Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Lessons from the battery metals bust

James Gruber, Assistant Editor | Firstlinks and Morningstar.com.au

A few years ago, I bumped into an acquaintance who told me that he’d quit his job as a lawyer because he’d made a killing in lithium stocks. He had most of his net worth in these stocks because he was sure that he’d make a lot more money – enough to retire on.

At the time, alarm bells rang in my mind because:

- There’s no sure thing in markets.

- Putting most of your net worth in commodity stocks is rarely a sound strategy.

- Having been a commodities analyst, I knew that the mining sector was extremely volatile and tricky to get right.

The recent crash in battery metal prices has caught many, including this acquaintance, by surprise. Billionaires such as Gina Rinehart, Andrew Forrest, and Chris Ellison are nursing losses. Some of the companies who’d previously boasted of never-ending industry riches are now struggling to survive. Investment bankers who’d pumped up these companies are having to explain what went wrong, while they’ve walked away with tens of millions in fees.

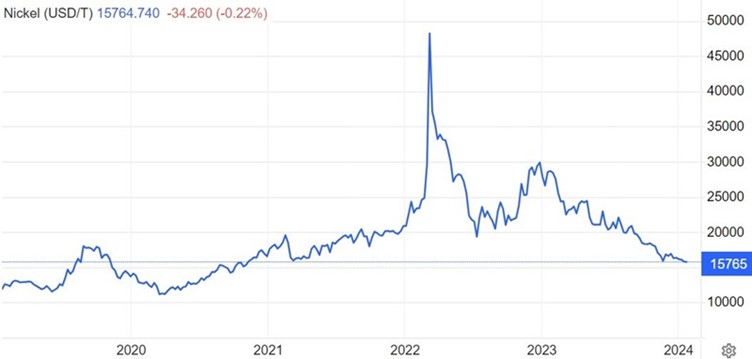

What’s happened with lithium and nickel isn't unique. It's a classic story of boom and bust that's occurred many times, both in the commodities space and in other sectors.

It's worth examining what went wrong with battery metals and what lessons investors can take away from the episode.

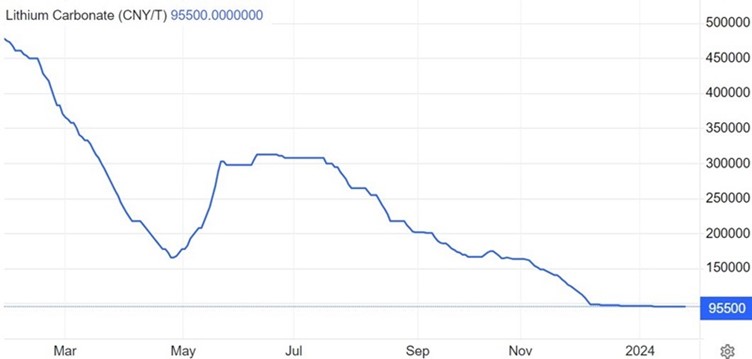

Source: Trading Economics

Source: Trading Economics

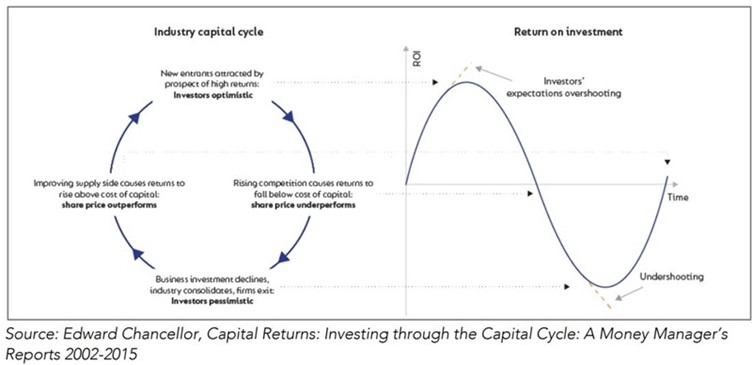

The capital cycle

What’s gone on is best explained via a framework developed by London-based hedge fund, Marathon Asset Management. Called the capital cycle approach, it's the basis for two books by well-known financial writer, Edward Chancellor (Capital Account and Capital Returns).

What Marathon does is apply Professor Michael Porter’s famous ‘five forces’ competitive strategy to the stock market. Porter said that companies don’t exist in a vacuum and that their fortunes are determined by the activities of other businesses. He outlined five forces which influence a firm’s strategic position: the bargaining power of suppliers and buyers, the threat of substitution, the degree of rivalry among existing firms, and the threat of new entrants. Unless a business is protected from these forces, then competition will “drive down the rate of return on invested capital toward the competitive floor rate of return”.

