Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Don't fight the Fed: The case for Gold

Arian Neiron | VanEck

As a banking turmoil has unleashed across two continents, investors have been piling into gold and gold equities again. The precious metal regaining its lustre amid current market uncertainty.

Gold mining companies surged early last week as gold traded around a one-year high, bucking the trend in wider Australian markets.

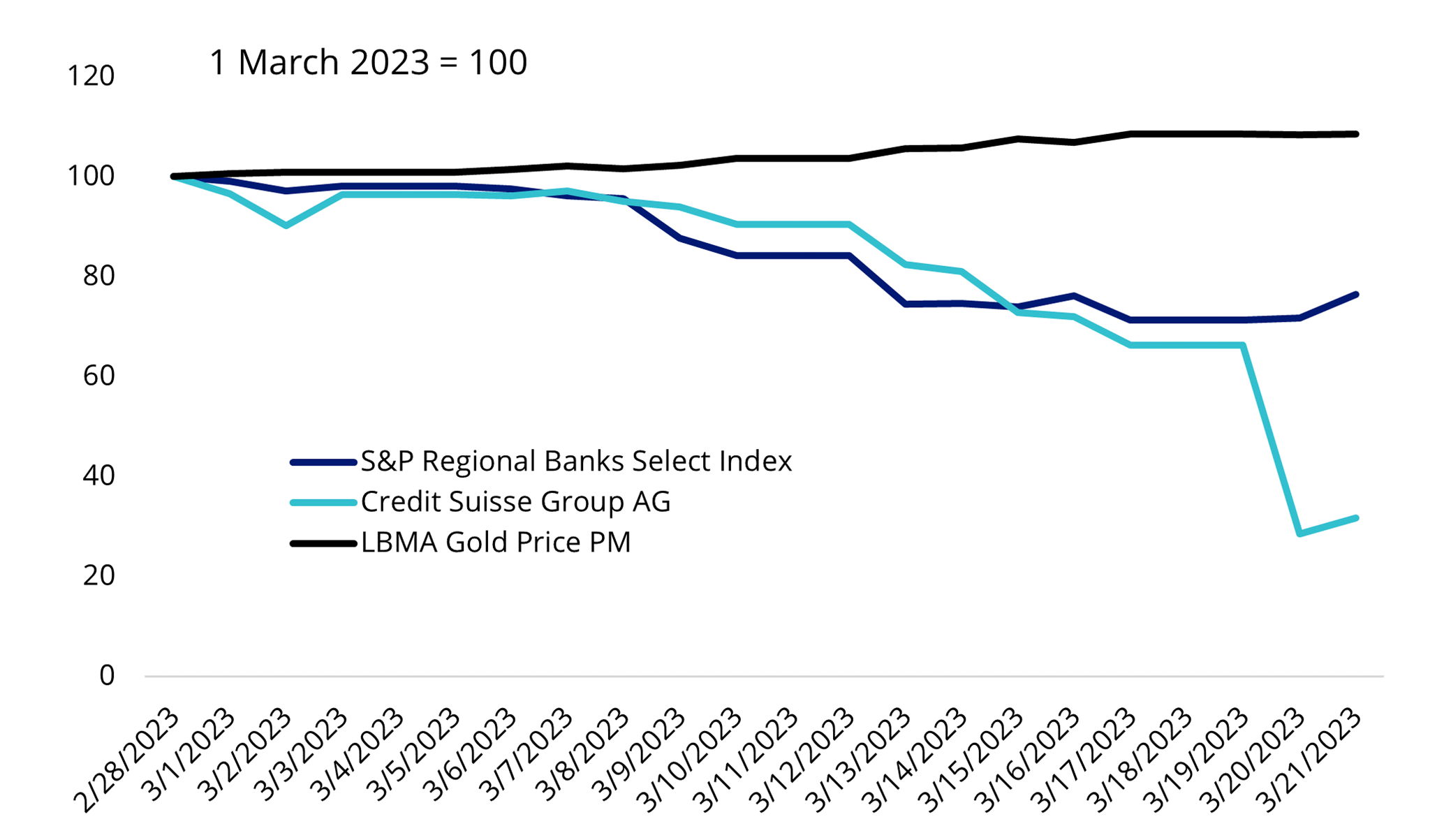

Gold’s safe haven appeal is back in force, as investors flocked to the yellow metal following the Silicon Valley Bank (SVB) collapse and Credit Suisse bail out, pushing gold prices up.

