Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Has the inflation beast been defeated?

The market ended on a whimper last week, dropping 0.72% on Friday to 7301.5, but there was a burst of excitement mid-week as investors, hoping the inflation beast has been defeated, took heart from data released in Australia, the UK, and the US.

Looking at Europe, the Stoxx 600 was up 6.1% for the month. Inflation data released for the Euro zone during the week showed inflation had grown less than expected, dropping to 10% in November compared to 10.6% in October and consensus expectations of 10.4 %.

However, it is falling and volatile energy prices driving the decline, as food prices are still rising strongly. There will likely be mixed inflation signals over the remainder of the year as commodity prices, fuel and supply chains remain in flux.

On Sunday, OPEC agreed to stick to its plan to cut oil output by 2 million barrels a day over 2023 despite concerns it would increase the cuts ahead of an EU ban on imports of Russian oil and a price cap of $US60 a barrel placed on the rogue state’s oil by the US and other G7 countries. The oil price is currently around $US90 a barrel compared to $US120 a barrel in early June.

In the UK, where inflation is running at about 11%, regulators have begun dismantling some of the restrictive capital requirements placed on banks during the global financial crisis to stimulate business by releasing stored bank capital back into debt markets. UK business confidence is dropping, and corporations are targeting higher prices for goods and services to offset rising costs.

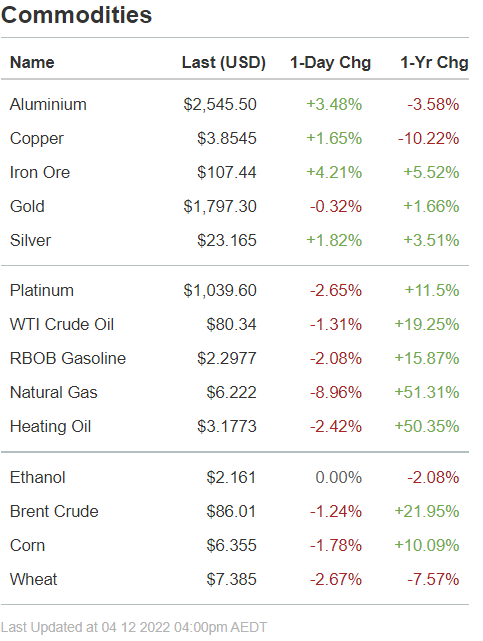

Input costs have not been helped by higher commodity prices across the board over the past 12 months.

Source: nabtrade

In the US a lower-than-expected CPI number during the week led to an across-the-board rally as investors drew a breath amid expectations the Federal Reserve has terminated its big interest rate hikes.

While the Fed has confirmed big cuts are off the table it has also stated it will stay the course to tame inflation.

“Despite some promising developments, we have a long way to go in restoring price stability,” Powell said in remarks delivered at the Brookings Institution.

This was followed by the release of jobs data that showed both the number of jobs being created and the average pay for workers was still on the rise, fuelling concerns it will put additional pressure on inflation.

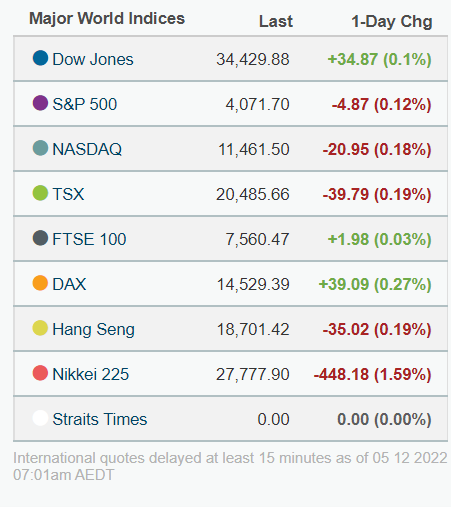

It caused US markets to dip sharply on Friday but by the close of trading key indices had recovered sufficiently to record a small gain.

Source: nabtrade

In Australia, the October inflation reading at 6.9% was down from 7.3% the previous month. It was that data and Powell’s statement that smaller rate hikes could start from December, that caused the S&P/ASX200 to spike sharply mid-week. However, local markets ended weaker on the Friday on thin trading as markets waited for further US and European data releases.

Source: nabtrade

Clearly, as we approach year end it is inflation that is driving markets. But perhaps what is yet to be fully priced into markets is the effects of inflation.

Rising inflation goes hand in hand with rising interest rates, which in turn causes consumers to tighten the purse strings. We are still waiting for the latter, but more importantly we are still waiting for analysts to push that anticipated falling consumer demand into their data bases and come out with revised earnings forecasts for leading corporates.

That may happen before the next reporting season in March, so although the tepid rally currently taking place may well continue into the New Year, a soothsayer may suggest ‘Beware the ides of March’, which for a bit of trivia refers to the murder of Roman dictator Julius Caesar on March 15, 44BC.

The market is expected to open the week higher this morning, based on ASX SPI 200 Futures trading up 20 points (0.27%) to 7,334.00 at 7.30am (05/12/22).

Analysis as at 05/12/2022. This information has been provided by WealthHub Securities Limited ABN 83 089 718 249 AFSL No. 230704 (WealthHub Securities). WealthHub Securities is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited ABN 12 004 044 937 AFSL No. 230686 (NAB). Whilst all reasonable care has been taken by WealthHub Securities in reviewing this material, this content does not represent the view or opinions of WealthHub Securities. Any statements as to past performance do not represent future performance. Any advice contained in the Information has been prepared by WealthHub Securities without taking into account your objectives, financial situation or needs. Before acting on any such advice, we recommend that you consider whether it is appropriate for your circumstances.