Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

America, the world’s new energy superpower

Paul Zwi | Clime Investment Management Limited

After having to import massive amounts of foreign energy for most of its modern history, the United States became energy independent in 2019, thanks to the fracking and shale revolution. In a paradigm-shifting development, the US has become the global energy superpower, combining production, technology and capital in a way never quite previously achieved – a development sure to have global implications for decades to come.

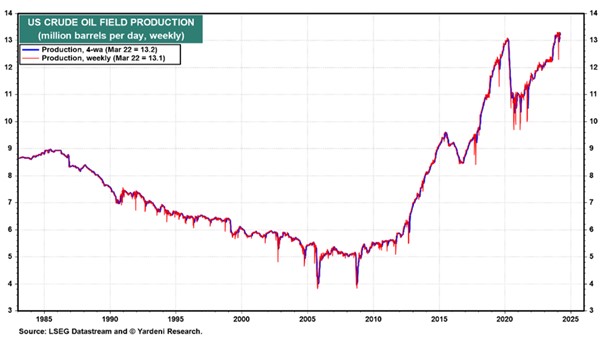

A few years ago, US oil and gas production dipped briefly during the pandemic as global demand collapsed, but it quickly bounced back. Today, the US is the largest crude producer in the world by a long shot, pumping out over 13 million barrels per day and accounting for nearly 20% of the world’s total oil production. Indeed, the US is now producing more oil than any country in history.

Source: Yardeni Research

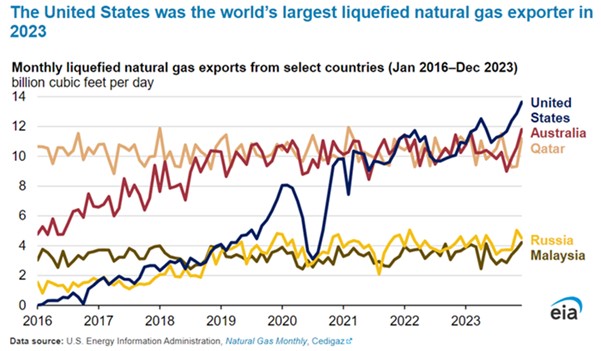

It’s a similar story for US natural gas production, which has also been setting record highs since recovering from the pandemic in 2021. As of 2022, the US exported far more natural gas than it imported – the bulk of which has been converted to liquified natural gas (LNG) and gone to Europe to ease the energy shortage created by the cut-off of Russian supplies following Putin’s invasion of Ukraine. Last year, the US overtook Australia and Qatar as the world’s largest exporter of LNG, and the country’s export capacity is set to continue growing.

Source: US Energy Information Administration

The United States has become the clear leader in the discovery of new energy technologies. It has started to build upon its manufacturing leadership in areas such as oil, gas, and power turbine equipment, and is exploring new energy technology manufacturing. New technology advances have been particularly meaningful in leading to major increases in energy production. For example, inventions in drilling including 3D seismic imaging, directional drilling, and hydraulic fracturing, reliable wind turbines, solar photovoltaics, the lithium-ion battery chemistry, and many others. Almost all of this technology discovery was driven in the United States.

No country comes close to US energy capabilities

This combination of largest producer, access to innovative energy extraction technology, plus capital market expertise, creates a commanding power which no other country possesses. For example, Saudi Arabia is strong in oil production, Qatar in LNG, Russia is a smaller player in both, China leads in some renewables, building materials processing and power equipment manufacturing capacity, and the UK is strong at capital markets. But none of these competitors have the combined strengths of the US energy profile.

Thanks to three laws introduced by the Biden administration, the Bipartisan Infrastructure Law, the Chips Act and the Inflation Reduction Act (the IRA), US corporates have committed to more than $200 billion in energy-related investments (including batteries, electric vehicles, renewables and hydrogen). While President Biden came into office with an anti-fossil-fuel stance, concerns about energy security have led to a far more open position towards Big Oil and Big Energy, albeit one that is not much spoken about.

