Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Protecting retirement income from inflation shocks

Aaron Minney |Challenger Limited

Since the creation of compulsory superannuation in the 1990’s, inflation hasn’t been a notable issue, but the past two years has been a stark reminder of the impact inflation can have on the spending power of retirees. Inflation spikes are less of an issue in the accumulation phase as there is time for investments to recover, but retirement is different. In retirement, regular income must be protected and maintained to give retirees confidence to spend on essentials, while ensuring maximum enjoyment of their golden years.

Are equities the answer?

A commonly held perception is that the best way to account for inflation is maintaining exposure to equity markets. The assumption is market returns will solve for the issue of inflation. However, looking back at historical performance across all asset classes, the reality is markets can take more than a decade to recoup the lost income in retirement.

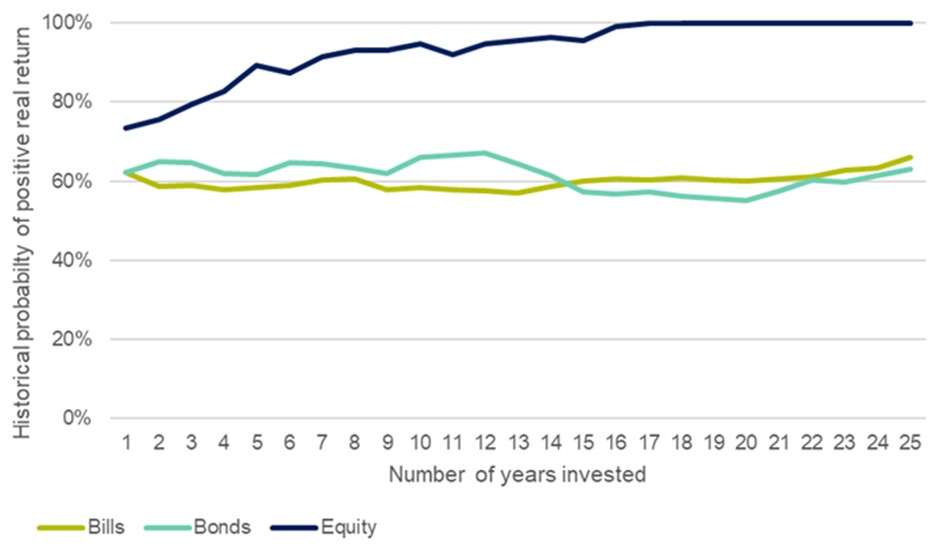

Analysing historical real returns generated by equities, bonds, and cash, what always matters is the long-term. Analysing returns from 1900 through to 2023, we see that equity markets have proven to deliver returns that outstrip inflation in 81 years – or 73% of the time. Bonds and cash provided a positive real return only 62% of the time over the same period.

Figure 1 Historical probability of positive real returns, 1900-202

Source: Calculations, based on data from Morningstar, S&P, Bloomberg and ABS

Historically, all investment horizons of 16 years (and longer) have provided a positive real return for Australian equity investors. By contrast, a diversified portfolio showed a 70/30 fund (70% equities and 30% bonds) needed 20 years to ensure a positive real return, while a 50/50 balanced fund needed 25 years.

So, while waiting for long-term returns to overcome any near-term short falls is a tried and tested approach in the accumulation phase, it needs to be considered differently in and approaching retirement. The impact is not just the length of time to recover the real capital value, but the income that is lost over that period.

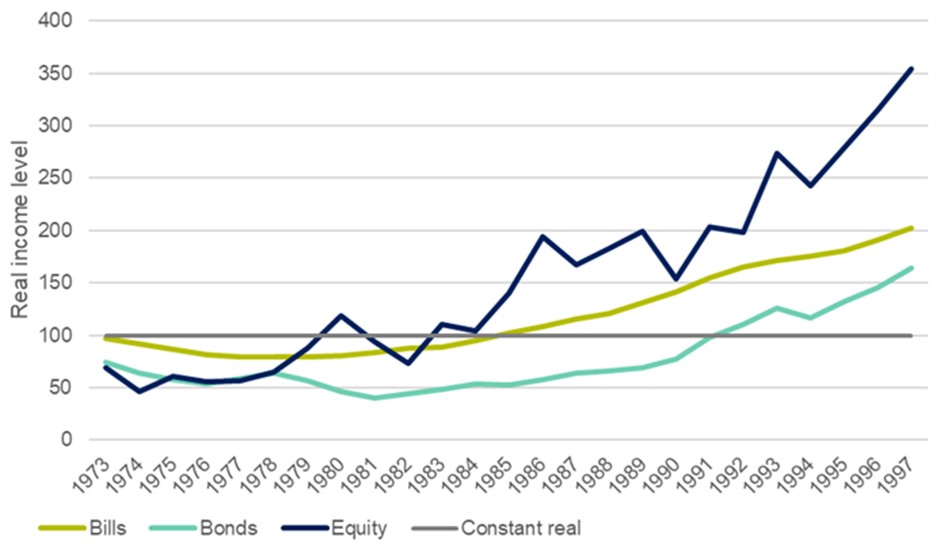

The last time we saw anything like the recent inflation spike was in the 1970s. A retiree who started drawing their income linked to the equity markets in 1973 would have seen their income fall by 30.7% and take nine years, through to 1983, to return to their initial level of income. Cash would have taken until 1985 to recover and bonds until 1992 (see figure 2 below). While history does not provide a guarantee of future performance, a person who started drawing an income linked to markets in 2023 could very well be facing a similar proposition.

