Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Has inflation peaked?

There is no more important market statistic at the moment than inflation. It determines consumer spending, company margins, central bank policy and of particular interest to millions of Australians, mortgage and deposit rates. High inflation and high rates will push down property prices, affecting the asset in which most Australian wealth is held, the $10 trillion of residential property.

While there is growing optimism that inflation will peak in 2022, the coming European winter threatens to maintain high food costs. We are now realising what a terrible strategic mistake France and Germany made with their dependence on Russia for gas, giving Vladimir Putin not only the money to finance the war, but the ability to turn off a pipeline and hold Europe to ransom.

From easy to ignore to impossible to avoid

For many years, inflation has not mattered much. In fact, the main worry for the Reserve Bank was deflation, as they tried to push inflation into its 2-3% target band by lowering interest rates.

The CPI rose 1.8% in the June 2022 quarter taking it 6.1% higher than a year ago. The stock market rose on the news, as inflation in the second quarter dipped from the first quarter and was slightly lower than expected suggesting inflation in Australia may have already peaked. Recent falls in the prices of wheat and corn are likely to slow food inflation in Australia, which accelerated over the last quarter.

Economist predictions for the end of the year range around 2.75%, requiring several more increases in cash rate by the Reserve Bank over the course of 2022.

US inflation hit another record in June 2022. The chart below shows the low US inflation and interest rates for the last decade, and it drove a rapid escalation in asset prices, and with it, massive speculation using free money that is now undergoing a painful unwinding. The US represents almost 60% of global stockmarkets, and where the US goes, Australia follows.

American consumers haven’t seen any relief from rising prices, and that could mean even more aggressive interest rate increases from the Federal Reserve, further raising the risk that the US economy might be forced into recession in order to cool off rising prices.

Morningstar’s Chief US Economist, Preston Caldwell, says:

“The June report will almost certainly mark the peak in inflation, as food and energy prices are set to fall sharply in next month's report. The uptick in inflation was driven heavily by food and energy prices, but indicators of food and energy prices have plummeted in July, which will show up in the next CPI report.

“It's still the case that the bulk of the inflation problem since the start of the pandemic has been driven by supply disruptions in autos, energy, and food. We expect these issues to be resolved, contributing to an unwinding of the inflationary surge.”

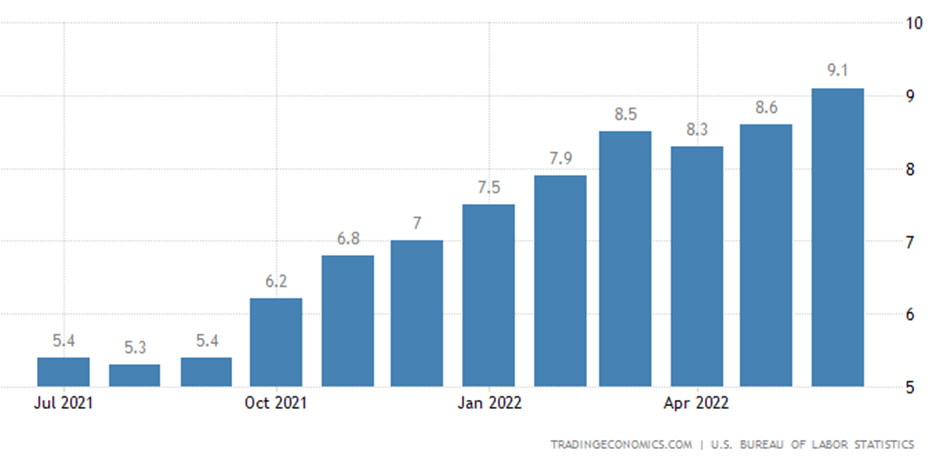

The Bureau of Labor Statistics in the US reported that the Consumer Price Index rose a larger-than-expected 1.3% in June 2022. As shown below, year over year, inflation was up 9.1% in June, the biggest increase since November 1981.

United States Inflation Rate

Caldwell says:

“The June report did show signs of a broadening in inflationary pressures, as have the last several months. This probably reflects a catch-up of pricing for businesses and industries which have lagged behind the overall inflation trend. However, the Fed has the opportunity to nip in the bud this broadening of inflation. Wage growth is running at moderate rates, so if the Fed continues with its course of tightening, we don't expect inflation in the broader economy to remain high.”

