Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Why the ASX200 will rise another 8% this year

Cameron McCormack | VanEck

In this wire, I share our outlook for the ASX/S&P 200, identifying the sectors that are presenting opportunities for investors, as well as the sectors investors may want to avoid being overexposed to in 2024. While Australia faces a higher-for-longer rate regime, and a rate cut this year now looks extremely unlikely, our latest analysis sees the ASX/S&P 200 rising to 8300 by the end of the year.

We see strength in remaining invested in Australian companies, particularly mid-caps, but being selective is as critical as ever. The big banks have risen to all-time highs this year but future performance doesn’t appear to be anchored in reality and the sector is vulnerable to a correction.

Meanwhile, we see opportunity in gold miners and select A-REITs, which continue to be undervalued, as well as companies in the consumer discretionary sector which look to maintain strength supported by Australia’s migration surge.

Check your exposure to the big banks

The market seems to be pricing a dream scenario for the banks, despite the risks of a flare-up in mortgage stress in a prolonged higher interest rate environment. Australia’s banks are overvalued. Valuations are stretched and are the most expensive globally. Australia’s banking sector is vulnerable to a correction and investors should be wary if they are overexposed.

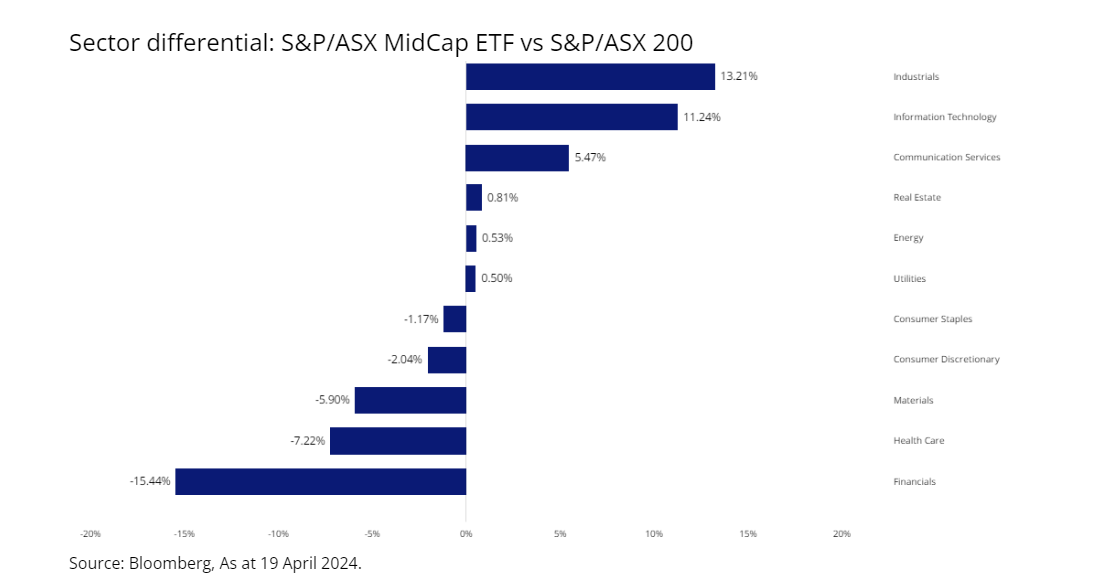

Those investors in any ASX/S&P 200-tracking ETF have around 25% of their money directed to the banks, due to the dominance of this sector. This leaves investors open to concentration risk as Australia has one of the most concentrated markets in the world.

An equal weighting approach to Australian equities provides increased diversification and would be the more prudent approach.

Australian mid-caps set to outperform

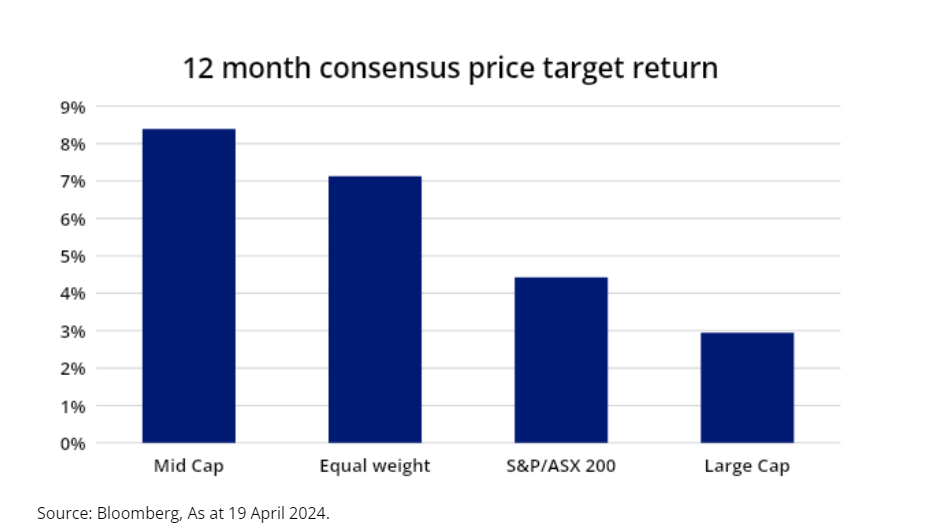

We see Australian mid-caps as being the star performer this year, outperforming the S&P/ASX 200. Smaller companies offer more upside potential through market share expansion and have historically outperformed in prolonged market recoveries. Valuations are attractive with a 12 month forward price to earnings below the historical average. Mid-caps also reported the highest upside price target revisions during the February earnings season.

