Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

28 May Markets at a glance

It is a relatively flat trading day for the S&P/ASX200 as gains in mining and gold stocks were offset by losses in financials as investors sit on the sidelines ahead of key inflation data released on Wednesday.

April’s CPI print is expected to give markets more clarity on the Reserve Bank of Australia’s (RBA) interest rate outlook. NAB expects inflation to fall back to 3.4% from 3.5% in the month, in line with market consensus.

Globally, US stock futures have opened higher ahead of the reopening of Wall Street after a public holiday.

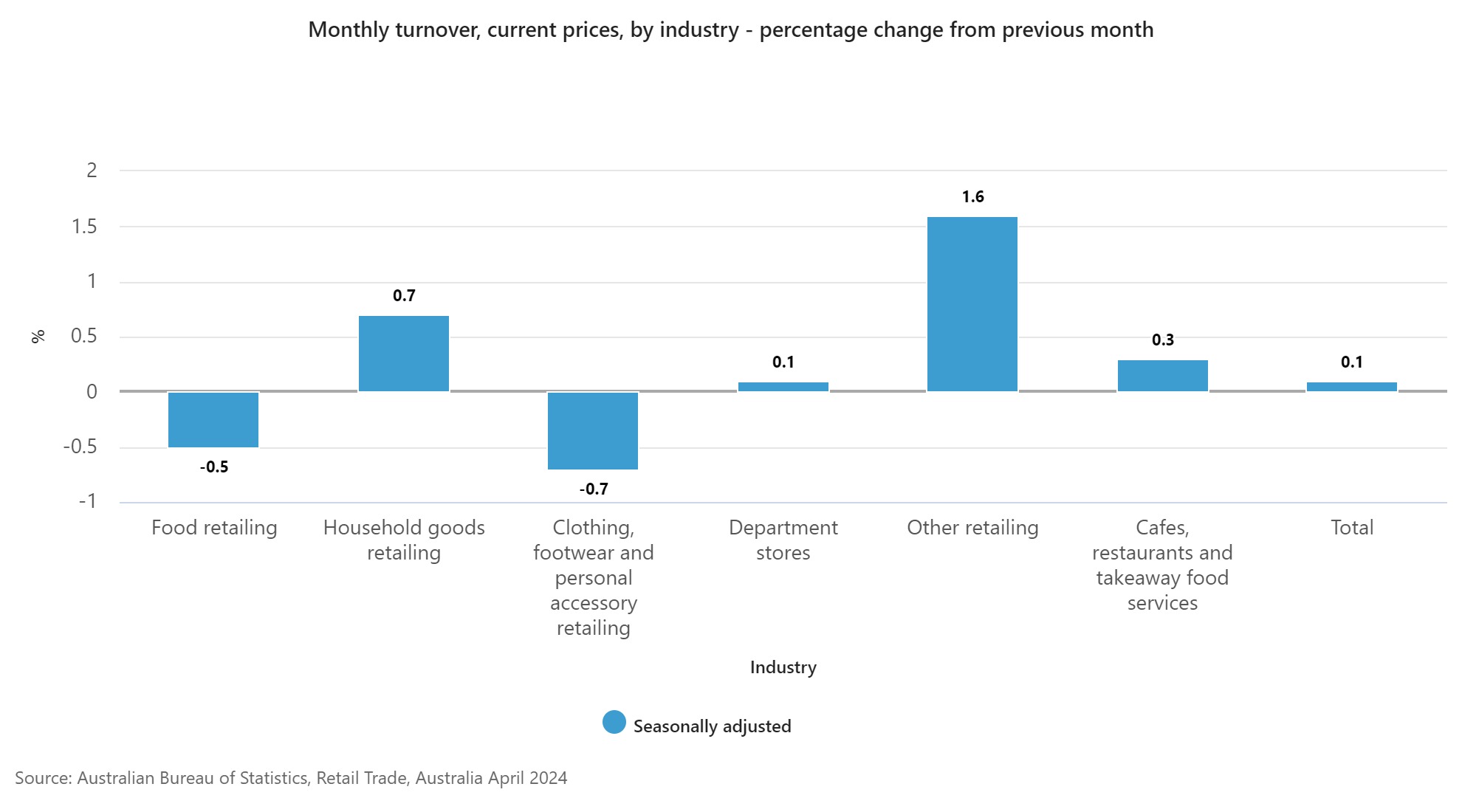

In currency markets the USD/CNY has affirmed its upward trajectory, as the US dollar slips for the third straight session with traders awaiting key PCE data on Friday. The Australian dollar (AUD) is trading higher, shrugging off a retail sales data miss, with April’s data showing a miniscule rise of just 0.1% as shoppers refrained from spending in the face of high borrowing costs and rising rents.

Monthly turnover, current prices, by industry – percentage change from previous month

While not covered by the retail data, costs for services continue to rise much faster than goods prices, from insurance to health and electricity.

The sticky service inflation is a key factor for the why the RBA may hold pat on lowering interest rates this year.

Stock specific, shares of Australian listed Peter Warren Automotive (PWR) have sunk to a record low, with the stock posting its biggest ever intraday percentage decline.

It comes as the company sees underlying profit before tax for FY24 to be in the range of AU$52 million, 12% below the Visible Alpha consensus midpoint, according to Citi.

Finally, shares of Southern Cross Media Group (SXL) are in focus, retreating from an over 7% spike earlier in the session, after it received a sweetened approach by Australian Community Media (ACM) with a proposal for southern Cross to acquire assets of ACM. SXL says the proposal is materially different to ACM’s previous one that it rejected in November 2023.

All prices and analysis at 28 May 2024. The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.