Four rare earths picks

Australia’s rare earths sector is emerging as a major new minerals mining and processing industry, on the back of the applications of rare earths – which are actually not all that rare, geologically – for a broad range of modern, high-tech uses, most particularly with respect to the “clean energy transition”.

The 16 rare-earth metallic elements comprise neodymium, praseodymium, dysprosium, lanthanum, cerium, promethium, samarium, europium, gadolinium, terbium, holmium, erbium, thulium, ytterbium, lutetium and yttrium. Scandium is also included in manly lists of rare earths but its geological occurrences and chemical properties differ from the rest.

The rare earth metals are used in the manufacturing of many electronic products that power the global economy, including cell phones, electric vehicles, aircraft engines, and wind turbines. But they are crucial to the manufacture of permanent magnets that are essential for electric motors, batteries, lasers, robotics and wind-power generation. In particular, the global push for net-zero carbon emissions through the adoption of electric vehicles (EVs) and renewable energy (particularly wind turbine) installations is driving global demand for rare earths.

At the moment, the glass industry is the biggest user of REE raw materials, using them for glass polishing and as additives that provide colour and special optical properties. The REEs are used as components in steel alloys, in high-technology devices, including smartphones, digital cameras, computer hard disks, fluorescent and light-emitting-diode (LED) lights, flat-screen televisions, computer monitors, and electronic displays. Large quantities of some REEs are also used in defence technologies, and the metals also have a growing range of uses in medical technology. All of these play a role in the growing demand for REEs, but what excites most investors is the metals’ exploding use in “clean energy”.

Just in the permanent magnets industry, demand for neodymium-praseodymium (NdPr) for manufacturing neodymium boron sintered/bonded magnets, known in the industry as NdFeB magnets, is forecast to grow from 130,000 tonnes of NdFeB magnets consumed in 2020 to 265,000 tonnes in 2030.

In all uses, global consumption of rare earths reached 167,000 tonnes of total rare earth oxides (TREO) in 2020 and is forecast to increase to 280,000 tonnes by 2030.

But there is a supply problem, the fact that China dominates the global rare earths market: China produces more than 70% of global supply, and also consumes about the same proportion of global demand – and what is more concerning for the developed world, China holds more than 90% of global processing capacity, and increasingly, it reserves much of its production for domestic use.

There are no known substitutes for REEs in most applications, given their unique magnetic, chemical and luminescent properties. Simply put, the developed world is desperate for reliable non-Chinese sources of supply for these materials. And that’s where Australia (and Australian companies) comes in.

Back in July 2021, I took a look at the rare earths sector. Here’s an update on what I think are the best exposures to rare earths.

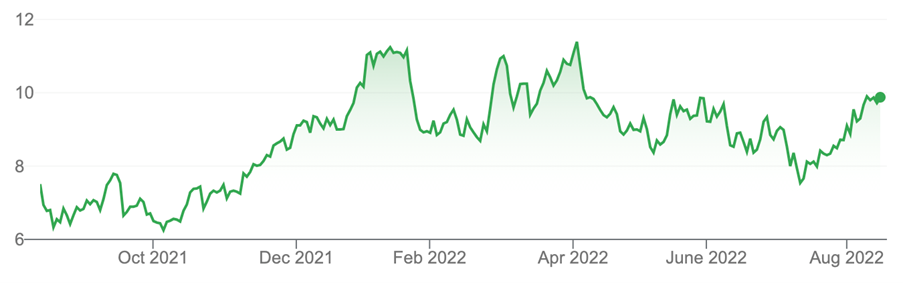

Lynas Rare Earths (LYC, $9.72)

Market capitalisation: $8.8 billion

12-month total return: 26.4%

3-year total return: 50.7% a year

Expected FY23 dividend yield: no dividend expected

Analysts’ consensus target price: $10.62 (Stock Doctor/Thomson Reuters), $8.75 (FNArena, two analysts)

As I said back then, Lynas (LYC) – which was trading at $6.43 at the time – is the flagship of the Australian rare earths sector. LYC mines rare earths at its world-leading orebody at Mt. Weld in Western Australia. An ancient collapsed volcano, Mt Weld is one of the largest and highest-grade rare earths deposits in the world, and it has plenty of potential to grow as further exploration is conducted.