Marathon has taken Porter’s theory into the world of investments. They suggest that in a free market, high returns on capital or the potential for growth will attract new investment. The stock market can accelerate this process because if a company’s shares sell at a premium to the replacement costs of the firm’s assets, then there is a strong incentive for management to increase their spending on new or existing projects.

High stock prices not only influence decision making in public markets, but private ones too. Private firms, observing similar businesses selling at high multiples of replacement cost, may also decide to increase business investment. Venture capitals and investment banks can spur this on by helping to finance this investment. They may also assist new firms to enter the fray. All of this drives up supply in the industry.

Marathon says that high returns on capital should act as a warning sign, but companies and their managements often extrapolate these returns far into the future. They assume that their prospects are bright, and the returns are assured. And they're often surprised when the competitive forces that bring on new supply in the industry act to lower returns.

Marathon suggests that professional investors, who often take their cues from company management, are also liable to be caught wrong-footed.

The classic bust

What’s happened in the lithium and nickel markets mirrors the capital cycle described above.

In lithium, prices soared almost 13-fold in 2021-2022 as demand for electric vehicles (EVs) took off and supply couldn’t keep up. Understandably, prices of lithium stocks exploded higher as investors bought into the ‘multi-decade growth story’ of EVs.

With stocks prices way above replacement costs, management at lithium companies decided to expand supply, either by boosting existing mines or bringing on new mines. Private firms, seeing the higher spot prices and share prices of competitors, also decided to increase supply to meet the greater demand for lithium.

Investment bankers raised new capital for public lithium firms to help build out new capacity. They also IPO’ed lithium companies, which brought more capital and supply into the industry.

At their peak, spot lithium prices were more than double the cost of production for companies at the most expensive end of the cost curve and about 3 times those at the lower end.

The result? The supply of lithium increased by almost 40% last year, as:

- Africa brought on supply at such a pace that it surprised everyone.

- Hard rock production rose in Western Australia.

- New salt lake sources were unearthed in China.

At the same time, demand for EVs softened in China, as the economy there struggled to rebound after Covid lockdowns.

Consequently, lithium prices and stocks cratered. Companies that were aggressively expanding supply are now pausing production and closing mines. Some are struggling to refinance loans. And others are pleading for government help for the industry (got love it when billionaires ask for handouts). There’s also increasing talk of takeovers and industry consolidation.

Investment bankers that once forecast industry supply deficits are now predicting surpluses, perhaps for the next five years. IPOs in the sector have dried up as some firms struggle to make ends meet.

Lessons for investors

What’s happened in battery metals isn’t unique. Previously, the Buy Now Pay Later industry went through a similar boom and bust cycle.

Here are some of the lessons from the lithium and nickel rout:

- Everyone focuses on demand in an industry when supply is often more important.

- Be sceptical of any sector that’s described as a structural growth story, especially in the commodities space.

- Beware of a spate of IPOs in one sector. It can signal that more money will enter the industry, driving up supply, and potentially driving down returns.

- If investment bankers are pumping up a sector, run the other way.

- Don’t blindly follow billionaires into investments. These people are often betting just a fraction of their net worth and won’t get hurt if it doesn’t turn out.

- With commodities, when spot prices are well above the costs of company production, it will almost inevitably lead to increased supply.

- When company management constantly talks up their share price, or bags short sellers, it’s a red flag.

- There is never a sure thing in markets – spread your bets accordingly.

Where to from here?

The lithium and nickel markets are now working their way through previous excesses. As the capital cycle diagram above suggests, the end of a cycle is normally characterized by business investment declining, firms existing, industry consolidation, and investors being pessimistic. That describes exactly what’s currently happening in these markets.

The industry is starting to get the attention of more fund managers. At a luncheon this week, Tribeca’s Jun Bei Liu described lithium stocks as ‘interesting’ given recent developments of production cutbacks and consolidation. Other funds such as Pella Asset Management have recently invested in the sector. Pella believes that lithium demand will exceed supply by 2025 as EV sales grow and there’s a shift to larger EVs, while lithium supply may struggle to ramp back up.

Time will tell, though we’re undoubtedly getting closer to the end of this cycle.

First published on the Firstlinks Newsletter. A free subscription for nabtrade clients is available here.

All prices and analysis at 24 January 2024. This article was first published in Firstlinks, a Morningstar publication (Morningstar Australasia Pty Limited (“Morningstar”) ABN: 95 090 665 544 AFSL: 240 892). This article was prepared James Gruber, assistant editor at Firstlinks and Morningstar.com.au

The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.