Figure 2 Investment-linked income example

Source: Calculations, based on data from Morningstar, S&P, Bloomberg and ABS

With history showing that market-linked investments don’t necessarily protect an income stream from inflation over the short to medium term, the question becomes how do retirees maintain their lifestyle in the face of cost-of-living increases?

A different strategy needed in retirement

There are three common approaches to addressing this very real and present challenge.

The Age Pension represents an income stream that is indexed to inflation and it is a good safety net for some retirees. However, those who desire a lifestyle goal beyond the Aged Pension need additional inflation protection.

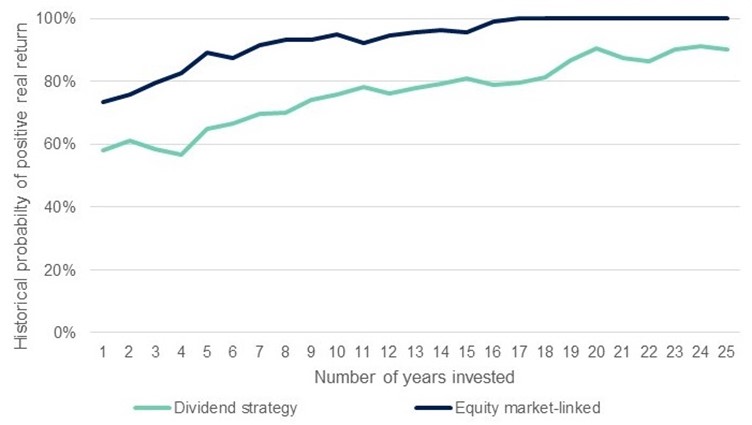

Living off dividend income is another approach that is particularly popular with retirees. Dividend yields tend to be counter-cyclical so are not as volatile as share prices. Historically dividend growth over 25 years was below inflation in 10% of the scenarios. However, the bigger challenge is the level of under spending by retirees taking this approach. By not drawing down on their capital, retirees experience a lower level of lifestyle than would have otherwise been possible.

Figure 3 Inflation protection of a dividend strategy

Source: Challenger calculations, based on data from Morningstar, S&P, BHM, Bloomberg and ABS

Alternatively, by consuming capital in retirement, retirees can generate increased income. A CPI-linked lifetime income stream, for example, sustains the lifestyle of the retiree by adjusting their payments with changes in the cost-of-living.

Protecting your nest egg in retirement

Protecting an investment portfolio from inflation can be an important concern for any investor. In retirement, the challenge increases as a retiree needs to protect their income stream to be able to sustain their lifestyle.

We know retirees are seeking an increased level of certainty in retirement. Recent research by YouGov, commissioned by Challenger, found that 2 in 3 Australians over 60 said cost-of-living impacted their confidence they would have enough money for retirement, while more than 70 per cent believe a guaranteed income in retirement would significantly boost happiness.

Inflation risk has a different impact on a portfolio in the retirement phase. It requires a unique investment approach to mitigate risks, while providing retirees with the confidence to safely spend. When investments in growth assets have returns below inflation (or negative), the only option for retirees is to reduce their lifestyle or run down their capital early. This inflation risk can have serious flow-on consequences for longevity and sequencing risk in a portfolio in the decumulation stage. There is more at stake for retirees – they do not have the luxury of time and are at heightened risk to the impacts of inflation, requiring a hedge in their retirement portfolio that can protect income and maintain lifestyle.

While the fall in inflation from multi-decade highs is good news for our economy, many retirees continue to struggle with cost-of-living because of the cumulative impact inflation has had on their financial position. Retirees need to consider how they can maintain their lifestyle in the face of inflation and cost-of-living pressures. There is a misguided perception that equity market exposure will be sufficient to achieve this, but the data shows retirement requires an investment strategy that will guarantee lifestyle regardless of market returns or inflation spikes. An inflation-protected income-strategy is vital to this, and while the Age Pension does deliver some income, it often falls short of meeting the financial needs and lifestyle expectations of many retirees.

As we continue to navigate a volatile market and geopolitical landscape, retirees need a portfolio with protection from inflation risks so that they don’t experience another cost-of-living crisis when inflation has another upturn. With more than 2.5 million Australians, 10% of our population, set to retire in the coming decade, retirement is a top priority for government, industry, and aging Australians. We, as an industry, have a responsibility to empower confidence to spend in retirement, provide assurance that income will keep pace with inflation, and protect from the swings in market-linked investments.

First published on the Firstlinks Newsletter. A free subscription for nabtrade clients is available here.

Aaron Minney is Head of Retirement Income Research at Challenger Limited. This article is for general educational purposes and does not consider the specific circumstances of any individual.

All prices and analysis at 22May 2024. This document was originally published on firstlinks.com.au on 22 May 2024. This information has been prepared by Challenger Limited (ABN 44 072 486 938) ( AFSL 234670)

The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.