Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

The RBA should warn that it could raise rates again

Kieran Davies | Coolabah Capital

High inflation and a still-tight labour market should see the RBA backtrack on policy and resume warning that it could raise rates again, something that CCI’s analysis has long suggested they should have delivered on last year.

Strong inflation at the start of this year places the RBA in a very uncomfortable bind when it meets next month to revise its outlook and decide on interest rates.

The RBA had recently turned neutral on interest rates, emphasising that it was “not ruling anything in or out”, but now seems likely to backtrack and warn again that the next move in interest rates could be up, with the governor likely regretting that her predecessor did not follow the RBA’s peers and raise rates more last year.

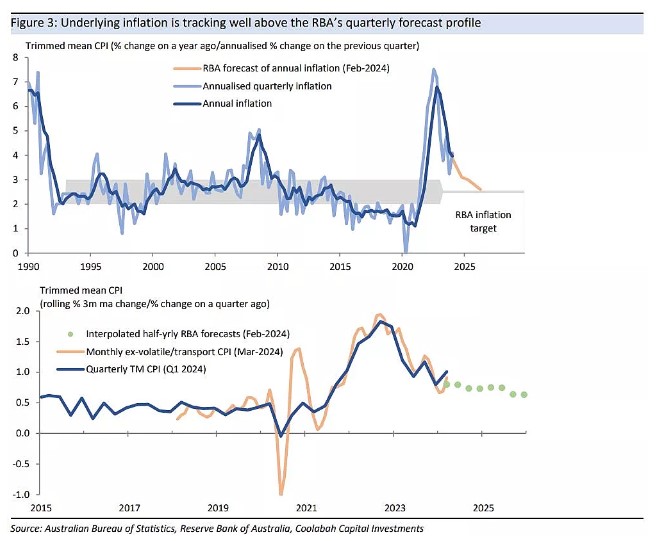

Echoing the experience of several other countries, underlying inflation accelerated in Q1 and is tracking well above the RBA’s forecast profile, with the trimmed mean CPI rising by 1% in Q1 and with the trajectory of the monthly CPI suggesting that it could plausibly increase by 0.9% or more in Q2.

At the same time, the labour market still remains tight in that unemployment of 3¾%, while off its multidecade low of 3½%, remains below the RBA’s 4½% estimate of full employment.

These developments should force RBA staff to revise up near-term forecasts for inflation and employment and temper the expected increase in unemployment when the bank’s outlook is updated in the Statement on Monetary Policy, due the same day as the 7 May interest rate decision.

Higher inflation and a still-tight labour market should trigger an active discussion among board members about whether they need to raise rates further, particularly when there is a risk that it takes longer to return inflation to the newly-mandated midpoint target of 2½%.

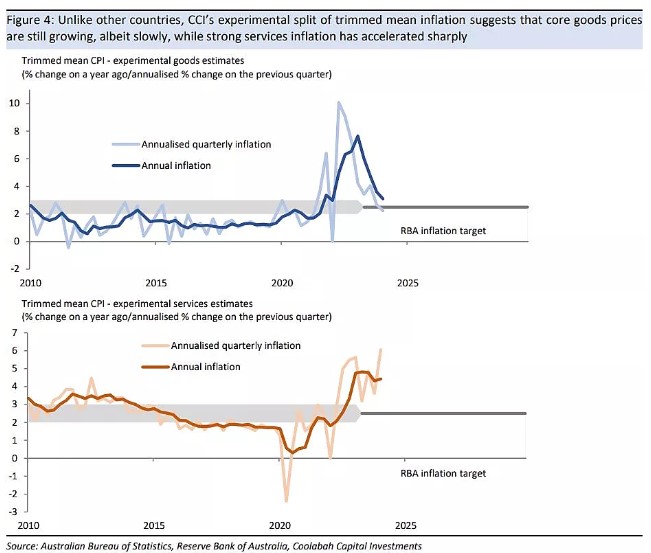

Board members would also be disappointed by the mix of inflation, where CCI's experimental measure split of the trimmed mean CPI points to a rapid acceleration in already-high core services inflation, with slow growth in core goods prices contrasting with the flat-to-down moves seen in other countries.

CCI’s policy rule analysis has long suggested that the RBA should have followed its peers and raised rates to about 5%, but the RBA purposefully decided to raise rates by less than its own outlook would imply in order to limit the damage to unemployment.

Some policy-makers might continue to run that line given weak economic growth, but that view should be challenged by July’s income tax cuts, which are worth $21bn for the financial year as a whole, equating to about ¾% of GDP.

The RBA believes that the rejigging of these cuts towards low- and middle-income taxpayers will not have much effect on the outlook, but there is the clear risk that cash-constrained households spend the money at a time when rising house prices are driving wealth higher and real incomes are past their low point.

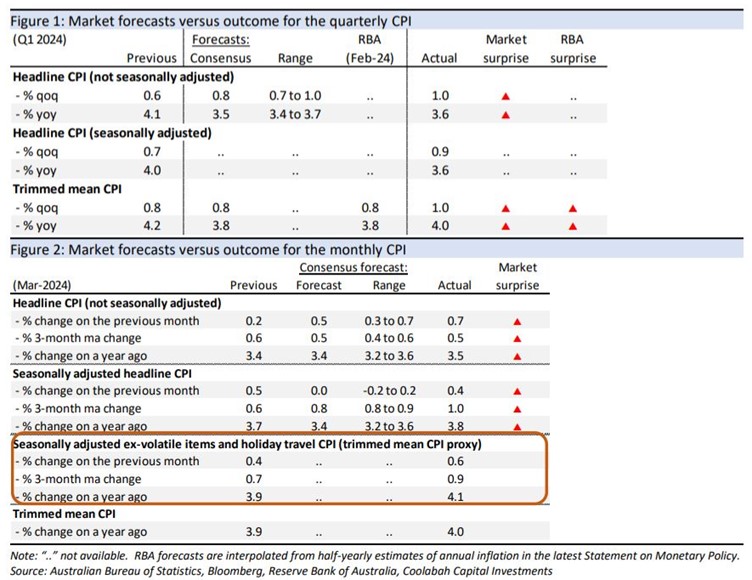

Underlying inflation was well above official and market forecasts in Q1

Underlying inflation is tracking well above the RBA’s quarterly forecast profile.

Unlike other countries, CCI’s experimental split of trimmed mean inflation suggests that core goods prices are still growing, albeit slowly, while strong services inflation has accelerated sharply.

Learn how the industry leaders are navigating today's market every morning at 6am. Access Livewire Markets Today.

All prices and analysis at 24 April (unless otherwise stated). This document was originally published in Livewire Markets on 24 April. This information has been prepared by Coolabah Capital Ltd (ACN 153 555 867) (AFSL No. 482238).

The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.