Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Why avoiding losers is the key to successful investing

Daniel Moore | Investors Mutual

Novak Djokovic is, probably, the GOAT of tennis (Greatest Of All Time). Does he hit more winners than other top players? No, not particularly. But he makes fewer mistakes. While playing in Australia in early 2023 he hit 374 winners, while his opponents, cumulatively, hit 314 winners. This is a winner ratio of around 20% better than his opponents. What is more striking, however, is the difference in error count. Novak made 576 unforced errors in the same timeframe while his opponents, made 802 errors – they made around 40% more errors!

Novak’s low error count is a key part of his incredible, enduring success. It might not make him popular, but it makes him a winner. It’s the same in golf, or football, or rugby, or any other sport. Don Bradman, the GOAT of cricket, only hit 6 sixes throughout his storied career – if you don’t hit it in the air, you can’t get caught out.

Avoiding more errors than your opponents is the key to winning. And it’s the same in investing. Avoiding losers is just as important as picking winners. Unfortunately, this is not the approach that most investors follow.

Why? It’s mostly down to human nature.

Psychologically, we get more enjoyment out of winning, as opposed to avoiding losses. It’s more interesting and exciting to focus on how much your investments have increased in value, rather than talking about the poor performing companies you decided NOT to buy, or the companies you sold after they dropped 10%, but before they dropped 40-50%.

However, our experience shows that a more balanced approach to investing delivers much better long-term outcomes. An approach that considers, and carefully weighs, upside potential with downside risks is more likely to deliver better returns. To maximise long-term returns investors should give equal weight to what they could lose if things don’t turn out well, as well as what they could gain if things do go well.

You should only invest if the risk and reward is in your favour

This approach has been a hallmark of the IML process for more than 25 years, we have an equally vigorous approach to both upside analysis and downside protection. We do this because avoiding large losses in your portfolio can have a dramatic effect on your long-term returns.

There are three main reasons why:

1. It’s simple maths.

If you avoid big losses, your portfolio doesn’t have to rise as much to deliver good returns.

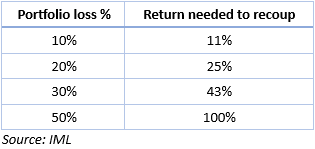

Shares, particularly smaller companies, can drop by 10% relatively regularly. It’s not too hard for them to rise 11% to make up the loss. But the further shares fall, the harder it becomes for them to make up that lost ground as the table below shows.

2. It’s critical for investors in, or close to, retirement

The technical term for this is sequencing risk – the risk that the ‘sequence’ of returns has a negative impact on an investor’s total savings.

Most sharemarket investors know that drops in the market happen, but they also know that over time markets tend to go up more than they go down, so this makes up for the losses. The main risk for sharemarket investors is that if one of these drops happens shortly before they are due to retire it can delay their retirement plans for years. And if it happens shortly after they retire it can significantly reduce the amount of money they have to live on in retirement.

To demonstrate this point, the chart below shows two people with very similar retirement plans who retire at 67 in line with the Association of Superannuation Funds of Australia (ASFA)’s current guidance on what they will need for a ‘comfortable retirement’:

- They both retire with a balance of $600,000 and invest the full amount in the ASX 300.

- They both withdraw $50,000 in the first year for living expenses and increase their withdrawal amount each year in line with inflation.

- The only difference is that Investor A retires in 1997 and Investor B retires in 2007.

Source: IML, as at 23 October 2023

Investor A’s funds stayed above their initial starting point for more than 10 years, only dipping below as the global financial crisis (GFC) hits. From there they decline reasonably steadily, but still last 27 years to the age of 94, well past average life expectancy.

Investor B has the bad luck to retire around a year before the GFC, so their funds dip below their initial starting point reasonably quickly and never recover. Investor B’s savings run out in less than half the time, in 13 years, when Investor B is 80.

The outcome is so stark because making withdrawals from your savings at low points during the market means that you don’t have enough capital to make up lost ground when the market bounces. So, investment strategies which include greater levels of downside protection are particularly valuable for investors in, or approaching, retirement.

3. It helps investors stay invested through the cycle

It’s an investment truism that you shouldn’t sell out after a major sharemarket correction, because you lock in your losses and miss the inevitable recovery. But while it might be well known, it’s not necessarily well followed. Many sharemarket investors, especially new investors, give up on markets after they see their savings drop significantly. It’s just as hard to pick the bottom as it is to pick the top.

And it is true that when markets do bottom, the bounce back is often swift. If you miss the rally you can severely damage your long-term returns. The S&P 500 posted a median return of 15% for the month following the bottom of the eight bear markets over the past 40 years.

If investors’ portfolios drop less, they are less likely to sell out, and less likely to miss the bounce after markets bottom. A study by the Vanguard Group in 2016, "Downside Protection Strategies: A Review of the Evidence", found that investors who used downside protection strategies were more likely to stay invested during market downturns than those who did not.

How do you analyse the potential downside of an equity investment?

Just like there are many ways of estimating the upside potential of an equity investment, there are also multiple ways of analysing the downside potential.

Here are the main things IML looks at for Australian companies:

- Cyclicality of earnings. Are earnings at a peak, on the way up, down or mid cycle?

- Balance sheet. Can a company withstand a downturn in the economy or might it need to raise equity and so dilute the investments of current shareholders?

- Management track record. Has management won or lost market share consistently? Has their capital allocation historically been sound, or are they likely to do value destroying acquisitions? How has management performed during difficult periods for the company or economy?

- Financial accounts. Are they transparent or not? Are there any concerning issues buried deep in the accounts?

- Is there regulatory risk or not? Does the company operate in an industry where the government is likely to change regulations? E.g. gambling, heavy-emitting industry etc

- Does the valuation of the business look attractive relative to its long-term history, the quality of the business, its growth prospects and its peers?

Investing is emotional as well as analytical

Great investors are often just as good at controlling their emotions and biases as they are at analysing companies and markets. Whether you’re a hardened professional investor, or a first-time retail investor, it’s never easy to control your emotions and make rational decisions under pressure - yet this is what we need to do to be successful. A lot of avoiding big losses is ensuring that you are in control of your own emotions, that you don’t get caught up in the hype. That you don’t fall for fads or FOMO.

When the world looks like a bleak place it’s hard to focus on the opportunity, but that’s when investors most need to. It’s the time when you could get the opportunity to buy a brilliant company at a bargain price. Similarly, when markets are running hot and delivering outsize returns, it’s hard to focus on risk – but that’s often the time when risks are at their sharpest.

The key is to have a consistent, risk-adjusted approach to investing through all the different stages of the market cycle. This might not give you a bagful of great after-dinner anecdotes, but it’s likely to make you more money in the long run.

First published on the Firstlinks Newsletter. A free subscription for nabtrade clients is available here.

Daniel Moore is a Portfolio Manager at Australian equities fund manager Investors Mutual Limited. All prices and analysis at 22 November 2023. This document was originally published in Firstlinks, a publication from Morningstar Australasia (ABN: 95 090 665 544, AFSL 240892), on 22 November 2023. This information has been prepared by Acorn Capital Pty Ltd (ABN 14 078 030 752 (AFSL 229988). The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.