Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Tailwinds for asset prices in 2024 and beyond

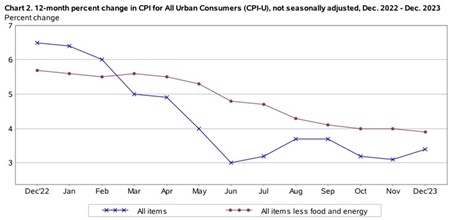

In the final quarter of 2023, it became increasingly obvious that investment markets had excessively discounted both the risk of a US recession and continuing high inflation. After a sharp pullback during October, equity and bond markets across the world rallied hard through November and December as US inflation readings plummeted. In calendar 2023, US CPI was recorded at 3.4%, half the rate of 2022 and 2% below the level of US cash rates.

Source: Bureau of Labor Statistics

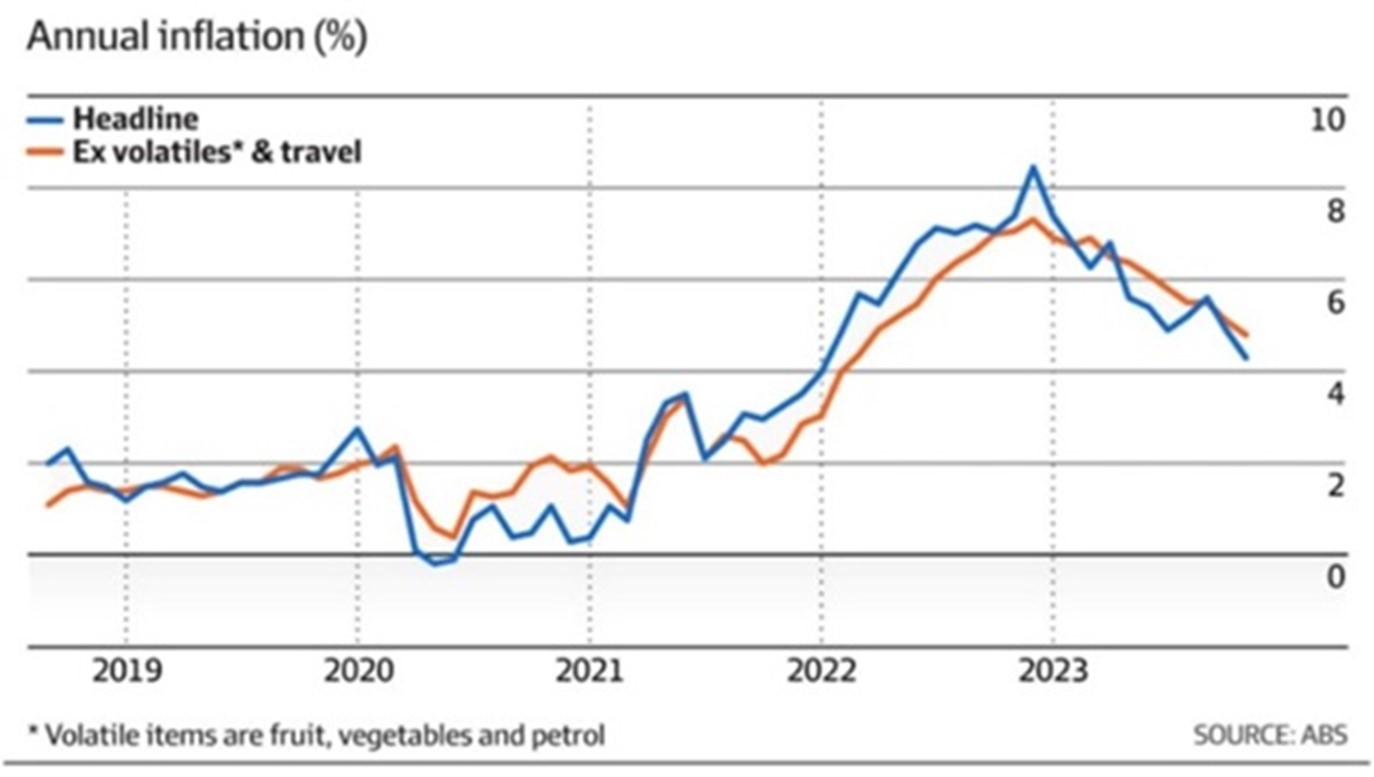

In Australia, annualised inflation readings have been retreating rapidly from the near 9% recorded in November 2022. Indeed, the recent rate (for year to November 2023) of 4.3% takes inflation back towards the cash rates. I expect annual inflation to fall towards 3% before June 2024, and cash rates will then be set well above inflation, so that “real” yields reappear.

