Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Three smart ways to play megatrends via ETFs

One of my favourite entrepreneurship professors used to chide students for pitching start-up ideas based mostly on an industry’s projected growth.

Students would present a bullish forecast, then claim their venture could capture 1% of a giant market. If only start-ups were that simple.

Too many investors fall into the same trap with megatrends. They focus on seductive growth forecasts and overlook the challenges of building market share.

Most megatrends sound enticing. By definition, megatrends are major patterns or trends that can change the global economy, business and society.

Some do. But many more supposed megatrends burn investors who fall for the sales pitch, buy too early, then give up on the trend just as it gets interesting.

Megatrend investing has become more accessible for retail investors with the launch of thematic Exchange Traded Funds (ETFs) on ASX in the past few years.

As the name suggests, thematic ETFs provide exposure to trends not widely available through ASX-listed companies. If you want to own multinational pharmaceutical giants or electric-vehicle manufacturers, you must look offshore.

I’ve always thought Self-Managed Superannuation Funds (SMSFs) and other long-term investors should have modest exposure to megatrends (via ETFs) in the “satellite” component of their portfolio, to boost returns over time.

Thematic ETFs were popular last year as technology stocks rallied and the prospect of tech megatrends, such as artificial intelligence, captured investor imagination. But thematic ETFs have performed terribly this year, amid the global tech wreck.

However, do not give up on megatrend investing via thematic ETFs. Some of these ETFs look attractive after heavy price falls over 12 months.

A few rules apply. First, focus on well-established megatrends rather than those in their infancy. Hydrogen, for example, has potential as a clean-energy source. But it’s too early (and speculative) to invest in a hydrogen ETF in my opinion.

Second, understand that there will be many more losers than winners as megatrends unfold. It usually pays to wait until the early entrants – often speculative companies –have faltered, paving the way for large firms to dominate the market.

Third, recognise that true megatrends are more powerful and last longer than most investors realise. One of the great megatrends – investing for an ageing population – is still delivering good returns and will be a key trend for decades to come. Aim to have at least a 5-7-year investment horizon (preferably longer) when buying thematic ETFs.

Fourth, always assess what an ETF owns before investing. That is true for all ETFs, especially thematic ones. Understand which stocks are included in the ETF’s underlying index. Are they a good representation of the trend for which you seek exposure? How concentrated are the stock holdings? Are there currency risks?

Fifth, don’t overlook valuations. Most ETF issuers provide information on their ETF’s average Price Earnings (PE) multiple and/or price-to-book ratio. Consider what’s happened to the valuations in the ETF and whether it offers value.

Finally, have realistic expectations. ETFs are a useful portfolio tool. But they provide exposure to all the losers in an index, as well as the winners. Depending on the weightings in the ETF, you get the average company quality. For some investors, pinpointing the best company in a megatrend makes more sense than buying the theme.

Caveats aside, here are three favoured megatrends and ETFs that provide exposure.

1. Cloud Computing

Long-term readers of this column know I have written about cloud computing many times over the years. At the risk of repetition, I include cloud computing again. I simply can’t leave it out of a list of favoured megatrends.

Data storage is one of the great technology megatrends. Yes, storing information in the “cloud” is hardly new. But as companies collect more data, particularly video that requires lots of storage, cloud computing has exceptional long-term prospects.

Think of your own data-storage needs. You probably have music, photos, documents and other data stored in the cloud. Think about how much data you create and how companies you deal with have to store that information in the cloud.

The BetaShares Cloud Computing ETF (CLDD) is my preferred tool for exposure to this megatrend. The ETF owns 35 leading global stocks in cloud computing and related industries and is bought and sold on ASX like a share.

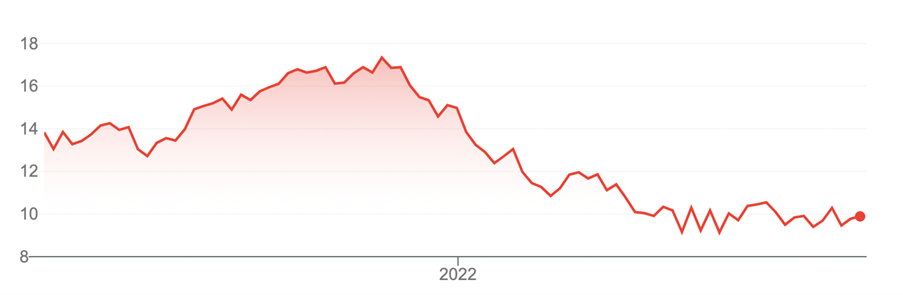

CLDD has performed poorly in the past 12 months, down 37% (to end-September 2022). Like other tech sub-sectors, cloud computing has been pummelled amid the broader tech sell-off.

That’s an opportunity for long-term investors who can withstand potential short-term volatility in CLDD. It looks interesting at the current price.

