Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Not Dead Yet Pining for the Fjords

Henry Jennings | Marcus Today

Monty Python had it right perhaps with the famous parrot sketch. Resting. Not dead. At least that is what the market now feels like after a lacklustre May (the Sell in May phenomenon), the Norwegian Blue seems to have awakened from its slumber and June has kicked off in style. Three solid days of gains. Not enough to get us all massively excited, three days does not a bull market make, but post the debt ceiling negotiations, the market appears happy to overlook the negative and accentuate the positive. The US Non-Farms number should have been a signal to sell, but instead, the US investors looked through the number and saw only 3.7% unemployment and a better-than-expected wage gain. Then, of course, there is the AI revolution taking place. Houston, we have lift-off. Somewhat of a long bow here on the ASX to find real winners as yet but the market has bet on APX, WBT and BRN as the likely winners. Who am I to argue? APX has been an extraordinary performer as one of the biggest gains in the sector this year. Up some 50%. It hit rock bottom with an entitlement issue before the AI bounce. It seems the tech renaissance was a catalyst for broader risk on sentiment and hopes of a Chinese revival. We even had some better-than-expected surveys from China to help things along.

The ASX 200 has been stuck. Resources have been becalmed on the South China Sea. No signs of life from China, but last week we started to see a change. The AUD perked up and then the iron ore price (maybe the other way around), the big miners, and even lithium stocks. Happy days indeed. Gold miners slid on a new risk embrace. Risk appetite was back on. Even the small caps started to find friends and volume. It is early days, but the June lull could catch a few off guard, maybe that tax loss selling went early this year. Maybe it is time to buy back into the resource trade. BHP would be an easy way to play that.

Whilst we have all been looking at the US Nasdaq market in wonder, it seems to have escaped local investors that the Japanese market is going gangbusters. Very overlooked to be honest, but some canny investors have been doing extremely well out of it. The iShares MSCI Japan ETF (IJL) has been a huge winner.

Source: Marcus Today 2023

That is a good-looking chart.

I know that investors tend to buy international shares in companies they have heard of, Meta, Google, Nvidia, etc but we overlook a slew of names that we are very familiar with, Sony, Toyota, Fuji etc. Why do we have that bias toward the US? Maybe we need to think outside the square a little sometimes?

India too has been in the news recently with the frontman for the world’s largest democracy in concert here in Sydney. Again, not a market we talk about or even focus on much, but the India ETF from Betashares is doing just fine. Not as fine as Japan, but still better than the ASX 200 perhaps recently.

Source: Marcus Today 2023

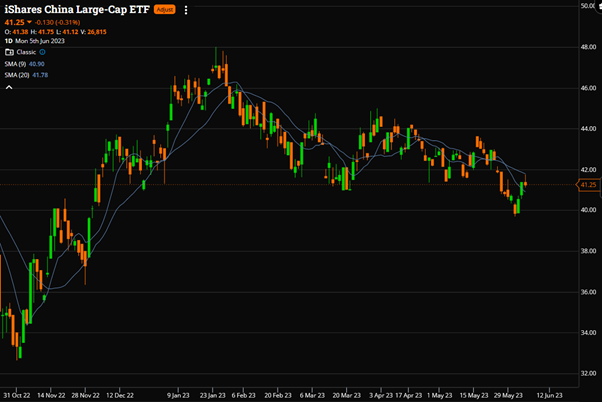

Again, maybe we need to broaden our horizons. We are so US-centric at times. Don’t all the investment books stress diversification in asset allocation? What could be more diversified than country ETF exposure away from the US at times? Even a beaten-down Chinese ETF focussed on the New Economy CNEW has shown signs of life. Maybe its day will come. For contrarian investors, the China Large Cap ETF from iShares is worth keeping an eye on for a turn.

Source: Marcus Today 2023

That one really has been a dead parrot.

The upshot, there are more things in heaven and earth Horatio. We need to look beyond the US. We need to embrace the Asia Pacific and all its markets. Diversification as we head into a US election year, yes I know it’s only June but where has this year gone, could continue to be very profitable for investors with a more adventurous spirit.

A free trial of the Marcus Today newsletter for nabtrade clients is available here.

Analysis as at 6 June 2023. This information has been provided by Marcus Today (AFSL is 473383), for WealthHub Securities Ltd ABN 83 089 718 249 AFSL No. 230704 (WealthHub Securities, we), a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 (NAB). Whilst all reasonable care has been taken by WealthHub Securities in reviewing this material, this content does not represent the view or opinions of WealthHub Securities. Any statements as to past performance do not represent future performance. Any advice contained in the Information has been prepared by WealthHub Securities without taking into account your objectives, financial situation or needs. Before acting on any such advice, we recommend that you consider whether it is appropriate for your circumstances.