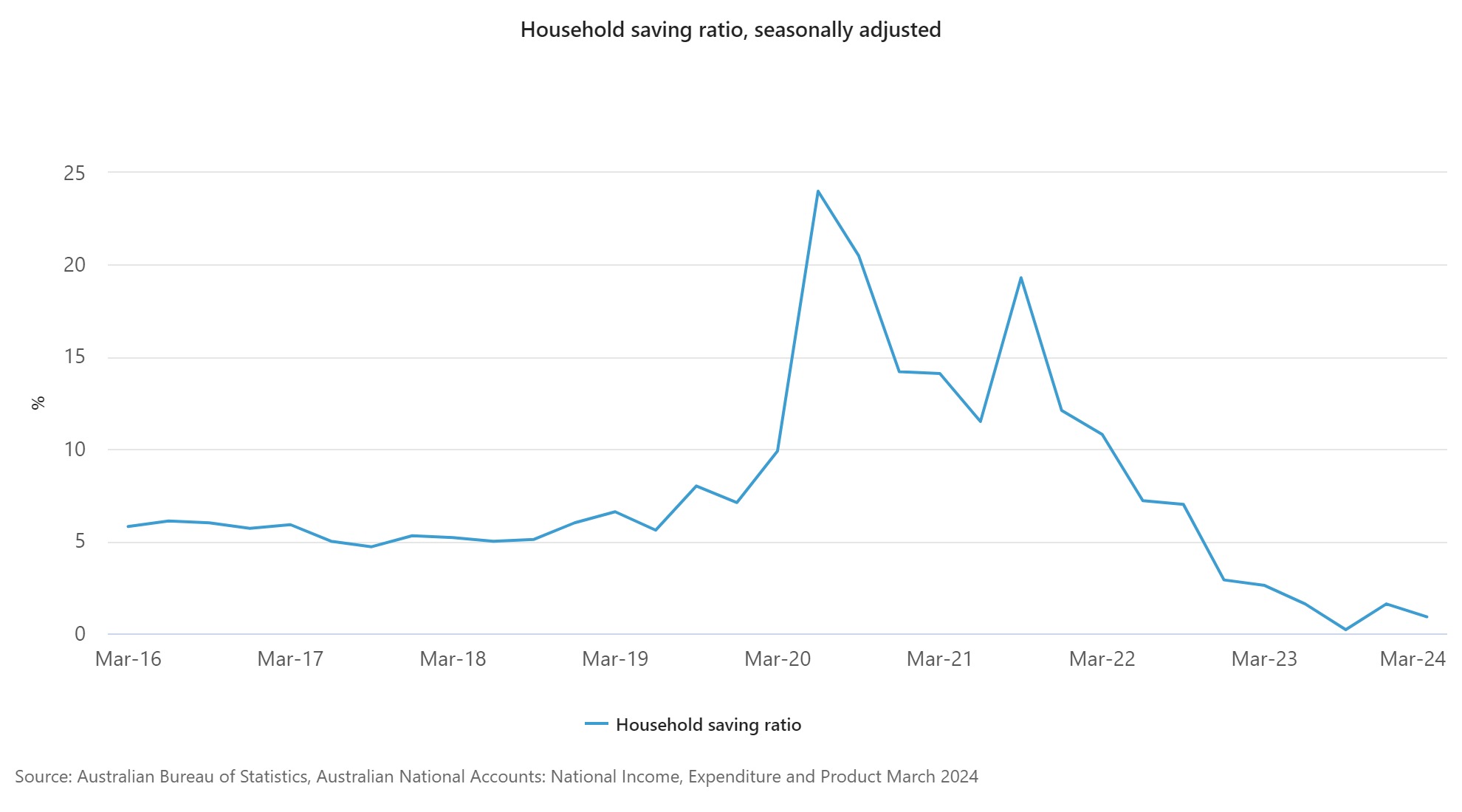

The household saving ratio took a hit, down to 0.9% from 1.6% in the quarter, as a rise in the nominal household consumption outpaced growth in gross disposable income.

Sector specific, Australian listed gold plays are lower as the price of bullion retreats on a stronger US dollar ahead of U.S. jobs data.

The miners are also in the red after iron ore futures touched a seven-week low, while copper prices dipped below a key $10,000/metric ton level for the first time in three weeks.

BHP Group (BHP), Rio Tinto (RIO) and Fortescue (FMG) are all lower.

In the news

Australian listed shares of Medibank Private (MPL) are on watch as the Australian privacy regulator (AIC) files a civil lawsuit against the company over a data breach that exposed personal information of millions of customers on the dark web in 2022.

Acting AIC Commissioner Elizabeth Tydd said the company “seriously interfered” with the privacy of Australians by allegedly failing to take reasonable steps to protect the data. Medibank says it intends to defend the allegations.

Elsewhere Sandfire Resources (SFR) shares are lower after the company said an external probe found the miner damaged Aboriginal cultural heritage at a copper mine in Western Australia due to “ignorance and process failings”, which occurred in 2017/18 during the construction of a satellite mine in the region.

And Australian listed shares of Seek (SEK) have jumped as the employment marketplace provider confirms the sale of its Latin American Assets, to employment marketplaces operator Redarbor for AU$85 million.

Going global

India’s share market is in the spotlight, as the result of the world’s largest election unnerved investors. While Narendra Modi retained power for a record third term, his Hindu nationalist party lost its outright majority for the first time in a decade. The market tumbled around 6%, posting its steepest decline on an election outcome day since 2004.

In currency markets, the greenback has stablised ahead of the Bank of Canada’s (BoC) interest rate decision and U.S. services data while the euro is flat to positive.

Emerging markets meantime are choppy, India’s rupee slid to a seven-week low on the tails of that general election result, the South African Rand has stumbled after the African National Congress lost its parliamentary majority for the first time in 30 years.

And the Mexican peso tumbled after the ruling left-wing Morena party was re-elected.

All prices and analysis at 5 June 2024. The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.