Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Is India the world’s best growth story

GQG Partners

There's a strong case to be made for investing in Emerging Markets (EMs). For example, when you adjust the GDP of the E7 (the seven largest EMs), for purchasing power parity (PPP), their output is greater than that of the G7 (the seven largest developed nations). In addition, as these nations are growing at a much faster rate than developed countries, their economic significance is increasing.

Within EMs, India is particularly attractive as an investment destination and as the world’s most populous nation it is simply too large for investors to ignore. Once labelled as one of the 'Fragile Five', India has roared to life through strong leadership and a stable government that has implemented positive economic reforms, improved infrastructure, and stimulated private enterprise.

India’s demographics are also favourable. Its middle class is quickly growing in size, and its population is relatively young – much younger than China’s – which has been boosting consumer spending.

India's favourable economic outlook

In our view, India’s economic growth prospects are more attractive than many other EM and developed nations, including China’s. The World Bank recently said that India’s economy is showing resilience in a challenging global environment. India has been one of the fastest-growing major economies in FY2022-23, expanding by 7.2% and India’s growth rate was the second highest among G20 countries and almost twice the average for EM economies. The World Bank forecasts India’s GDP growth for FY2023-24 to be 6.3%, with the expected moderation mainly due to challenging external conditions and waning pent-up demand after the passing of the COVID-19 pandemic. However, service sector activity is expected to remain strong with growth of 7.4% and investment growth is also projected to remain robust at 8.9%.

India’s economic resilience has been underpinned by robust domestic demand, strong public infrastructure investment, and a strengthening financial sector. Over the longer term, we believe this may support economic growth in the nation led by Prime Minister Narendra Modi, who has prioritised economic development.

In contrast to India’s strong growth prospects and democratic government, economic growth in China has been much weaker. China is dealing with ongoing economic challenges such as government interference in private and state businesses, high debt levels, and instability in the real estate sector. Structural factors too, such as an aging population, are weighing on economic growth in China. China’s economic growth was forecast by the World Bank this month to slow to 4.4% in 2024, down from a forecast 5.1% in 2023.

Other things favour India too

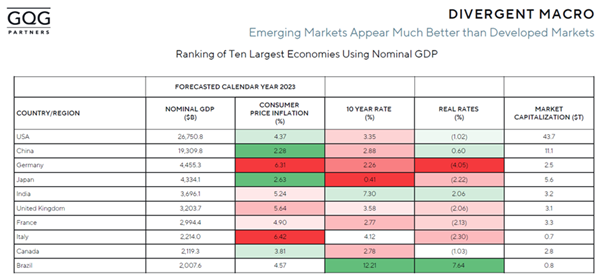

There are other factors we believe favour investment in India over China and other EMs. The nation’s stock market capitalisation is large and diverse – it is bigger than the UK or the German market (as the table below shows). India’s economy and listed companies have benefited from a stable government over the last decade, and that has encouraged growth in its stock market. India’s government has invested significantly on roads and rail and related infrastructure – that has had a multiplier effect on the economy and listed companies are benefitting from the uptick in spending in these areas.

Source: Capital IQ. Estimates for calendar year 2023. Actual results may differ from any projections illustrated above.

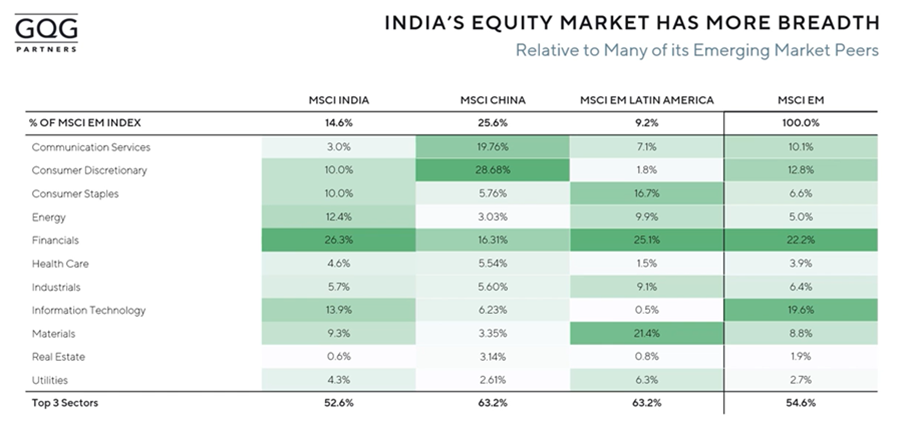

Importantly, India’s equity market offers more breadth and diversity than its EM peers; it is significantly less concentrated than Chinese and Latin American equity markets in the largest three sectors, as the table below shows.

Source: Source: S&P Capital IQ, MSCI. Data as of June 30, 2023. You cannot invest directly in an index. Past performance may not be an indicator of future results.

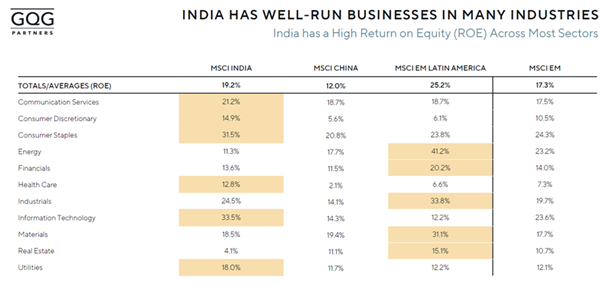

In addition, India’s stock market arguably offers higher quality investment options than other EMs including China, as its listed companies typically offer a greater return on equity (ROE) than that offered by Chinese companies (as the charts below show). Indian companies offer relatively high ROE as its companies have been relatively capital starved and hence those business that survived and grew tend to be more efficient. We believe active management is, however, needed to identify the most promising investment prospects and help minimise investment risks.

Source: Source: S&P Capital IQ, MSCI. N/A indicates zero sector exposure in that MSCI index. ROE is calculated using the trailing twelve-month period as of June 30, 2023. You cannot invest directly in an index. Past performance may not be an indicator of future results.

There are other positives to investing in India. Structural changes over the past decade have made India more competitive. India has built up its foreign exchange reserves which has given the nation an economic buffer and war chest to handle economic turbulence, such as that resulting from higher interest rates and inflation. Notably, on 14 July 2023, India’s Forex reserves stood at US$609.02 billion, a 15-month high, though they have dipped since then.

Compared to China, India is well placed to grow in these challenging economic times and investors should consider an equity allocation to the world’s most populous nation.

First published on the Firstlinks Newsletter. A free subscription for nabtrade clients is available here.

All prices and analysis at 6 December 2023. This article was first published in Firstlinks, a Morningstar publication (Morningstar Australasia Pty Limited (“Morningstar”) ABN: 95 090 665 544 AFSL: 240 892). This article was prepared by GQG Partners (Australia) Pty Ltd, ACN 626 132 572, AFSL number 515673.

The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.