Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Investment markets & key developments: share markets bounce despite short-term outlook

Share markets mostly rose over the last week on hopes that central banks will be able to tame inflation without causing a recession. However, it was messy with Eurozone shares – where the risk of recession is greatest – first making a new bear market low earlier in the week. Australian shares followed the global lead higher with very strong gains in IT, consumer discretionary, health and property stocks. Bond yields generally rose except in Australia. Oil and metal prices fell but the iron ore price rose. The AUD rose slightly despite a further rise in the USD.

The beat goes on with rising interest rates but there was nothing really new over the last week.

- The minutes from the last Fed meeting were hawkish – referring to a “significant risk ... [that] elevated inflation could become entrenched”, that the “outlook warranted moving to a restrictive stance” and that it saw a 50 or 75bps hike as being appropriate in July – but there was nothing new in this. And since the last Fed meeting, economic data and inflation indicators have been softer.

- The RBA hiked by 0.5% as expected citing high inflation, the resilient economy, the tight jobs market, likely faster wages growth and the importance of keeping inflation expectations down and it repeated its commitment to “doing what is necessary to ensure inflation returns to target”. But again, there was nothing new here. We remain of the view that higher debt levels today and falling real incomes will see the economy slow faster in response to rising interest rates than seen in the past which will see the cash rate peak around 2.5% early next year, well below market expectations for a rise to 3.5% or more next year.

Market expectations for rate hikes have generally fallen over the last three weeks as inflation fears have receded a bit and economic data has slowed. For example, the market’s expectation of the Fed Funds rate at year-end has fallen from 3.7% three weeks ago to 3.36% now and the market’s expectation for the RBA’s cash rate at year-end has fallen from 3.86% three weeks ago to 3.18%. The hawkish pivot a month or so ago by central banks including the RBA has seen market expectations for longer-term inflation fall. What’s more, various indicators suggest that inflation pressures in the US may have peaked and if so, this is a positive sign for other countries including Australia as the US is leading other countries by about six months on inflation.

Metal and wheat prices are now well down from recent highs and oil prices now also appear to be rolling over – all of which is good for inflation. Of course, gas prices keep rising with a high risk that Russia ceases gas flows to Germany and this is maintaining pressure on coal.

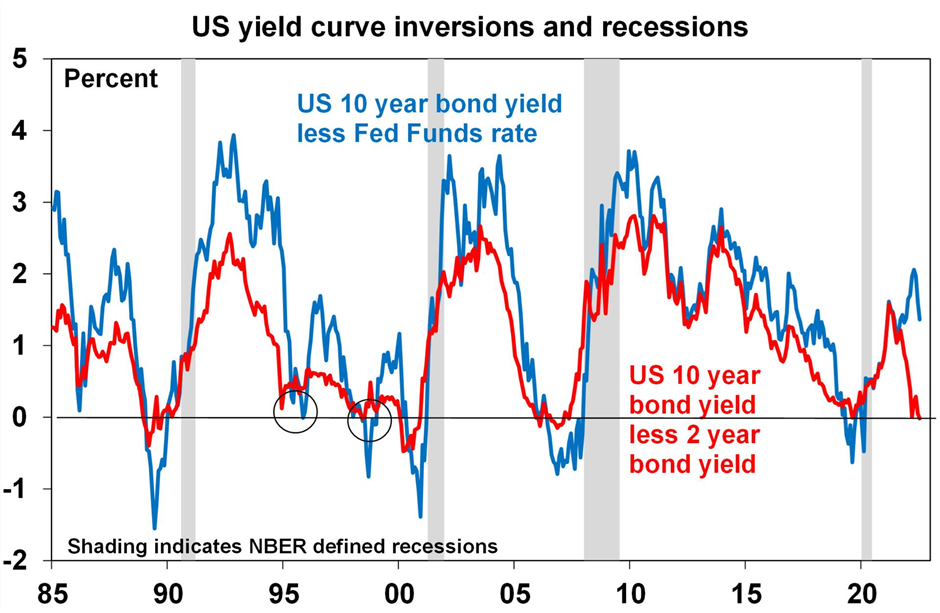

Global economic data has also softened as seen recently in business conditions PMIs. The risk of recession is greatest in Europe, but there is now a high risk that the US will have a technical recession - i.e. two quarters in a row of falling GDP - in the first half of this year. What’s more, the US yield curve has continued to flatten with the gap between 10-year and 2-year bond yields inverting again. And if a recession eventuates shares likely have more downside as earnings start to fall, because the falls in markets so far mainly reflect a valuation adjustment (i.e. lower PE’s) in response to higher bond yields.

Source: Bloomberg, AMP

The bottom line remains that with central banks still tightening and recession risk high shares remain at high risk of further falls in the short term. This could well run out to September or October with October having a reputation as a “bear market killer”.

On a 12-month view, we remain optimistic that shares can rise on the grounds that cooling inflation pressures should enable central banks to ease up on the interest rate brake in time to avoid a recession (or at least avoid a deep recession). With US inflation pressures slowing it’s unlikely that the Fed needs to cause a recession to get inflation under control.

