Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

How the Australian dollar can boost your portfolio in turbulent markets

Dan Pennell | Plato

With increasing exposure to offshore assets, Aussie investors are often faced with a decision on whether or not to hedge currency movements.

A decision to hedge means you take an opposing position in the currency pair, and consequently remove the impact of its movement on your offshore investments.

But over the past month, as various macro themes including geopolitical tensions, rising inflation, weaker Chinese growth, and investor concern around the future of rates, pushed global markets lower, we have seen a great case study on how remaining exposed to currency can help boost your returns in tough market environments.

How can currency exposure help?

Be it diversification or exposure to exciting global companies, there are many benefits to investing overseas.

One important, yet often overlooked benefit, is that your overseas investments offer protection against imported inflation.

Imported inflation can be caused by an increase in foreign prices or the depreciation of the local exchange rate. If you are lucky enough to fly overseas for a post-COVID break, a weaker Aussie dollar can import inflation and make those well-deserved holiday treats more expensive.

Offshore assets can help protect against these risks.

If prices are rising overseas, then your global investments should increase with them. In addition, an investor protects against the depreciation of their home currency because their assets are now worth more to them when converted into AUD. Put simply, a strong US dollar will buy more Aussie dollars when converted.

But isn’t currency just a risk?

Currencies can be a volatile asset class and exposure to them is an important risk to consider when investing overseas. Many of our clients do hedge this risk away, but as I will explain, currency can be your friend, particlalury when your equity portfolio might be looking a little friendless.

Over the long term there has been a strong relationship between the Aussie dollar and global markets. With a positive correlation over the last two decades, the AUD is seen as a risk on currency.

This means that it moves with markets, generally weakening when equity markets fall and strengthening when markets rise.

In a past note I illustrated how currency exposure helped in the 2008/9 financial crisis. To summarise - from June 2008 to Feb 2009, the US market lost -41%, a huge pain point for investors. However, in the same period the AUD fell -33% versus the US dollar, benefitting an Australian investor.

The result was that the US market only fell -13% in AUD terms. In a challenging period, when investors really needed it, currency saved almost a third of one’s investment!

Now let's look at the month just gone (August 2023).

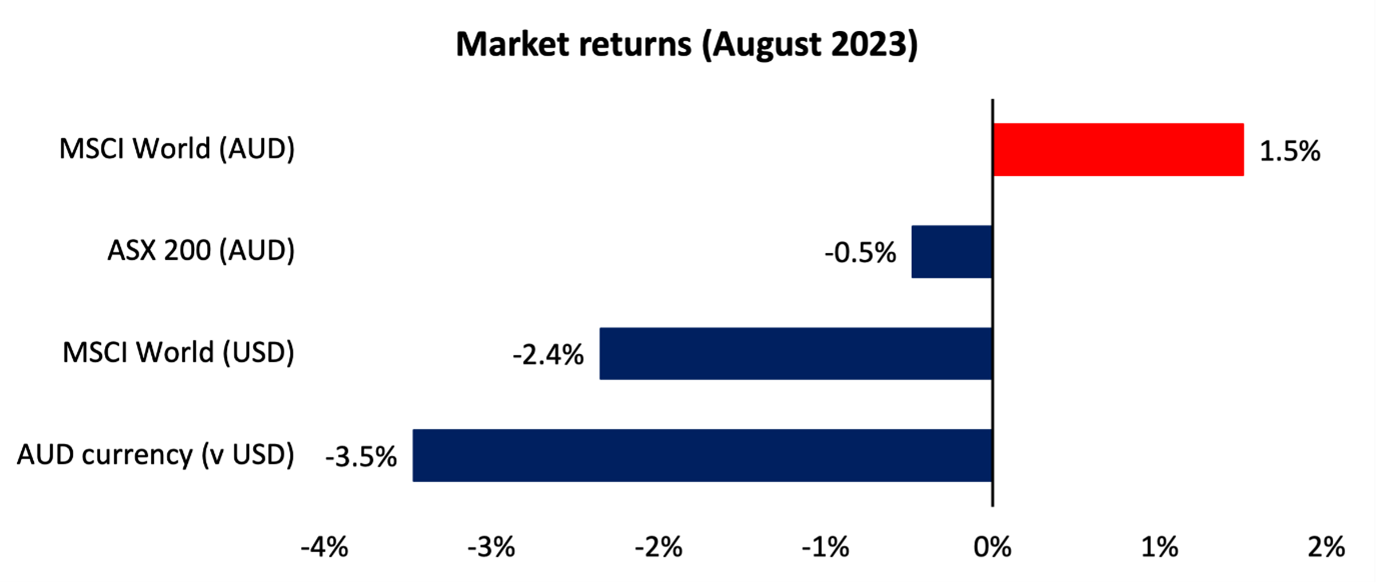

The chart below illustrates how investors in global markets benefited from unhedged global equities portfolio.

The impact of currency on market returns.

Source: Bloomberg

Not only did the local share market produce negative returns (ASX 200 -0.5%), but global markets fell even more, with the MSCI World down -2.4% in USD terms (or in AUD for an investor that hedged out currency movements).

However, a weak Aussie dollar (-3.5% v USD) jumped to the rescue, converting a negative return in the MSCI World to a positive return (+1.5%) when based in AUD.

This is an important, albeit short, case study of how currency can provide a significant benefit at a time when it is most needed.

Overseas investments certainly bring new risks for investors, but a broad global allocation provides diversification and reduces overall equity risk.

In addition, as illustrated, an unhedged allocation to global equities can further reduce risk and help offset falling assets. A weakening Aussie dollar can make paying for your next overseas holiday more painful, but hopefully one can relax knowing that it will be helping to enhance your retirement next egg.

Learn how the industry leaders are navigating today's market every morning at 6am. Access Livewire Markets Today.

All prices and analysis at 18 September 2023. This document was originally published in Livewire Markets on 1 August 2023. This information has been prepared by Plato Investment Management ABN 77 120 730 136, AFSL 504616.

The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.