Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Why emerging markets have reached an inflexion point

James Johnstone | Co-Head of Emerging & Frontier Markets, Redwheel

Emerging market indices have performed poorly over the past 10 years. Economic growth in these markets started to stall even before Covid and that prompted many investors to head for the exits.

But the decade-long sell-off has led to attractive valuations at a time when a commodity super-cycle could pave the way for outperformance.

Transition metals and emerging markets

A major theme in recent years is decarbonisation. Major economies are beginning to wean themselves off fossil fuels and are looking for new ways to curb emissions, with many aiming to achieve net zero between 2030 and 2050.

By current estimates, US$56 trillion in incremental infrastructure investment is needed to meet net zero by 2050. This implies an average investment of US$1.9 trillion annually.

Central to achieving these emission targets will be transitioning our existing energy infrastructure to cleaner fuel sources, which places many emerging market nations in an enviable position.

That’s because the transition away from fossil fuels is likely to be metal intensive. Replacing existing fuel sources with renewable electricity and manufacturing batteries to store this power will require large volumes of metals such as copper, lithium, and rare earth elements.

Where are we going to find those metals? There's a little bit in Australia and there's a little bit in Canada, but the vast bulk of new metal discoveries we're going to need to make will be in Africa or South America.

Demand for these metals could begin to outpace supply, creating bottlenecks and price hikes – all to the benefit of producing nations. The scarcity of these resources also places significant power into the hands of local governments to raise tax revenues.

Peru and Chile, collectively producing 35% of global copper, provide a good example of this. However, neither Peru nor Chile are comfortable places to put more money. It costs billions of dollars to invest there.

If you’re Glencore or Goldfield – who are commissioning to put US$2 billion, US$3 billion or US$4 billion into each hole in the ground in Chile - they have to sit down with President Boric and say, ‘what's my royalty rate?’, ‘what's the taxation rate?’ And the threat of expropriation is high.

While this does present risks to producers, I believe that these risks have been priced in.

Attractive valuations versus developed markets

The demand for metals is expected to support the growth of emerging markets and widen the real GDP growth differential with western markets. This marks forward price-to-earning (P/E) ratios for the sector look attractive.

In part, this is attributable to the commitment of emerging nations to maintain tight monetary policy over the past decade. These economies have largely avoided using unconventional policies (such as quantitative easing). They also raised rates before developed economies – and remain ahead of the curve.

As developed economies struggle with soaring inflation and interest rates, monetary constraint has made emerging market economies resilient.

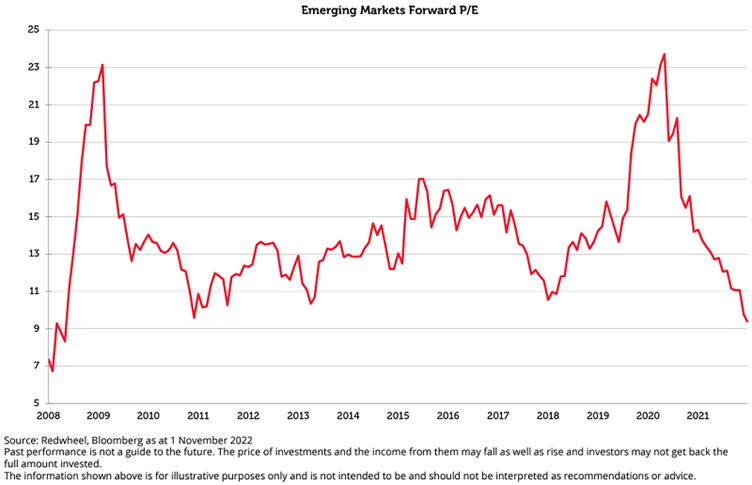

Attractive emerging markets forward price to earnings ratios

Emerging markets have fallen to valuation levels not seen since 2008 while earnings continue to climb.

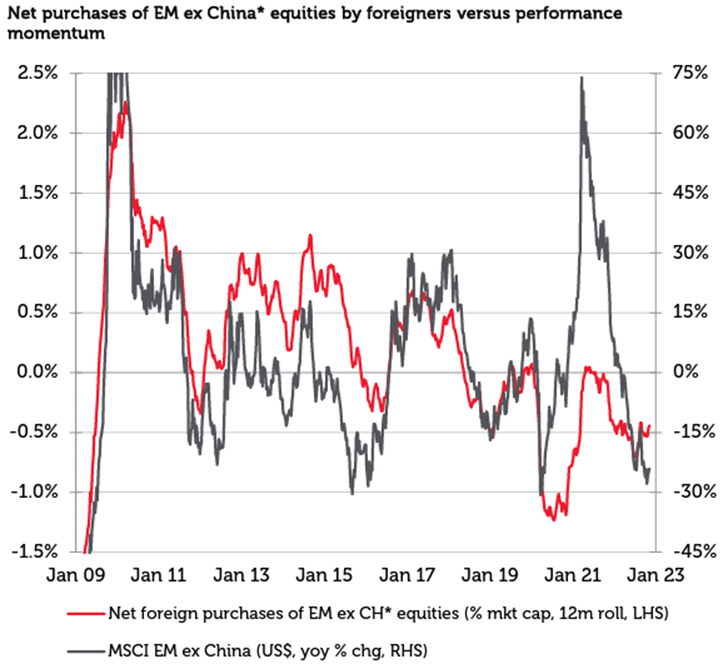

Yet despite attractive valuations, international capital flows into emerging markets are close to record lows. Since the early 1990s, buying emerging markets at times when most investors are selling has proven to be a successful strategy.

Investor capital has exited emerging markets creating contrarian opportunities

*Korea, Taiwan, India, Brazil, Mexico, South Africa, Thailand, Indonesia, Philippines, Malaysia, Turkey. Source: CLSA, National Stock Exchanges, WFE as at 20 October 2022. The forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The information shown above is for illustrative purposes only and is not intended to be, and should not be, interpreted as recommendations or advice.

History may repeat

If I had told you back in 2002 to buy emerging markets, you would've thought I was mad. Emerging markets had been through an incredibly difficult crisis. The Indonesian economy had collapsed in 1997. The rupee went from 2,000 to the US dollar to 18,000 to the US dollar in the space of six months. The Thai baht collapsed. The Korean won collapsed.

But emerging markets did exactly what we thought they were going to do. Emerging market GDP grew. The emerging market growth story worked. China raised 750 million people out of poverty. Indonesia’s GDP has gone from US$200 billion to US$1.1 trillion. India is now a larger economy than the UK.

With that context in mind, the emerging market selloff could represent a good entry point for investors.

First published on the Firstlinks Newsletter. A free subscription for nabtrade clients is available here.

James Johnstone is Co-Head of Emerging & Frontier Markets at Redwheel, a Channel Capital partner. Analysis as at 8 December 2022. This information has been provided by Firstlinks, a publication of Morningstar Australasia (ABN: 95 090 665 544, AFSL 240892), for WealthHub Securities Ltd ABN 83 089 718 249 AFSL No. 230704 (WealthHub Securities, we), a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 (NAB). Whilst all reasonable care has been taken by WealthHub Securities in reviewing this material, this content does not represent the view or opinions of WealthHub Securities. Any statements as to past performance do not represent future performance. Any advice contained in the Information has been prepared by WealthHub Securities without taking into account your objectives, financial situation or needs. Before acting on any such advice, we recommend that you consider whether it is appropriate for your circumstances.