We like the prospects of mid-cap industrial companies Aurizon Holdings (ASX: AZJ) and Cleanaway Waste Management (ASX: CWY). These companies offer pricing power which will keep profit margins resilient in an elevated inflation environment.

Sector pick: Gold miners set to shine

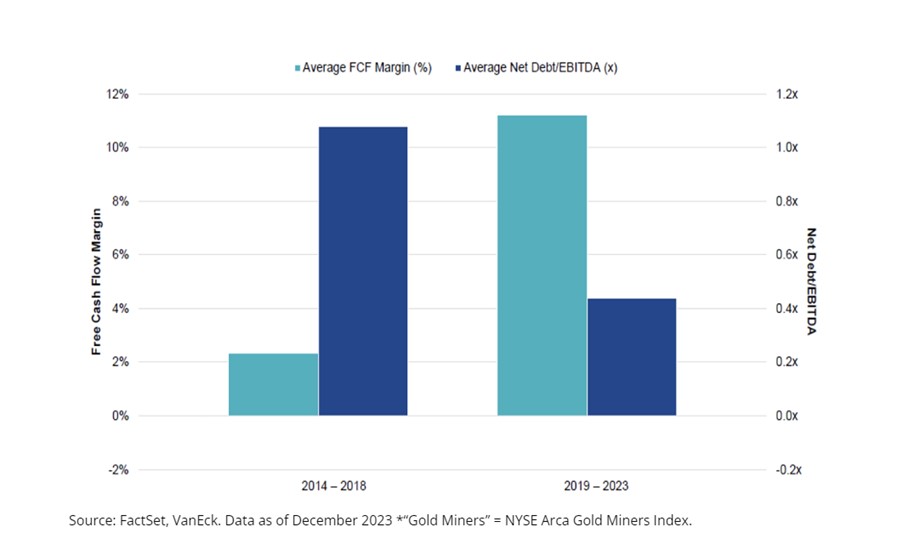

We see gold going to US$2600/oz. Meanwhile, gold miners trading are at a 50% discount to gold, presenting a strong value opportunity. Persistent inflation, potentially bumpy economic path and heightened geo-political tensions could serve as a tailwind for gold miners.

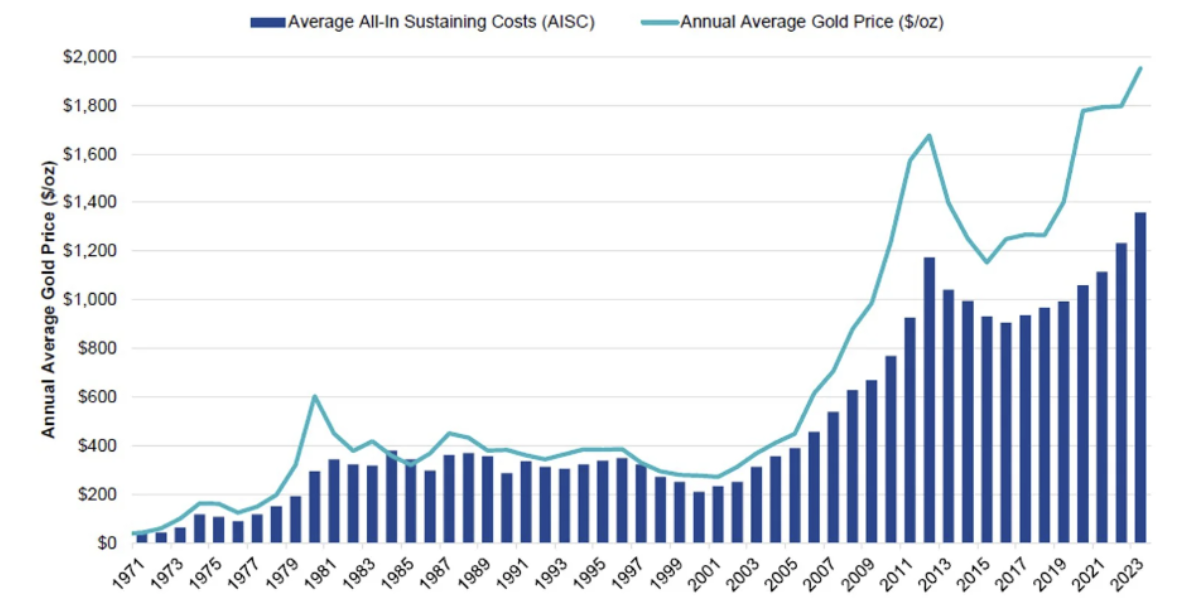

Australia’s big 3 gold miners; Evolution Mining (ASX: EVN), Northern Star Resources Limited (ASX: NST) and Newmont Corporation (ASX: NEM) are all well positioned. Gold miners have de-leveraged and can generate a substantial amount of free cash flow. Cash flow in the chart below would be represented by the white space between the aqua line (the gold price) and the dark blue columns (all-in-sustaining costs). As the gold price rises, so too should free cash flow.

