Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Traders continue to trade the big favourites

The ASX200 eked out modest gains on Thursday despite negative leads from Wall Street, when inflation figures shocked markets that were already pricing in the highest inflation print since the early 1980s. With an annualised inflation figure of 9.1%, US investors are now considering the prospect of a 100bpt interest rate increase from the Federal Reserve at its next meeting. In Australia, unemployment dropped to a record low of 3.5%, with a super tight labour market suggesting we will also see higher rates sooner than expected.

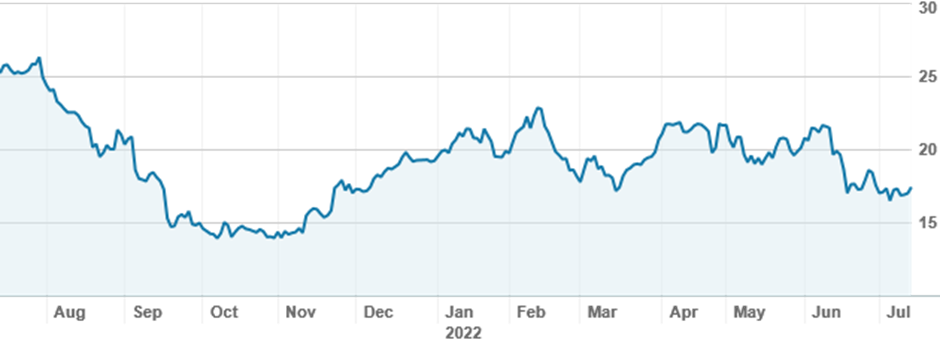

As with the ASX as a whole, trading volumes on nabtrade are subdued. For investors, there isn’t much to get excited about – cheap stocks appear to be cheap for a reason, and few stocks are at the kind of highs that would justify taking profits. Traders continue to trade the big favourites, Fortescue Metals Group (FMG) and BHP (BHP), whose share prices are strongly correlated with the iron ore price, providing some opportunity to snaffle small gains on a regular basis.

Fortescue Metals Group (FMG) shares over twelve months

Source: nabtrade

While well off their highs, neither company has reached last year’s lows, so longer term holders are often hanging onto to substantial gains but are loath to sell at current prices. Interestingly Rio Tinto (RIO), which is generally a far less popular stock, has rejoined the top five trades, although trading is relatively mixed. The stock was a strong buy on Wednesday under $95, which appears to be the magic number.

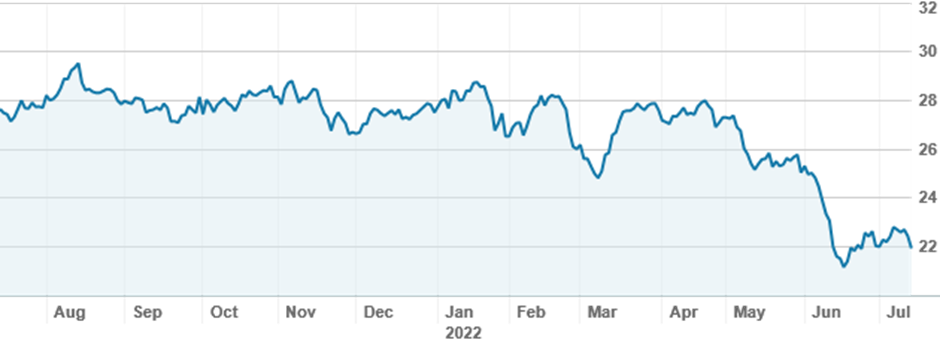

Financials always find investors and traders, but sideways movement in the big four is failing to pique a great deal of interest. ANZ (ANZ) is the least favoured of the banks, but a 2% fall on Thursday and general ongoing weakness in the stock brought out the buyers. The ANZ share price is down 21% over twelve months and 24% over five years, but investors still enjoying receiving their dividends while hoping for a turnaround in the bank’s fortunes.

ANZ share (ANZ) over twelve months

Source: nabtrade

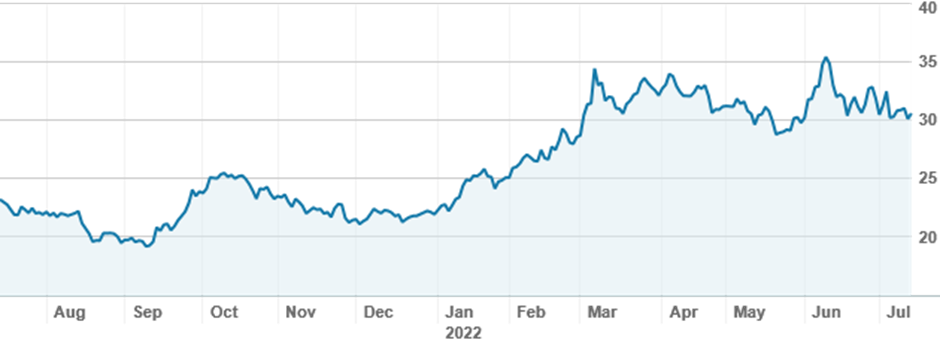

One long-held favourite is CSL (CSL), which has stabilised after falling below $250 several times since the Covid crash, although it remains well off its highs of around $340. It has recently crept back above $290 and many are taking profits. Woodside Energy (WDS) has taken the opposite direction for investors; many were taking profits during its recent run of strength on the back of the soaring oil price, and have since returned to buying as the price has fallen.

Woodside Energy shares (WDS) over twelve months

Source: nabtrade

On international markets, investors are playing it safe, with the exception of small buys in perennial favourite Tesla (TSLA.US). The big names are dominating the buys, with Apple (APPL.US), Amazon (AMZN.US) and Microsoft (MSFT.US) at the top of the list.

Analysis as at 14 July 2022. This information has been provided by WealthHub Securities Ltd the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 (NAB). Whilst all reasonable care has been taken by WealthHub Securities in reviewing this material, this content does not represent the view or opinions of WealthHub Securities. Any statements as to past performance do not represent future performance. Any advice contained in the Information has been prepared by WealthHub Securities without taking into account your objectives, financial situation or needs. Before acting on any such advice, we recommend that you consider whether it is appropriate for your circumstances.