Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Three ETFs in three out-of-favour sectors

A fund manager I know runs an interesting exercise at the start of each year. Their team examines the market’s worst-performing sector and debates if it’s a buy.

The test forces the team to think about deeply unloved sectors. It’s a bit like the Dogs of Dow theory where you buy “10 dog stocks” with the highest dividend yield.

Granted, contrarian investing is easier in theory than in practice. It takes courage to buy sectors that are deeply out of favour and high conviction to stick to that view.

These traits separate great investors from the rest. We’re constantly told to be “greedy when others are fearful” and vice versa. But how many of us buy in the eye of a storm?

That’s particularly important this week after the brutal fall in Australian shares on Tuesday. Inflation is a bigger, more persistent problem than markets realised. Interest rates are going higher.

Still, nobody picks the precise turning point in sector recoveries. There is always a risk that a sector that more than halves can fall further still. Novice investors can be surprised at how low sectors go – and for how long they stay down. You need patience.

Caveats aside, buying quality companies in unloved sectors is the essence of long-term investing. Yes, there are also good stocks in popular sectors. The key is identifying value. It’s usually in out-of-favour sectors that valuation extremities emerge.

Energy is an example. Most investors didn’t want to know energy stocks a few years ago. Unrelenting negativity about the future of fossil-fuel production crushed sentiment. Now the market can’t get enough of some global oil and coal stocks.

Not all sectors recover like energy. Some stay down for years due to negative structural or cyclical trends. The key is identifying sectors that have good long-term prospects but have been oversold largely on short-term market fears.

It’s true that the worst-performing sector one year is often among the better-performing sectors the next year, and vice versa. That said, simple rules of thumb when investing can be dangerous. Assess each sector on its merits.

With contrarian sector investing, it pays to use Exchange Traded Funds (ETFs). Chosen well, an ETF provides diversified exposure to many stocks in a sector. There’s enough risk in turnaround investing as it is, without having to punt on individual companies. That’s best left for professional investors who specialise in deep-value investing.

ASX has a reasonable selection of sector-based ETFs over Australian equities. But much of the best sector action is overseas. For some investors, the only option is investing in ETFs issued on other exchanges.

With that in mind, here are three deeply out-of-favour sectors to consider and an ETF in each that provides exposure.

1. Asian tech

Four of the top five worst-performing ETFs in Stockspot’s latest annual ETF review had a common theme: heavy exposure to Asian technology stocks.

Rising interest rates this year sparked a rotation from tech and other growth stocks with long-duration earnings to so-called “value stocks”. Global tech stocks tumbled.

Asian tech stocks had the added complication of China’s regulatory crackdown on its tech sector. As I wrote in this Report last month, analysts continue to downgrade the valuations for Chinese tech stocks. Others believe the Chinese tech sector is “un-investable” because of the risk of government privatisation of tech.

Clearly, Asian tech is for experienced investors who have a high-risk tolerance and understand the challenge of contrarian investing.

Investors who want less risk could consider the iShares Asian 50 ETF (IAA). About a third of the 50 stocks in its underlying index are from the information tech sector. IAA is down 31% in the year to end-August 2022.

