Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Reporting season has something for everyone...

While the US market has cheered inflation figures of ‘just’ 8.5%, reporting season in Australia is underway and investors have plenty to consider. The effects of higher rates do not appear to be significantly hampering Australian business, for which confidence has climbed 7 points in nab’s monthly survey, however consumers are fearing the worst, with consumer sentiment down 22% since December 2021. These consumer sentiment figures are similar to those during Covid (down 20%) and the GFC (down 29%) and are affecting those with a mortgage, and those without, suggesting interest rates are not the only factor.

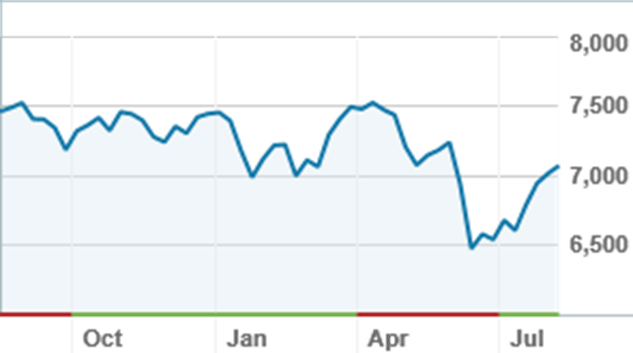

The ASX200 is up 7% over the last month, including 1.4% over the last week and on Thursday held above the psychologically important 7000 point threshold. The Australian sharemarket is still well below March highs, but has rebounded more quickly than many feared given the increasingly clouded global outlook.

ASX200 (XJO) over one year

Earnings season is giving investors an opportunity to assess the real impact of inflation, rates and other factors on business. Commonwealth Bank (CBA) is the only bank of the Big Four to report its annual result in August (the other three report in October as their financial year ends on 30 September), and announced a cash earnings profit of $9.6bn; the result caused barely a ripple in the share price despite being slightly ahead of expectations. As it continues to hover above $100, most nabtraders feel the stock is too expensive – but holders are loathe to sell, given weakness in the share price tends to be short lived. Higher value investors did add to their holdings.

Commonwealth Bank (CBA) shares over one year

Nab also updated the market with a quarterly result; the share price briefly sank 4% and nabtraders were quick to top their portfolios.

Really though, all the big trades are still in the materials and energy sector. While the heavyweights in iron ore and oil always attract flows, the battery metals sector, and Lake Resources (LKE) in particular, were the big news on Thursday. LKE’s management made no announcement, but the share price shot up 20%, leading to heavy buying from momentum traders and those who enjoy a speculative play. The broad context behind the share price move was the US Democrat’s enormous ‘Inflation Reduction Act’, formerly known as Build Back Better, which includes nearly $370bn in climate and energy spending, as well as increased sales of electric vehicles in China following an easing of lockdown restrictions. Lithium prices have rocketed over the last twelve months and the expected surge in demand from global developments are expected to put further upward pressure on lithium prices. LKE has recently been subject to short seller activism, and it is possibly that shorts have been forced to close out their positions.

Pilbara Minerals (PLS), Core Lithium (CXO) and Sayona Mining (SYA) have also seen buying as the sector hots up again. Followers of the sector will have no trouble recalling the 20% correction in lithium’s big names in early June following a strongly negative Goldman Sachs forecast; for those currently holding the return to favour is welcome, and unusually very few holders are selling into strength.

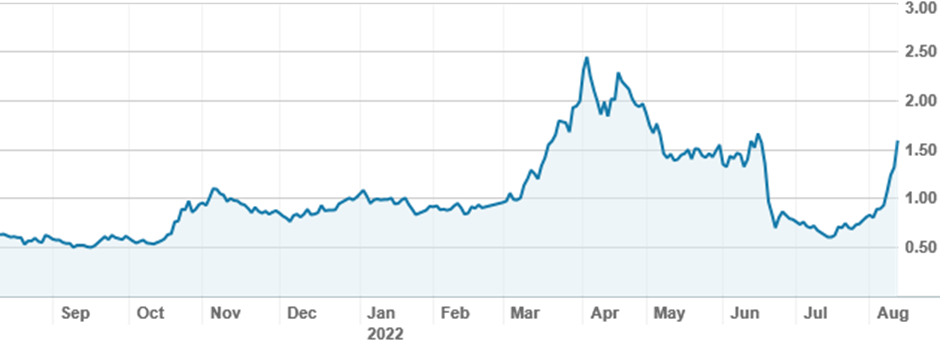

Lake Resources (LKE) shares over one year

Among the big names, BHP’s (BHP) has seen mixed trading on high volumes, while Fortescue Metals Group (FMG) continues to provide just enough volatility for high value traders to eke out a profit.

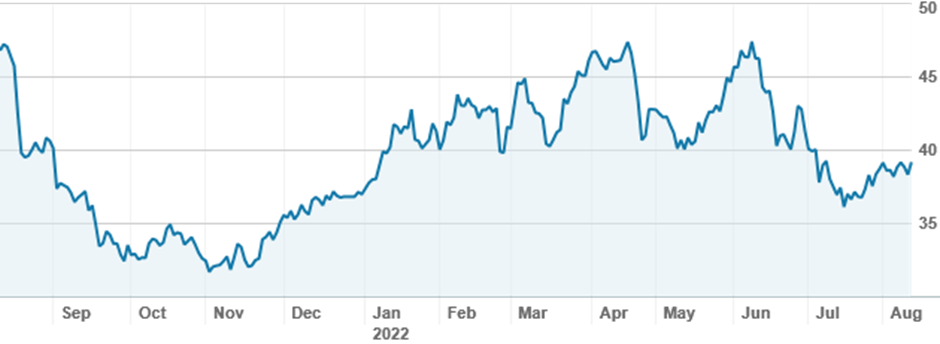

BHP (BHP) shares over one year

Telstra’s (TLS) annual results failed to raise interest; holders continue to enjoy the dividend and the low volatility over the last twelve months, when it has traded in a surprisingly tight range, mostly between $3.80 and $4.20. CSL (CSL), due to report next week, has seen selling above $295.

On international markets, the semiconductor market is of great interest to a small number of traders and investors. Chip giant Nvidia (NVDA.US) posted a revenue miss of more than $400m in its second quarter earnings, partly due to declining demand for gaming; the stock is down nearly 40% year to date. The stock soared 6% overnight, however, and remains volatile as the Nasdaq has now entered bull market territory. The Biden Government has proposed the CHIPS Act, which prioritises semiconductor manufacture to secure critical technological infrastructure; nabtraders have been actively trading ETFs in the semiconductor space.

Analysis as at 11 August 2022. This information has been provided by WealthHub Securities Ltd the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 (NAB). Whilst all reasonable care has been taken by WealthHub Securities in reviewing this material, this content does not represent the view or opinions of WealthHub Securities. Any statements as to past performance do not represent future performance. Any advice contained in the Information has been prepared by WealthHub Securities without taking into account your objectives, financial situation or needs. Before acting on any such advice, we recommend that you consider whether it is appropriate for your circumstances.