Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

A list of lists regarding the macro investment outlook for 2023

Shane Oliver | AMP Capital

After very strong returns in 2021 thanks to reopening from COVID restrictions and stimulatory fiscal and monetary policies, 2022 was a rough year reflecting high inflation, a surge in interest rates and bond yields, geopolitical issues (notably the invasions of Ukraine) and recession worries.

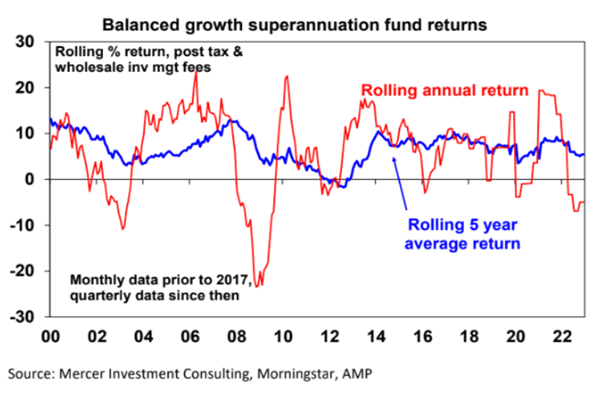

This saw average balanced growth super funds lose around 5% (or around 12% after inflation), as both shares and bonds lost value, after returning 14% in 2021. Over the last five years, they have returned around 5.5% p.a. with a pattern of successive strong followed by weak years, etc, since 2017.

Will the poor returns continue, or can we expect a rebound? Here is a simple point form summary of key insights and views on the outlook.

Five lessons for investors from 2022

- Inflation was not dead (just resting) – the pandemic-driven surge in money supply and reopening-driven surge in demand against a backdrop of supply constraints released it from its long slumber.

- To control inflation, central banks have to act and sound very tough. They started a bit late initially but got there eventually in 2022.

- Share markets go through periodic rough patches – and high inflation and rapidly rising interest rates are not good for them.

- Geopolitics matters – particularly if war disrupts commodity supply.

- Turn down the noise – investors are now bombarded with irrelevant, low quality and conflicting information which confuses and adds to uncertainty. This was particularly evident in 2022. The best approach is to turn down the noise and stick to a long-term investment strategy.

Nine reasons for optimism

2022 was not so good and economic growth will slow sharply this year thanks to rate hikes and cost of living pressures (with a high risk of recession in the US and Europe), but there are several reasons for optimism.

1. Long-term inflation expectations remain low – while they were a bit slow initially central banks swung into inflation-fighting action with rapid rate hikes and tough rhetoric showing they learned the key lesson of the 1970s – which is to keep inflation expectations down.

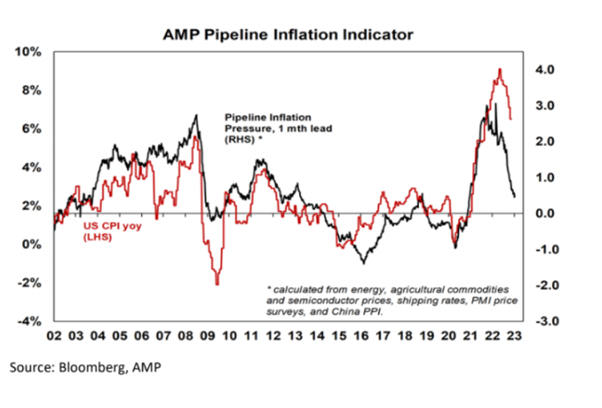

2. Inflation has likely peaked – this is most evident in the US where inflation led on the way up and is likely now leading on the way down. US inflation peaked mid-last year and our Pipeline Inflation Indicator points to a sharp fall ahead. Labour market tightness is showing signs of easing which should take pressure off wages – this is flowing from slowing demand and in Australia will be helped foreign workers returning.

3. Key central banks have likely seen or are close to peak hawkishness – this flows from the likely fall in inflation and signs of cooling demand.

4. China’s move away from zero COVID will provide an offset to weaker US and European growth – albeit after an initial setback as new cases surged, much like they did in other countries that reopened.

5. The US dollar looks to have peaked – which should ease debt servicing pressure in emerging countries with US dollar-denominated debt.

6. Vaccines, anti-virals and with less harmful mutations have allowed the world to start moving on from COVID. China is now playing catch-up.

7. In Australia, the less aggressive RBA along with other factors (see below), should help us avoid recession.

8. Geopolitics may not be as threatening. Western democracies united and authoritarianism/strongmen leaders took a hit in 2022 – with Putin weakened by the mess in Ukraine, China’s difficulties exiting zero-COVID and Trump on the nose after the US mid-terms. The war in Ukraine may not get any more threatening, there are signs of a thaw in China relations and there are no major elections in key countries in 2023.

9. While US mid-term election years are often poor for shares (as seen in 2022), the 12 months after the US mid-terms are normally strong.

Five reasons Australia is likely to avoid a recession

A slump in consumer spending (thanks to rate hikes, cost of living pressures and falling property prices) along with weaker global growth will see Australian growth slow to around 1.5% this year. The risk of recession is high, but it’s likely to be avoided.

