Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

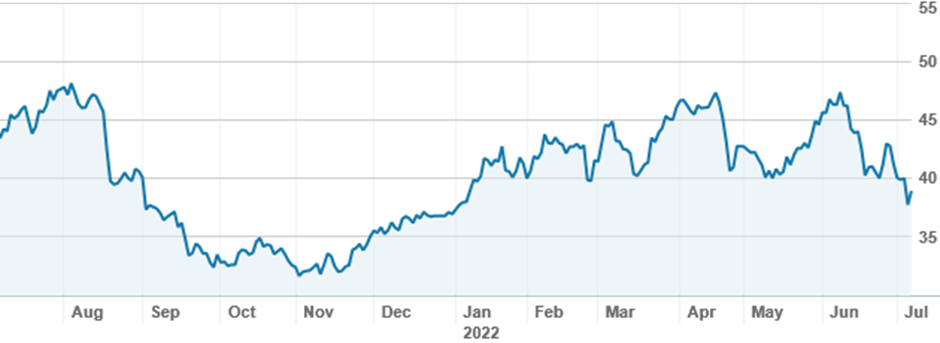

Time to sit tight?

The new financial year has seen the ASX stabilise and even claw back a bit of the ground lost on the last day of FY22. Fears of a looming recession in the US and other developed economies has seen substantial falls in the oil price, and downward pressure on commodities prices, while the latest Federal Reserve minutes reveal increasing concerns about the impact of heightened inflation, suggesting further supersized rate hikes may be coming.

Volumes overall remain subdued but weakness in materials is bringing out the buyers, who are unfazed by suggestions that demand for commodities will fall on a slowing global economy. BHP (BHP) shares fell to a six month low and were enthusiastically bought on huge volumes; the stock was 94% buy on Wednesday. Fortescue Metals Group (FMG) shares, still a favourite with high value traders, saw buying of a similar magnitude. Rio Tinto (RIO), less popular than the former two, also made the top 5, with strong buys.

BHP share price over twelve months (BHP)

Source: nabtrade

The energy sector has also been under pressure as the oil price has fallen, albeit from elevated levels. Woodside Energy (WDS) fell as much as 6% on Wednesday, providing a re-entry point for some who’d taken profits earlier in the year. Santos (STO) saw similar levels of buying.

Woodside shares (WDS) over twelve months

Source: nabtrade

One interesting change is the return of CSL (CSL) to the selling list. The share price had a modest pop in recent days, and holders have been trimming their positions. The CSL share price has been relatively resilient in the volatility of recent months, having traded in a narrow range since February; many investors have held their positions for a decade or more and are sitting on substantial capital gains.

The banks are continuing to see trading, albeit at much reduced levels, being neither cheap enough to buy, nor expensive enough to sell. Nab (NAB) was a 90% sell by value due to some high value investors wanting to trim above $28.

On international markets, investors have lost enthusiasm for anything but the big names, and even starting to trim some of those positions. Tesla (TSLA.US) has seen trimming in small values, Alphabet (GOOG.US) has seen high value buying.

Analysis as at 7 July 2022. This information has been provided by WealthHub Securities Ltd the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 (NAB). Whilst all reasonable care has been taken by WealthHub Securities in reviewing this material, this content does not represent the view or opinions of WealthHub Securities. Any statements as to past performance do not represent future performance. Any advice contained in the Information has been prepared by WealthHub Securities without taking into account your objectives, financial situation or needs. Before acting on any such advice, we recommend that you consider whether it is appropriate for your circumstances.