Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

‘Tis the Season – Ho! Ho! Ho!

Where has this year gone? We have had euphoric market highs and depressing market lows. It used to be that February and August were our busy season. Results. Now it seems that it is game on every month. Whether it is conference season, or the current AGM season, we have seen a raft of companies updating the market. Some have imploded spectacularly, Reliance Worldwide (RWC) is one geared to the housing sector. Codan (CDA) got smacked on West African problems, mining stocks have reported quarterlies with weather a feature and rising inflationary pressures. There have not been too many upgrades although many have reaffirmed guidance and we have been absent dire warnings of the end of days, that many analysts were fearing. Our banking money printing machines have once again shown that the big four still are in pretty good shape and the higher interest rates are proving a big kicker for the business model. Even European banks are looking better. No more negative yields around the world.

This slightly feelgood AGM season has enabled the bulls. We have even had talk of the Santa rally. Yes, it is only November, but thoughts are turning to the selling season. They usually do post Melbourne Cup. Many retailers will be pining their hopes on Xmas cheer. Will the RBA rain on the parade? Good to see Super Retail (SUL), JB HiFi (JBH) and Lovisa (LOV) still optimistic on the outlook.

Last Xmas, I felt like I was five years old again, I had written my note to Santa. Please can you bring me that Orange ‘Raleigh Chopper’ bike that I want. I have been good all year, I promise. And there it was, bright and shiny and new on Xmas day. Same with the market. 7420. It just got better from there too, as New Year’s Eve rolled around, 7450. What could go wrong? Santa rally well and truly delivered. Then came the hangover. And we have felt a little under the weather since it peaked again at Easter.

This year we have a number of tailwinds heading into the festive season. The market is starting from a relatively low base. We have potential for a Fed pivot. Or at least a less aggressive rate climate. Politics could play a part and China does need to do something to stimulate. Surprisingly iron ore stocks are heading higher as iron ore falls and the AUD rises. That seems to be stalling though.

Locally the budget is out of the way with no damage done, US midterms coming up. Going back to 1934, mid-terms see the US S&P500 rise in the year that follows, in all but one year. The average rise in the S&P500 from the low of the second year (2022), to the high the following year, is 47%. It hit a low of 3640 in late September. 47% would put it back to, well way above the previous all-time high of 4797 back in January this year. Dreaming. Maybe. Let’s not get too far ahead of ourselves. Plenty of headwinds out there.

Given markets have had the kitchen sink thrown at them and are holding in, albeit at much lower levels, maybe the only way is up. The path of least resistance. For now. My only concern is the crashing US tech behemoths. Remember everything is connected. These are the foundations of the US rally. For now, the market is holding up, but there is a risk that some funds may be forced to sell to fund other parts of their portfolio.

The easy way to play a market bounce, Xmas is coming after all, is to use an Index ETF. There are plenty around, both on the US and the ASX200. A200, IOZ or even GEAR if you are looking for leverage. Plenty on the S&P 500 too. IVV being one of the most popular.

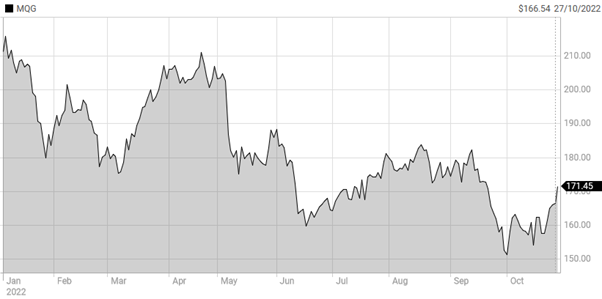

If you are looking at stocks, you may want to consider businesses that are exposed to better conditions in equity markets. Fund managers and Macquarie (MQG) could be worth a look, with another positive result from the bank recently. It has been hard to get excited about money managers in a changing world with all the ETF competition, but remember as markets rise, so too does the FUM. That helps income, but the real kicker will be performance fees. The industry is on notice to lift its game and justify itself.

It is hard to go past MQG though as one with leverage and the skills to best benefit from a rising equity and asset market. It has bounced from the recent lows in September and potentially more to come as brokers upgrade the outlook. Still a firm ‘Marcus Today’ favourite stock. Come for the growth, bank the yield. Best minds in the business still.

Source: nabtrade

Showing no sign of any weakness but this is quality and should be on your Xmas list. Maybe I should ask Santa for a pullback so I can fill my stocking.

A free trial of the Marcus Today newsletter for nabtrade clients is available here.

All prices and analysis at 28 October 2022. This information has been provided by Marcus Today (AFSL is 473383), for WealthHub Securities Ltd ABN 83 089 718 249 AFSL No. 230704 (WealthHub Securities, we), a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 (NAB). Whilst all reasonable care has been taken by WealthHub Securities in reviewing this material, this content does not represent the view or opinions of WealthHub Securities. Any statements as to past performance do not represent future performance. Any advice contained in the Information has been prepared by WealthHub Securities without taking into account your objectives, financial situation or needs. Before acting on any such advice, we recommend that you consider whether it is appropriate for your circumstances.