While the jump in US inflation was widespread, the cost-of-living increases were concentrated right where it hurts consumers most: food, fuel, and shelter. Excluding food and energy, the CPI rose 0.7% in June, and 5.9% over the last 12 months.

This article now draws on two other authors who take opposite views on the inflationary outlook.

1. Why inflation might have peaked in June

This is edited highlights from Samuel Smith, a US author of High Yield Investor.

In this article, we will share five reasons why we think inflation may have peaked in June and why we think inflation will still remain at an elevated level for the foreseeable future.

Reason 1: Falling commodity prices

The biggest green shoot for a peaking of year-over-year CPI increases is the fact that commodity prices have been falling in recent weeks, and the market seems to be pricing in substantial further declines given how it is pricing businesses in those industries. For example, energy giant Exxon Mobil, agricultural giant Nutrien, and mining giant Rio Tinto have all seen their prices plummet in recent weeks.

In fact, the pullback in these key commodity sectors has prompted Barclays to reduce its year-end CPI forecast by 600 basis points to 5.7%, which is a far cry from the robust high single digit first half numbers we have been seeing so far in 2022.

Reason 2: Supply chain backlogs clearing

Shipping costs are falling and product delivery times are improving according to Pantheon Macroeconomics. This is the result of gradual efforts to combat backlogs finally taking effect, continued reductions in COVID-19 related headwinds, and demand destruction resulting from higher prices.

Reason 3: Reduced inflation expectations in bond markets

The performance of the iShares TIPS Bond ETF (TIP) year-to-date says a lot about expectations for inflation. Despite inflation rates soaring this year, TIP has had a rough performance year-to-date. That is because bond market investors are not expecting inflation levels to stick around and TIP's performance is dependent on long-term inflation levels, not necessarily just the short-term performance.

(Editor's note: In Australia, this is equivalent to inflation-linked bonds, where there have been similar price movements, such as on the Vanguard Inflation-Linked Bond Index ETF).

While bond market investors are not always right, where they put their money often sends a powerful signal of where things may be headed.

Reason 4: Decelerating wage growth

While wages continue to grow at a strong pace relative to history, June's 5.1% year-over-year increase was a deceleration from earlier in the year and lags 400 basis points behind the inflation rate. This implies that the current inflation rate is not only unsustainable given that it significantly exceeds the growth in workers' income levels, but it also means that cost pressure growth on businesses is beginning to subside, which is also a deflationary signal.

Reason 5: Inventory growth

Last, but not least, as was already mentioned the supply chain is finally catching up with the post-COVID demand explosion, leaving retailers with demand surpluses. On top of that, rapidly rising interest rates are making it more difficult for buyers to finance products that have typically been purchased on credit. A big example of this is the housing sector, where home builders are having to slash prices in order to move inventory. Similar things are being predicted for the used car market.

Investor takeaway

There are several clear evidences that inflation’s momentum is declining and in fact CPI might have actually peaked in June. As long as the economy suffers no more major supply shocks and can continue to iron out its imbalances, inflation should settle at a more reasonable level in the near future and remain there until deflationary technological innovations can bring it down still further.

2. Inflation? We ain't seen nothin' yet

This is an edited transcript of a video by Peter Zeihan. He is one of my favourite commentators on geopolitics, with vast knowledge of world events, including the war in Ukraine. Peter is the founder of Zeihan on Geopolitics.

Well, the new data that came out of the United States government is not great, suggests that the inflation rate within the American system is about 9.1% which is easily a 40-year-high. And if you look at most of the things that are going on with the markets and with jobs and with energy and with food, it's going to be going up. So let me knock down all of those real quick so you see where we're coming from.

Ongoing food shortages

We're looking at fertiliser limitations on a global scale. The Chinese have restricted the export of phosphate because they need it for rice, the Russians are discovering it's hard to get their potash out because of the shutdown of a rail or partial shutdown of a rail line that goes through Belarus and into Lithuania on the way to the port of Kaliningrad. And because natural gas prices are so high, a lot of companies, particularly in Europe, have stopped making nitrogen-type fertilisers at all. So we've got price pressures in all three.