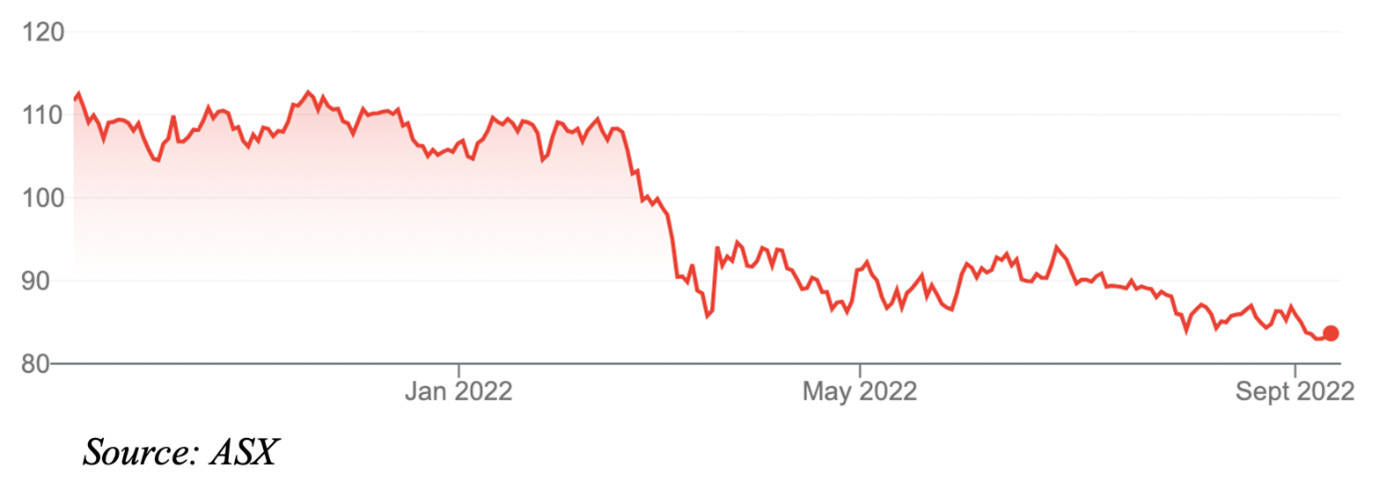

iShares Asia 50 ETF (IAA)

Another option is the VanEck China New Economy ETF (CNEW). It owns 120 stocks across a range of sectors, so is less exposed to Chinese tech. Food, beverages and tobacco, consumer durables and biotech make up almost half of the ETF by sector.

Those seeking pure exposure to Asian tech could consider the BetaShares Asia Technology Tigers ETF (ASIA). It owns the 50 largest tech and online retail stocks in Asia (excluding Japan). The ETF has a mix of internet, media, semiconductor and technology stocks. Just over half of the ETF is invested in Chinese companies.

ASIA is down 32% over one year to 13 September 2022.

2. Europe

Few sectors are as out of favour as European banks. The sector has underperformed for more than a decade. This year, Russia’s invasion of Ukraine and fears of a Eurozone recession have pushed the sector even lower.

Remarkably, the MSCI Europe Bank traded on an average forward Price Earnings (PE) ratio of 6.5 times at end-August 2022. That compares to a PE of 11.4 times for European equities and about 14-16 times for Australian banks.

Put another way, European banks are trading at a massive discount (on average) to comparable banks in other developed markets. In the short term, rising interest rates benefit bank Net Interest Margins and earnings, and strengthen their capacity to pay higher dividends. That is true of European bank stocks this year.

Investors who want pure exposure to European bank stocks won’t find it on the ASX. The closest offering is BetaShares Global Banks ETF (BNKS). However, US, Canadian and Asian banks account for well over two-thirds of that ETF by region.

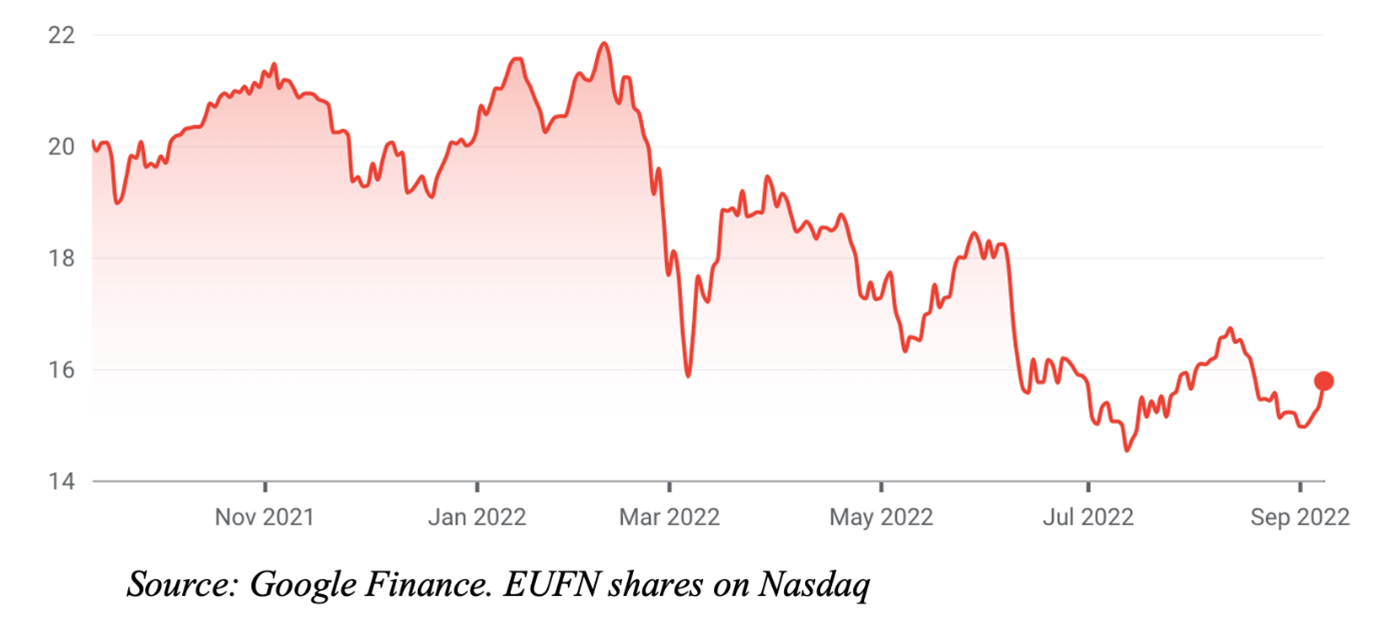

The iShares MSCI European Financial ETF (EUFN) is an option for focused European banking exposure. Traded on the Nasdaq exchange, EUFN had 46% of its assets in European banks at end-August 2022. The rest is in insurers and diversified financials.