Chart 1: Gold benefitting from financial instability

Source: Morningstar, Macquarie Strategy, to COB 21 March 2023

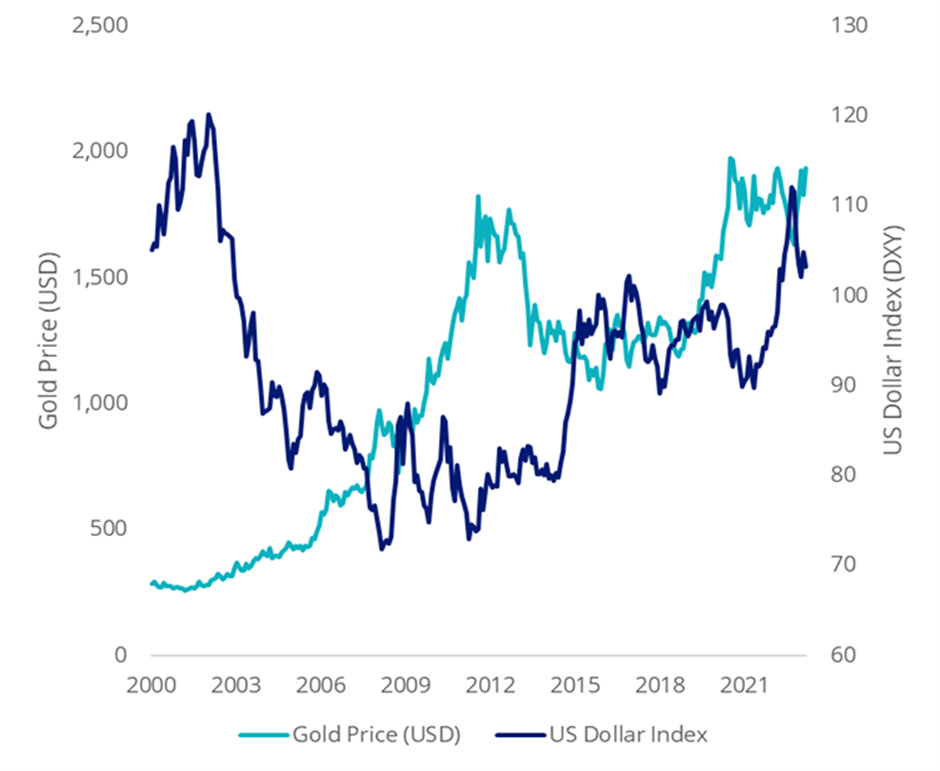

Gold prices have also been boosted from the big drop in US government bond yields and a decline in the US dollar (as measured by the DXY Index). Lower bond yields reduce the opportunity cost of holding a metal that pays no income. A weaker dollar lifts the price of commodities that are denominated in the US currency.

Chart 2: Gold prices have also been boosted by weakness in the USD (DXY)

Source: Bloomberg.

The Fed indicates that rate cuts are not in scope until 2024, contrary to what markets believe following the the SVB fallout. Our view is gold would be a beneficiary if the Federal Reserve (Fed) paused interest rate increases in response to problems in the banking system.

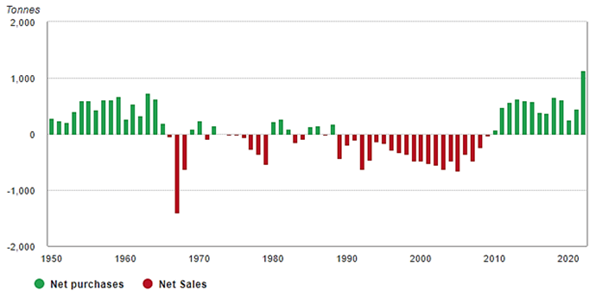

The World Gold Council recently said, though not without risks, a good case for gold remains in place for 2023 driven by: elevated geopolitical risk; a developed market economic slowdown; a peak in interest rates, and risks to equity valuations. In addition, continued central bank buying can’t be ruled out.

Central bank buying in 2022 was the highest on record.

Chart 3: Central bank demand for gold rose in 2022

Source: World Gold Council, 2022

It’s not just the gold price that has benefited from the current crisis in confidence.