Chart 1: BetaShares Cloud Computing ETF

Source: Google Finance

2. Semiconductors

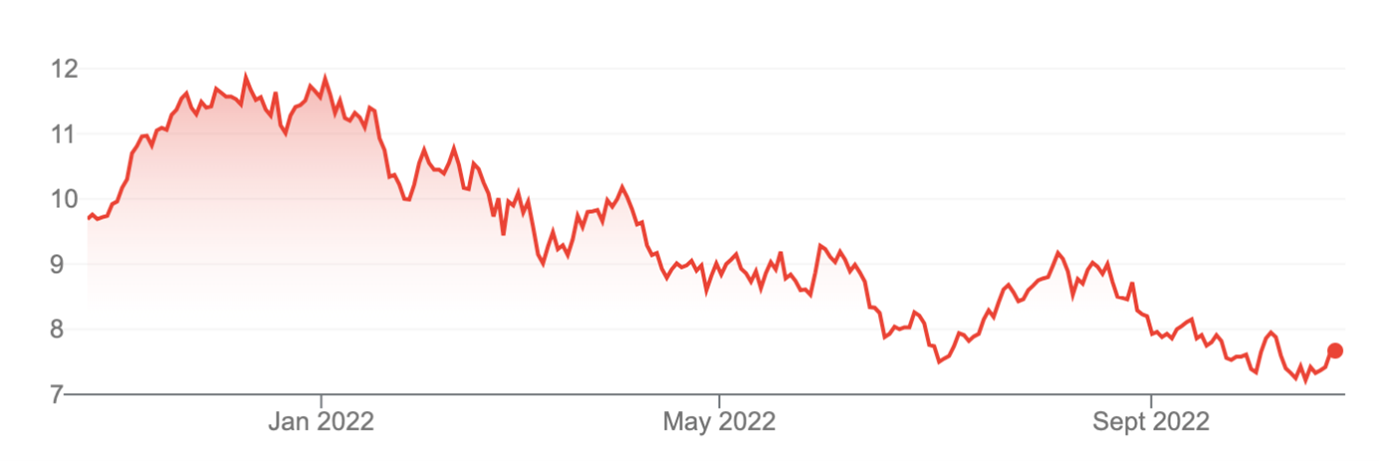

Semiconductor stocks have had an awful 2022, battered by waning consumer demand as the global economy slows and fears of excessive chip inventory. One investment bank said this will be the worst year in a decade for the semiconductor industry.

Analysts fear the semiconductor cycle is turning negative – a concern playing out as more semiconductor companies warn of slowing demand. A downturn in demand could be deeper, longer and broader than first thought.

Add to that China’s slowdown and global semiconductor stocks could easily make new lows this year, exacerbating weakness in global tech stocks.

Still, that could be a buying opportunity for long-term investors. Semiconductor demand has excellent long-term fundamentals as billions of new devices require chips to connect them to the Internet of Things, for artificial intelligence to analyse.

In April, McKinsey predicted the global semiconductor industry would become a trillion-dollar industry by 2030 (from US$600 billion in 2021). Yes, we shouldn’t fall for bullish market forecasts, but semiconductors will become an even bigger industry over this decade as more devices require a computer chip.

The Global X Semiconductor ETF (SEMI) provides exposure to global semiconductor firms. The ETF is down almost 23% over one year to 20 October 2022. It’s an ETF to put on the portfolio watchlist, in anticipation of lower prices in the next few months.

Chart 2: ETFS Semiconductor ETF

Source: Google Finance

3. Food

Food seems less glamorous than most megatrends. But as the global population grows and more people join the middle class, much more food will be needed. The World Bank estimates food demand will rise by 70% by 2050.

At the same time, the supply of arable land will continue to shrink. That will boost demand for new technologies that enhance agriculture productivity.

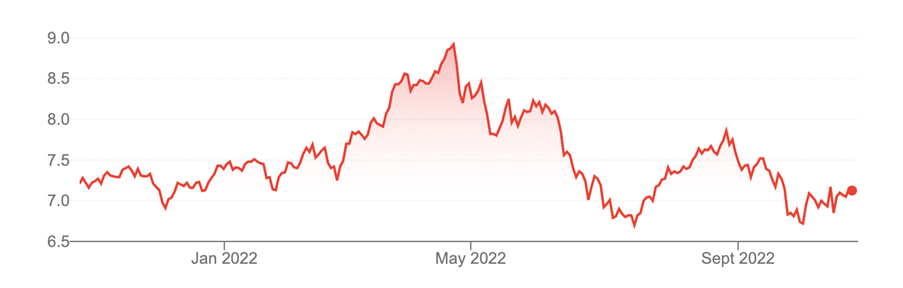

The BetaShares Global Agriculture ETF (FOOD) provides exposure to global agriculture companies via ASX. FOOD invests in 60 of the world’s largest agricultural companies. About a third of the ETF is in fertilisers and agriculture chemicals.

FOOD has fallen about 18% over six months to end-September 2022, in line with broader equity-market weakness. After rallying during the early part of Russia’s invasion of Ukraine (amid fears of food shortages), FOOD has retreated.

Agriculture stocks can be volatile and there will be many more losers in agriculture technology (agtech) than winners.

But as megatrends go, backing global agriculture companies that have to feed a growing global population has long-term appeal. This theme much growth ahead as agtech continues to drive farm innovations that help feed more people.

Chart 3: BetaShares Global Agriculture ETF

Source: ASX

Tony Featherstone is an expert contributor to the Switzer Report. All prices and analysis at 28 October 2022. This information was produced by Switzer Financial Group Pty Ltd (ABN 24 112 294 649), which is an Australian Financial Services Licensee (Licence No. 286 531This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. This article does not reflect the views of WealthHub Securities Limited.