Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Investors return to cyclical stocks and former darlings

Inflation and interest rates remain the key focus for investors all around the world this week. Australia’s CPI numbers came in a little below expectations (1.8% vs market 1.9%; annualised 6.1% vs market 6.3%), but were strong enough to cement expectations of a 50bpt increase in interest rates at the RBA’s next meeting. One key factor was the clear domestic component to the numbers, rather than simply supply chain pressures on imports and the effects of the Russia-Ukraine war. Fuel and new home construction are likely to heavily impact consumers, but price increases were very broad - more than 80% of the inputs to the inflation ‘basket’ increased by more than 2.5%.

Internationally, the US Federal Reserve surprised no one by increasing interest rates by 75pts, to a relatively neutral rate of 2.25-2.5%. Chair Jerome Powell made the comment that it may ‘be appropriate to slow’ the rate of increases from this point, resulting in a strong rally on Wall Street.

The ASX200 followed the S&P500’s lead, and added more than 1% on Thursday, as investors returned to cyclical stocks and former darlings. While volumes remain well below their peak, investors are finding opportunities, with overall trades up nearly 50% from their recent lows.

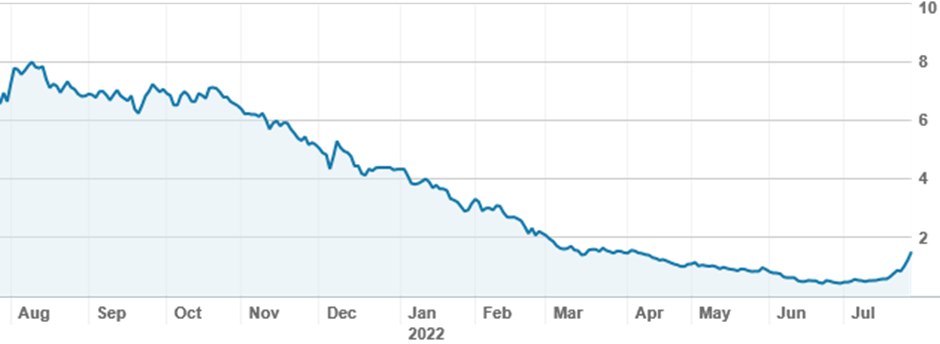

One dramatic return to form has been the buy now, pay later sector, which until recently had been sold down to almost nil in investor portfolios. Zip Co (ZIP) has tripled since its pre 30 June low of 43.5c, to close at $1.52 on Thursday. Its dramatic turnaround has occurred since it dropped plans to merge with challenged BNPL player Sezzle (SZL); the latter has increased five fold in just days, and was forced to offer an explanation to the ASX after the stock was put in a trading halt. (The company stated there was no market sensitive information that could be driving recent trading activity). Nabtraders were happy to get on board; both stocks were actively traded, with Zip seeing huge turnover. Average trade sizes were surprisingly large and were marginally weighted toward buys. It’s worth remembering that Zip and Sezzle have lost 77% and 87% of their value respectively over the last twelve months, despite their recent bounce.

Zip Co (Z1P) shares over twelve months

Source: nabtrade

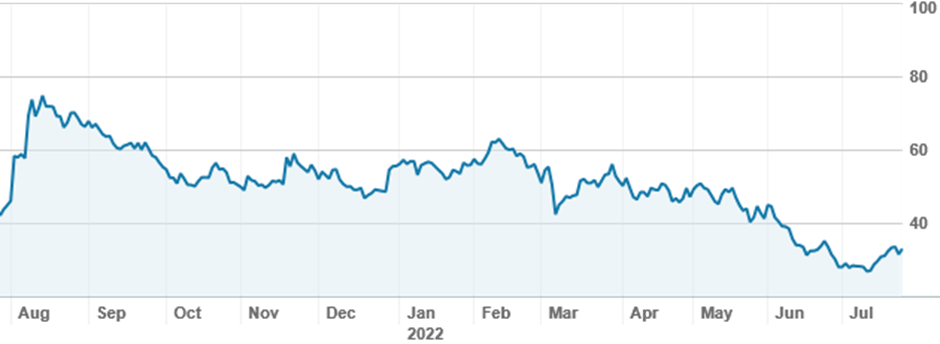

Much like the BNPL sector, online retailer Kogan (KGN) has fallen hard since Covid sent consumers scrambling to buy cut price electronics and set up home offices. In a business update on Thursday, the company announced a 10% fall in gross profit year on year, but inventories have improved markedly and improved trading in the most recent quarter. The stock soared an incredible 50% on the update; round 8% of Kogan’s shares have been sold short, so some of the bounce may have been shortsellers covering their positions. As with Zip and Sezzle, Kogan shares are down more than 55% over twelve months.

Kogan (KGN) shares over twelve months

Source: nabtrade

At the less speculative end of the market, Rio Tinto (RIO) gave a relatively underwhelming half yearly update and declared a much smaller dividend than the previous period. Nabtraders were largely unmoved, but were very happy to take profits in Fortescue Metals Group (FMG) when the share price bounced after the company announced record iron ore production.

While financials have struggled for attention with the all the noise, nab shares (NAB) have popped above $30 for the first time since early June, and saw widespread profit taking. Investors also liked Macquarie’s (MQG) AGM presentation, and bought more of the consistent performer.

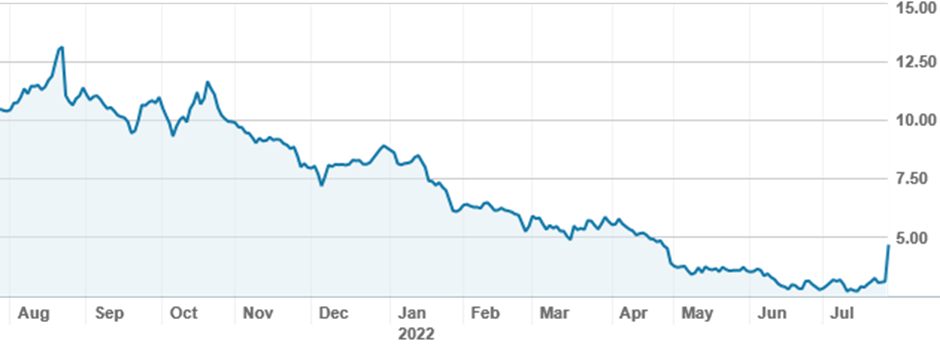

On international markets, investors are sitting on their hands, with only the active ETF traders taking positions. One high value investor took a large position in Victoria’s Secret (VSCO), the well known lingerie retailer. The company has struggled in recent years, despite (or perhaps because of) intensive marketing spend; major brokers have cut their price targets on the stock but most remain well above the current price.

Victoria’s Secret (VSCO) shares over twelve months

Source: nabtrade

Analysis as at 28 July 2022. This information has been provided by WealthHub Securities Ltd the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 (NAB). Whilst all reasonable care has been taken by WealthHub Securities in reviewing this material, this content does not represent the view or opinions of WealthHub Securities. Any statements as to past performance do not represent future performance. Any advice contained in the Information has been prepared by WealthHub Securities without taking into account your objectives, financial situation or needs. Before acting on any such advice, we recommend that you consider whether it is appropriate for your circumstances.