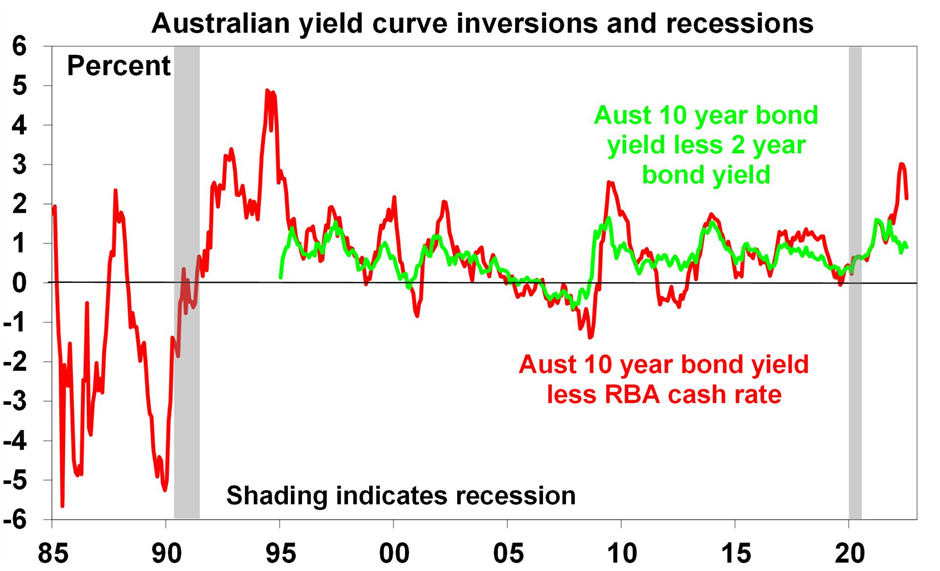

In Australia, the various yield curves are still far from inverting (not that they have been a great guide).

Source: Bloomberg, AMP

The latest NSW floods are devastating for those directly impacted but are more inflationary than deflationary and so are unlikely to see the RBA change course.

Analysing the economic impact of the latest floods is complicated because for some areas it's now the fourth major flood this year. But while they will cause short-term disruption to economic activity the net effect as with most natural disasters is likely to be stimulatory as rebuilding kicks in (yet again). So on a six-month horizon, they are more likely to add to economic growth rather than detract from it. They will though add to inflationary pressure because of further disruption to fruit and vegetable supplies and increased demand for household furnishings and other equipment, building materials and workers who are in short supply. They are yet another supply shock threatening to boost inflation expectations. So, the latest floods are unlikely to see the RBA delay rate hikes or change course.

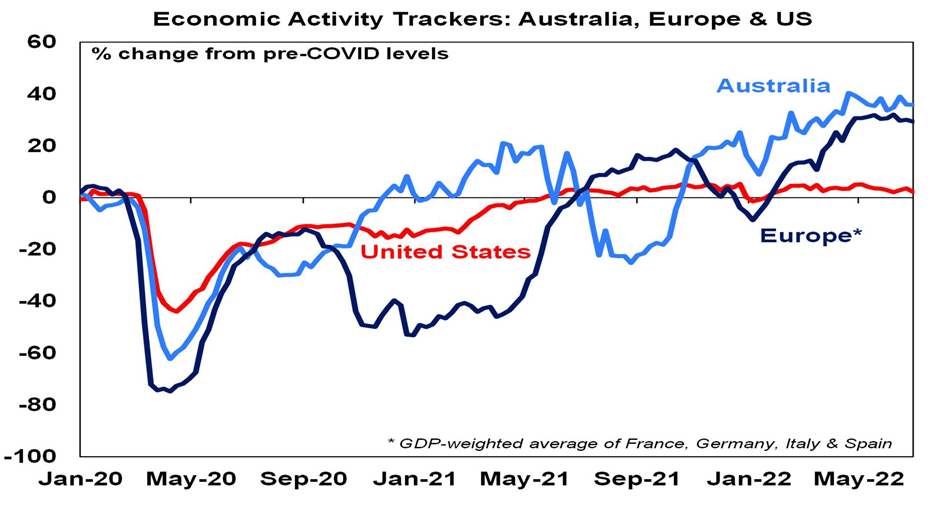

Economic activity trackers

Our Australian Economic Activity Tracker was little changed in the past week and our US and European Trackers softened slightly. All have lost momentum.

Source: AMP

Based on weekly data for eg job ads, restaurant bookings, confidence, mobility, credit & debit card transactions, retail foot traffic, hotel bookings. Source: AMP

Australian economic events and implications

Australian economic data was generally stronger than expected although its yet to reflect the full impact of rate hikes and cost of living pressures.

Housing finance unexpectedly rose 1.7% in May but still appears to be in a gradual topping process with higher mortgage rates and the slump in the property market likely to drive a sharp downturn in home loans. Building approvals also rose 9.9% in May but this was driven by a bounce in volatile unit approvals and the trend still points down. Home building activity is likely to hold up better than suggested by the fall in approvals from their high because there is still a large pipeline of work yet to be completed (due to bad weather and supply bottlenecks).

All prices and analysis at 11 July 2022. This information was produced by Switzer Financial Group Pty Ltd (ABN 24 112 294 649), which is an Australian Financial Services Licensee (Licence No. 286 531This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. This article does not reflect the views of WealthHub Securities Limited.