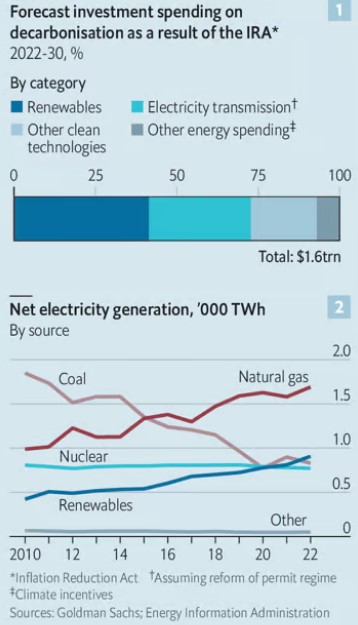

The US dominates capital raising for investments. The IRA’s climate-related provisions provide some $370 billion in tax credits and government funding over the next decade for energy and infrastructure. Some of the tax credits (such as for clean hydrogen) are uncapped by Congress, so if investors flock enthusiastically from around the world (e.g. Australia’s Andrew Forrest), the IRA’s public climate spending could exceed $800 billion. Add in the likely impact on private capital and the figures could rise to $1.6 trillion in decarbonisation investments over that period, according to Goldman Sachs.

Source: The Economist

Meanwhile, the US continues to deploy renewables, such as solar power and battery storage, at a significant rate. Together, these sources are expected to make up around 80% of all new electric-generating capacity in the US this year. Such growth is thanks to the decline in the cost of these technologies, and expectations that they are going to get even cheaper as they get deployed further, in turn boosting adoption, getting more competitive, in a virtuous cycle.

Implications from America being an energy superpower

In short, the US has become the world’s top energy superpower. The consequences are far-reaching:

- The US has become the global leader in increasing energy production.

- This is generating energy price deflation from its technology innovation.

- The US is leading the world in reduction of tons of emissions (on a tons-per-year reduction basis).

- America is now the global leader in providing energy market stability and security.

These energy strengths of the United States imply a new geo-political paradigm, which is yet to be fully understood. For example, the US relationship with the large Middle Eastern oil and gas producers was historically an extremely delicate one, with American diplomacy built around indulging behaviours on the global sphere it usually would not tolerate. Perhaps in the near future, the reality of global energy superpower status will force some re-thinking. As expressed in the Hoover Institution’s recent paper by Paul Dabbar, “Most current US energy diplomacy is still moored to the previous energy posture of weakness”.

America’s growing market share deprives Russia, Saudi Arabia, Iran, and other petro-states like Venezuela of pricing power and geopolitical leverage, lowering energy prices and boosting geopolitical stability. US oil supply growth has also kept oil prices relatively low in the face of OPEC production cuts designed to prop them up.

Even with the “OPEC+” additions, the cartel currently controls less than half of the global supply of oil (and shrinking). Lower energy prices stimulate the global economy and help ease inflationary pressure.

US energy abundance could usher in a new era of US technological advancement and productivity growth that increases living standards. If this seems like tremendous news for America, that’s because it is. Perhaps yet another reason for US stock markets to be at record all-time highs.

Source: Chart Advisor, Investopedia

First published on the Firstlinks Newsletter. A free subscription for nabtrade clients is available here.

- The Hoover Institution, Stanford University: “US Energy Superpower Status and a New US Energy Diplomacy” by Paul Dabbar.

- The Economist: “America’s chance to become a clean-energy superpower” 5 Apr 2023.

- The Financial Times: “The new commodity superpowers” 8 Aug 2023.

- US Energy Information Administration.

- Goldman Sachs.

- Yardeni Research.

Paul Zwi is a Portfolio Strategist at Clime Investment Management Limited, a sponsor of Firstlinks. The information contained in this article is of a general nature only. The author has not taken into account the goals, objectives, or personal circumstances of any person (and is current as at the date of publishing).

All prices and analysis at 10 April 2024. This document was originally published on firstlinks.com.au on 10 April 2024. This information has been prepared by Clime Asset Management Pty Limited (ABN 37 067 185 899)( AFSL 221146)

The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.