Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Cruising through the icebergs

Roger Montgomery | Montgomery Investment Management

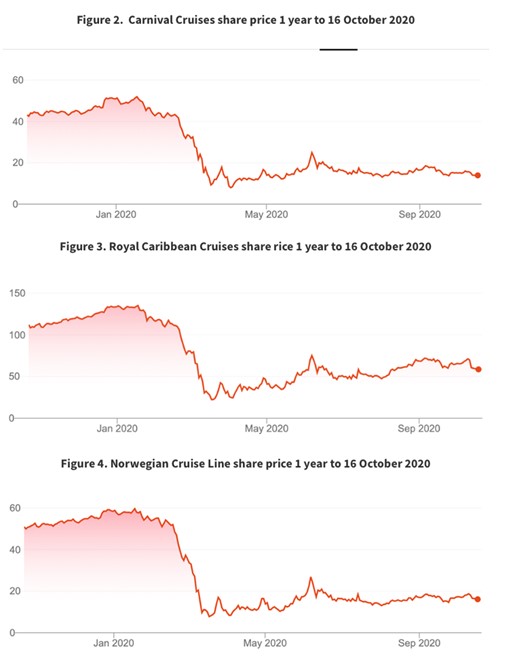

Back in October 2020, in the depths of the COVID-19 pandemic, in a blog titled “why cruise lines could be worth buying again,” we proffered an investment thesis that the sharp drops in the share prices of the major listed cruise line companies did not reflect the then fast-advancing technology that would facilitate a reopening of global activity even in the absence of a vaccine, and that pent-up demand (82 per cent of passengers are repeat cruisers) for travel would see a surge in cruising activity exceeding the expectations then implied in share prices.

Figure 1., displays the share price charts we published in that blog post (the embedded chart references refer to the blog post of October 21, 2020).

Source: Montgomery Investment Management

Figure 1. Cruising for a bruising? Share price charts as of 21 October 2020

Today, just three and half years later, the performances of the major cruise lines’ shares haven’t fully shaken off the effects of the pandemic. While Royal Caribbean (NYSE:RCL) is up 116 per cent, Norwegian Cruise Line (NYSE:NCLH) is up only 14 per cent and the highly indebted Carnival Corporation (NYSE:CCL) is just six per cent higher.

Given that Carnival has performed the least impressively, it’s worth examining its current circumstances to help determine whether a recovery is possible.

It seems navigating the high seas of the stock market has been a voyage fraught with risk and relatively unimpressive returns. That is certainly the case for investors who cast their lot with Carnival, the cruise industry titan then known for its vast fleet and now known for its equally vast debt.

Recent developments have seen the company's shares generally register modest gains, and these follow a setback triggered by the company’s latest financial disclosures.

Carnival’s fiscal first-quarter performance offered a beacon of hope, with strong figures and optimistic projections for the remainder of 2024. However, these forecasts hadn't accounted for an unexpected challenge: the collapse of the Francis Scott Key Bridge in Baltimore, necessitating the rerouting of several cruises to alternative harbours along the East Coast of the United States.

The anticipated financial impact of this event was capped at a seemingly minor "up to U.S.$10 million", equivalent to one cent per share. The figure gains significance, however, when viewed against Carnival’s financial position, which includes the revelation that a mere one per cent fluctuation in net yields could sway its financial outlook by as much as U.S.$135 million.

Despite the lingering shadow of the pandemic, which had once pushed Carnival's finances to the brink and plunged its debt to sub-investment grade, the company has been charting a steady, albeit long, ‘cruise’ toward recovery. Noteworthy are the significant debt prepayments. The roadmap for 2024 and 2025 now includes manageable debt maturities, laying the groundwork for Carnival’s potential return to a more stable financial position.

Over the horizon, Carnival’s prospects are reported to be brightening. Thanks to a resurgence in occupancy rates, helped along by compelling pricing strategies, customer deposits have surged to around U.S.$7 billion, a marked increase from the pre-pandemic figure of less than U.S.$5 billion.

Meanwhile, travellers are booking voyages further in advance and are reported to be indulging in higher-margin onboard luxuries at a significantly higher rate than before the pandemic. This uptick in consumer spending behaviour, especially evident during the peak cruise booking season known as "wave season," suggests a strong sales period for Carnival.

Of course, the journey ahead remains uncertain, with Carnival’s debt levels still a critical factor. As Carnival charts a course through its financial currents, its voyage towards stability and growth continues, and as the debt continues to decline, it will inevitably capture the attention of investors.

The timeline for Carnival to fully retire its extra debt remains uncertain. Investors currently expect it should be cleared before 2034. Carnival generated U.S.$4.3 billion in cash from operations and U.S.$2.1 billion in adjusted free cash flow in 2023, and it plans to use these cash flows to continue paying off the debt.

With the company's market capitalisation less than five times cash flow from operations and just ten times adjusted free cash flow, investors with a patient disposition should keep the company’s shares on their watchlist. When the market becomes confident the debt will imminently be paid down, the share price could surge.

Learn how the industry leaders are navigating today's market every morning at 6am. Access Livewire Markets Today.

All prices and analysis at 4 April 2024 unless otherwise noted. This document was originally published in Livewire Markets on 4 April 2024. This information has been prepared by Montgomery Investment Management ABN 73 139 161 701)( AFSL No. 354 564).

The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.