Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Are nabtrade investors optimistic about the outlook for CSL?

As the ASX closes one of the busiest weeks of reporting season, investors are digesting company updates and looking for clues as to the outlook for equities in a rising inflation, rising rate world. So far, results have been solid, and few companies have surprised significantly to the upside or the downside. At a global level, investors are still hopeful that the Nasdaq’s new bull market can continue, and that the Federal Reserve will slow its rate of interest rate hikes sufficiently to pull off a rare soft landing.

On nabtrade, many are maintaining a ‘wait and see’ approach. Volumes are well above their June lows, but remain soft for earnings season, when experienced investors in particular do much of their trading. Perhaps the lack of surprises is limiting opportunities for those who hope for a bargain. As a result, most activity is in the big names which are usually at the top of the most traded list, regardless of whether they have reported.

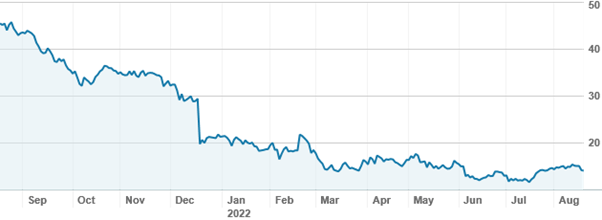

The energy sector has caught some attention this week, with Santos (STO) and Beach Energy (BPT) report this week, following Woodside’s update last week. With oil prices surging over the last twelve months (albeit falling back recently), profits were up substantially (Santos’ underlying profit grew by 300%, Beach’s underlying NPAT increased by 39%), but the companies’ share prices failed to rally – in fact, Beach Energy fell nearly 10%. For BPT, this was due to a reported fall in production hidden by high oil prices; nabtrade investors were quick to buy the stock on weakness. Beach Energy is far from at its lows – its share price is up more than 55% over twelve months – however it remains well off its pre Covid high of $2.70.

Beach Energy (BPT) shares over twelve months

Source: nabtrade

Woodside Energy (WDS) remains a popular buy as investors pocket its healthy dividend. Similarly BHP (BHP) has continued to find buyers after reporting a bumper profit and increased dividend; those buying over the last few months have been rewarded as the share price has also risen in recent days.

Australia’s third largest listed company, CSL (CSL) reported on Wednesday, and despite reporting its second largest profit on record, disappointed the market with a lower profit. CSL shares were down as much as 6% on the day, but subsequently rallied and were trading at $299 on Thursday. Nabtraders were enthusiastic sellers at $299.95, just shy of $300. CSL was previously a high conviction stock, held by a small number of investors through its incredible run over the last two decades, but was a strong buy below $250 over the last two years, and now has a much wider holding among nabtrade investors.

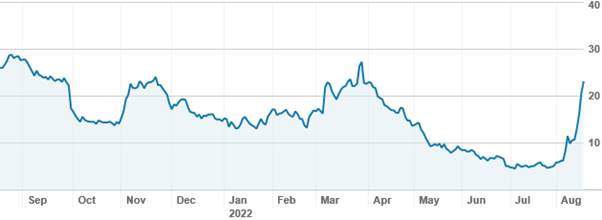

Former darling of the funds management sector, Magellan Financial Group (MFG), also presented its results on Wednesday. As they reports their funds flow (new investments vs redemptions) monthly and market movements and performance can also be tracked monthly, funds management businesses should deliver relatively predictable results, but Magellan’s fund underperformance, loss of CIO and CEO and redemptions by its largest client have seen it fall dramatically from grace over the last 18 months. Some investors have been tempted by the falling share price, hoping it would stabilise and then return to favour, so, while MFG is not a top 20 holding, it often appears in the top 20 most traded stocks. Unfortunately the company’s annual results did nothing to placate the market; some nabtraders were buying.

Magellan Financial Group (MFG) shares over twelve months

Source: nabtrade

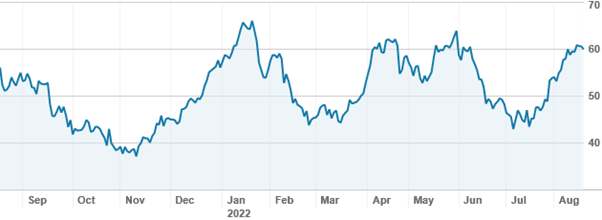

The lithium sector also continues to find buyers, with many enjoying the volatility with the speculative end of their portfolios. Lake Resources (LKE) remains popular, as does Core Lithium (CXO) and Pilbara Minerals (PLS). Mineral Resources (MIN) has also been a popular buy following its recent surge.

Mineral Resources (MIN) shares over twelve months

Source: nabtrade

On international markets, Bed Bath and Beyond (BBBY.US) has become the latest meme stock to capture the attention of the Reddit/WallStreetBets crowd. Canadian billionaire Ryan Cohen, who joined the GameStop board in early 2021 at the beginning of the meme stock craze, has taken a 10% stake in the company and recently bought 1.67m call options with a strike price of $60-80; the BBBY share price is up 440% this month but is still a third of Cohen’s target price, giving the meme crowd plenty to hope for. A small number of nabtraders have chosen to join the ride.

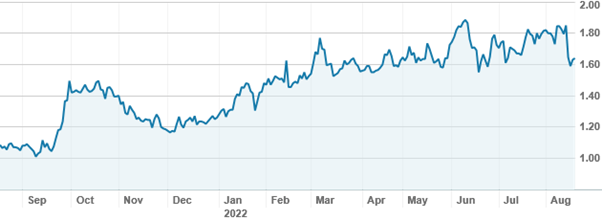

Bed Bath and Beyond (BBBY.US) shares over twelve months

Source: nabtrade

Analysis as at 18 August 2022. This information has been provided by WealthHub Securities Ltd the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 (NAB). Whilst all reasonable care has been taken by WealthHub Securities in reviewing this material, this content does not represent the view or opinions of WealthHub Securities. Any statements as to past performance do not represent future performance. Any advice contained in the Information has been prepared by WealthHub Securities without taking into account your objectives, financial situation or needs. Before acting on any such advice, we recommend that you consider whether it is appropriate for your circumstances.