Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Identifying AI opportunities in healthcare

Andy Acker | Janus Henderson

AI has enormous potential to improve healthcare delivery across the globe, and some practical applications could benefit investors.

As artificial intelligence plays a bigger role in the global economy, one area where the technology is expected to have a substantial impact is healthcare.

Nvidia, the leading provider of AI computing power, says healthcare currently makes up only about 1% of its $100 billion data center business. But that figure is projected to grow exponentially, with healthcare likely becoming the biggest vertical in its data center segment within a decade.

In the meantime, some AI applications are already making a difference to both patient outcomes and company revenues. We see three key areas where AI’s potential is turning into real benefits in healthcare.

Data building for drug discovery

Typically, it takes at least 10 years and billions of dollars of investment for a company to bring a new therapy to market. But AI algorithms could help speed at least one part of the research and development process – target identification and drug discovery.

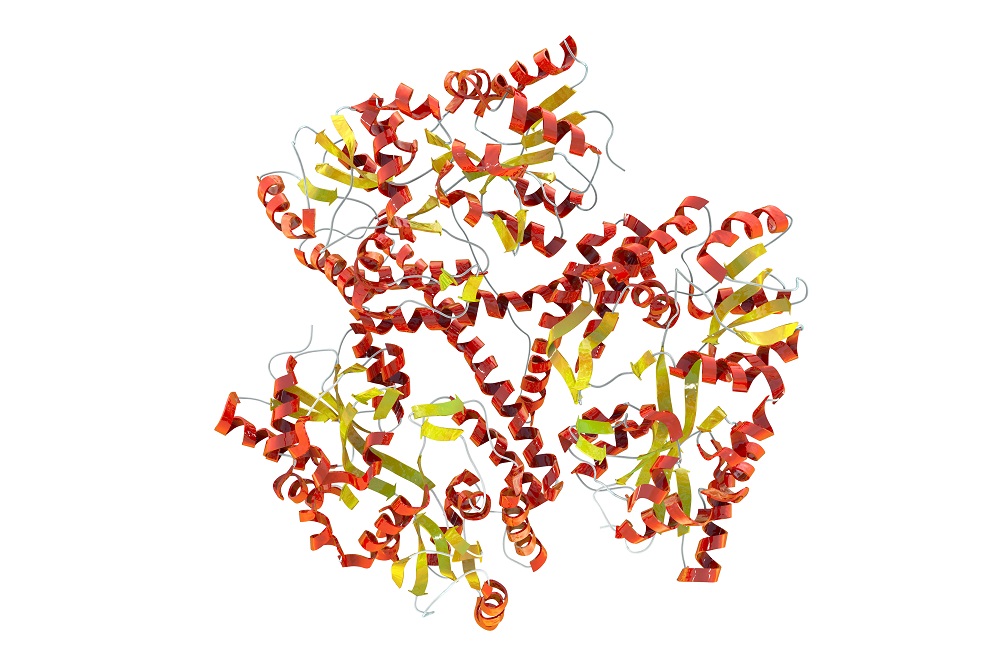

Today, new AI algorithms are being developed to identify drug targets and create molecules based on modeling of biological and chemical datasets. Advances continue to be made, with new tools now able to decode the shape of proteins – large complex molecules in human cells that drive the structure, function, and regulation of the body’s tissues and organs – and how they interact with other molecular systems in the body, DNA,1 RNA,2 and ligands (molecules that bind to a receiving protein molecule, or receptor). Such level of complexity could lead researchers to an even deeper understanding of the biology of disease and speed up the process/lower the cost of bringing new drugs to market.

The Huntingtin protein, coded by the HTT gene. Mutated HTT leads to Huntington’s disease.

Source: Getty Images

These advances are undoubtedly exciting. But turning AI’s potential into viable treatments for patients remains challenging. Therapies still have to go through the yearslong process of human clinical trials and regulatory review. And what might look good in a computer model may not prove as efficacious or as safe in human cells: no AI-focused biotech company has yet brought a drug to market.

For now, we think the prudent way to think about AI and drug discovery is to recognize the technology as one of many structural trends that could propel a high rate of growth in biopharma in years to come. Investors might also want to focus on companies providing the picks and shovels that enable AI-driven drug research. These include DNA sequencing and related services, which are needed to help build the enormous datasets that fuel AI algorithms.

Medical device use and imaging

AI is also being deployed in imaging and diagnostics to better detect and treat disease, including cancer where early detection is critical. With mammograms, for example, AI-based 3D imaging is improving the chances of spotting invasive breast cancer earlier and reducing the number of images radiologists must review. A new blood-based screen uses AI and machine learning to identify DNA shed by cancer cells in the bloodstream. The test can look across multiple types of cancers, including those without early screening options, such as pancreatic, esophageal, ovarian, and liver cancer, and predict with 88% accuracy the organ associated with the DNA – a hit rate that is expected to improve over time.

Other disease categories are also benefiting, including aortic stenosis. This heart condition occurs when the aortic valve narrows and blood is unable to flow normally, straining the heart. Today, the disease is broadly underdiagnosed and undertreated: More than one million patients in the U.S. suffer from a severe form of aortic stenosis, but only around 100,000 people receive a transcatheter aortic valve replacement (TAVR) annually.

To close the gap, one TAVR manufacturer is partnering with health systems to use AI to comb through electronic medical records and flag patients who meet the criteria for treatment but, for one reason or another, have been overlooked. We think the effort will pay off over time, driving greater referral and treatment rates and better care for patients.

Pre- and post-procedural assistance

AI is also improving surgery outcomes. One leading maker of robotic-assisted surgery systems, for example, now records and collects data from procedures that incorporate its tools. Surgeries are segmented into stages and doctors can study their performance relative to a best-in-class outcome, which AI helps determine by correlating surgical techniques with patient outcomes. The data should allow surgeons to study a specific surgical activity and improve performance based on objective measures. And over time, AI may be able to warn a surgeon that he or she may have forgotten a step during a procedure or is about to do something that statistically has shown to increase the odds of error.

Likewise, when it comes to healthcare delivery, companies are beginning to use AI to record and code procedures in real time with the aim of eliminating one of the biggest sources of inefficiencies in the U.S. health system – payor/provider connectivity. In 2021, 17% of all healthcare claims were rejected, according to one study of insurers that participate in the federal marketplace in the U.S., in part because of improper coding.3 New AI-enabled systems could help reduce errors and open a market opportunity worth billions of dollars in annual revenue.

Learn how the industry leaders are navigating today's market every morning at 6am. Access Livewire Markets Today.

All prices and analysis at 24 May 2024. This document was originally published in Livewire Markets on 24 May 2024. This information has been prepared by Janus Henderson Investors (Australia) Funds Management Limited ABN 43 164 177 244 AFSL 444268.

The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.