Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Earnings season continues and investors are locking in profits

Global and domestic share markets have softened this week, as investors lose confidence in a slower rate hiking trajectory and a soft landing for the global economy. UK inflation came in at an eye-watering 10.1%, with Citi suggesting it could reach as high as 18% on soaring gas prices. Meanwhile the Jackson Hole Economic Symposium in the US, hosted by the Federal Reserve of Kansas City, has kicked off and will be closely followed for hints as to the US Fed’s next move.

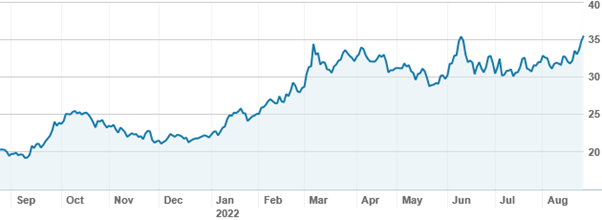

Domestically the ASX has seen its third week of reporting season, and the benchmark ASX200 index is largely unchanged. Investors are still taking advantage of opportunities that present themselves; currently the energy sector is in focus. Woodside Energy (WDS), a favourite with SMSFs in particular, has been sold off by high value investors keen to lock in profits as it closes in on its 52 week high. Woodside shares are up over 70% over twelve months, despite a pullback in the oil price.

Woodside Energy (WDS) shares over twelve months

Source: nabtrade

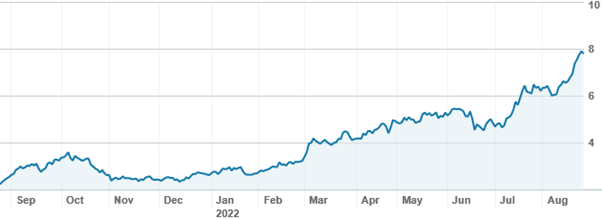

Whitehaven Coal (WHC) delivered record net profit after tax (NPAT) of $1.95bn in its results on Thursday; the share price actually slipped 5% early in the session but closed down just over 1%. Whitehaven’s shares are up an incredible 250% over twelve months as the coal price has benefitted from heightened demand; the energy crisis in the northern hemisphere and sanctions on Russian oil and gas have forced many to turn back to coal which was previously suffering as the world attempts to decarbonise. Nabtraders have taken profits.

Whitehaven Coal (WHC) shares over twelve months

Source: nabtrade

Beyond coal and oil, investors still can’t get enough of the lithium sector, which has bounced back strongly from Goldman’s dire predictions for prices in May. Pilbara Minerals (PLS) is one of the less speculative plays, with a wide holding among nabtrade investors; trading is currently mixed as investors ponder whether it will return to its highs, having jumped well over 50% since June. Allkem (AKE), formerly Galaxy Resources and Orocobre which merged their businesses, is similarly closing in on its highs; investors are taking profits.

The funds management industry is undergoing change as Perpetual’s (PPT) bid for Pendal Group (PDL) was improved and looks likely to go ahead. While the Pendal share price jumped 8% on the news, nabtraders were buying Perpetual, which fell 9.5%. Pendal’s shares have been down as much as 50% this year, while Perpetual is down 30% over twelve months. The funds management industry has been increasingly disrupted by low cost index options such as ETFs, and by large superannuation managers insourcing investment selection. Global fund manager Magellan Financial Group (MFG) has fallen more than 70% from its peak, as a warning to those that get too big.

On international markets, there has been high value selling in chip maker Nvidia (NVDA.US). At $US172, Nvidia shares have fallen 50% from their peak, and are still trading on a PE of 46x. That said, the most recent rally has seen the shares rise more than 20% in a matter of weeks, so recent buyers have profits to take. Short lived meme stock Bed Bath and Beyond (BBBY.US) has fallen in a heap after Canadian activist billionaire Ryan Cohen admitted to having sold the holdings that sparked a 500% jump in the share price.

Analysis as at 25 August 2022. This information has been provided by WealthHub Securities Ltd the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 (NAB). Whilst all reasonable care has been taken by WealthHub Securities in reviewing this material, this content does not represent the view or opinions of WealthHub Securities. Any statements as to past performance do not represent future performance. Any advice contained in the Information has been prepared by WealthHub Securities without taking into account your objectives, financial situation or needs. Before acting on any such advice, we recommend that you consider whether it is appropriate for your circumstances.