Lynas operates the largest single rare earths processing plant in the world, in Malaysia, which it built in 2012 to process rare earth material at a lower cost than it could in Australia. The company is building a $500 million rare earth processing facility at Kalgoorlie in WA to undertake early-stage processing of ore mined at nearby Mt Weld before it is sent to Malaysia for upgrading. The expansion will start next year and hit full operational capacity in 2024, just as it is becoming crucial for western economies to secure supplies.

Lynas is also building two rare earths separation plants in the US, both of which will receive material directly from Kalgoorlie. The first plant, announced in January 2021, will be a “light” rare earths metals plant equipped to produce about 5,000 tonnes of rare earths products per year, including about 1,250 tonnes of neodymium and praseodymium (NdPr). The second plant, announced in June 2022, will handle “heavy” rare earths. The US projects are co-funded by the US Department of Defense (sic), which tells you how keen the US is on having a non-Chinese supply option.

(There are “light” and “heavy” rare earths, based on their atomic number: the light rare earths are lanthanum, cerium, neodymium, praseodymium and samarium. These elements typically comprise approximately 85%—90% of rare earth resources. The “heavy” rare earth metals make up the balance and are much less abundant.)

The company’s main product is neodymium-praseodymium (NdPr), and it expects that market to triple in size over the next 10 years. Aside from NdPr, which is also used in batteries and wind turbines, consumer electronics, robotics, appliances and medical devices, the company’s dysprosium, terbium, lanthanum and cerium products are also finding new uses.

In FY21, Lynas achieved a record net profit of $157.1 million on sales revenue of $489 million. Despite the continuing effects of the COVID-19 pandemic, which particularly affected the Malaysia plant, Lynas lifted total production volume by 8.2% to 15,761 tonnes of rare earth oxide (REO), and total NdPr production rose by 17.3%, to 5,461 tonnes.

After a stellar first-half, analysts expect full-year FY22 numbers to come in at about $946 million in sales revenue, and net profit at $552 million. That would be a belter of a year in anyone’s language.

Lynas said in 2019 that it wanted to increase production of rare earths by 50% to 10,500 tonnes by 2025, but chief executive Amanda Lacaze told the Diggers & Dealers conference last month that strong demand meant that Lynas would have to be more ambitious: under a strategy to produce “more and faster,” Lynas now aims to produce 12,000 tonnes by 2024.

LYC has been an excellent performer on the ASX in recent years; while that has moved the stock closer to full valuation for the present, some analysts still see decent upside prospects from here.

Lynas Rare Earths Limited (LYC)

Source: nabtrade

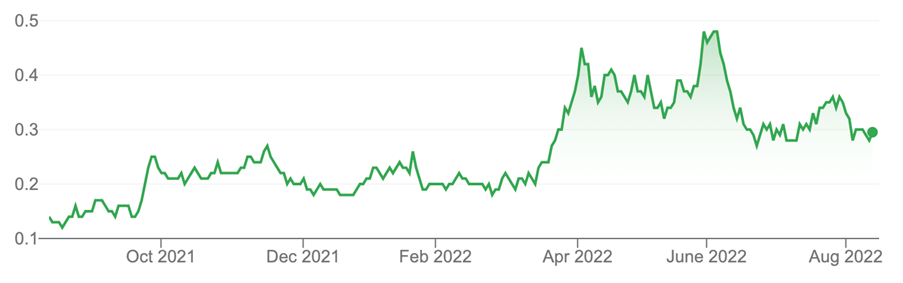

Arafura Resources (ARU, 28 cents)

Market capitalisation: $439 million

12-month total return: 115.4%

3-year total return: 52.5% a year

Expected FY23 dividend yield: no dividend expected

Analysts’ consensus target price: 56 cents (Stock Doctor/Thomson Reuters, one analyst)

Arafura Resources (ARU) – which was trading at 12.7 cents in July 2021 – owns the Nolans rare earths project in the Northern Territory, which is one of the world’s largest undeveloped projects, with an existing JORC compliant resource of 56 million tonnes at 2.6% total rare earth oxides with 26.4% neodymium-praseodymium enrichment.

