Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Ignore the noise, long-term investors will be well rewarded

John Abernethy | Clime Investment Management Limited

One conclusion drawn by analysts, projecting into the future, is that growth will slow, and investment returns will be lower. That cannot be said of the medium to long term outlook for Australia - and probably most of developing Asia. We have abundant tradable resources and outputs across energy and agriculture. We are close to the fastest growing economy in the world and our population will increase by at least 15% over the next decade.

We have abundant capital ($3.5 trillion of super) and a franking system that enhances returns. Our government is not highly indebted, and our budget outcomes are also superior to our peers. Economic growth, profit growth and therefore dividend growth is fairly assured over the next decade and the opportunity for patient investors to benefit is greatly enhanced by recent price corrections.

A focus on the long term is important and there is no rush to invest. Steady accumulation that allows compounding of returns to occur is the key to investment success. Dividend paying companies with quality attributes are the best opportunity.

The challenges

The following are the short-term influences on Australia’s prospects:

- Slower world growth in 2023 than normal, but with no worldwide recession

- Interest rates to continue to rise but the rate of increase to slow

- Inflation to peak in coming months and then pull back below 4%

- Cost of living pressures emerging with higher energy costs

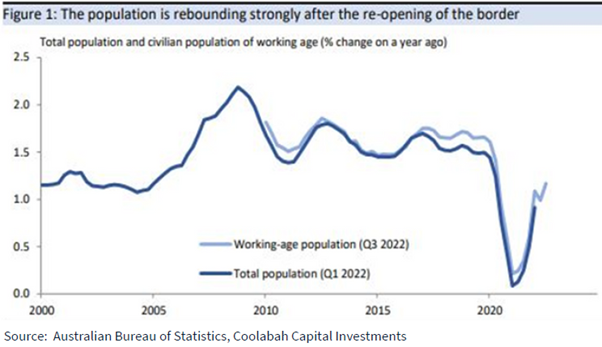

- Population growth to occur as borders are reopened, and

- China to recover its growth momentum and, together with India, ensuring that our external sector is well supported

It is Australia’s position inside the Asian trade bloc that ensures we are well positioned for superior economic growth compared to our developed world peers. In particular, our outlook is far superior to much of Europe.

However, there are short-term challenges, and I will outline these in the following charts.

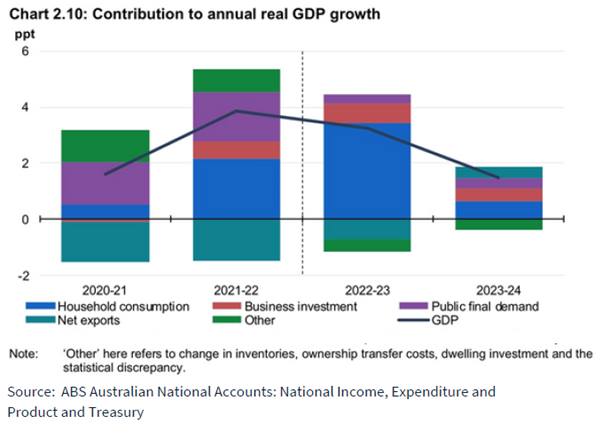

First, economic growth will slow as the government pulls back on the budget deficit (stimulation) and grapples with a budget structure that has been loaded with social support schemes rather than growth initiatives.

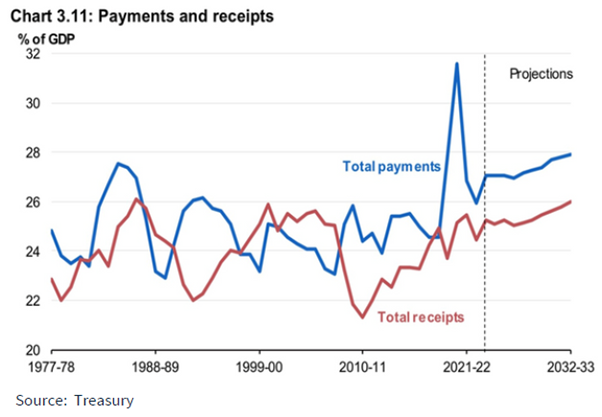

The chart below shows the budget outlook with the government sector representing a larger portion of economic activity and output than before COVID. The setting of long-term social expenditure programs (e.g. the NDIS and child care) will mean that tax collections as a percentage of GDP must rise.

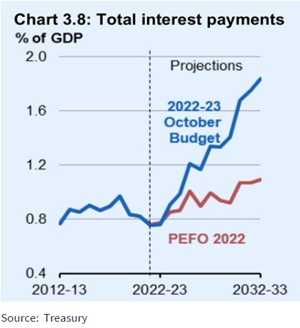

Further, the budget outlook is becoming affected by rising government debt (ex-COVID) and rising interest rates on that debt. A further rise in bond yields (above 4%) would impact budget outcomes and affect fiscal policy.

