Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

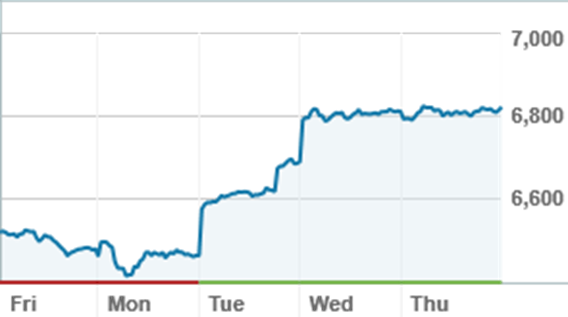

Selling into strength

The ASX200 has added 4% over five days, including 3.75% 0n its best day since mid 2020. The turnaround in sentiment was sparked by the RBA’s announcement of a 0.25% interest rate rise on Tuesday, half the expected increase and a catalyst for global markets to reignite hopes of a ‘pivot’ and softening in the central bank tightening cycle. Two days of roaring optimism were followed by a quiet day on Thursday, as investors caught their breath. Nabtraders have been increasingly cautious as global markets have fallen into bear territory and the ASX trades well below its highs. While they increased their activity this week, most were selling into strength rather than buying the rally.

Source: nabtrade

The biggest trade of the week remains Pilbara Minerals (PLS), which was already having an incredibly strong year but has turned vertical in recent days. PLS is one of the more recent additions to the top 20 holdings, but has a relatively broad base of holders, giving many the opportunity to lock in substantial profits in recent days. The average sell price was $4.95; the stock closed at $5.40 on Thursday, up another 5% on the day.

Pilbara Minerals (PLS) shares over twelve months

Source: nabtrade

Interestingly Core Lithium (CXO) was a buy at the same time, albeit in smaller volumes. The CXO share price is roughly 30% off its recent highs, in contrast to PLS. This follows a recent capital raising at just $1.03 a share; the last close was $1.16.

The banks, which have fallen heavily in the trading volumes, were also heavily trimmed on strength. Nab (NAB) had the most aggressive selling, more than 90% of trades, while Westpac (WBC) had the highest volumes, with roughly 30% sold. Even Commonwealth Bank (CBA) was a sell, despite being well off its highs.

Whitehaven Coal (WHC) has continued its stellar run, up 300% year to date; existing holders, of whom there are relatively few, have been trimming their positions. New Hope Corporation (NHC), up a relatively pedestrian 200% in comparison, has also been sold.

New Hope Corporation (NHC) shares over twelve months

Source: nabtrade

It is said that the final stage of a bear market is capitulation, when long suffering shareholders finally give up hope and sell. This may be true of Magellan Financial Group (MFG), which updated its funds under management on Thursday, reporting substantial further outflows from the business. The share price fell 8.5% to an 8 year low; the stock is now down nearly 70% over twelve months, and substantially more from its pre Covid highs of more than $70. Nabtrade holders were selling after the news; generally nabtraders are greedy when others are fearful, but the trajectory of MFG has sapped the confidence of even the greediest buyers.

Magellan Financial Group (MFG) shares over twelve months

Source: nabtrade

On international markets, this lack of confidence is showing through in reduced volumes and smaller trade sizes. The one bright spot is ETF trading, which is focussed on bullish and bearish ETFs in specific sectors and themes, including the Euro, natural gas and China.

Analysis as at 6 October 2022. This information has been provided by WealthHub Securities Ltd the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 (NAB). Whilst all reasonable care has been taken by WealthHub Securities in reviewing this material, this content does not represent the view or opinions of WealthHub Securities. Any statements as to past performance do not represent future performance. Any advice contained in the Information has been prepared by WealthHub Securities without taking into account your objectives, financial situation or needs. Before acting on any such advice, we recommend that you consider whether it is appropriate for your circumstances.