Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Year end blues for investors

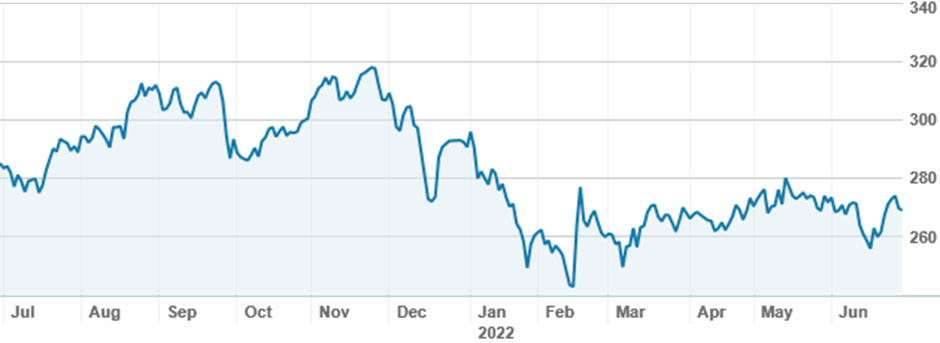

The ASX200 had lost less than 1% before 3pm on its last trading day of the financial year, before it fell heavily at the close, pushing the day’s fall to 1.97%. That fall left the market nursing a 10.19% loss over the 2021-22 financial year, roughly half the loss of the S&P500 over the same period, but still a technical correction and a disappointing outcome for investors. The key drivers were soaring inflation and rapidly rising interest rates, and increasing concerns that higher rates will result in a hard landing for the economy. Optimists point to exceptionally low unemployment and strong recent indicators such as retail sales, while bears note that central banks have historically failed to tame inflation of this magnitude without a substantial slowdown in economic activity.

If you felt like things were going reasonably well for a while over the last year, despite the headlines, the data actually backs you up – the ASX200 made a new high in August, and reach similar peaks at the beginning on January and in April, before capitulating in the face of rising evidence that rates would be hiked far earlier than the RBA had foretold. (Remember that earlier in the year, Reserve Bank Governor Phillip Lowe was insisting rates were unlikely to start rising before 2024). Your holdings may also tell a different story to the broader index; while financials, materials and healthcare, which comprise more than 50% of the index, were down between 8% and 11%, information technology was down nearly 40%. On the other side of the ledger, energy was up nearly 25% on the back of higher oil prices, and utilities were up nearly 30%. Investors with a portfolio diversified across sectors may have performed more strongly than the broader index, which is heavily concentrated; BHP (BHP) alone comprises more than 10% of the ASX200.

S&P ASX200 (XJO) over twelve months

Source: nabtrade

So how were nabtraders closing out the financial year? Overall trading volumes have been subdued in the last month, as investors fear a drawn out correction rather than the heady bounceback from the Covid dip of 2020. The big four banks were sold off on Thursday, and saw buying – investors are generally keen to add to their financials holdings when prices are weak. Westpac (WBC) remains the strong favourite, seeing high value buying under $20. The remainder of the big four also saw buying, while Bank of Queensland (BOQ) also popped into the top20. With an FY fall of nearly 25%, BOQ has underperformed even Westpac (also down close to 25%), and has been a modest but consistent buy through 2022.

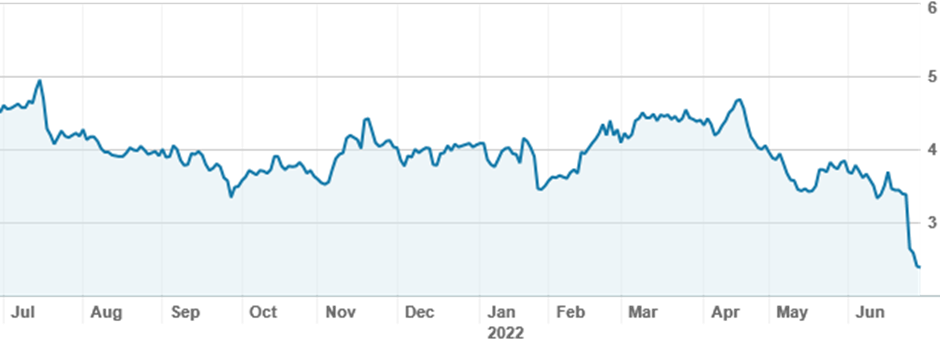

One of the few sells coming into 30 June was CSL (CSL), formerly a high conviction stock, held by relatively few investors but in very high volumes. As its share price has failed to regain its pre Covid highs and has dipped below $250 on several occasions, the number and breadth of CSL holders has increased dramatically over the last two years. While analysts continue to love the stock and many suggests its fortunes are improving, many nabtraders were trimming into EOFY.

CSL (CSL) shares over twelve months

Source: nabtrade

The one super hot sector for calendar year 2022 has been battery metals, particularly lithium. After posting exceptional – perhaps too exceptional – returns in the first part of the year, warnings that lithium prices would moderate, and some company specific headlines such as the departure of Lake Resources’ CEO days after it was added to the ASX200, have seen prices come back. Nabtrade investors have been happy to accumulate at lower prices; Pilbara Minerals (PLS) and Lake Resources (LKE) have seen buying.

While gold miners should be sitting pretty in a (global) bear market, Evolution Mining (EVN) fell 20% on Monday after reporting substantially reduced production numbers. The company’s share price is now down close to 50% over twelve months; nabtrade hopefuls were buying.

Evolution Mining (EVN) shares over twelve months

Source: nabtrade

On global markets, the dwindling enthusiasm continues. The three most traded companies, Tesla (TSLA.US), Apple (APPL.US) and Amazon (AMZN.US) were all net sells, as were Tencent (0700.HK) and Shopify (SHOP.US).

Analysis as at 30 June 2022. This information has been provided by WealthHub Securities Ltd the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 (NAB). Whilst all reasonable care has been taken by WealthHub Securities in reviewing this material, this content does not represent the view or opinions of WealthHub Securities. Any statements as to past performance do not represent future performance. Any advice contained in the Information has been prepared by WealthHub Securities without taking into account your objectives, financial situation or needs. Before acting on any such advice, we recommend that you consider whether it is appropriate for your circumstances.