Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Forget lithium – we’re going for gold!

Henry Jennings | Marcus Today

To paraphrase the great Laurie Lawrence, we are going for Gold. Seems appropriate in an Olympic year too. Whilst we have been talking about the price of iron ore or the fallout from the lithium bubble, gold has been quietly doing its thing. To the point that we are now seeing bullion trade at record highs in both USD and in AUD terms. US2248 and $3466. The interesting thing about the precious metal is that it really hasn’t behaved as it should. When interest rates go up, then gold should suffer. Gold actually costs money to store. And when rates are high, there is no incentive to hold physical gold as other alternative investments, such as bonds and even equities, are more attractive. Even with all that happened politically, with the invasion of Ukraine, gold did not leap as it did back in 1980 when the Russians rolled into Afghanistan. Another Olympic year. Importantly, it held firm when rates were rising, and now, we have falling rates, and we see gold hitting record highs. How good is that? An asset that does ok when it shouldn’t and does really well when it should. Given the geopolitical climate too, it is no wonder that the gold price has broken up.

At one stage, bitcoin was expected to be the millennial’s answer to gold. Bitcoin and other cryptocurrencies have done really well, but for the older investor there is still a sense that ‘crypto is really crapto’. There doesn’t seem to be a day that goes by without some news of a scam involving crypto. Then of course, Sam Bankman Fried is back in the news. Gold does not seem to have the same dodgy reputation as the currency of choice for scammers, drug dealers and organised crime.

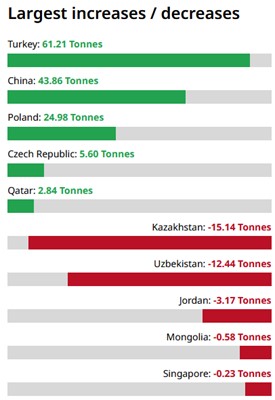

So, who has been buying all the gold? Apart from retail investors, it has been central banks across the globe building up their gold reserves.

Source: World Gold Council

You can understand Turkey to some extent with the inflation it has, but China? Why?

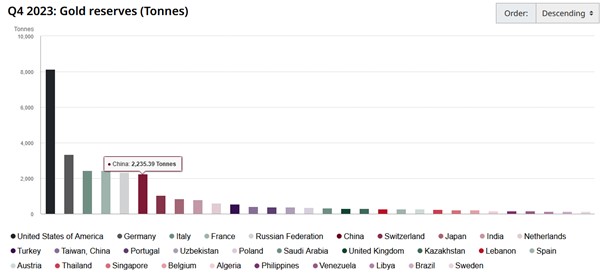

Source: World Gold Council

Is this yet another commodity market that China is trying to corner? They have a monopoly on the Battery Tech and Chemical trade. A monopoly on rare earths, Nickel, Iron ore demand and usage, and even copper to some extent. Gold is the new target.

This year 60% of the world will go to the polls. The US is obviously the main event, and it will be interesting to say the least.

The political and geopolitical risks are rising. Recently we have seen Israel bomb the Iranian embassy in Syria. That is opening a whole new can of issues. It has the potential to escalate. In Ukraine, given Donald Trump’s views on Europe, Putin would be salivating at the prospect of Don back in the Oval Office.

Worryingly for gold bugs, US commentators have started talking gold. Not something they talk about on Bloomberg or CNBC very often. The lithium boom caught the talking head's attention, and then it crashed. Typical.

I do not think that the gold price is in for a collapse though. Rate cuts, politics and central bank buying will keep things bubbling. Inflation is not dead but waiting in the wings like the Spanish Inquisition. No one expects it.

The question for investors, is have I missed this? Well, certainly some of the rally. Many people hate resource and commodity stocks. I really do not know why? Australia is built on resources. We know what we are doing. And every day a price list of the products is available for all to see and many to hedge. These commodities trade on the London Metal Exchange and the Chicago Metal Exchange. Can you say the same thing about CSL products? Or for NextDC (NXT)? Do you know the prices that Wisetech (WTC) charge for their logistic service? Nope? But you know what BHP gets for Iron ore and Copper. Roughly, anyway. What Newmont gets for an ounce of gold? Sure do.

Forget the mystery of gold. Treat it as a widget. A widget that costs so much to find, so much to produce, and then there is a price at the end. It is not rocket science. It is not special in that respect. Just digging dirt and processing it to sell. Like any production. Cars, data centres, IT, etc. Cost in/Price out = Profit or loss.

There is nothing mystical about it.

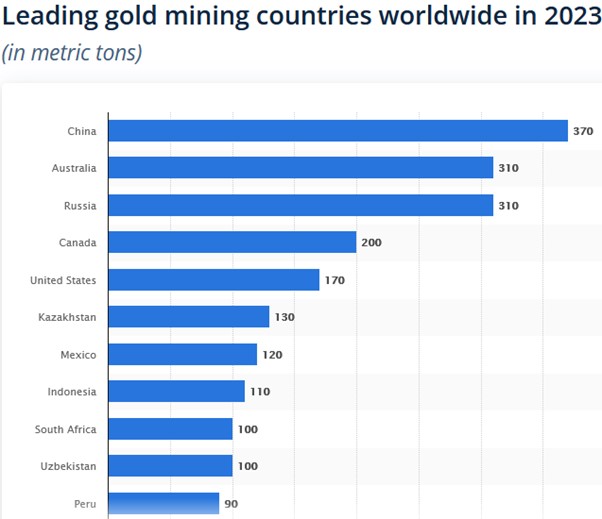

Australia is one of the biggest producers of gold.