In addition, the world's number one wheat exporter, Russia, has invaded the world's number four wheat exporter, Ukraine and is systematically destroying all civilian infrastructure it comes across with a double emphasis on agricultural infrastructure. So we have already lost one of the world's great agricultural powers. And probably before the end of the year, Ukraine will devolve into a net importer for at least several years.

Demographic changes

On top of that, the Baby Boomers are moving into retirement and the replacement generation that is taking their jobs is known as the Zoomers. While the Baby Boomers are the largest generation we've ever had, the Zoomers are the smallest in calendar year 2022. There is already a shortage of 400,000 workers and that number will increase each year until at least 2034 where it will probably peak at around 900,000 shortage.

This is not gonna get better anytime soon. And as frustrating as that is, it is so much worse everywhere else. Now the United States may have a slightly damaged demography the whole Boomer versus Zoomer problem, but America's Baby Boomers did something that most of their equivalent cohort around the world did not do. They had kids. Millennials are spending now, and that gives the United States a ballast demographically and economically that most countries in the world don't have.

The US consumer has about $2 trillion of spare cash still saved up from the aftermath of COVID. And so we're not seeing meaningful reductions in retail sales or general consumption. In fact, with the US now mid-summer, people are traveling as much as they possibly can which is putting more pressure on everything.

Why does this matter for inflation?

The US Federal Reserve still has a consumption profile that it can regulate with interest rates. So the Fed is likely to do another sharp rate increase very soon and at least one or two more before the end of the year. Because the American system has consumption, we have a tool that is still appropriate to the situation. Europeans don't.

The Europeans don't have much a Millennial generation. If they were to raise interest rates, it really wouldn't have any impact on consumption. So if they raise rates at all, they're gonna be going more slowly and in lower increments, and that is widening the differential between rates in the United States versus rates in Europe, which is pushing the Euro through the floor.

Interest rates are not an appropriate tool in Europe. That makes inflation in Europe even worse, because oil is dollar-denominated, natural gas is dollar-denominated, food is for the most part dollar-denominated and so are fertilisers, so is iron ore, so is bauxite, so are most of the commodities and most of the finished metals. And now the Europeans are not simply dealing with less consumption and less economic activity and more exposure to Russia. Everything that they need to make modern society work has to be imported in someone else's currency and that currency is going through the roof. Yes, inflation in North America is bad, but nothing compared to what the Europeans are wrestling with.

Where does that leave us? To summarise a few points:

- The market expects a spike in inflation for the next year, due to supply constraints and strong spending, but then inflation will slow.

- If we look back to pre-Covid, the reason central banks feared deflation was the growth of cheap Asian goods, especially from China, and it's likely trade globalisation will eventually unlock again.

- Again longer term, the ageing of the population, especially in Europe and Asia, will be deflationary as older folk tend to spend less than younger people setting up houses and raising families.

- Europe realises it has become too dependent on Russia for energy, and while the adjustment to other sources, including renewables, will be slow and painful, at some point the change in energy mix will take pressure off the oil price, especially as European growth slows. It was not that long ago that oil was trading close to zero.

- And finally, the major factor reducing company costs and driving down prices was technological change and disruption bringing new competition to most industries. This will not stop.

Many of these factors are more likely to act on inflation over the medium to long term, leaving the next year or two exposed to more pain.

First published on the Firstlinks Newsletter. A free subscription for nabtrade clients is available here.

Graham Hand is Editor-At-Large for Firstlinks. Analysis as at 1 August 2022. This information has been provided by Firstlinks, a publication of Morningstar Australasia (ABN: 95 090 665 544, AFSL 240892), for WealthHub Securities Ltd ABN 83 089 718 249 AFSL No. 230704 (WealthHub Securities, we), a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 (NAB). Whilst all reasonable care has been taken by WealthHub Securities in reviewing this material, this content does not represent the view or opinions of WealthHub Securities. Any statements as to past performance do not represent future performance. Any advice contained in the Information has been prepared by WealthHub Securities without taking into account your objectives, financial situation or needs. Before acting on any such advice, we recommend that you consider whether it is appropriate for your circumstances.