This month, Arafura announced a placement of 156.7 million new shares at an issue price of 26.5 cents, to raise $41.5 million, to progress Nolans. Potential investors were told that the project has Major Project Facilitation status from the Australian government; that Arafura was negotiating a long-term purchase agreement for Nolans’ produce with GE Renewable Energy; and was also working towards a definitive binding offtake agreement with Hyundai Motor Company for NdPr oxide: at present, Arafura and Hyundai have a memorandum of understanding (MoU) under which Hyundai has agreed to take 1,000—1,500 tonnes a year of NdPr oxide over a seven-year term, commencing 2025.

Arafura will use the money it raised for front-end engineering and design services (FEED) work, to begin detailed design and construction tendering work or early contractor involvement (ECI) work, and to fund working capital needs.

The placement was strongly supported by new and existing investors from around the globe, reflecting significant interest in the company’s “tier 1 asset and vertically integrated corporate strategy”. Investors believe that Nolans will deliver a secure and sustainable supply of NdPr Oxide into the global market for electric vehicles and renewable energy uses.

Nolans will be a $1 billion project but is expected to have a mine life of at least 38 years, with plenty of exploration potential to extend that further. Arafura says it could potentially supply 5% of world demand for magnet rare earths, producing up to 4,440 tonnes a year of NdPr oxide and 470 tonnes a year of a mixed middle-to-heavy rare earth (SEG/HRE) oxide, a product containing the middle and heavy rare earths including samarium, terbium and dysprosium.

Arafura Resources Limited (ARU)

Source: nabtrade

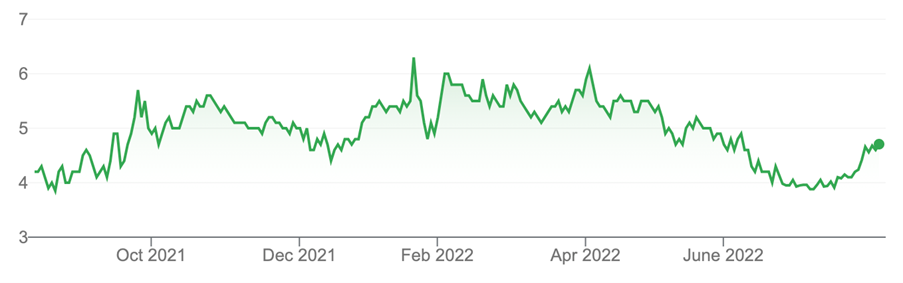

Hastings Technology Metals (HAS, $4.60)

Market capitalisation: $467 million

12-month total return: 7%

3-year total return: 15.3% a year

Expected FY23 dividend yield: no dividend expected

Analysts’ consensus target price: $6.50 (Stock Doctor/Thomson Reuters, two analysts), $6.30 (FN Arena, one analyst)

Hastings Technology Metals (HAS) calls itself “Australia’s next rare earths producer,” with its flagship Yangibana rare earths project in the Upper Gascoyne region of Western Australia incorporating a mine and proposed beneficiation and hydro-metallurgy processing plant, which will treat rare earths deposits hosting high neodymium and praseodymium content, to produce a mixed rare earths carbonate (MREC) that will be further refined into individual rare earth oxides at processing plants overseas. Hastings also owns the Brockman project, considered Australia’s largest heavy rare earths deposit, near Halls Creek in the Kimberley.

But Yangibana is the priority. The project comprises operations at both the Yangibana site, where Hastings discovered the deposit in 2014 and a rare earths processing plant at Onslow, which will have a production capacity of about 15,000 tonnes a year of mixed rare earth carbonate, containing 3,400 tonnes of neodymium and praseodymium. Investment bank Macquarie expects Hastings to mount a $200 million equity raising as the final step in funding for the project.

Hastings has taken quite a Europe-centric strategy, planning to be a reliable long-term source of supply of rare earth feedstock to the European permanent magnets industry, supplying it with critical minerals including NdPr for manufacturing neodymium boron sintered/bonded magnets, known in the industry as NdFeB magnets.

The company has signed offtake agreements, the major one being with German group ThyssenKrupp, which will take 9,000 tonnes a year of MREC for the first five years and 5,000 tonnes a year for the second five years, totalling 70,000 tonnes over a 10-year period. The committed offtake volume that will go to ThyssenKrupp represents 60% of Hastings’ annual production volume from Yangibana for the first five years, and 33% for the second five years.