• The Top Producer was Newmont (NEM) through the Boddington Mine in WA. NEM is the largest producer in the world. It has 10 Tier 1 assets. 6 world-class Cu – Au projects.

Source: World Gold Council

Source: World Gold Council

NEM is the result of the merger of Newmont and Newcrest. There are significant synergies to come. $500m by the end of 2025 is forecast. Plus, the company is set to sell six Tier 2 assets to raise $3bn to focus on its better assets.

So given its lacklustre performance since it joined forces with NCM, this one should continue to push higher.

• Northern Star (NST) is one of the big players that the gold bugs love. Class act and again it has been in a consolidation phase with the Super Pit in Kalgoorlie. This one has become the go-to for investors looking for large cap exposure. That is unlikely to change. Strong balance sheet with $229m in net cash. Underlying 1HFY 24 EBITDA of $889m. $702m cash earnings. Share buy back only half completed. Class act and global leader.

Source: Iress, Marcus Today

• Evolution Mining (EVN) has been a little underwhelming despite great management and assets. It has had issues with rain. Cowal and Mt Rawdon have seen production reduced but guidance remains. More upside as it recovers from drop recently.

Source: Iress, Marcus Today

• Gold Road (GOR) again has had some rain issues at 50% owned Gruyere. Unhedged, strong cash position, debt-free, record net profit after tax. It has rallied hard from the bottom recently, but there should be more to come.

Source: Iress, Marcus Today

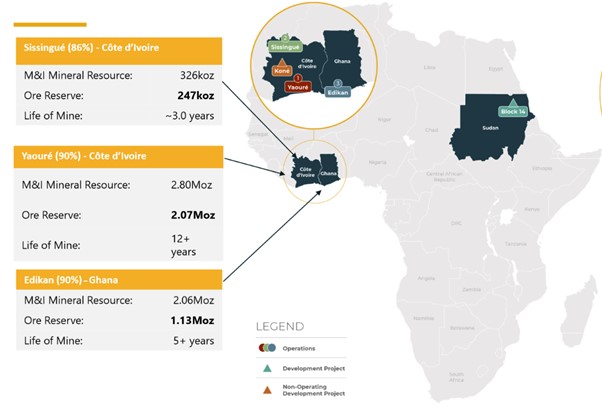

• Perseus (PRU) is not without country risk but again, one of the biggest producers on the ASX.

Source: Perseus

It is currently bidding for OreCorp (ORR) which may be a slight distraction. PRU is cheap compared to its peers. It trades at around half the PE of its peers, and at half the Enterprise Value to Ore Reserves of those rivals. It includes GOR, RMS, RSG and WAF in that basket.

It talks of geographical diversity but it is all about Africa. It has a new project in Sudan, with its Meyas Sand long-life asset. It does have a small issue with the life of mine with its existing operations. It talks organic growth. Exploration is hoped to solve that issue. Kicking higher.

Source: Iress, Marcus Today

Honourable mentions go to Genesis Minerals (GMD) with Raleigh Finlayson at the helm and De Grey Mining (DEG) with possible corporate action as GOR holds a 20% stake.

Conclusion

Remember gold stocks are not like a Christmas puppy. They are not for life. Gold miners and other resource stocks are not long-term holds. They are for buying and selling. The miners are probably the hardest to trade or invest in successfully. You have to embrace the contrarian in you as an investor. Sometimes you have to swim against the tide. Buy when no one else is interested. But it requires patience.

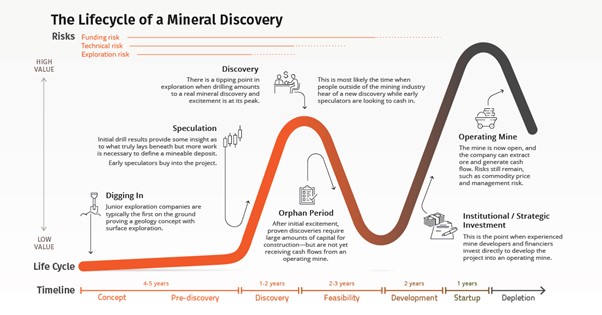

It is important to remember the cyclical nature of resource stocks.

Source: Visual Capitalist

Timing is everything. The sector is running hot for now. It will not last forever. If you have some exposure, enjoy it and ensure that you take profits along the way. Be disciplined.

The large-cap gold miners (see above) can be equally as volatile as the juniors. However, they do offer the benefit of bigger balance sheets and the ability to weather the storms when they come.

For now, the sector is still a buy but keep an eye out for the winds of change. Be prepared for volatility. The hoped-for rate cuts are a driving force and are the continued geo-political risks that could explode the closer we get to the US election. One thing is for sure, central banks will keep buying gold!

A free trial of the Marcus Today newsletter for nabtrade clients is available here.

All prices and analysis at 2 April 2024. This information has been prepared by Marcus Today Pty Limited. Marcus Today Pty Ltd ABN 57 110 971 689 is a Corporate Authorised Representative (no. 310093) of AdviceNet Pty Ltd ABN 35 122 720 512 (AFSL 308200).

The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.