Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

The impact of higher royalties on coal miners

We modestly reduce our fair value estimates for coal miners operating in Queensland after the state imposed higher royalties on coal sales. Of our coverage, no-moat Anglo American is the most affected, and we reduce our fair value estimate (FVE) £3,350 to £3,200 per share. We also lower our FVEs for no-moat BHP from $38.50 to $38.00 per share, and for no-moat Glencore from £580 to £570 per share. However, we maintain our FVEs for no-moat New Hope (NHC) and Whitehaven Coal (WHC) of $4.00 per share and $5.20 per share, respectively.

The higher Queensland royalty rates add to the impact on coal miners’ unit costs from rising operating expenses, with labour, fuel, logistics, and equipment costs all increasing due to inflation. We think the surprise nature of the changes along with their quantum will likely lead to less investment in expansions and new coal mines in the state. Coal is not rare and so capital will likely flow to more stable jurisdictions with lower royalty rates such as New South Wales. More broadly, this could reflect the rising risk of increased taxation and potentially resource nationalism given high commodity prices and the generally poor state of government budgets around the world. With coal out of favour due to concerns over carbon emissions, high current prices make coal miners an easy target for cash-strapped governments.

Coal is cyclical and needs periodic booms and high prices to incentivise the investment required to ensure supply. Queensland’s actions could exacerbate potential future coal supply issues by increasing the incentive price needed to sustain supply, particularly if other jurisdictions follow suit. Ironically, the royalty hike could keep prices higher than they otherwise would be over the longer term. It does also raise the spectre of firms negotiating fiscal terms with first world governments before investing.

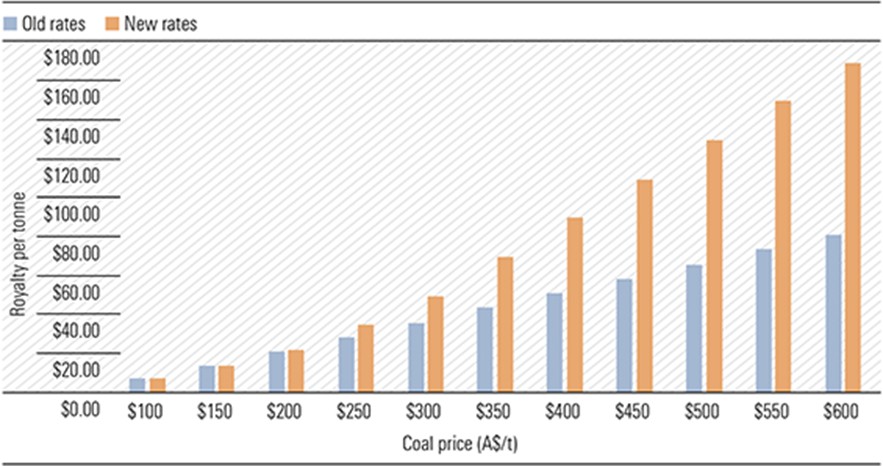

Queensland will keep the current royalty rates of 7% for prices up to and including A$100 per tonne, 12.5% from A$100 to A$150 per tonne, and 15% from A$150 to A$175 per tonne. However, from 1 July 2022, new rates of 20% from A$175 to A$225 per tonne, 30% from A$225 to A$300 per tonne and 40% above A$300 per tonne will apply. At prices above A$175 per tonne, effective royalty rates have risen materially. The state produced around 220 million tonnes (Mt) of coal in 2021, two thirds of which was metallurgical coal, with the rest thermal coal. With spot prices for metallurgical coal and thermal coal around A$510 and about A$565 per tonne, respectively, these new rates are a windfall for the state’s coffers. They are also a transfer of value likely to be mostly from mining companies, but also potentially from downstream steel mills and steel consumers.

Exhibit 1: Queensland coal royalties

Source: Queensland Government, Morningstar

Queensland’s royalty changes mainly affect the near term for some of the coal miners on our coverage list. We continue to assume metallurgical coal prices average around A$435 per tonne, and thermal coal prices average about A$290 per tonne, respectively, from 2022 to 2024. However, with our assumed mid-cycle prices from 2026 remaining about A$145 per tonne for metallurgical coal and about $115 per tonne for thermal coal, our long-term assumed prices aren’t affected by the higher royalty rates at this stage. However, the royalty hike could place further upward pressure on long-term prices, in addition to recent industry cost inflation.

BHP has limited exposure to higher Queensland royalties given its large iron ore and copper businesses, and also due to the recent sale of its lower-quality metallurgical coal assets including an 80% interest in BMC.

As for NHC, most of its operations are in New South Wales in the form of its 80%-owned Bengalla coal mine. However, the company continues to seek approval to develop Stage 3 of its 100%-owned New Acland mine in Queensland, with existing operations at the mine winding down in the interim. If developed, Stage 3 would produce around 5Mt per year of high energy, low ash saleable thermal coal for more than two decades. We think approval is likely noting the royalty change will have a relatively minor effect on the company given it owns most of the freehold land on which the mine will be located. As title to this land was created before 1910, under Queensland law, NHC is not required to pay royalties on the majority of Stage 3 production.

WHC does not currently have any operating mines in Queensland, with existing operations including Maules Creek, Narrabri, and the Gunnedah open cut mines all located in New South Wales. The company’s only potential exposure is the proposed A$1bn Winchester South development in the Bowen Basin. Development could be delayed as a result of the new royalties. There is also the chance it is less likely to be developed, but this depends on the supply decisions of other miners and if there is an inflationary impact on longer-term prices.

We currently value WHC’s investment in Winchester South at its $480m cost. We note the purchase was made at a time when coal prices were considerably lower, so if anything, we think the likely value of the asset could now be higher. As such, despite WHC potentially paying higher royalty rates if Winchester South is developed, we make no change to our $5.20 per share FVE.

Queensland’s decision is likely to see WHC preference development of its 100%-owned, $800m Vickery project in New South Wales. If developed, the mine is likely to produce around 7.2Mt per year of saleable metallurgical and thermal coal for more than two decades. The company also recently gained approval to extend the life of its existing Narrabri mine for a further decade from the early 2030s.

Mathew Hodge, CFA is Morningstar's director of equity research, Australia & New Zealand. Analysis as at 30 June 2022. This information has been provided by Firstlinks, a publication of Morningstar Australasia (ABN: 95 090 665 544, AFSL 240892), for WealthHub Securities Ltd ABN 83 089 718 249 AFSL No. 230704 (WealthHub Securities, we), a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 (NAB). Whilst all reasonable care has been taken by WealthHub Securities in reviewing this material, this content does not represent the view or opinions of WealthHub Securities. Any statements as to past performance do not represent future performance. Any advice contained in the Information has been prepared by WealthHub Securities without taking into account your objectives, financial situation or needs. Before acting on any such advice, we recommend that you consider whether it is appropriate for your circumstances.