Yangibana is fully permitted for long-life production and with offtake contracts signed and debt finance in the advanced stage. The company says construction is scheduled to take 27 months, from Q3 2022. At the moment, the mine has an official projected mine life of 15 years, but recent drilling results from the Bald Hill, Simon’s Find and Fraser’s prospects at Yangibana make that number highly conservative, and it is likely to be extended.

Having conducted a one-for-20 share consolidation in May 2022, Hastings, at $4.60, is trading at the equivalent of 23 cents, up from 18 cents in my July 2021 article. Analysts think the price has the potential to go significantly higher.

Hastings Technology Metals Limited (HAS)

Source: nabtrade

Iluka Resources Limited (ILU, $10.12)

Market capitalisation: $4.4 billion

12-month total return: 13.3%

3-year total return: 33.5% a year

Expected FY23 (December) dividend yield: 3.6% fully franked (grossed-up, 5.1%)

Analysts’ consensus target price: $13.35 (Stock Doctor/Thomson Reuters, eight analysts), $11.49 (FN Arena, five analysts)

In 2020, mineral sands heavyweight Iluka Resources (ILU) found itself in an interesting situation. It had always known that rare earths were contained in the mineral sands monazite and xenotime, which it previously mined at its mothballed Eneabba mine in Western Australia, and that it could produce them from stockpiles at Eneabba. The Eneabba stockpile contains monazite and xenotime, produced as by-products from Iluka’s Narngulu mineral processing plant and stored since the early 1990s. Simple reclamation allowed the company, in the September 2020 quarter, to begin shipping a rare earths concentrate containing neodymium, praseodymium, dysprosium, terbium, cerium and lanthanum to world markets.

Iluka says Eneabba is the world’s highest-grade rare earths operation. The stockpile does not require any mining infrastructure, meaning it can be brought to market quickly. In April, Iluka’s board hit the green light on its $1.2 billion rare earths refinery project at Eneabba, with construction to start in the second half of the year, underpinned by a low-cost $1.05 billion loan from the commonwealth government, under its Critical Minerals Facility. First production of rare earth oxides (REO) containing neodymium, praseodymium, dysprosium, terbium and more, is anticipated in 2025.

Just on what is contained in the Eneabba stockpile, Iluka says it could produce for nine years, to 2033, at an average annual rate of 12,400 tonnes a year of rare earths oxide (REO), with 2,700 tonnes a year of average NdPr production. But the company’s existing mineral sands operations at the Cataby and Jacinth-Ambrosia sites will continue to replenish the stockpile, while its large-scale Wimmera mineral sands resource, located in the Murray Basin of Western Victoria and which is currently the subject of a preliminary feasibility study, contains rare earth minerals similar to those in the Eneabba stockpile, with a higher proportion of the high-value, heavier elements, dysprosium and terbium. Iluka expects Wimmera to be able to feed the Eneabba refinery, too. The company has other deposits, as well, and could also take supply from third parties.

And, of course, Iluka is the world’s largest producer of zircon and the high-grade titanium dioxide feedstocks rutile and synthetic rutile, and demand for those materials isn’t going away anytime soon.

Iluka has been a strong performer lately, but again, analysts see plenty of upside. And as an added bonus, it’s a fully franked dividend payer.

Iluka Resources Limited (ILU)

Source: nabtrade

All prices and analysis at 17 August 2022. This information was produced by Switzer Financial Group Pty Ltd (ABN 24 112 294 649), which is an Australian Financial Services Licensee (Licence No. 286 531This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. This article does not reflect the views of WealthHub Securities Limited.

Australia’s rare earths sector is emerging as a major new minerals mining and processing industry, on the back of the applications of rare earths – which are actually not all that rare, geologically – for a broad range of modern, high-tech uses, most particularly with respect to the “clean energy transition”.

The 16 rare-earth metallic elements comprise neodymium, praseodymium, dysprosium, lanthanum, cerium, promethium, samarium, europium, gadolinium, terbium, holmium, erbium, thulium, ytterbium, lutetium and yttrium. Scandium is also included in manly lists of rare earths but its geological occurrences and chemical properties differ from the rest.

