Investing for climate change

About two decades ago, I became fascinated with companies developing technologies to address climate change. Back then, we called them “green energy” stocks.

They were a motley bunch of mostly loss-making, speculative companies. For all the potential, winners were rare.

Fast forward 20 years and I see investors repeating similar mistakes. The first is assuming the winners from climate change will be tech companies developing renewables solutions. Some will do well: many more won’t.

With investing, we need to stop thinking about climate change as a future problem that requires a solution. Rather, think of it as a current problem that requires widespread societal change to drive climate mitigation and adaptation.

Through that lens, climate-change investing looks different. It’s not about picking the next big winner that develops a new tech solution in the future. Rather, it’s about identifying which global companies – across industries – are best placed to adapt.

Climate-change winners could come from unlikely sources. For example, BlueScope (BSL) as it works towards “green steel” or Fortescue Metals Group (FMG) as it pursues ambitions in hydrogen. Perhaps Aurizon (AZJ) will successfully move away from fossil-fuels transportation and more towards bulk freight in agriculture and other commodities.

My point is: climate change is an issue affecting all listed companies in one way or another. It almost seems redundant to “invest for climate change” because this trend is as much about risk management as it is about opportunity identification.

You don’t want to own companies that leave it too late to transition to climate change and are left stranded with almost worthless assets.

Rather than try to pick individual winners, consider using an active or index fund that provides diversified exposure to potential climate-change winners.

Most of all, focus globally with climate-change investing. As is often the case, the best action is overseas, particularly in areas such as wind-farm and solar-panel manufacturing.

Here are four climate-change-focused funds to consider. The first two are index funds; the next two are actively managed funds.

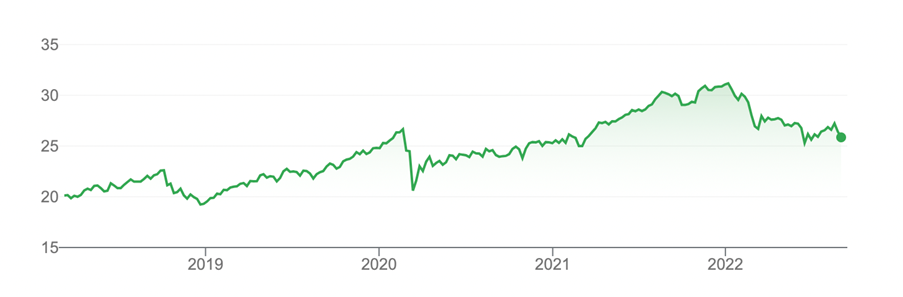

1. Van Eck MSCI International Sustainability Equity ETF (ESGI)

Available on ASX, ESGI provides exposure to 125 international companies. This smart-beta ETF uses negative and positive screens. It excludes companies that own fossil-fuel reserves or mine thermal coal, as well as those involved in a range of harmful industries. Think adult entertainment, gambling, tobacco, weapons and so on.

Through a positive ESG screen, the top 15% of companies (by ESG performance) from each global sector are included in ESGI. Remaining companies are weighted by their carbon-emission intensity. Suffice it to say, ESGI has a rigorous methodology for excluding global ESG laggards and including ESG leaders.

ESGI’s underlying index has returned about 9.% annually over the past five years to end-July 2022. But falls in the last six months – in line with broader market weakness –have dented returns.

Nevertheless, ESGI has an interesting list of stocks within it and suits long-term investors who want stricter ESG parameters for global stock selection through climate-change-focused ETFs.

Chart 1: VanEck MSCI International Sustainability Equity ETF (ESGI)

Source: ASX

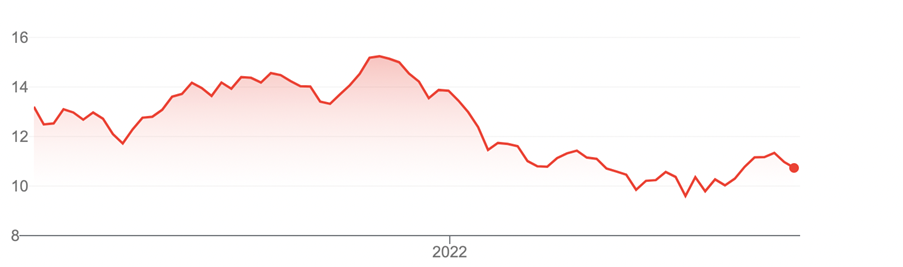

2. BetaShares Climate Change Innovation ETF (ERTH)

ERTH provides exposure to up to 100 global companies that make at least half of their revenue from products or services that help address climate change or other environmental problems through the reduction of CO2 emissions.

ERTH’s underlying index includes lots of well-known global companies in clean energy, green transport, waste management, sustainable product development, and energy efficiency and storage. Almost half of ERTH is invested in US stocks.

ERTH suits investors who want more exposure to companies developing environment solutions rather than those doing a better job to adapt to climate change. As such, ERTH arguably has a higher risk profile than other sustainability ETFs.

As with any ETF, look “beneath the bonnet” to ensure the fund is sufficiently true-to-label. ERTH, for example, invests in Zoom Video Communications. Some investors might believe it’s a stretch to include an online-conferencing company as a climate-change innovator. To be fair, online meetings can reduce air and other transportation.

ERTH has returned -21.3% over 12 months to end-July 2022. That’s partly what makes ERTH interesting. After heavy falls this year, it’s due for some recovery, although that could take time given long-duration growth stocks have lost favour as interest rates rise.

Long-term investors who want to own global companies at the vanguard of technological innovation in climate change could do worse than consider ERTH – particularly after its price slump this year.