Average all-in sustaining costs* versus average annual gold price (US dollars/oz)

Source: Scotiabank. Data as of December 31, 2023. *All-in-sustaining costs (AISC) reflecting the full cost of gold production from current operations, including adjusted operating costs, sustaining capital expenditure, corporate general and administrative expenses and exploration expenses. Past performance is not indicative of future results.

Over the past five years, a persistent focus on debt reduction and free cash flow generation has fundamentally transformed how these companies look from both an absolute and relative valuation perspective. Gold miners are making a strong case for value investors right now.

Sector pick: A-REITs

A-REITs are primed for a comeback. Interest rate stabilisation and positive economic outlook improve confidence in the assessment of valuations, encouraging capital recycling. REIT leverage levels have decreased, and interest coverage levels have increased steadily since the global financial crisis.

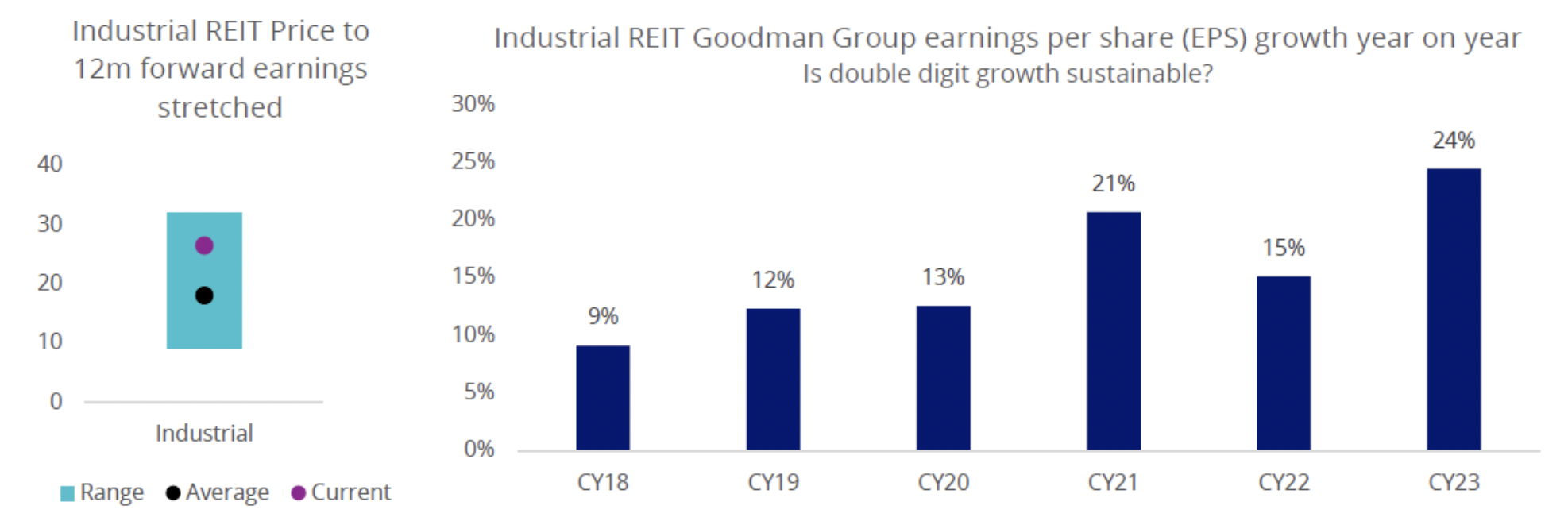

Office REITs offer attractive discounts to book value. The fall in occupancy rates has stabilised and net operating income has picked up. Retail REITs are fairly priced. Occupancy rates are strong and net operating income has accelerated. Industrial REIT Goodman Group (ASX: GMG) 12-month forward P/E ratio is trading at the upper bound of its historical average. It could be vulnerable to a correction if double-digit earnings growth is not maintained.

Bloomberg, data to 31 March 2024. Industrials as GMG.

Sector pick: Consumer discretionary

A paradoxical dynamic is likely where Australia records a soft landing but mortgage stress increases as rates stay higher for longer, further squeezing household budgets.

However, Australia’s migration surge will support retail spending and therefore, consumer discretionary names such as Wesfarmers (ASX: WES), JB HiFi (ASX: JBH) and Super Retail Group (ASX: SUL). The sector reported strong net beats during the February earnings season and we anticipate this to continue.

Learn how the industry leaders are navigating today's market every morning at 6am. Access Livewire Markets Today.

All prices and analysis at 26 April (unless otherwise stated). This document was originally published in Livewire Markets on 26 April. This information has been prepared by VanEck Investments Limited (ABN 22 146 596 116) (AFSL 416755).

The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.