Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

RBA on Hold

Tapas Strickland | Head of Economcis, Markets Key points:

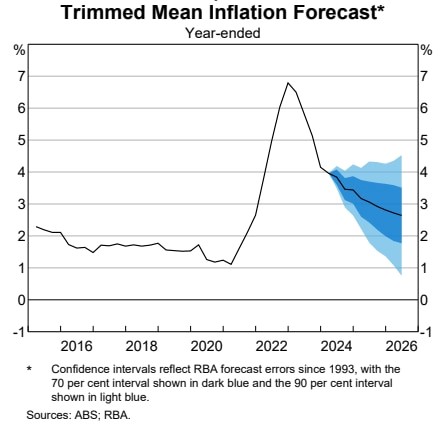

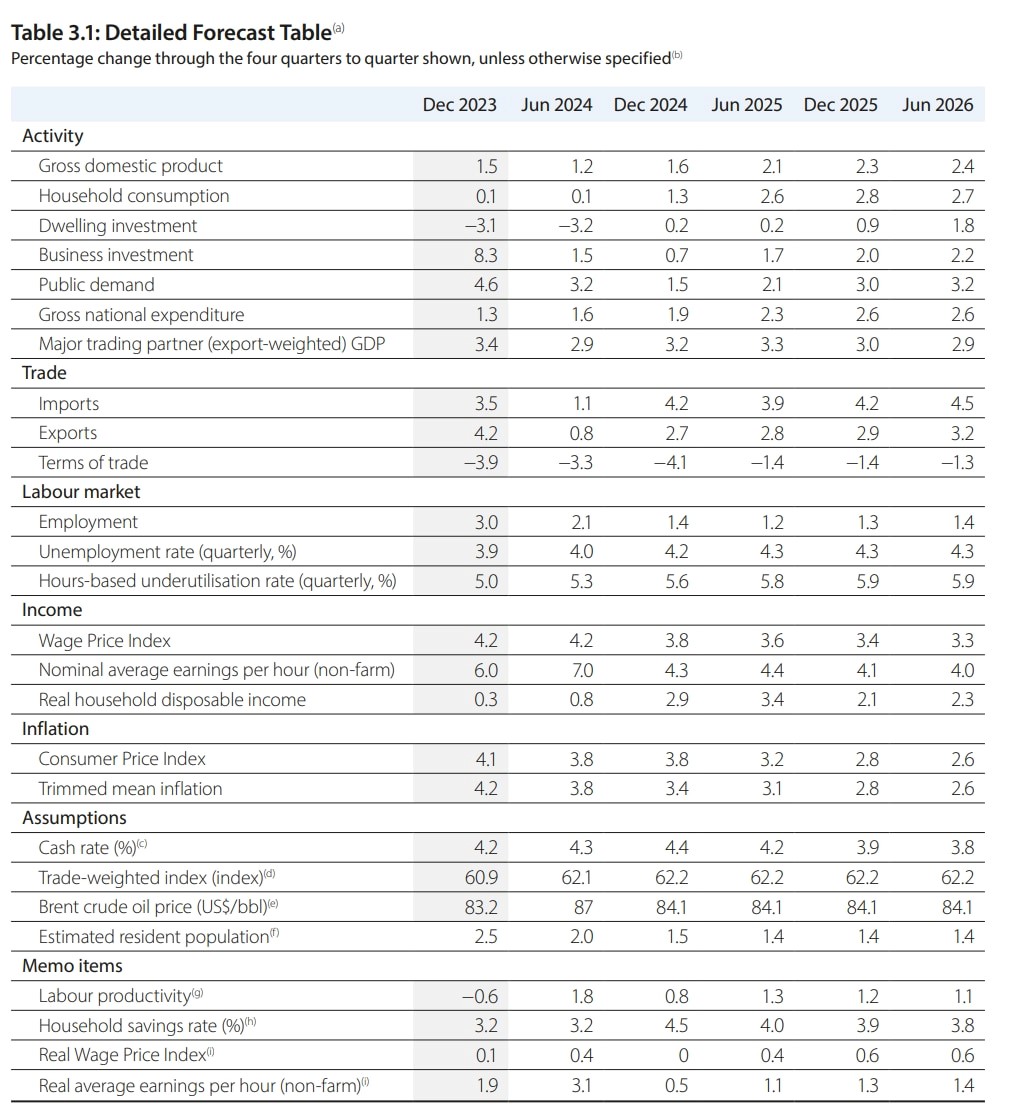

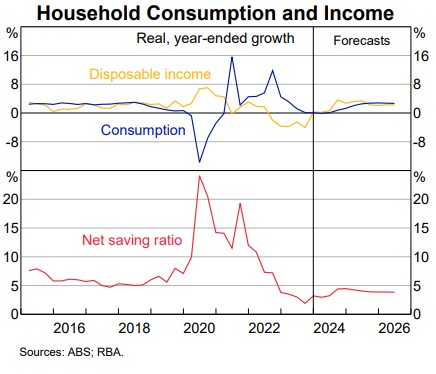

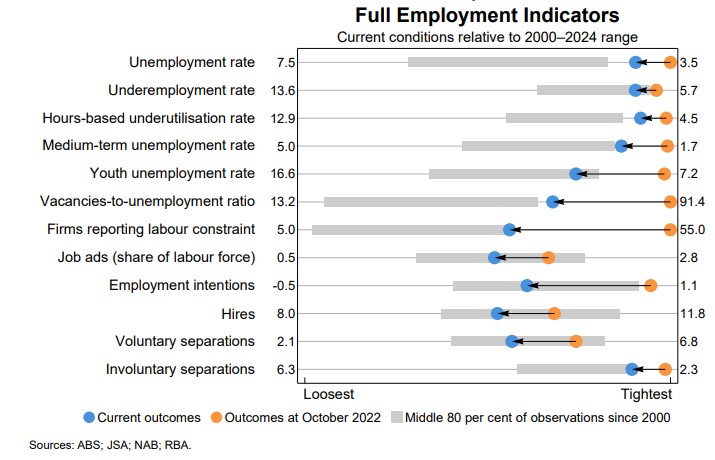

Details:The RBA held rates on hold as universally expected. What surprised though was the absence of a hawkish bias with the RBA keeping the mantra of “not ruling anything in or out”, phrasing which was adopted in March. Governor Bullock in the post-Meeting press conference noted that the Board “believe we have rates at the right level” and that the Board did discuss the option of raising rates. On balance the Board decided to stay where they were, and policy was assessed to be restrictive. While there is no explicit hiking bias, Governor Bullock said that the RBA needed to be “alert and vigilant” on inflation. That of course keeps focus on Q2 CPI (31 July). One reason for why the RBA needs to be vigilant is that the RBA did not take much signal from the upward surprise from the recent Q1 CPI for future inflation outcomes. The May SoMP noted that “forecast disinflation is guided by a suite of models that take some signal from the stronger-than-expected March quarter CPI outcome. However, it is possible that more signal should be taken from the upside data surprise as it may suggest that there is more persistence or ‘stickiness’ in domestically determined components of the basket than currently assumed (which is not offset by the higher cash rate path assumption underpinning these forecasts)”. The reason why trimmed mean inflation is still forecast to return to the mid-point of the 2‑3% inflation target by mid-2026 is because “the higher cash rate path in the forecasts supports the return of inflation to target”. Here the RBA has adopted the market path with the cash rate broadly steady at 4.2% until mid-2025, whereas the prior February SoMP had a cash rate assumption of 3.6% by mid-2025. The output gap was assessed to be positive but subdued aggregate demand was expected to return demand and supply into balance in the next couple of years. The forecasts overall mean little ability to absorb additional upward inflation surprises if the