Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

From stockmarket boom to stockpicker’s opportunity

Shane Woldendorp | Orbis Investments

For anyone expecting the phenomenal stockmarket returns of the last decade to keep rolling, we have some sobering news. They probably won’t. If history is any guide, the best of times for investors tends to be followed by the worst of times. Given the post-GFC era was an amazing period for global equities, the next decade could prove much more challenging. But more than 30 years of contrarian investing has taught us that good stock picking results can make an enormous difference when equity markets are generally weak, and now, more than ever, is the time to invest differently.

Below are our observations of the current market environment that investors should consider when making decisions.

The good times don’t roll

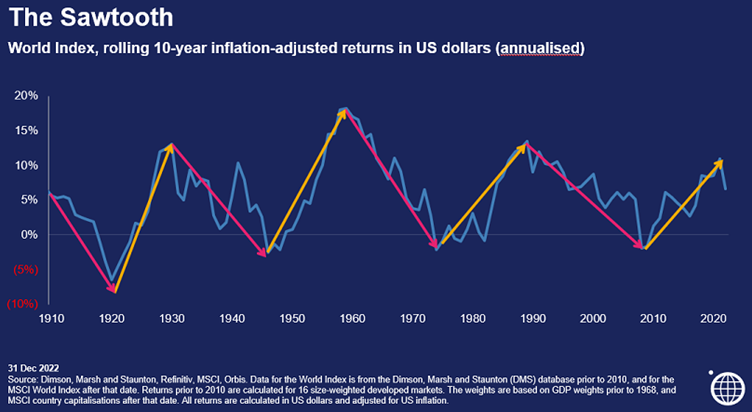

If the best of times really have come to an end, what can investors expect from the coming period? Whilst we don’t own a crystal ball, the following chart (which we call 'The Sawtooth') paints quite an ugly picture of what the next decade or so could look like. History demonstrates that periods of incredible up-cycles are followed by decades-long periods where returns are disappointing (and sometimes negative after inflation).

With the bubbly excesses of the previous decade only just starting to deflate, and valuation gaps still astonishingly wide, it’s likely markets are a long way from completing the post-bubble deflation process that has been typical of history. Put simply, we think there is likely more pain to come.

Embrace regime change

Faced with the reality that the worst of times are upon us, how can investors do better than the market? One of the most important lessons from history is that the winners (the stocks that perform well) rarely persist from one cycle to the next, meaning investors hoping to outperform can’t simply invest in the same things that did well in the previous decade. To do better than the market, you need to invest in things that are different from what’s been winning lately – the stocks likely to become the market leaders in the new regime. And that’s where things get exciting for active, contrarian, value-orientated investors.

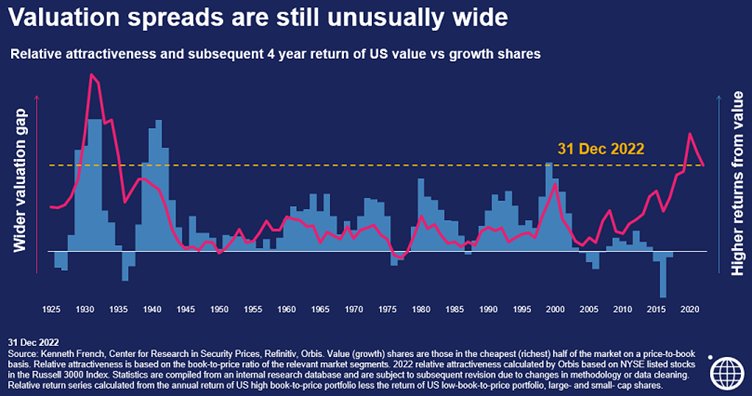

Valuation matters

Because the most recent 'everything bubble' rose to such dizzying heights, it gave rise to historically wide valuation gaps between the 'haves' (growth stocks) and the 'have-nots' (value stocks). In fact, valuation gaps today are as wide as they have been at any time since the Great Depression—almost 100 years ago—and remain wider than they were at the peak of the Tech bubble! Valuation gaps matter because they are a good indicator of forward returns for value stocks compared to their growth counterparts. As the “everything bubble” continues to deflate and valuation gaps narrow, richly priced growth stocks may suffer, giving cheaper value stocks the opportunity to thrive. This provides some exceptional opportunities for astute investors who combine the benefits of a long-term view with a willingness to look very different.

Exploiting the opportunity

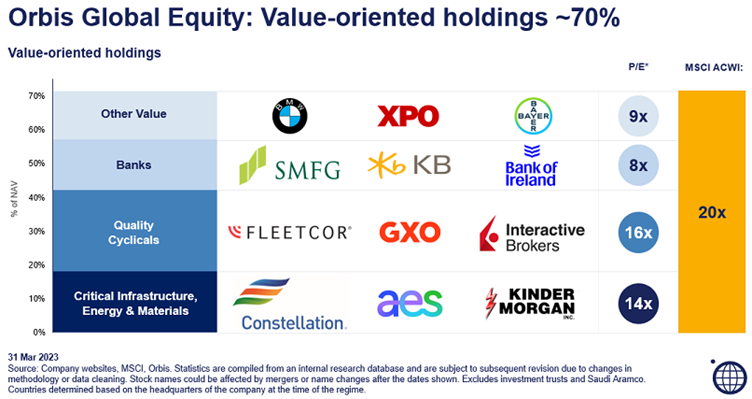

As contrarians, we are naturally drawn to areas of the market that are out of favour and thus potentially undervalued. Although we are not beholden to any particular style of investing—be it value or otherwise, today we are finding the best opportunities in the market are among value stocks. Given its current attractiveness, it should come as no surprise that Orbis Global’s exposure to the value factor is currently at a record high, with value-oriented holdings accounting for around 70% of the portfolio. In particular, we are finding opportunities in areas like critical infrastructure, energy and materials, quality cyclicals, and selected banks, as illustrated in the chart below, which makes us excited about the potential for relative returns, even as the broader market eyes a protracted 'worst of times' phase.

Perhaps the most striking feature about the value-orientated holdings our bottom-up, contrarian research has identified is just how cheap they are compared to the World Index, which trades at about 20x earnings. These are a collection of businesses that we believe are better positioned for the coming environment and trade at much lower multiples than the World Index.

Blunting 'The Sawtooth'

If, as 'The Sawtooth' predicts, the market is facing a prolonged period of disappointing returns, there’s one clear way investors can avoid the same fate – invest differently to the market. Whilst the good times might be over for the market in general, the future is much brighter for savvy value-orientated investors willing to think and invest differently.

First published on the Firstlinks Newsletter. A free subscription for nabtrade clients is available here.

Shane Woldendorp is an Investment Specialist at Orbis Investments, a sponsor of Firstlinks. Analysis as at 15 June 2023 This information has been provided by Firstlinks, a publication of Morningstar Australasia (ABN: 95 090 665 544, AFSL 240892), for WealthHub Securities Ltd ABN 83 089 718 249 AFSL No. 230704 (WealthHub Securities, we), a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 (NAB). Whilst all reasonable care has been taken by WealthHub Securities in reviewing this material, this content does not represent the view or opinions of WealthHub Securities. Any statements as to past performance do not represent future performance. Any advice contained in the Information has been prepared by WealthHub Securities without taking into account your objectives, financial situation or needs. Before acting on any such advice, we recommend that you consider whether it is appropriate for your circumstances.