Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

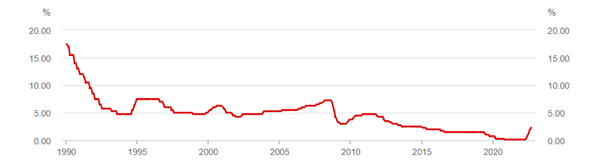

Did the RBA's fifth rate rise surprise nabtrade investors?

Tuesday, to a new seven year high of 2.35%. Many readers will recall rates well above the current level, and in many cases be grateful that savers can finally earn a decent return on their term deposits again, but the overall implications for the economy are worrying. Such a steep acceleration in rates was inconceivable, at least to the RBA, less than 9 months ago, and those households with high debt levels may struggle to adjust. So has retail spending fallen? Not really; consumer spending added 1.1% to a healthy GDP quarterly growth figure of 0.9%. And Governor Lowe intimated on Thursday that rate rises may begin to slow, giving the market a boost after its recent falls. The result is that the ASX200 is largely unmoved over the last week, with the benchmark remaining around 6850 points.

Source: Reserve Bank of Australia

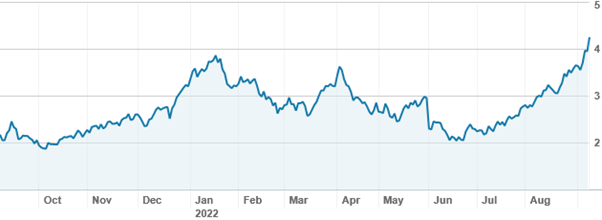

This sideways pattern is failing to spark investors’ enthusiasm; for most, the only real attractions are the materials and energy sectors. Lithium is both a long and short term play; the megatrend of decarbonisation and demand for battery metals attract longer term investors, while traders are enjoying the volatility. Pilbara Minerals (PLS) is the largest holding in the lithium sector on nabtrade, and is inside the top 20 holdings, above more established companies like Santos (STO). Its recent run has surprised even long term believers, and with the share price up 7.5% on Thursday alone, many are taking profits.

Pilbara Minerals (PLS) shares over twelve months

Source: nabtrade

Also in the sector, Allkem (AKE), Lake Resources (LKE) and Core Lithium (CXO) are riding high; many investors are trimming, along with Sayona (SYA) and Liontown (LTR). Interestingly few seem to be interested in or possibly aware of Wesfarmers’ (WES) sizable lithium bet via its Mt Holland project in WA. It was reported just last week that the company is in offtake negotations with Tesla, Mitsui and LG; while investors are more likely to follow the fortunes of Kmart and Bunnings, Wesfarmers’ bet in the battery metals space may be one to watch.

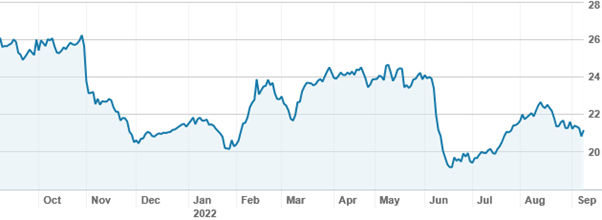

Beyond materials, many stocks are nearing key prices; healthcare giant CSL (CSL) is currently just below $300, which has led to many holders trimming their positions. Nab (NAB) shares have fallen below $30 which has led to buying; the share price has held above this level several times in 2022, leading many to believe that below $30 is a good entry point. Westpac (WBC) has seen strong buying under $21; despite lagging CBA and nab in performance over two years, it has been a popular buy on nabtrade over this period. With a dividend yield of 5.8%, many income investors have not been too concerned about price performance.

Westpac (WBC) shares over twelve months

Source: nabtrade

On international markets, investors have lost enthusiasm for most stocks and sectors, with volumes falling across the board. One notable standout was premium vehicle manufacturers, with a handful of small trades in BMW (BMW.DE) and Rolls Royce (RR.GB); if you can’t afford the vehicle, buying (a small part of) the company may be the next best thing.

Rolls-Royce (RR.GB) shares over twelve months

Source: nabtrade

Analysis as at 8 September 2022. This information has been provided by WealthHub Securities Ltd the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 (NAB). Whilst all reasonable care has been taken by WealthHub Securities in reviewing this material, this content does not represent the view or opinions of WealthHub Securities. Any statements as to past performance do not represent future performance. Any advice contained in the Information has been prepared by WealthHub Securities without taking into account your objectives, financial situation or needs. Before acting on any such advice, we recommend that you consider whether it is appropriate for your circumstances.