However, as 2024 opens, is it possible that markets have already factored in much of the good news? If that is so, should self-managed investors be cautious?

My answer is simple. Investors should always be cautious, and more so as they move deeper into retirement years and into higher pension requirements. Further, investors should also be sceptical of groupthink or consensus.

The best protection for an investor is to maintain a strong qualitative overlay that focuses on high quality, cash generating investments – whether they be equities, fixed income or property investments. Sticking to quality and value, plus an appropriate asset allocation, is the best way to invest with suitable caution.

Markets have fittingly repriced and recovered as inflation readings across the world have fallen. Further, given that interest rates – whether they be cash or long dated bonds – did not excessively rise against inflation, the bounce in asset prices is justified. As the world economy (including Australia) moves through a low growth period (first half of 2024), it will become increasingly obvious that stronger growth is assured in 2025 and risk assets will be rewarded.

Macro charts show why markets have quickly recovered

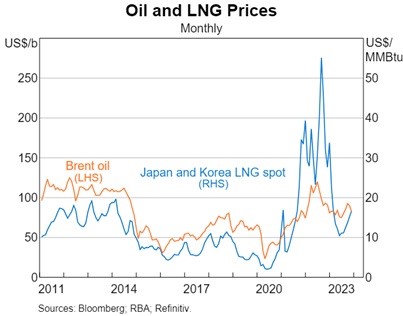

The key driver in moving inflation from “transitory” (coming out of Covid) to “intransigent” was the war in Ukraine and the effect on energy prices (oil, natural gas and coal). This was primarily because Europe (in particular, Germany) had embedded itself in Russian gas supply and because OPEC+ was seemingly sympathetic to Russia’s needs, by restricting oil supply to maintain oil revenues.

The opening chart plots oil and LNG prices and shows the price surges that flowed following the invasion of Ukraine. It is interesting to note the substantial price declines that occurred in 2023, now flowing into inflation readings.