- The RBA is less aggressive and less likely to overtighten compared to other major central banks.

- Thanks to poor weather, and material and labour shortages, there is a large pipeline of home building approved but yet to be completed.

- The business investment outlook remains solid.

- A rebound in Chinese growth is likely to support export volumes and prices. After a rough start to the year due to the surge in COVID cases with the reopening, Chinese growth is expected to rebound to around 6% this year thanks to the reopening providing an offset to weakness in other countries. The return of Chinese students, tourists and the relaxation of export bans (notably on coal) could add around 1% to Australian growth spread over a couple of years.

- Immigration is rebounding rapidly, which means more workers and support for economic growth. These considerations should also support a continuation of the relative outperformance of Australian shares compared to global shares.

Key views on markets for 2023

Easing inflation pressures, central banks moving to get off the brakes, the anticipation of stronger growth in 2024 and improved valuations should make for better returns in 2023. But there are likely to be bumps on the way – particularly regarding recession risks – and this could involve a retest of 2022 lows or new lows in shares before the upswing resumes.

Global shares are expected to return around 7%. The post-mid-term election year normally results in above-average gains in US shares, but US shares are likely to remain a relative underperformer compared to non-US shares reflecting higher PE multiples. The $US is likely to weaken further which should benefit emerging and Asian shares.

Australian shares are likely to outperform global shares again, helped by stronger economic growth than in other developed countries and ultimately stronger growth in China supporting commodity prices helped by the grossed-up dividend yield of around 5.5%.

Bonds are likely to provide returns around the running yield or a bit more, as inflation slows and central banks become less hawkish.

Unlisted commercial property and infrastructure are expected to see slower returns, reflecting the lagged impact of weaker share markets and higher bond yields on valuations.

Australian home prices are likely to fall another 9% or so as rate hikes continue to impact, resulting in a top to bottom fall of 15-20%, but with prices expected to bottom around September, ahead of gains late in the year as the RBA moves toward rate cuts.

Cash and bank deposits are expected to provide returns of around 3%, reflecting the backup in interest rates through 2022.

A rising trend in the $A is likely this year, reflecting a downtrend in the overvalued $US, the Fed moving to cut rates and solid commodity prices helped by stronger Chinese growth.

Five reasons to expect continuing volatility

While investment returns should improve, volatility is likely to stay high.

- Growth is slowing in key advanced countries – with uncertainty about the depth of any downturn and the flow on to profits.

- Inflation – while it's likely to slow further it will still be high for a while.

- Quantitative tightening (withdrawing the cash pumped into economies through the pandemic) will accentuate monetary tightening to an uncertain degree.

- Geopolitical risks around Ukraine, China and Iran are still high.

- Raising the US debt ceiling as needed around mid-year could be fraught given the increased power of fiscal conservatives in the House of Representatives.

Five things to watch

- Inflation – if it continues to rise, central banks will be more hawkish than we are allowing for, risking deep recession.

- Recession – a mild recession in US and Europe should be manageable but a deep recession will mean significantly more downside in shares.

- US politics – the return to divided government, with GOP controlling the House means a high risk of brinkmanship around raising the debt ceiling, causing volatility in markets as we saw in 2011 and 2013.

- Geopolitics – with the war in Ukraine, China's tensions around Taiwan and the risk of increased tensions around Iran are the main risks.

- Australian home prices – a sharper-than-expected fall as fixed rates reset and unemployment rises, and could cause financial stability issues.

Nine things investors should remember

- Make the most of compound interest to grow wealth. Saving regularly in growth assets can grow wealth significantly over long periods. Using the “rule of 72”, it will take 144 years to double an asset’s value if it returns 0.5% p.a. (ie, 72/0.5) but only 14 years if the asset returns 5% p.a.

- Don’t get thrown off by the cycle. Falls in asset markets can throw investors off a well-considered strategy, destroying potential wealth.

- Invest for the long-term. Given the difficulty in timing market moves, for most, it’s best to get a long-term plan that suits your wealth, age and risk tolerance and stick to it.

- Diversify. Don’t put all your eggs in one basket.

- Turn down the noise. This is critical with the information overload coming from social media, and mainstream media going down the clickbait path.

- Buy low, sell high. The cheaper you buy an asset, the higher its prospective return will likely be and vice versa.

- Avoid the crowd at extremes. Don’t get sucked into euphoria or doom and gloom around an asset.

- Focus on investments you understand offering sustainable cash flow. If it looks dodgy, hard to understand or has to be justified by odd valuations or lots of debt, then stay away. There is no free lunch!

- Seek advice. Investing can get complicated and it's often hard to stick to a long-term investment strategy on your own.

Learn how the industry leaders are navigating today's market every morning at 6am. Access Livewire Markets Today.

All prices and analysis at 17 January 2023. Livewire gives readers access to information and educational content provided by financial services professionals and companies (“Livewire Contributors”). Livewire does not operate under an Australian financial services licence and relies on the exemption available under section 911A(2)(eb) of the Corporations Act 2001 (Cth) in respect of any advice given.

This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. This article does not reflect the views of WealthHub Securities Limited.