Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

The good, bad & ugly plays for investors wanting to rebuild their portfolios

With ‘inflation will soon drop’ speculation building, explaining why stocks in the US have rallied recently, what are the good, the bad and the ugly plays for those trying to rebuild their portfolios after a rough few years. Let’s graphically look at those years.

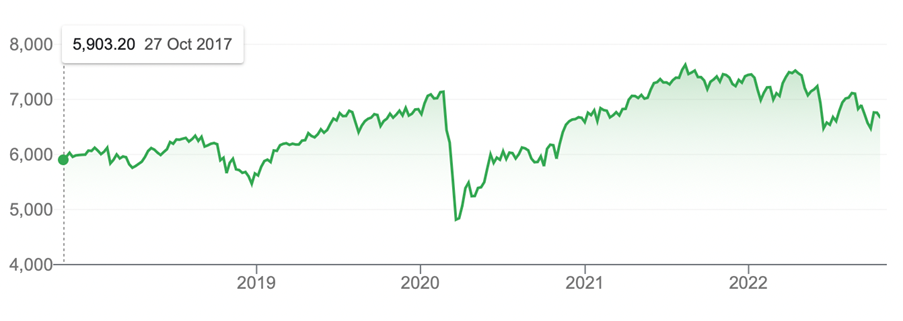

S&P/ASX 200

Source: google.com

As I write, the S&P/ASX 200 Index is around 6800, which is actually lower than where the market was before we learnt about something called the Coronavirus, which gave birth to a market crash on 21 February 21 when the Index was at 7139. That means we are still down 4.8%, thanks to those damn bats and snakes in Wuhan! And we’re down around 10.8% since 13 August 2021, but the real slide started just after New Year’s Eve when the Yanks got warned that big interest rate rises were on the way.

US S&P 500

Source: google.com

The S&P 500’s slide started on 4 January and it’s been a big 19% sell-off. It has been worse, while our 2022 drop is only 8.6%. The recent rebound in the US is connected to a belief that an inflation dive is getting close. The dates to watch are 4 November for the October jobs reading and 10 November for the next US inflation number.

A Wall Street Journal report that Fed officials were suggesting that the US central bank might need to pause with its rate-rise program spurred investors. Some took this to mean that a good inflation data drop could soon show up, which should spark a more meaningful rebound in stock prices. Others interpreted it as the Fed has to be wary that too many 0.75% rate rises could make a US recession a certainty.

A fall in bond yields was seen as another endorsement of the thinking that November’s expected 0.75% hike in the official interest rate might be the last for this year. However, for that to happen, inflation has to show it’s on the way down.

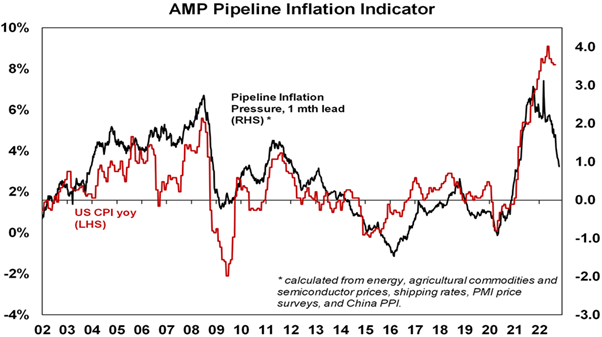

So what’s the latest take on that subject? AMP’s chief economist Shane Oliver has been watching a range of economic data readings and has created a US Inflation Pipeline Indicator. This is showing that these indicators are pointing to an eventual fall in the official Consumer Price Index (CPI). The chart below shows this clearly (CPI red line, pipeline black line).

Source: AMP Capital

This is what Dr Oliver has concluded from this chart: “…signs of a slowing ahead in US inflation continue to build and this should help the Fed slow the pace of rate hikes soon. A year ago, global growth, US wages data, rents, commodity prices, US government spending, anecdotes, car prices, money supply growth, freight rates, business surveys and inflation expectations were all pointing up for US inflation. “Now they are all slowing or clearly pointing down. And consistent with this, our Pipeline Inflation Indicator continues to slow. Once these start to show up in actual inflation they should enable the Fed to slow down the pace of hikes, hopefully early enough to avoid a recession or at least a severe recession.”

So we have a waiting game for the stock market rebound, which rests on, firstly, a fall in the official US CPI and then a belief that this will be enough for the Fed to ease up on interest rate rises. Incidentally, a better-than-expected jobs report on 4 November, where unemployment rises and jobs created are worse-than-expected, could also get optimists on Wall Street and locally excited and buying.

If you want a good safe play ahead of the eventual fall in inflation and the market take-off, buying a simple exchange trade fund for the S&P/ASX 200 (such as IOS, VAS, A200 or STW) will give you exposure to a market rebound over 2023, which is likely to be over 10%, if history is a guide.

Even if takes longer than you’d expect, this play is bound to return income of 4% plus before franking credits, so it’s a good play.

A ‘bad’ but still positive play would be to buy an exchange traded fund for the US-based S&P 500 index, such as IVV from iShares, which I tip will have a really big rebound. So, why is it a ‘bad’ play? Well, many currency experts tip the Oz dollar will also rebound from current low levels and a rising $A reduces the overall return from any rise in the US index.

The smarter play is to go for a hedged option, namely something like IHVV. This is more expensive at 10 basis points compared to IVV at 3 basis points, but it’s worth it when the Oz dollar is bound to rise.

The ‘ugly’ play again can be a winner — even a huge winner — and that’s GEAR from Betashares, which turbo charges gains on the local stock market. However, it also magnifies losses when the stock market falls.

If the drop in inflation is delayed and stock markets fall again, this potentially attractive speculative strategy could get really ugly for a while.

Of course, all these market moves ahead of inflation’s retreat are risky but I argue central banks are getting right now by going in hard and fast with interest rate rises, but now they have to be careful to avoid a recession.

Anyone comparing the actions of central banks today compared to the 1980s, when the interest rate rises were smaller but more numerous, and which saw home loan rates crawl to 17% locally, would have to believe that inflation will soon retreat — and this will be great news for stocks.

All prices and analysis at 28 October 2022. This information was produced by Switzer Financial Group Pty Ltd (ABN 24 112 294 649), which is an Australian Financial Services Licensee (Licence No. 286 531).This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. This article does not reflect the views of WealthHub Securities Limited.