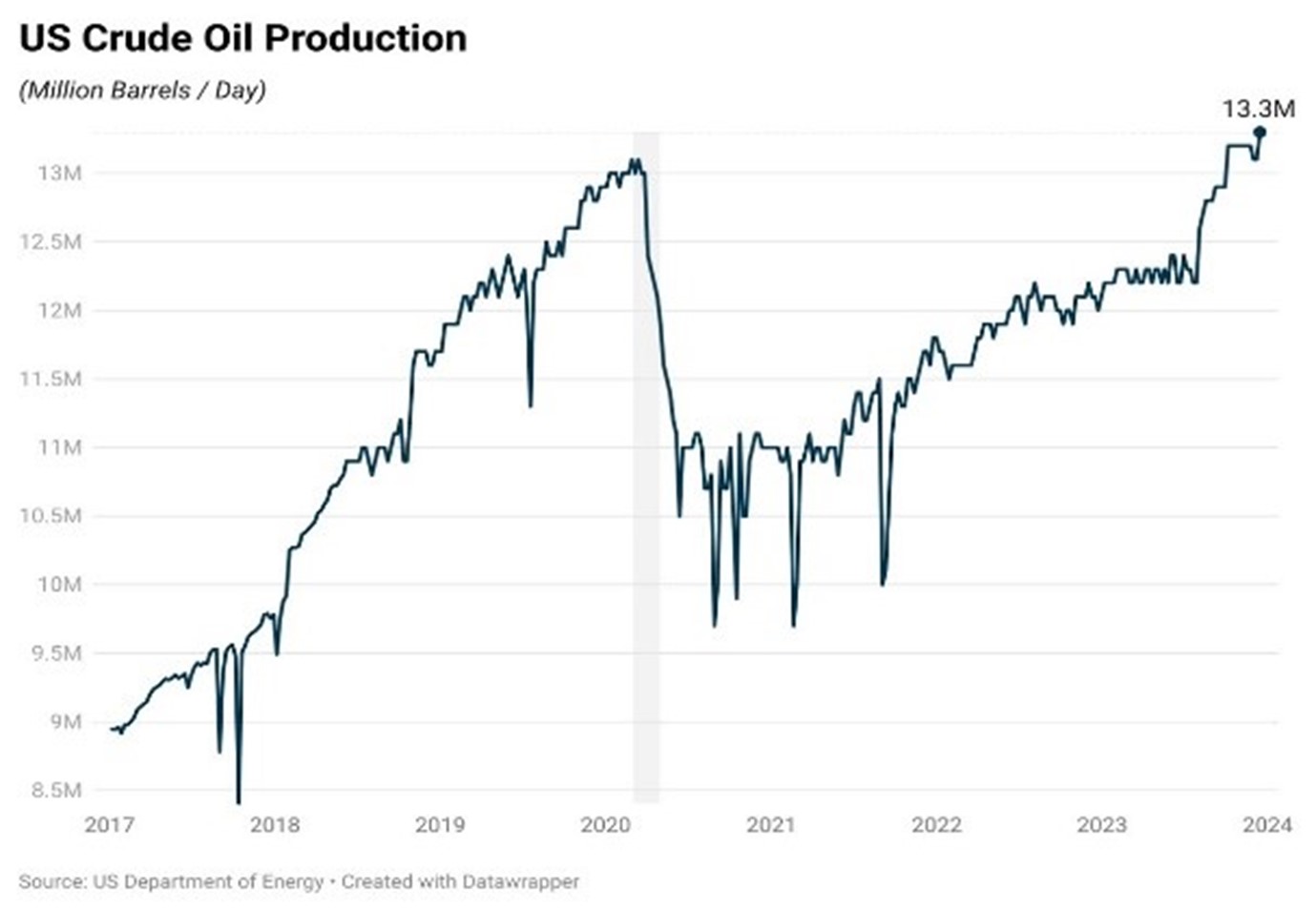

Contrary to widespread opinion, the decline in oil and energy prices did not occur because world demand faltered, but rather because the US brought back its oil production. This is important because it shows the power of the US to mobilize its economy to meet economic issues. In particular, it shows that the US will defend itself against economic attack. The creation of “intransigent” inflation caused by OPEC+ was swiftly met by rising oil production, on the surface in complete contrast to US goals of reducing its carbon footprint consistent with world agreements.

Just this week, it was reported that the US has become the world's biggest exporter of liquefied natural gas for the first time, with 2023 shipments overtaking leading suppliers Australia and Qatar. The US exported 91.2 million tonnes of LNG in 2023, a record, according to data through December 31 compiled by Bloomberg.

This is remarkable because surging US oil and LNG production was kept well away from the mainstream press, which remains fixated on clean energy developments across the world.

The US production record is important for Australia to observe and understand. Managing 'inflation outcomes', 'the cost of living' and 'the cost of doing business' requires responsive and thoughtful leadership. As one of the largest exporters of energy in the world (LNG and coal), Australia should understand the economic risks of not having proactive inflation-fighting policies that flow from our abundant energy resources. Our current policy settings that drive energy prices higher are nonsensical. Why feed inflation when we could have held prices and costs down by more aggressively utilising the budget surplus? The legacy of poor long term energy planning for the Australian economy has become obvious and no more so than since the Ukraine war.

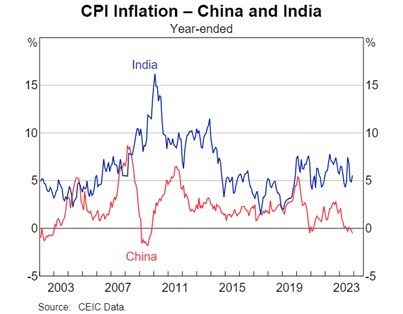

The recovery of US oil production has shifted both the supply and demand curves of oil markets. As the US increases its supply, it withdraws from buying on international markets and this has led to a scramble by OPEC+ to reduce production. At the same time, Russia is providing discounted oil to China and India, the result being that inflation is under control in India and has plummeted in China.

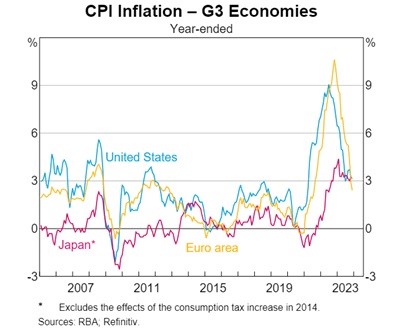

Inflation is dropping dramatically across the US, Europe and Japan. This was an appropriate trigger to stir asset prices higher as it became clear that lower inflation meant that bond yields (risk free rates) had peaked.

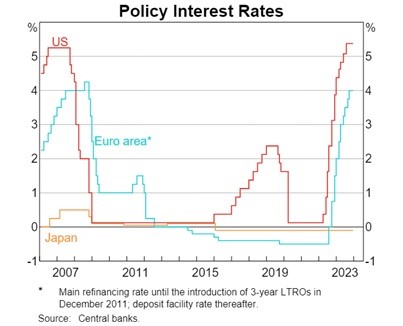

What flows from the above is that interest rate settings in the US (in particular) are too high. As noted, US bond yields have already been bid lower in the open market, even though the Federal Reserve has been reticent to admit that inflation appears beaten by energy price compression.