The rare earth metals are used in the manufacturing of many electronic products that power the global economy, including cell phones, electric vehicles, aircraft engines, and wind turbines. But they are crucial to the manufacture of permanent magnets that are essential for electric motors, batteries, lasers, robotics and wind-power generation. In particular, the global push for net-zero carbon emissions through the adoption of electric vehicles (EVs) and renewable energy (particularly wind turbine) installations is driving global demand for rare earths.

At the moment, the glass industry is the biggest user of REE raw materials, using them for glass polishing and as additives that provide colour and special optical properties. The REEs are used as components in steel alloys, in high-technology devices, including smartphones, digital cameras, computer hard disks, fluorescent and light-emitting-diode (LED) lights, flat-screen televisions, computer monitors, and electronic displays. Large quantities of some REEs are also used in defence technologies, and the metals also have a growing range of uses in medical technology. All of these play a role in the growing demand for REEs, but what excites most investors is the metals’ exploding use in “clean energy”.

Just in the permanent magnets industry, demand for neodymium-praseodymium (NdPr) for manufacturing neodymium boron sintered/bonded magnets, known in the industry as NdFeB magnets, is forecast to grow from 130,000 tonnes of NdFeB magnets consumed in 2020 to 265,000 tonnes in 2030.

In all uses, global consumption of rare earths reached 167,000 tonnes of total rare earth oxides (TREO) in 2020 and is forecast to increase to 280,000 tonnes by 2030.

But there is a supply problem, the fact that China dominates the global rare earths market: China produces more than 70% of global supply, and also consumes about the same proportion of global demand – and what is more concerning for the developed world, China holds more than 90% of global processing capacity, and increasingly, it reserves much of its production for domestic use.

There are no known substitutes for REEs in most applications, given their unique magnetic, chemical and luminescent properties. Simply put, the developed world is desperate for reliable non-Chinese sources of supply for these materials. And that’s where Australia (and Australian companies) comes in.

Back in July 2021, I took a look at the rare earths sector. Here’s an update on what I think are the best exposures to rare earths.

Lynas Rare Earths (LYC, $9.72)

Market capitalisation: $8.8 billion

12-month total return: 26.4%

3-year total return: 50.7% a year

Expected FY23 dividend yield: no dividend expected

Analysts’ consensus target price: $10.62 (Stock Doctor/Thomson Reuters), $8.75 (FNArena, two analysts)

As I said back then, Lynas (LYC) – which was trading at $6.43 at the time – is the flagship of the Australian rare earths sector. LYC mines rare earths at its world-leading orebody at Mt. Weld in Western Australia. An ancient collapsed volcano, Mt Weld is one of the largest and highest-grade rare earths deposits in the world, and it has plenty of potential to grow as further exploration is conducted.

Lynas operates the largest single rare earths processing plant in the world, in Malaysia, which it built in 2012 to process rare earth material at a lower cost than it could in Australia. The company is building a $500 million rare earth processing facility at Kalgoorlie in WA to undertake early-stage processing of ore mined at nearby Mt Weld before it is sent to Malaysia for upgrading. The expansion will start next year and hit full operational capacity in 2024, just as it is becoming crucial for western economies to secure supplies.

Lynas is also building two rare earths separation plants in the US, both of which will receive material directly from Kalgoorlie. The first plant, announced in January 2021, will be a “light” rare earths metals plant equipped to produce about 5,000 tonnes of rare earths products per year, including about 1,250 tonnes of neodymium and praseodymium (NdPr). The second plant, announced in June 2022, will handle “heavy” rare earths. The US projects are co-funded by the US Department of Defense (sic), which tells you how keen the US is on having a non-Chinese supply option.

(There are “light” and “heavy” rare earths, based on their atomic number: the light rare earths are lanthanum, cerium, neodymium, praseodymium and samarium. These elements typically comprise approximately 85%—90% of rare earth resources. The “heavy” rare earth metals make up the balance and are much less abundant.)

The company’s main product is neodymium-praseodymium (NdPr), and it expects that market to triple in size over the next 10 years. Aside from NdPr, which is also used in batteries and wind turbines, consumer electronics, robotics, appliances and medical devices, the company’s dysprosium, terbium, lanthanum and cerium products are also finding new uses.

In FY21, Lynas achieved a record net profit of $157.1 million on sales revenue of $489 million. Despite the continuing effects of the COVID-19 pandemic, which particularly affected the Malaysia plant, Lynas lifted total production volume by 8.2% to 15,761 tonnes of rare earth oxide (REO), and total NdPr production rose by 17.3%, to 5,461 tonnes.

