Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

ANZ's big play brings out the traders

Weary investors relaxed a little this week, with the ASX200 gaining over 2%, and reporting season in the US delivering relatively positive results. Bank of America’s Global Fund Manager Sentiment Survey found a ‘dire level of investor pessimism’ in the first six months of 2022, but some are hopeful that all the bad news is now priced in. The ASX is off around 9% year to date, while the S&P500 has fallen more than 20%, however the ASX had a relatively modest recovery post Covid compared to the US market, giving the latter arguably further to fall. Volumes remain subdued with all eyes on the Federal Reserve’s next move – markets are pricing in a 36% chance of a 100bpts rate hike on 28 July.

Those investors who are still trading tend to be older, wealthier, and more experienced than those who are sitting on the sidelines. Very few have sold into the weakness; a lot of nabtraders were taking profits in the first quarter of the calendar year and are yet to reinvest. The big news of the week was ANZ’s (ANZ) $4.9bn takeover offer for Suncorp Bank (SUN), which scuppered any suggestion of a fifth pillar to take on the ‘big four’ banks. ANZ has suffered a significant loss of market share in home lending as its processing times blew out in the recent residential property boom; this purchase will bring its share back to where it was some years ago. An institutional placement was completed and the shares came back online on Thursday; nabtraders were relatively mixed on the deal.

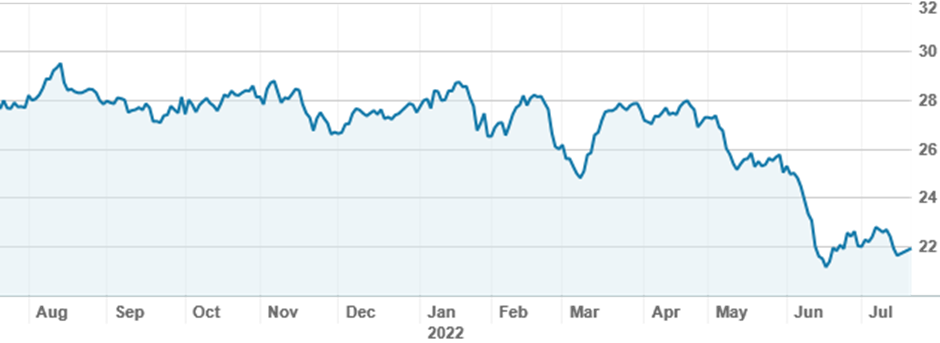

ANZ (ANZ) shares over twelve months

Source: nabtrade

ANZ has been the weakest performer of the big four over the last twelve months, losing 20% of its value, while Westpac remains the most popular trade.

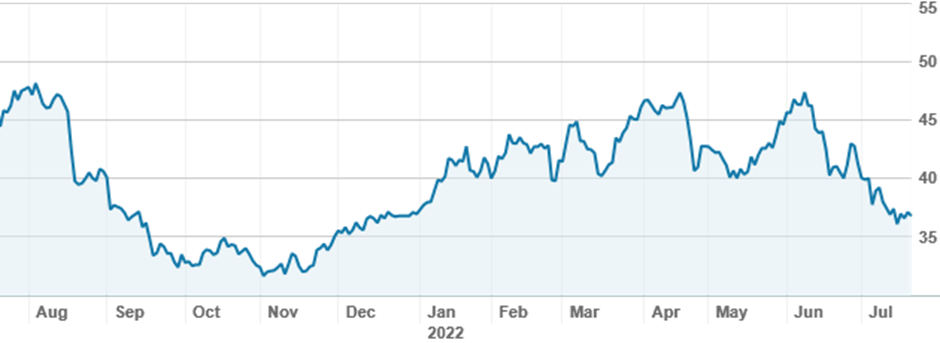

Materials remain the sector of choice for who are looking for opportunity; while Fortescue Metals Group (FMG) continues to be the trader’s favourite, BHP’s (BHP) recent weakness has encouraged long term investors to top up their portfolios. The iron ore price remains under pressure as the Chinese property sector comes under further scrutiny, nearly twelve months after mega-developer China Evergrande hit international headlines.

BHP (BHP) shares over twelve months

Source: nabtrade

Lithium stocks have returned to the top of the tables, with Allkem (AKE, the merged Galaxy-Orocobre entity) delivering an output update that resulted in broker Jefferies cutting their price target from $15.50 to $14.50. Given the current price is hovering around $10, investors were happy to jump on board. Pilbara Minerals (PLS) and Core Lithium (CXO) were both trimmed.

Long term favourites CSL (CSL) and Macquarie Group (MQG) both remain off their highs but have also had small bounces lately, and have been trimmed. CSL has been a popular buy under $250, and Macquarie tends to find favour around $160 (although it hasn’t remained there for long).

On international markets, there is a clear shift toward active trading from a small number. The US market offers an extensive range of exchange traded funds to actively trade short term market movements – for most, however, the time difference is too much and a buy-and-hold strategy is more palatable.

Analysis as at 21 July 2022. This information has been provided by WealthHub Securities Ltd the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 (NAB). Whilst all reasonable care has been taken by WealthHub Securities in reviewing this material, this content does not represent the view or opinions of WealthHub Securities. Any statements as to past performance do not represent future performance. Any advice contained in the Information has been prepared by WealthHub Securities without taking into account your objectives, financial situation or needs. Before acting on any such advice, we recommend that you consider whether it is appropriate for your circumstances.