Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

29 May Markets at a glance

The S&P/ASX200 is under pressure in the afternoon session as the broader index slumps to a three-month low, dragged lower by rate-sensitive financial stocks as April’s CPI print unexpectedly rose to a five-month high due in part to increases in petrol, health, and holiday costs.

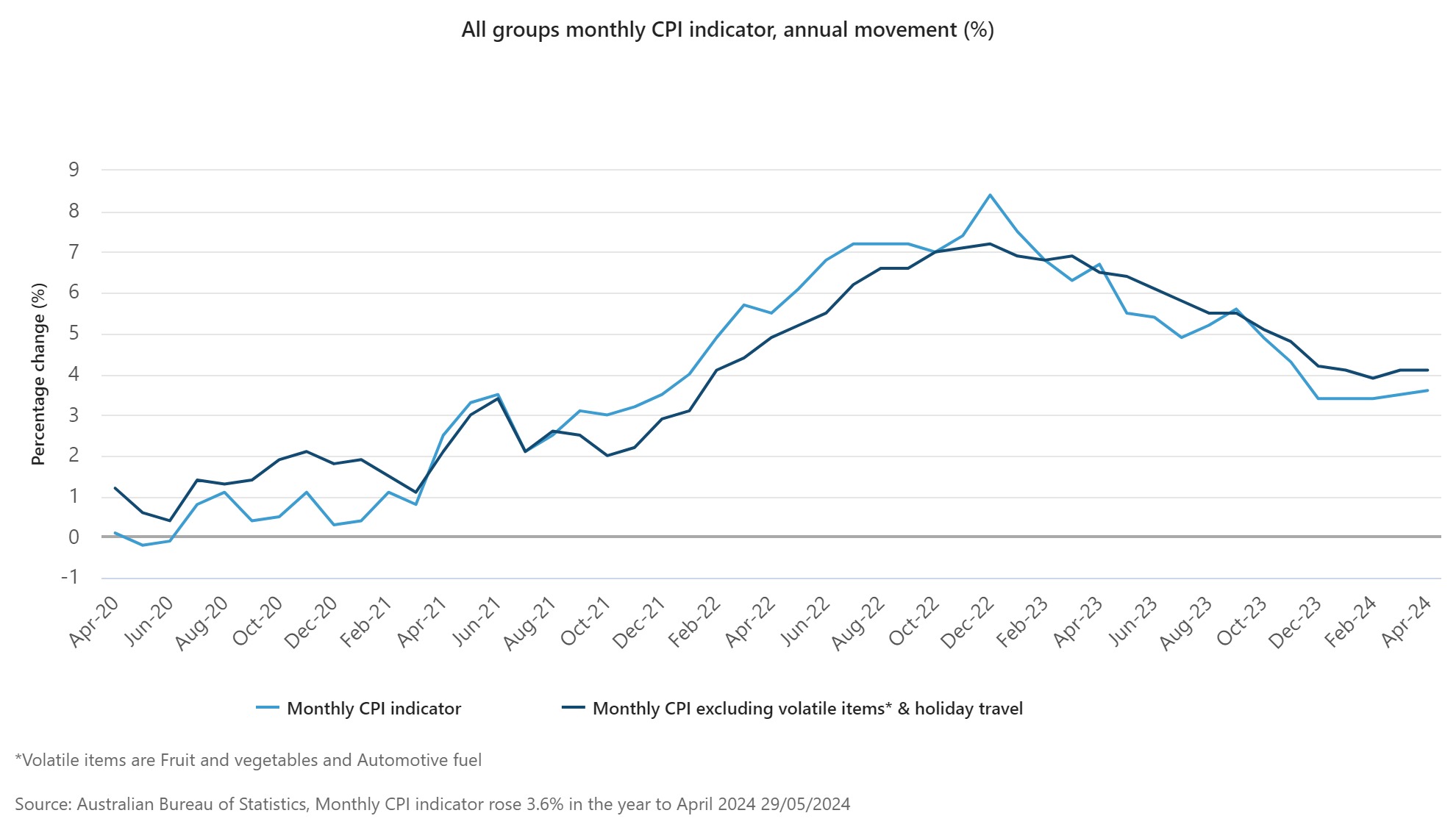

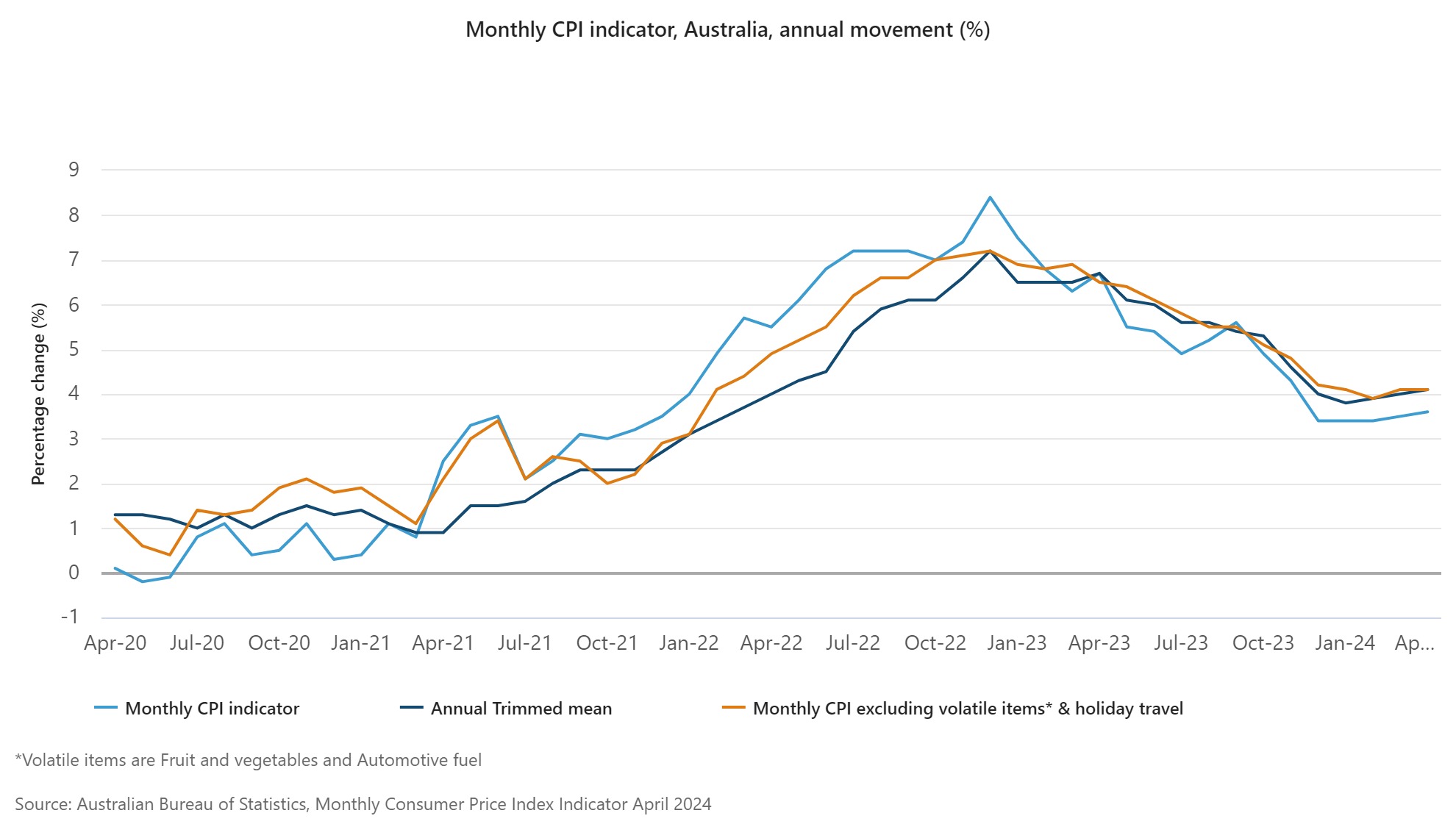

Data showed the monthly consumer price index (CPI) rose at an annual pace of 3.6% in April, missing forecasts for a slight fall to 3.4%.

A closely watched measure of core inflation by the RBA, the trimmed mean, also rose to an annual pace of 4.1%.

The uptick has added to the small risk the next move in interest rates by the Reserve Bank of Australia (RBA) might be higher with markets now pricing in a 17% chance of a quarter-point hike in September, up from the 12% chance priced in before data release.

The AUD/USD has pushed higher after that hot April inflation print.

Globally, US Treasury yields have risen to multi-week highs as market participants cautiously await US inflation data later in the week with hopes for any clues on the outlook for the path of policy at the US Federal Reserve.

Still US markets continue to march higher with the Nasdaq passing the 17,000 level, to close above it for the first time as market darling Nvidia (NASDAQ: NVDA) again minted a fresh record high.

Oil remains in focus amid expectations OPEC+ and its allies will maintain crude supply curbs at its June 2 meeting.

Stock specific, Australian listed shares of Insurance Australia Group (IAG) are lower in today’s’ trade as the company confirmed after market on Tuesday it had been served a class action by law firm Slater and Gordon relating to proceedings regarding the company’s loyalty discounts started by ASIC. In a statement to the market, IAG says it will defend itself against the class action maintaining it has delivered on loyalty promises made to customers and does not agree it may have misled customers about the extend of discounts they would receive.

Elsewhere, ASX-listed shares of Fisher & Paykel Healthcare (FPH) are among the day’s top gainers, after the medical equipment maker posted a 6% rise in full year underlying NPAT and sees further improvement in gross margins in FY25 with an upgraded outlook for full its full year operating revenue.

Finally, a good news story for Australian listed small cap Cleo Diagnostics (COV), shares surging over 52% to an all-time high as the diagnostics company says a study has found its ovarian cancer blood test outperforms current clinical workflows to predict malignancy.

Nufarm (NUF) is trading ex-dividend.

All prices and analysis at 29 May 2024. The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.