After a stellar first-half, analysts expect full-year FY22 numbers to come in at about $946 million in sales revenue, and net profit at $552 million. That would be a belter of a year in anyone’s language.

Lynas said in 2019 that it wanted to increase production of rare earths by 50% to 10,500 tonnes by 2025, but chief executive Amanda Lacaze told the Diggers & Dealers conference last month that strong demand meant that Lynas would have to be more ambitious: under a strategy to produce “more and faster,” Lynas now aims to produce 12,000 tonnes by 2024.

LYC has been an excellent performer on the ASX in recent years; while that has moved the stock closer to full valuation for the present, some analysts still see decent upside prospects from here.

Lynas Rare Earths Limited (LYC)

Source: nabtrade

Arafura Resources (ARU, 28 cents)

Market capitalisation: $439 million

12-month total return: 115.4%

3-year total return: 52.5% a year

Expected FY23 dividend yield: no dividend expected

Analysts’ consensus target price: 56 cents (Stock Doctor/Thomson Reuters, one analyst)

Arafura Resources (ARU) – which was trading at 12.7 cents in July 2021 – owns the Nolans rare earths project in the Northern Territory, which is one of the world’s largest undeveloped projects, with an existing JORC compliant resource of 56 million tonnes at 2.6% total rare earth oxides with 26.4% neodymium-praseodymium enrichment.

This month, Arafura announced a placement of 156.7 million new shares at an issue price of 26.5 cents, to raise $41.5 million, to progress Nolans. Potential investors were told that the project has Major Project Facilitation status from the Australian government; that Arafura was negotiating a long-term purchase agreement for Nolans’ produce with GE Renewable Energy; and was also working towards a definitive binding offtake agreement with Hyundai Motor Company for NdPr oxide: at present, Arafura and Hyundai have a memorandum of understanding (MoU) under which Hyundai has agreed to take 1,000—1,500 tonnes a year of NdPr oxide over a seven-year term, commencing 2025.

Arafura will use the money it raised for front-end engineering and design services (FEED) work, to begin detailed design and construction tendering work or early contractor involvement (ECI) work, and to fund working capital needs.

The placement was strongly supported by new and existing investors from around the globe, reflecting significant interest in the company’s “tier 1 asset and vertically integrated corporate strategy”. Investors believe that Nolans will deliver a secure and sustainable supply of NdPr Oxide into the global market for electric vehicles and renewable energy uses.

Nolans will be a $1 billion project but is expected to have a mine life of at least 38 years, with plenty of exploration potential to extend that further. Arafura says it could potentially supply 5% of world demand for magnet rare earths, producing up to 4,440 tonnes a year of NdPr oxide and 470 tonnes a year of a mixed middle-to-heavy rare earth (SEG/HRE) oxide, a product containing the middle and heavy rare earths including samarium, terbium and dysprosium.

Arafura Resources Limited (ARU)

Source: nabtrade

Hastings Technology Metals (HAS, $4.60)

Market capitalisation: $467 million

12-month total return: 7%

3-year total return: 15.3% a year

Expected FY23 dividend yield: no dividend expected

Analysts’ consensus target price: $6.50 (Stock Doctor/Thomson Reuters, two analysts), $6.30 (FN Arena, one analyst)

Hastings Technology Metals (HAS) calls itself “Australia’s next rare earths producer,” with its flagship Yangibana rare earths project in the Upper Gascoyne region of Western Australia incorporating a mine and proposed beneficiation and hydro-metallurgy processing plant, which will treat rare earths deposits hosting high neodymium and praseodymium content, to produce a mixed rare earths carbonate (MREC) that will be further refined into individual rare earth oxides at processing plants overseas. Hastings also owns the Brockman project, considered Australia’s largest heavy rare earths deposit, near Halls Creek in the Kimberley.

But Yangibana is the priority. The project comprises operations at both the Yangibana site, where Hastings discovered the deposit in 2014 and a rare earths processing plant at Onslow, which will have a production capacity of about 15,000 tonnes a year of mixed rare earth carbonate, containing 3,400 tonnes of neodymium and praseodymium. Investment bank Macquarie expects Hastings to mount a $200 million equity raising as the final step in funding for the project.

