Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Persistent services inflation contrasts with falling goods prices

Kieran Davies | Coolabah Capital

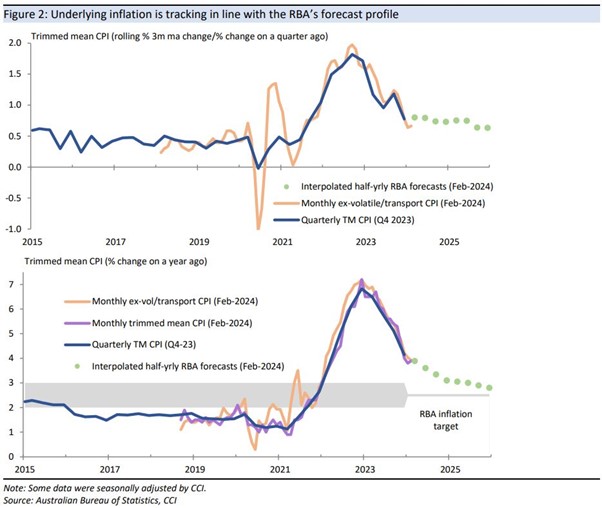

The monthly CPI for February showed underlying inflation tracking in line with the RBA's forecast profile, with persistent services inflation contrasting with falling goods prices in trend terms.

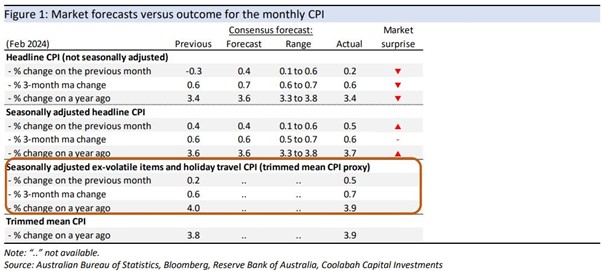

The ex-volatile items/holiday travel CPI rose by 0.5% in February after increasing by only 0.2% for four months in a row, where the increase in February was the largest rise since August.

This suggests that the RBA's preferred measure of inflation - the quarterly trimmed mean CPI, which is due on 24 April, ahead of the 6-7 May board meeting - is on track to post another increase of 0.8% in Q1, in line with the RBA's interpolated forecast. There is still a margin of error in mapping from this monthly measure of underlying inflation to the quarterly trimmed mean CPI, although both rose by 0.8% in Q4.

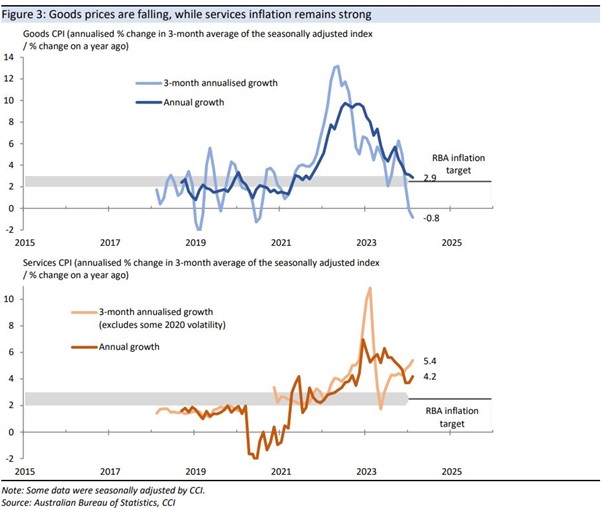

Importantly, the monthly CPI echoed the trend shown in other advanced economies, where ongoing strength in services inflation contrasts with goods disinflation.

Goods and services prices have been seasonally adjusted and are broader in scope than the ex-volatile items/holiday travel CPI that proxies the trimmed mean CPI. But that is still useful in demonstrating how the RBA will need a material slowdown in services inflation to be confident that overall inflation will sustainably return to the 2½% midpoint of its target.

Market forecasts versus outcome for the monthly CPI

Underlying inflation is tracking in line with the RBA’s forecast profile

Goods prices are falling, while services inflation remains strong

Learn how the industry leaders are navigating today's market every morning at 6am. Access Livewire Markets Today.

All prices and analysis at 28 March 2024. This document was originally published on Livewire Markets website on 28 March 2024. This information has been prepared by Coolabah Capital Ltd ACN 153 555 867 Australian Financial Services Licence No. 482238.

The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.