Gold miners

Gold miners stand to benefit from the current instability as their balance sheets remain strong and they typically rise more than the gold price in an upswing. If inflation remains elevated for several years, the financial system will not be able to return to normal for an extended period. This could create a favourable environment for gold miners.

As gold equities have been underperforming the gold price over the past few years, gold equities remain historically cheap relative to the price of bullion.

Gold miners tend to outperform gold bullion when the price rises, and underperform when the gold price falls. This has been true this month, with VanEck’s Gold Miners ETF (ASX:GDF) returning 14.04% so far in March, compared to the 8.46% rise of the LBMA PM Gold Price.1 (All returns as at 20 March 2023, source LBMA, Morningstar.)

ETFs are an efficient way for investors to access gold investing.

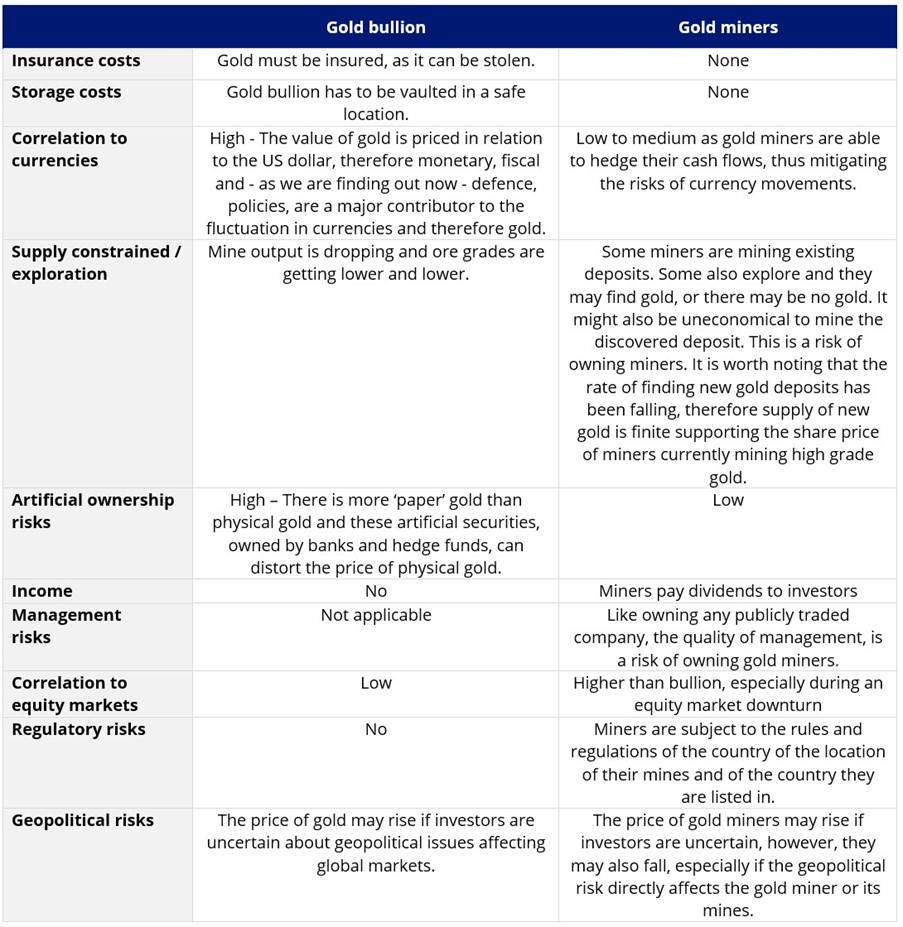

Below we outline the risks of each type of exposure to gold, owning gold bullion and owning gold miners:

Differences between gold miners and bullion

Source: VanEck, 2023

While each gold strategy has its merit for portfolio inclusion, you should assess all the risks and consider your investment objectives.

Learn how the industry leaders are navigating today's market every morning at 6am. Access Livewire Markets Today.

Arian Neiron is CEO & Managing Director of VanEck. All prices and analysis at March 28 2023. This information was produced Arian Neiron and published by Livewire Markets (ABN 24 112 294 649), which is an Australian Financial Services Licensee (Licence No. 286 531). This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. This article does not reflect the views of WealthHub Securities Limited.