Hastings has taken quite a Europe-centric strategy, planning to be a reliable long-term source of supply of rare earth feedstock to the European permanent magnets industry, supplying it with critical minerals including NdPr for manufacturing neodymium boron sintered/bonded magnets, known in the industry as NdFeB magnets.

The company has signed offtake agreements, the major one being with German group ThyssenKrupp, which will take 9,000 tonnes a year of MREC for the first five years and 5,000 tonnes a year for the second five years, totalling 70,000 tonnes over a 10-year period. The committed offtake volume that will go to ThyssenKrupp represents 60% of Hastings’ annual production volume from Yangibana for the first five years, and 33% for the second five years.

Yangibana is fully permitted for long-life production and with offtake contracts signed and debt finance in the advanced stage. The company says construction is scheduled to take 27 months, from Q3 2022. At the moment, the mine has an official projected mine life of 15 years, but recent drilling results from the Bald Hill, Simon’s Find and Fraser’s prospects at Yangibana make that number highly conservative, and it is likely to be extended.

Having conducted a one-for-20 share consolidation in May 2022, Hastings, at $4.60, is trading at the equivalent of 23 cents, up from 18 cents in my July 2021 article. Analysts think the price has the potential to go significantly higher.

Hastings Technology Metals Limited (HAS)

Source: nabtrade

Iluka Resources Limited (ILU, $10.12)

Market capitalisation: $4.4 billion

12-month total return: 13.3%

3-year total return: 33.5% a year

Expected FY23 (December) dividend yield: 3.6% fully franked (grossed-up, 5.1%)

Analysts’ consensus target price: $13.35 (Stock Doctor/Thomson Reuters, eight analysts), $11.49 (FN Arena, five analysts)

In 2020, mineral sands heavyweight Iluka Resources (ILU) found itself in an interesting situation. It had always known that rare earths were contained in the mineral sands monazite and xenotime, which it previously mined at its mothballed Eneabba mine in Western Australia, and that it could produce them from stockpiles at Eneabba. The Eneabba stockpile contains monazite and xenotime, produced as by-products from Iluka’s Narngulu mineral processing plant and stored since the early 1990s. Simple reclamation allowed the company, in the September 2020 quarter, to begin shipping a rare earths concentrate containing neodymium, praseodymium, dysprosium, terbium, cerium and lanthanum to world markets.

Iluka says Eneabba is the world’s highest-grade rare earths operation. The stockpile does not require any mining infrastructure, meaning it can be brought to market quickly. In April, Iluka’s board hit the green light on its $1.2 billion rare earths refinery project at Eneabba, with construction to start in the second half of the year, underpinned by a low-cost $1.05 billion loan from the commonwealth government, under its Critical Minerals Facility. First production of rare earth oxides (REO) containing neodymium, praseodymium, dysprosium, terbium and more, is anticipated in 2025.

Just on what is contained in the Eneabba stockpile, Iluka says it could produce for nine years, to 2033, at an average annual rate of 12,400 tonnes a year of rare earths oxide (REO), with 2,700 tonnes a year of average NdPr production. But the company’s existing mineral sands operations at the Cataby and Jacinth-Ambrosia sites will continue to replenish the stockpile, while its large-scale Wimmera mineral sands resource, located in the Murray Basin of Western Victoria and which is currently the subject of a preliminary feasibility study, contains rare earth minerals similar to those in the Eneabba stockpile, with a higher proportion of the high-value, heavier elements, dysprosium and terbium. Iluka expects Wimmera to be able to feed the Eneabba refinery, too. The company has other deposits, as well, and could also take supply from third parties.

And, of course, Iluka is the world’s largest producer of zircon and the high-grade titanium dioxide feedstocks rutile and synthetic rutile, and demand for those materials isn’t going away anytime soon.

Iluka has been a strong performer lately, but again, analysts see plenty of upside. And as an added bonus, it’s a fully franked dividend payer.

Iluka Resources Limited (ILU)

Source: nabtrade

All prices and analysis at 17 August 2022. This information was produced by Switzer Financial Group Pty Ltd (ABN 24 112 294 649), which is an Australian Financial Services Licensee (Licence No. 286 531This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. This article does not reflect the views of WealthHub Securities Limited.