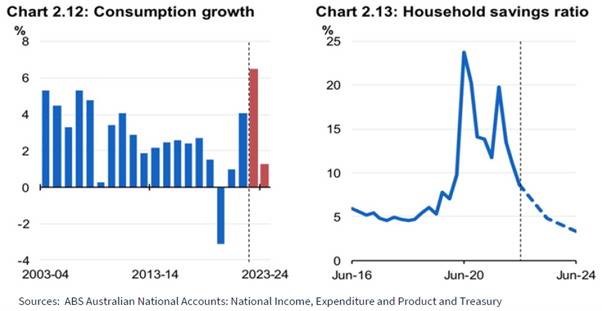

In looking at the household sector, the chart below shows the sector is currently buoyant as it ploughs through the household savings built up during the COVID crisis. The slowdown forecast by Treasury may be conservative, but we must note the concern of government regarding household pressures coming from cost-of-living imposts.

Clearly household consumption will slow as interest rates rise because these directly cut into the available discretionary expenditure of mortgage holders.

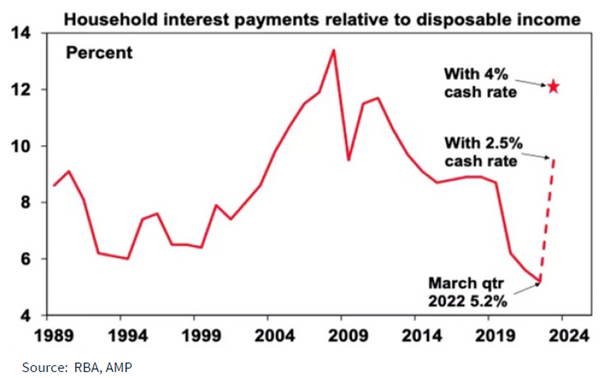

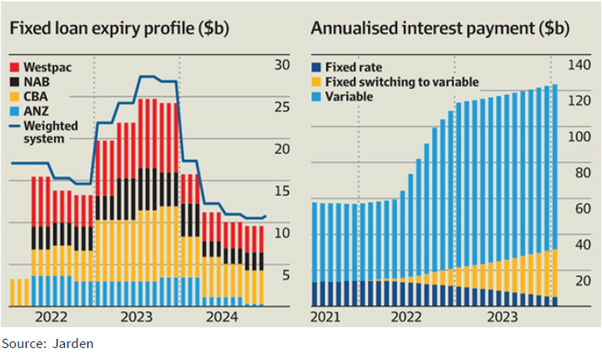

The effect of rising interest rates on the part of the household sector that is mortgaged is significant. Rising interest rates take from disposable income and discretionary expenditure. Each 1% increase in mortgage rates takes $20 billion from the household sector over one year.

The other looming issue for mortgage borrowers is rolling from low-cost fixed mortgages to variable mortgages. This cycle has commenced with limited consequences (at this point) for banks, but it will need monitoring should it push households into distress in 2023. However, the RBA is aware of this issue and that may result in interest rate increases being checked at some point.

The future remains bright

The business sector remains buoyant with capital investment being maintained to meet the growing economy and external trade opportunities. A return of immigration, tourism and overseas student education will bolster Australia’s growth and business opportunities.

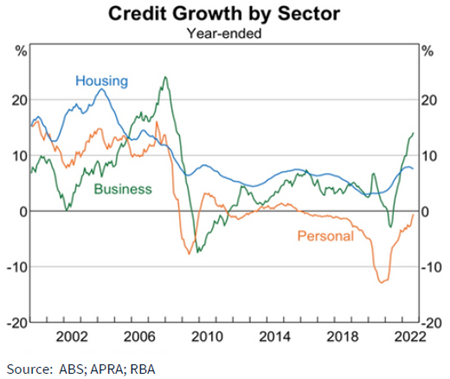

We can see confidence in the business sector from the steadily increasing business borrowing levels reported by the banking sector to the regulators.

My conclusion is that investors should take heart from three facts:

- The decline in asset markets is a consequence of the necessary lift in bond yields as inflation stirred. Bond yields were too low on any sensible analysis and their rise re-establishes the well-established connection of bond yields and the required return on risk assets.

- The decline or adjustment of asset prices has already happened, with sharply higher bond yields and PER compression. Unless there is a global recession, investors should now be looking for appropriate investments to take them into the next growth cycle.

- Australia remains uniquely positioned with a solid economic growth outlook, predictable population growth, an exceptional trade position, and a strong national balance sheet.

Whilst the short-term outlook for asset markets is by no means certain, it does appear that market price declines are once again an opportunity to buy superior cash-generating businesses or assets.

Australian asset markets are adjusting. Investors seeking income will secure a superior yield than that available in many developed economies.

Superior growth and superior yield suggest that patient Australian investors, appropriately diversified, will be well rewarded over the next few years.

First published on the Firstlinks Newsletter. A free subscription for nabtrade clients is available here.

John Abernethy is Chairman of Clime Investment Management Limited and Clime Capital Limited and Director of Jasco Holdings Limited and WAM Research Limited. Analysis as at 11 January 2023. This information has been provided by Firstlinks, a publication of Morningstar Australasia (ABN: 95 090 665 544, AFSL 240892), for WealthHub Securities Ltd ABN 83 089 718 249 AFSL No. 230704 (WealthHub Securities, we), a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 (NAB). Whilst all reasonable care has been taken by WealthHub Securities in reviewing this material, this content does not represent the view or opinions of WealthHub Securities. Any statements as to past performance do not represent future performance. Any advice contained in the Information has been prepared by WealthHub Securities without taking into account your objectives, financial situation or needs. Before acting on any such advice, we recommend that you consider whether it is appropriate for your circumstances.