There is no doubt that US cash rates must come down (and by at least 1%) through 2024, but with the question being, “When?” - given the US Presidential election is in November.

What about Australia?

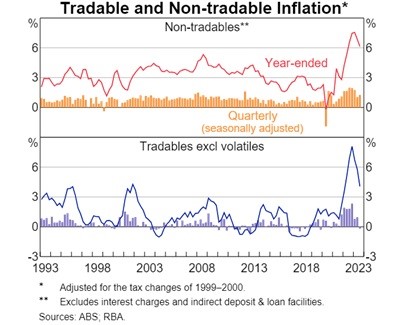

In Australia, the FY24 outlook for inflation is good but more so in FY25, albeit delayed by politically motivated policy decisions driven by an eye on the election cycle. This is shown by our inflation chart below where “transitory” inflation (driven by “tradeables” or imported inflation) has been replaced by elements of “intransigent” factors (“non-tradeables” mainly the costs of services pushed by wage increases).

Whilst tradeable inflation flowed from pandemic lockdown effects on supply and a weak AUD, more recent inflation has been caused by cost pressures within the economy. Importantly, both of these overlapping inflation cycles have predominantly been “cost” rather than "demand” driven.

That is why inflation is now falling and will continue to fall over the next 9 months. Lower petrol prices, lower electricity and gas prices (from July 2024), a rising AUD (as cash rates move above inflation) and zero inflation in China, all point to a rapid decline in inflation in Australia. Cash rates have peaked with no need for the RBA to adjust them higher. Therefore, the cost of debt that also feeds “cost” inflation will now be tempered.

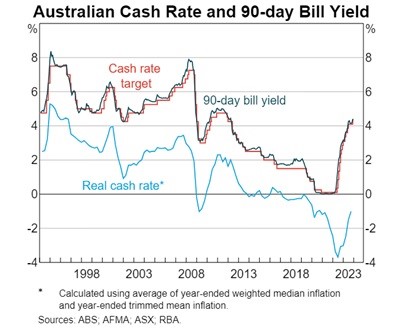

The chart below, which compares cash rates to inflation, suggests that the blue line (the “real” cash rate) will become positive by about 1%, creating a sustainable positive real interest rate for the first time in a decade. Over the last 80 years it is more normal to have positive real interest rates than negative real interest rates – so investors need not be alarmed by this return to normal.

What will hold up Australian inflation in the meantime?

The nonsensical delay in reducing energy prices (until July), the indexing of consumption taxes (eg. excise duties), road tolls and other essentials for young households (like health insurance and education) will all contribute. Further, the lack of initiative by the Government to bring forward tax cuts in an attempt to hold down wage increases, will keep inflation higher than it should or could be. Lack of taxation initiative has effectively increased the cost of doing business which then leads to expense recovery by increases in the costs of goods and services.

If markets have factored in the good news, is this a risk for investing?

My answer to this is a resounding “No”. The economic growth of Australia seems assured in 2025, with stable and lower inflation (sub 3%), and the prospects for economic growth that will feed the earnings and cash flows of both growth and risk asset valuations.

My positive outlook is driven by these observations:

First, 2025 will see the lingering consumption demand growth from immigration, with a return of education exports (students) and travellers.

Second, Stage 3 tax cuts will flow through the economy in 2025, contributing to growth.

Third, the continuing need for infrastructure investment will be added to by significant rebuilds flowing from floods in Nth QLD and Victoria. Rebuilds are a constant for growth that are often overlooked by economists.

Finally, the recovery of China and compounding growth of India mean our export earnings will continue to be strong. Australia borders with over 4 billion people across Asia and as their standard of living improves, our growth is assured.

First published on the Firstlinks Newsletter. A free subscription for nabtrade clients is available here.

All prices and analysis at 17 January 2024. This article was first published in Firstlinks, a Morningstar publication (Morningstar Australasia Pty Limited (“Morningstar”) ABN: 95 090 665 544 AFSL: 240 892). This article was prepared by Founder and Chairman of Clime Investment Management Limited, a sponsor of Firstlinks. The information contained in this article is of a general nature only. The author has not taken into account the goals, objectives, or personal circumstances of any person (and is current as at the date of publishing).

The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.