Chart 2: BetaShares Climate Change Innovation ETF (ERTH)

Source: ASX

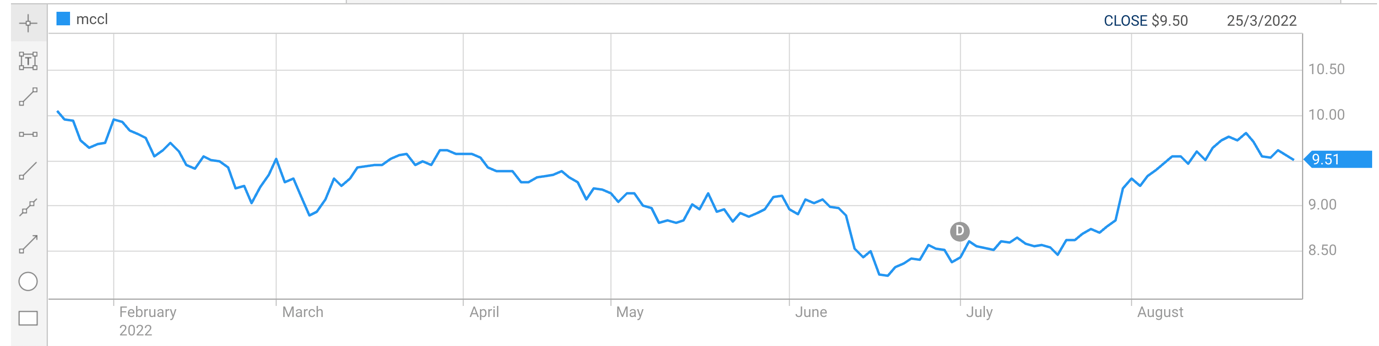

3. Munro Climate Change Leaders Fund (Managed Fund) (MCCL)

MCCL is a newer entrant among actively managed funds that focus on climate change and are quoted on ASX as Exchange Traded Managed Funds.

MCCL focuses on global companies involved in clean energy, the circular economy, clean transport and energy efficiency. About two-thirds of MCCL is invested in US stocks. Stocks in the fund include NextEra Energy, Waste Management and Tesla.

MCCL (the ASX version) has had a tough time since its inception in January 2022. It has lost 7.2% to end-July 2022, slightly better than its underlying index.

The fund has an experienced investment team and a disciplined process for selecting potential climate-change winners.

It’s easy to give up on funds after a period of negative returns. But the best time to invest is usually after poor performance, particularly when much of it is due to prevailing marketing conditions. The caveat, of course, is that you have confidence in the fund, its investment team, process and stock holdings.

For investors who want active exposure to global investing in climate-change companies, MCCL is worth a look. More conservative investors might wait until MCCL develops a longer track record in this form of investing.

Chart 3: Munro Climate Change Leaders Fund (Managed Fund) (MCCL)

Source: ASX

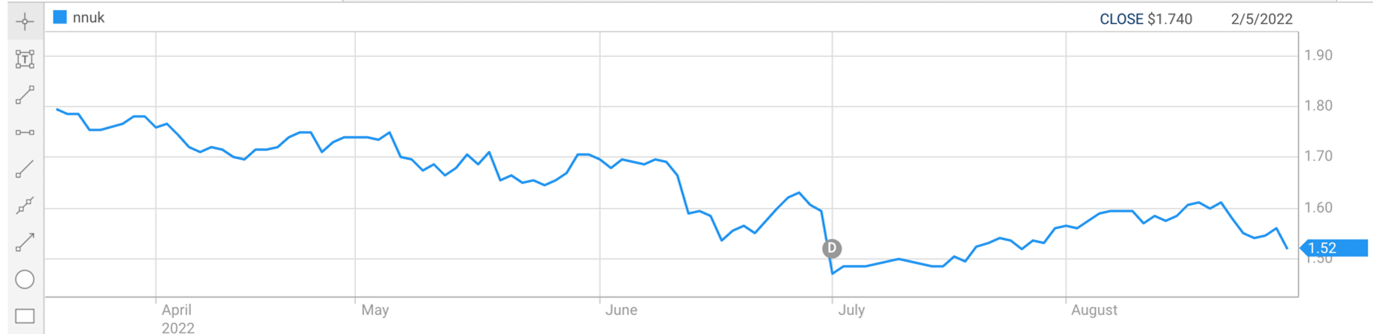

4. Nanuk New World Fund (NNUK)

Another recent addition to ASX, NNUK is an actively managed fund that invests in global equities exposed to broad themes in environmental sustainability. The fund focuses on companies involved in clean energy, energy efficiency, agriculture, water, waste management, recycling, pollution control and advanced manufacturing and materials.

NNUK’s investment strategy has been in operation since November 2015. Since inception, the average annualised return is 11.5% to end-July 2022, or a 2.5% excess return over the fund’s benchmark index.

However, NNUK is down 14% year-to-date (to end-July 2022) in a volatile market. The fund has a fairly concentrated portfolio, so suits investors who want a high-conviction approach to global sustainability investing. NNUK has an experienced investment team behind it – and runs on the board in environmental investing through global equities.

Chart 4: Nanuk New World Fund (NNUK)

Source: ASX

Tony Featherstone is an expert contributor to the Switzer Report. All prices and analysis at 1 September 2022. This information was produced by Switzer Financial Group Pty Ltd (ABN 24 112 294 649), which is an Australian Financial Services Licensee (Licence No. 286 531This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. This article does not reflect the views of WealthHub Securities Limited.