economy remains resilient. In the discussion of risks, productivity growth was again raised with the RBA noting “baseline forecasts include an assumption that labour productivity growth increases to the rate recorded in the decades preceding the pandemic…if productivity is weaker than assumed, businesses would face higher costs of producing a given amount of output, putting upward pressure on prices paid by consumer”. Other forecasts for the economy were broadly similar. The unemployment rate by end 2024 is expected to be 4.2% (4.3% in prior February SoMP) and to stabilise at 4.3% beyond mid-2025. The RBA notes the adjustment in the labour market is occurring via declining average hours and fewer job vacancies. Wages growth was again assessed to be around its peak. GDP growth was revised down a little in 2024 at 1.6% y/y (1.8% in prior February SoMP), before picking up to 2.3% y/y in 2025 (2.3% in prior February SoMP). It was noted consumption growth was very weak even though population growth is very strong. |

Chart 1: RBA still forecasts trimmed mean back to target by mid-2026

Chart 2: RBA detailed SoMP forecasts reveal the cash rate assumption drives - with rates on hold until mid-2025

Chart 3: Consumption growth is weak suggesting rates are restrictive

Chart 4: Labour market still tight, but easing on some metrics such as hours and vacancies

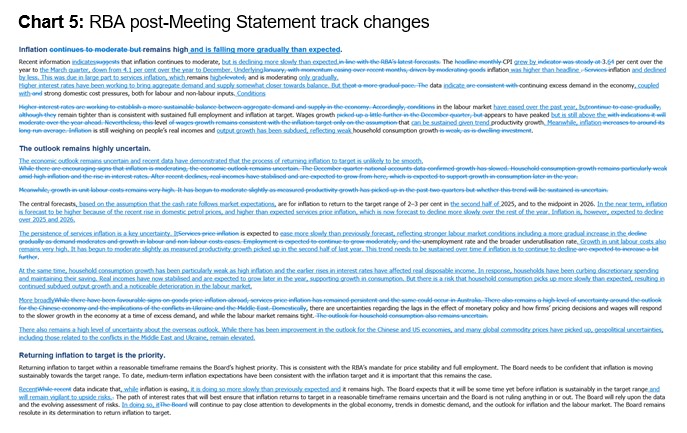

Chart 5: RBA post-Meeting Statement track changes

This document has been prepared by National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 ("NAB"). Any advice contained in this document has been prepared without taking into account your objectives, financial situation or needs. Before acting on any advice in this document, NAB recommends that you consider whether the advice is appropriate for your circumstances. NAB recommends that you obtain and consider the relevant Product Disclosure Statement or other disclosure document, before making any decision about a product including whether to acquire or to continue to hold it. All prices and analysis at 7 May 2024. This information has been prepared by National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 ("NAB"). The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here. |