EUFN is down 22% so far this calendar year.

iShares MSCI European Financial ETF (NASDAQ: EUFN)

3. Biotech

Biotech has also underperformed this year amid the rotation from growth to value stocks, as interest rates rise.

The S&P Biotechnology Select Index, a barometer of 156 US-listed biotech stocks, has fallen 34% over one year to September 2022. That compares to a -9% return in the S&P 500 Index during that period. Biotech has been a terrible short-term bet.

The biotech sector has now given back most of the gains made during COVID-19. The S&P Biotechnology Select Index is trading at levels last seen in early 2020.

As I wrote in April for this Report, few sectors have as much long-term potential as biotech. Many breakthroughs in the next decade will have their origins in biotech.

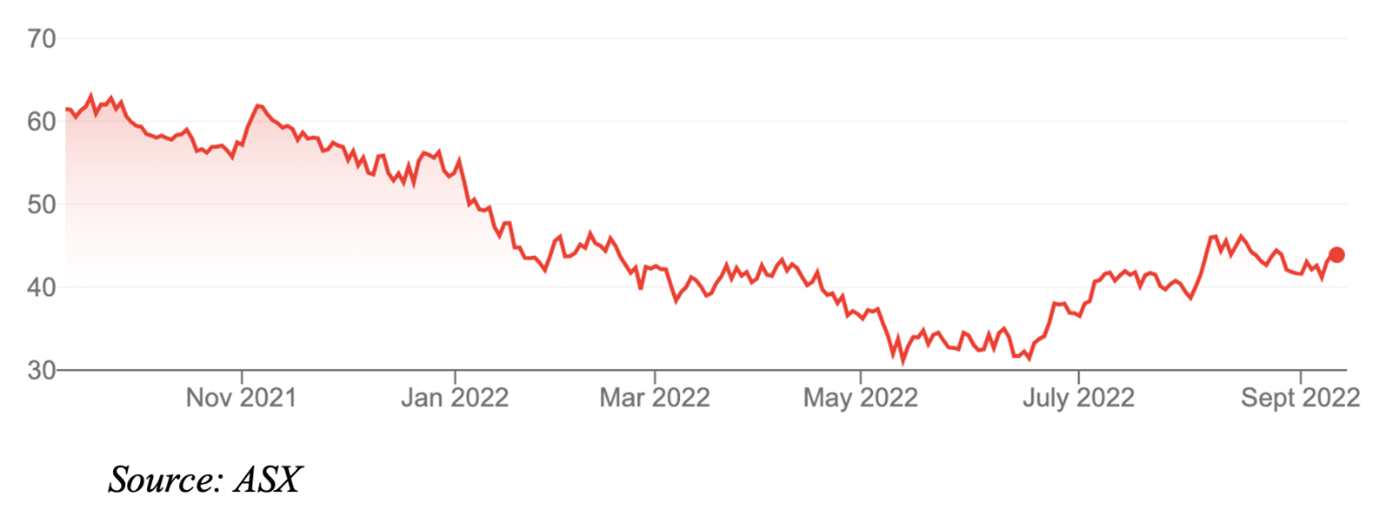

The ETFS S&P Biotech ETF (CURE) is an option. CURE provides exposure to US biotech companies included in the S&P Biotechnology Select Industry Index. About three-quarters of the ETF is invested in biotech; the rest is in healthcare providers.

In addition to drug-discovery risk, CURE has currency risk because it is not hedged for currency movements. About half of CURE is invested in small-cap biotech companies. CURE is down almost 30% over one year to 13 September 2022.

ETFS S&P Biotech ETF (CURE)

The VanEck Global Healthcare Leaders ETF (HLTH) is another option. Unlike CURE, HLTH invests across the healthcare sector. Roughly, HLTH is split between the biotech, pharmaceutical, life-science tools and services, and healthcare equipment sub-sectors.

All prices and analysis at 19 September 2022. This information was produced by Switzer Financial Group Pty Ltd (ABN 24 112 294 649), which is an Australian Financial Services Licensee (Licence No. 286 531This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. This article does not reflect the views of WealthHub Securities Limited.